—— Intel CEO to Leave Company After Failed Turnaround; XRP Sours to Become Third-Largest Crypto; US Cyber Weekend Sales Jump 9% YoY; SMCI Found Not Guilty in Independent Review; Amazon Invests in AI Chip Startup to Challenge Nvidia; US to Provide Ukraine with $725mn Arms Package

1. Intel CEO to Leave Company After Failed Turnaround

Intel Corp. CEO Pat Gelsinger is set to step down after his efforts to lead the company’s turnaround fell short, with the chipmaker continuing to lose ground to its competitors.

In the interim, Chief Financial Officer David Zinsner and Michelle Johnston Holthaus, newly appointed CEO of Intel’s product group, will serve as co-CEOs while the board conducts a search for Gelsinger’s replacement. Frank Yeary, independent chair of Intel’s board, will take on the role of interim executive chair.

Gelsinger, 63, returned to Intel in 2021 with high expectations, hailed as the potential savior of the company. A long-time Intel veteran who began his career there as a teenager, he left in 2009 to become CEO of VMware.

Upon his return, Gelsinger vowed to restore Intel’s technological dominance, but the company has struggled to regain its competitive edge against rivals like Taiwan Semiconductor Manufacturing Co. (TSMC).

Source: Bloomberg – Intel CEO Gelsinger Leaves as Chipmaker’s Turnaround Flounders

______

2. XRP Sours to Become Third-Largest Crypto

XRP, the cryptocurrency linked to Ripple Labs Inc., has surged to become the third-largest digital asset during a $100 billion market rally.

On Monday, XRP’s price rose 15% to $2.50, with its market capitalization jumping from less than $30 billion on November 5, when Donald Trump won the U.S. presidential election, to $137 billion, according to CoinGecko. The rally reflects expectations of pro-crypto policies under Trump’s administration.

Notably, XRP’s market value has recently surpassed competitors like Solana and Tether’s USDT. This growth comes despite Ripple Labs facing a 2020 SEC lawsuit alleging unregistered securities sales through XRP.

In August, a federal court ordered Ripple to pay a $125 million fine but ruled that XRP itself is not a security—a landmark victory for Ripple and the crypto industry.

XRP’s surge highlights growing investor confidence, driven by hopes for crypto-friendly regulations and the resolution of Ripple’s legal challenges.

Source: Bloomberg – Ripple-Linked XRP Soars to Third-Largest Token After Trump Win

______

3. US Cyber Weekend Sales Jump 9% YoY

According to data from Salesforce, this year’s Cyber Weekend e-commerce sales in the U.S. saw a 9% increase, up from 6% in 2023. The average discount offered was 28%, slightly down from 30% last year.

Cyber Weekend refers to the Saturday and Sunday following Thanksgiving, nestled between Black Friday and Cyber Monday. This period accounts for approximately 20% of U.S. retailers’ annual sales.

Caila Schwartz, Director of Consumer Insights at Salesforce, noted that while consumers were highly anticipative and meticulously planned for Cyber Week, the discounts did not fully meet their expectations. Despite this, there was a substantial volume of purchases, demonstrating consumer resilience and enthusiasm for seasonal deals.

Additionally, the National Retail Federation (NRF) predicts that holiday season sales for 2024 will grow by 3.0% to 3.5%, reaching between $979.5 billion and $989 billion, marking the slowest growth in six years.

Overall, despite a slight reduction in discount depth, consumer purchasing enthusiasm remained strong, contributing to robust growth in Cyber Weekend e-commerce sales.

Source: Bloomberg – Florida Developers Rush to Meet Demand for Newly Built Condos

______

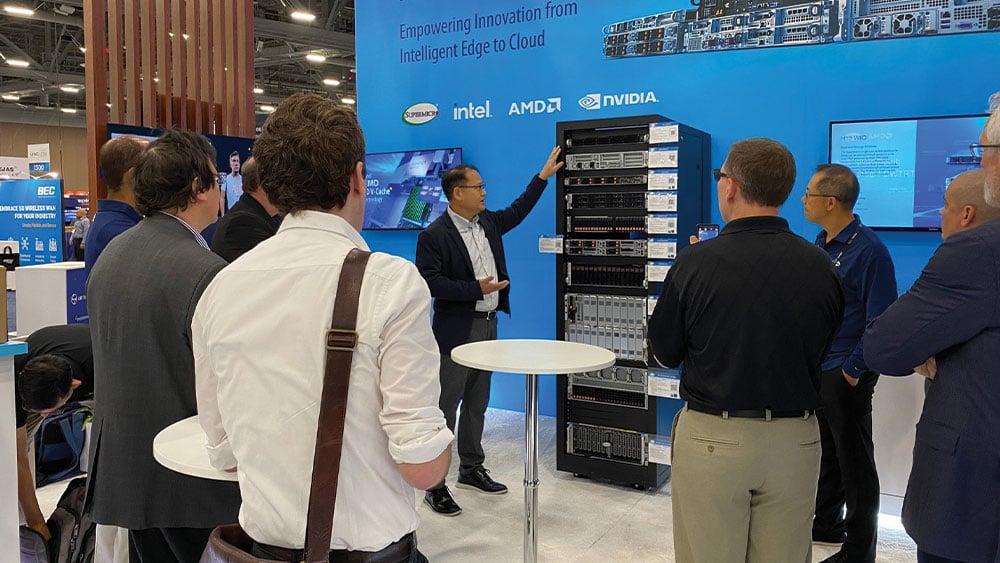

4. SMCI Found Not Guilty in Independent Review

Super Micro Computer Inc. recently announced that an independent review conducted by a special board committee, with support from Cooley LLP attorneys and forensic accounting firm Secretariat Advisors, revealed no evidence of misconduct by its management or board of directors, and confirmed the independence of the audit committee.

Despite these findings, the committee recommended changes in key leadership positions, including appointing a new chief financial officer, chief compliance officer, and general counsel to better match the company’s current scale and complexity, and to prepare for future growth.

Following the release of these findings, Super Micro’s stock surged by 22.5% in New York. The company also stated that there would be no changes to the financial results previously reported for the most recent fiscal year. Kenneth Cheung, formerly the vice president of finance, has been appointed as the new chief accounting officer.

Additionally, the company has begun the process of searching for a new CFO to replace David Weigand.

Source: Bloomberg – Super Micro Finds No Evidence of Fraud; Will Replace CFO

______

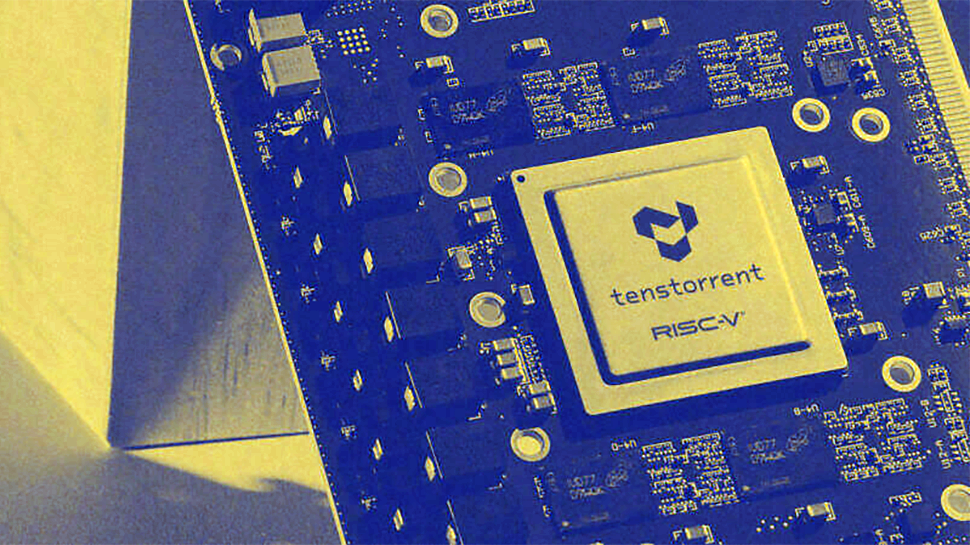

5. Amazon Invests in AI Chip Startup to Challenge Nvidia

Jeff Bezos, founder of Amazon.com Inc., along with Samsung, has invested $700 million in Tenstorrent, an AI chip startup aiming to challenge Nvidia Corp.’s dominance in the AI industry. This investment round, led by South Korea’s AFW Partners and Samsung Securities, values Tenstorrent at approximately $2.6 billion. Other investors include Bezos Expeditions, LG Electronics Inc., and Fidelity, drawn by the reputation of Tenstorrent’s founder, Jim Keller, and the potential growth in the AI technology sector.

Located in Santa Clara, California, Tenstorrent is developing more cost-effective AI solutions using open-source and common technology, avoiding expensive components like high-bandwidth memory (HBM), which Nvidia heavily utilizes.

Keller highlighted that competing with Nvidia using HBM is not viable as Nvidia controls significant market leverage due to its bulk purchasing and cost advantages. This strategic choice aims to offer an alternative, more affordable pathway to AI development.

The funds raised will be allocated to expanding Tenstorrent’s engineering team, investing in the global supply chain, and constructing large AI training servers to showcase its technology.

Source: Bloomberg – Bezos Backs AI Chipmaker Vying With Nvidia at $2.6 Billion Value

______

6. US to Provide Ukraine with $725mn Arms Package

The United States is preparing to announce a new arms package for Ukraine, valued at approximately $725 million. This package, potentially the largest since a $1 billion distribution in April, includes the second batch of anti-personnel mines authorized by President Joe Biden. These mines are battery-powered and can be programmed to deactivate after a certain period. The package also features anti-tank and counter-drone munitions among other items.

This development comes as the Biden administration navigates the impending transition to President-elect Donald Trump, who has indicated a desire to end the conflict with Russia swiftly. The announcement, expected as early as Monday, is part of the 71st Presidential Drawdown Authority package. Pentagon officials have expressed concerns about depleting U.S. inventories too significantly, citing potential risks to American military readiness.

Amidst these developments, Trump’s nominee for special envoy for Ukraine and Russia, Retired General Keith Kellogg, has suggested the possibility of discontinuing military aid to Ukraine. However, he also noted that Biden’s approval for Ukraine to use U.S.-made ATACMS missiles against Russia might provide Trump with increased diplomatic leverage.

This arms package is a critical element of the U.S. strategy as it supports Kyiv in its ongoing conflict against Russian aggression.

Source: Bloomberg – US to Announce a New $725 Million Arms Package for Ukraine

______

7. Citadel Commodity Trading Earns $4bn in Profit

Air travel is expected to become more expensive globally in 2025, although the rate of fare increases is predicted to moderate compared to the sharp rises experienced post-Covid. According to a forecast by American Express Global Business Travel Group Inc., the anticipated increases will reflect the ongoing higher operational costs and persistent supply chain disruptions affecting the airline industry.

The American Express report notes that while airfare prices will likely increase across various routes, the extent of these hikes will differ significantly by region. In North America and Europe, the increases are expected to be relatively modest, around 2%. Conversely, regions like Asia and Australasia, which were among the last to relax pandemic restrictions, may see more substantial fare increases of up to 14%.

Despiteitive outlook on passenger demand for 2025, airlines are facing challenges in expanding their capacity due to delays in the delivery of new planes from major manufacturers such as Airbus SE and Boeing Co.

Additionally, extended servicing times for jet engines are further restricting the availability of aircraft, thus limiting the ability of airlines to meet the rising demand and contributing to higher ticket prices.

Source: Bloomberg – Citadel Defies Commodities Slump to Rack Up $4 Billion in Gains

______

本文内容来自《Financial Times》、《Bloomberg》,以及《The Real Deal》等多家财经新闻媒体。