Condo Development Preferred Equity 805

Type: Preferred Equity

Target: $4,000,000

Annual Return: 8.0% - 9.0%

Min-invest Amount: $10,000

Duration: 18 months

Gross Financing: $4,000,000

* (Phase I. Investment:$2,000,000,the expected closing date is Mar 15th, 2019 or after fundraising accomplished)

* (Phase II. Financing:$2,000,000,the expected closing date is May 1st, 2019 or after fundraising accomplished)

Expected Return: 8.0%-9.0%(and condo book price discount)

Investment Type: Preferred Equity

Minimum Investment: $10,000 per Membership Unit

Investment Duration: 18 Months

Payment Period: Semi-annual Payment in advance

* As of May 2018, the final market vacant land value is $19,000,000.It is estimated that the project will be valued at about 70 million after its completion in April 2020. The appraisal report is provided by CBRE.

* Subscribers of 1 to 9 membership units gain 8.0% expected return;Subscribers of 10 to 24 membership units gain 8.5% expected return, also, subscribers will able to get 1% off from the condo book price if he/she commit to purchase an unit of the building;more than 25 membership units gain 9.0%. subscribers will able to get 4% off from the condo book price if he/she commit to purchase an unit of the building. The selling price is subject to the Condo book approved, for more information please contact Crowdfunz.com.

Address: 37-14 34th Street, Long Island City, NY 11101

Region: Queens, NY

Land Area: 19,521 SF(100*195 FT)

Zoning: M1-2/R6A(FAR 4.0)

Building Area: 78,084 SF

Appraisal: $1,9000,000*

Construction Loan: Approved

Project Outline:

- The project is located in long island City, Queens, New York City. The developer purchased the property for 16.5 million in June 2017 with his LP, and then bought out his LP shares for $19.4 million including the $18.5 million plus transfer cost in 2018, equivalent to about $248/SF of land, which is a competitive price compared with other surrounding land costs. At present, the buildings on the original land have been demolished, The property is about to start construction.

- The project is expected to be a 76-story, 76-unit complex (from studios to three bedrooms) consisting of 21,000 square feet of commercial facilities and a 55-parking complex, targeted at urban professionals in Manhattan.

- The Property is about 3 minutes walk to 4 subway lines (M/R/N/W), 10 minutes walk to line 7, 5 minutes walk to Manhattan.

* According to the May 2018 appraisal report provided by CBRE, the land was valued at $19 million, and the residential value after the completion of the project was $66.7 million, with the total estimated value of the project for commercial facilities being $75.21 million.

Building Planning and Selling Price:

| Level | Gross Area(SF) | Commercial | Residential | Net Area | EFF |

|---|---|---|---|---|---|

| Basement | 17,959.167 SF | 6,200 SF | 6,200 SF | 35% | |

| 1st fl | 17,959.167 SF | 15,262 SF | 2,164 SF | 15,262 SF | 85% |

| 2nd fl | 19,521 SF | 7,143 SF | 6,286 SF | 32% | |

| 3rd fl | 12,125.8 SF | 10,535.5 SF | 9,560 SF | 79% | |

| 4th fl | 12,125.8 SF | 10,535.5 SF | 9,560 SF | 79% | |

| 5th fl | 12,125.8 SF | 10,535.5 SF | 9,560 SF | 79% | |

| 6th fl | 12,125.8 SF | 10,535.5 SF | 9,560 SF | 79% | |

| 7th fl | 11,895.8 SF | 10,535.5 SF | 9,536 SF | 79% | |

| BH | 1,972.4 SF | 8,925 SF | 8,140 SF | 68% | |

| Residential | 21,462 SF | 60,374 SF | 52,642 SF | ||

| Commercial | 21,462 SF | ||||

| TOTAL | 117,810.73 SF | 74,104 SF |

* The final listing price and unit size will subject to the price list on condo book.

| Expected Schedule of Interest Payment | ||||||

|---|---|---|---|---|---|---|

| Payment | Round of Investor | Payment Date *1 | Interest-bearing Date | Interest Due Date | Interest Period | Notes |

| First Time | First Round Investors | 4.05, 2019 | 3.15, 2019 | 9.25, 2019 | 6.3 Months | Distributed on 4.05, 2019 *2 |

| Second Round Investors | 5.01, 2019 | 5.01, 2019 | 9.25, 2019 | 4.8 Months | Distributed | |

| Second Time | All Investors | 9.26, 2019 | 9.26, 2019 | 3.25, 2020 | 6 Months | Distributed |

| Third Time | All Investors | 3.26, 2020 | 3.26, 2020 | 9.25, 2020 | 6 Months | Distributed |

| Fourth Time | Investors | 9.26, 2020 | 9.26, 2020 | 3.26, 2021 | 6 Months | Distributed |

*1If the Payment date falls on holidays or not working day, the payment will be processed by the next business day.

*2Updated at 4.05, 2019

Solid Fund Structure

Developer successfully closed the construction loan($45M) , owner’s equity($16M) is ready, the preferred equity from CrowdFunz Investors($4M) will ensure the capital source for the development need.

Sufficient Collateral

Developer provides over $16M equity as collateral to preferred equity investors, additional, provides full personal guarantee with over $91 million personal net asset.

Reliable Expected Return

The annualized return of the investment is 8.0% for subscribers of 1 to 9 membership units, 8.5% for subscribers of 10 to 24 membership units plus the 1% off discount to purchase the units of the building. 9.0% for Subscribers of 25 or more membership units plus the 4% off discount to purchase the units of the building.

Great Location

The property is located in the core area of LIC with convenient transportation, only 10 mins away from Midtown Manhattan. 5 mins away from Amazon HQ2.

Industry-leading developers

Developers is a real estate development, construction, and acquisition firm based in New York City that’s driven by an unmatched commitment to quality and innovation. In his pass 20 years, finished over 100 projects located in NYC.

Long Island City Market Overview

$965,672

Median Sales Price

The average absolute price is $965,672 with the highest of $3,695,000 at Casa Vizcaya.

* Source: LIC real estate report, Morden Space Q1 2018

Zip Code Area Population Characteristics:

| 11101 Zip Code Area | |

|---|---|

| Regional population | 25,317 |

| Average Age | 35.4 |

| High School or Above | 72.4% |

| Population Composition | Young people with high incomes |

| Average Househole Income | $73,313 |

| White Collar/Blue Collar | 87%/13% |

| Family with Child | 20.5% |

| Average Family Member | 2.14 |

| Principle Residence | 17.1% |

* Data source: ArcGIS Esri database, and Property Shark, December 2018.

Surrounding Property Construction:

- Within the 3 miles around the project center, there are 70 projects in progress in the past year. Among which 31 projects are waiting for the approval of drawings, 35 projects are under construction, 1 project has been completed and occupied, and 2 projects have been abandoned.

- In the residential building of the same type, the largest project developed by PMG is located at 23-10 Queens Plaza South. This project is a 330,000 feet 44-story residential project with a comprehensive development building supporting the community service center. At present, the project has been basically completed.

- Second, the 29-22 Northern Blvd project, developed by Quadrum Global, is a 43-story, 467-unit residential building that is still under construction.

- The total cost of 35 residential projects in the nearby area is more than 1.5 billion us dollars, among which 10 projects of 1-5 million us dollars account for 10 projects, 6 projects of 5-10 million us dollars account for 6 projects, and 19 projects of more than 10 million us dollars account for 19 projects.The vast majority of these are building projects for Rental apartments.

Sales Comparison 1:

Address: 25-19 43 Avenue, Long Island City, NY, 11101

- Year of Sale: 2016

- Total Units: 85

- Story: 9

- Developer: Ekstein Development

- 421A Tax Deductable: Yes(per NYC Department of Finance)

| Apt # | Bedroom | Bath | SF | Status | Listed Price | Date | PPSF |

| PH3 | 2 | 2 | 1159SF | Under Contract | $1,450,000.00 | $1,251.08 | |

| 506 | 1 | 1 | 739SF | Sold | $848,022.00 | 2018/1/30 | $1,147.53 |

| 601 | 2 | 2 | 970SF | Sold | $1,046,581.00 | 2018/1/31 | $1,078.95 |

| 608 | 2 | 2 | 1046SF | Under Contract | $1,230,000.00 | $1,175.91 | |

| 708 | 2 | 2 | 1046SF | Sold | $1,250,000.00 | 2017/7/20 | $1,195.03 |

| 602 | 1 | 1 | 770SF | Sold | $870,603.00 | 2018/1/12 | $1,130.65 |

| 211 | 2 | 2 | 1004SF | Sold | $1,100,000.00 | 2016/6/20 | $1,095.62 |

| 505 | 1 | 1 | 739SF | Sold | $825,000.00 | 2016/4/29 | $1,116.37 |

| Average | $1,148.89 |

* Data sources: Steeteasy.com/Building

Sales Comparison 2:

Address: 27-21 44 Drive, Long Island City, NY, 11101

- Year of Sale: 2016

- Total Units: 120

- Story: 27

- Developer: Silvercup properties

- Facilities: Bicycle parking, Elevator, Gym, Parking lot

- 421A Tax Deductable: Yes(per NYC Department of Finance)

| Apt # | Bedroom | Bath | SF | Status | Listed Price | Date | PPSF |

| 2501 | 2 | 2 | 1027SF | Sold | $1,650,000.00 | 2017/11/19 | $1,606.62 |

| 801 | 1 | 1 | 662SF | Sold | $870,603.00 | 2018/01/24 | $1,315.11 |

| 1305 | Studio | 1 | 464SF | Sold | $636,406.00 | 2018/01/23 | $1,371.56 |

| 1401 | 1 | 1 | 662SF | Sold | $915,000.00 | 2017/03/24 | $1,382.18 |

| 1803 | 1 | 1 | 646SF | Sold | $850,000.00 | 2017/02/10 | $1,315.79 |

| 1502 | 3 | 2 | 1261SF | Sold | $1,900,000.00 | 2017/01/03 | $1,506.74 |

| 205 | 2 | 2 | 996SF | Sold | $1,385,000.00 | 2016/11/01 | $1,390.56 |

| 2402 | 3 | 2 | 1261SF | Sold | $1,939,766.00 | 2017/11/29 | $1,538.28 |

| Average | $1,428.35 |

* Data sources: Steeteasy.com/Building

Rental Comparison 1:

Address: 11-24 31st Avenue, Long Island City, NY, 11106

- Property: East River Tower

- Units: 62

- Floors: 20

- Facilities: Doorman, Elevator, Gym, Parking Available

- 421A Tax Deductable: Yes(per NYC Department of FInance)

| Apt # | Bedroom | Bath | SF | Status | Rent/Month | Date | PPSF |

| 18A | 2 | 1.5 | 700SF | Rented | $3,850.00 | 2017/03/01 | $66.00 |

| 10C | 1 | 1 | 711SF | Rented | $2,600.00 | 2017/02/23 | $43.88 |

| 18 | 2 | 1.5 | 1000SF | Rented | $3,850.00 | 2017/03/27 | $46.20 |

| 7D | 1 | 1 | 699SF | Rented | $2,700.00 | 2016/07/06 | $46.35 |

| 5D | 1 | 1 | 711SF | Rented | $2,500.00 | 2016/07/21 | $42.19 |

| 17C | 2 | 2 | 711SF | Rented | $4,200.00 | 2016/04/12 | $70.89 |

| Average | $52.59 |

* Data sources: Steeteasy.com/Building

Rental Comparison 2:

Address: 35-40 30th St., Long Islang City, NY, 11106

- Year of Sale:May 2010

- Units: 62

- Floors: 6

- Facilities: Gatekeepers, Elevator, Gym, Parking lot

- 421A Tax Deductable: Yes(per NYC Department of FInance)

| Apt # | Bedroom | Bath | SF | Status | Rent/Month | Date | PPSF |

| 3J | 1 | 1 | 632SF | Rented | $2,550.00 | 2016/12/22 | $48.42 |

| 1J | 1 | 1 | 650SF | Rented | $2,750.00 | 2016/09/06 | $50.77 |

| 1C | Studio | 1 | 460SF | Rented | $1,925.00 | 2016/06/13 | $50.22 |

| 4D | Studio | 1 | 466SF | Rented | $2,000.00 | 2016/04/28 | $51.50 |

| 3D | Studio | 1 | 450SF | Rented | $1,800.00 | 2015/11/02 | $48.00 |

| 5D | Studio | 1 | 460SF | Rented | $1,950.00 | 2015/08/17 | $50.87 |

| 4C | Studio | 1 | 460SF | Rented | $1,950.00 | 2015/08/09 | $50.87 |

| PHC | 2 | 2 | 1,046SF | Rented | $4,000.00 | 2015/06/29 | $45.89 |

| Average | $49.57 |

* Data sources: Steeteasy.com/Building

Surrounding Similar Property Comparison:

Sales Status about surrounding similar property private suite unit.(Dec.2016 to Dec. 2018)

- Number of Properties: 21

- Number of Sales Units: 21

- Median Transaction Price $PSF: $1,001

- Median Transaction Price: $6000,000

- Median Sales Area: 571 ft²

| Address | Area(SF) | $/SF | Transaction Date | Transaction Price | Year of Build |

| 35-40 30th St #1D | 573 | $828.97 | 2017/07/05 | $475,000 | 2007 |

| 42-51 Hunter St #3A | 1209 | $974.36 | 2017/09/27 | $1,178,000 | 2007 |

| 44-15 Purves St #8B | 713 | $1,122.02 | 2017/11/27 | $800,000 | 2012 |

| 26-26 Jackson Ave #905 | 787 | $1,175.35 | 2017/04/26 | $925,000 | 2007 |

| 43-33 42nd St #3B | 537 | $968.34 | 2018/11/29 | $520,000 | 2008 |

| 44-27 Purves St #9C | 663 | $1,011.48 | 2017/07/26 | $670,610 | 2006 |

| 44-27 Purves St #11D | 789 | $1,001.27 | 2018/01/26 | $790,000 | 2006 |

| 44-27 Purves St #14F | 525 | $1,123.81 | 2018/02/22 | $590,000 | 2006 |

* Data sources: Property Share.com

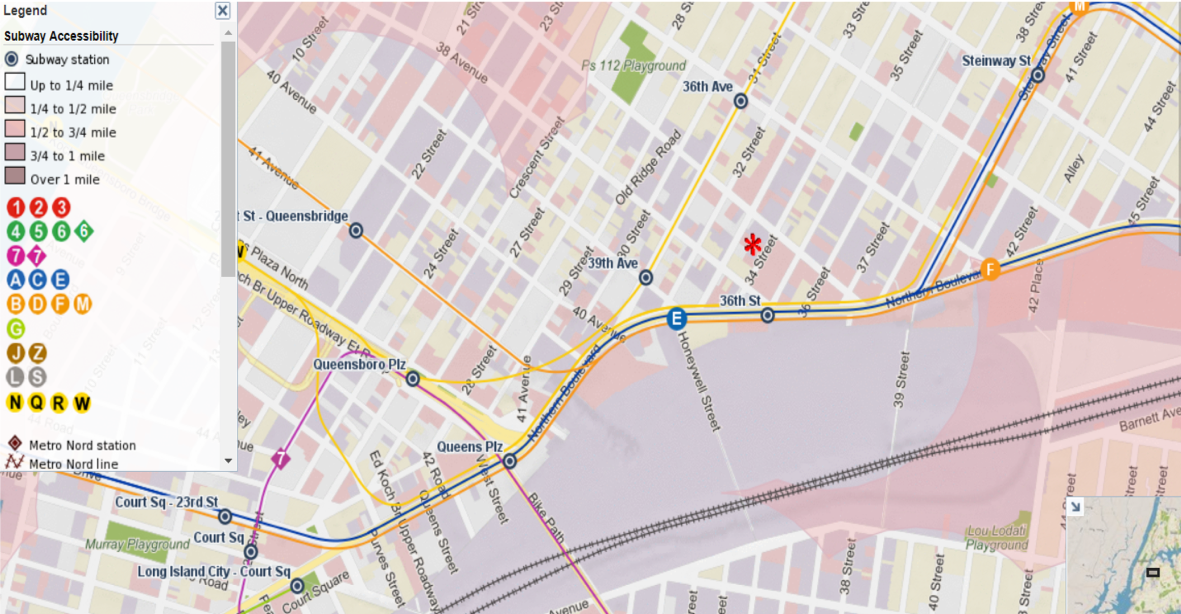

Geographic Location:

The property is located in the core area of long island city, NY. The surrounding are commercial development, dense population, environmental safety, business friedly and livable. This project is extremely convenient in transportation. It has only 4 minutes walking distance to M\R\N\W subway, 10 minutes to 7 line subway and 5 minutes to enter Manhattan.

Transportation:

METRO:M、R、N、W、7

BUS: Q66、Q101、Q102

Distance to JFK:13 miles (30 min)

Distance to LGA:4 miles (12 min)

| Public Facilities | |

|---|---|

| School | P.S 166(Elementary School) |

| CUNY School of Law | |

| Public school 70Q | |

| Park | Dwyer Square |

| Dutch Kills Green | |

| Museum | Museum of the Moving Image |

| Museum of Modern Art | |

Development Firm: LIC Common.

Introduced Year: 1997

Major shareholders: 3

Project Location: The core area of Manhattan & Brooklyn

Project Type: private suites and condominium & Mixed-use and hotel building.

Number of projects: More than 100 projects, 100% project complete on rate.

This project is a well-known Chinese developer in New York, with more than 20 years of experience in the real estate industry, focusing on the development of advanced projects in the core areas of New York.In the past 20 years, more than 100 projects have been completed, and the project completion rate is 100%. I have a deep understanding of the local market of New York, a deep understanding of the local market demand, and a good reputation and reputation for development. With its excellent development concept, I have successfully occupied a place in the New York real estate market.

In the past, the developer's successful development record, rich experience in the development of private suite real estate, and good credit in commercial lending have won the favor of numerous real estate buyers by virtue of its strong strength.

1. Since the second quarter of 2018, the U.S. real estate market has been in adjusting period. The price growth rate fell from the pick at the end of 2017, and the sales prices moderately declined. Looking forward to the trends in the next 2 years, the real estate industry will face higher costs of borrowing due to incremental interest rates, and the overall market might turn back to a more rational position which is based on affordability and supply and demand. In such market trends, CrowdFunz will mainly focus on debt investment opportunities as the core of strategy, adopting conservative loan agreements to build partnerships with real estate developers, and reduce uncertainty from fluctuant market adjustment which may lower the profitability of CrowdFunz’s investors.

2. The mission of CrowdFunz is to offering fixed income products that have controllable value-at-risk, conforming to the demands of investors who would like to minimize their risk profiles. CrowdFunz also insists on selecting real estate projects with low loan-to-value ratio and high collateral as a part of core criteria of debt investment.

3. Compared to other regional real estate markets in the U.S., the market environment of New York city generally has relatively lower volatility and downward interval; the real estate market at New York city has strong local economic support and steady residential and commercial demands. By regional market familiarity and professional understanding of real estate development, CrowdFunz carefully selects those fundraising projects of which the underlying assets or development plans possess great business fundamentals and potentials.

4. As a result of our conservative strategy, CrowdFunz 805 project was successfully passed our risk filtering processes and due diligence. CrowdFunz securitized the borrowing to private equity investment opportunities and introduces it to all CrowdFunz’s clients and potential investors. We believe that the strong market fundamentals in Elmhurst real estate market, the developer’s reliable track of record, and dependable feasibility of the operational planning of the development may support the success of investment for investors who are looing for moderate risk-return trade-off.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-2 yrs | 3-5 yrs | 6-10 yrs | 10+ yrs | |

| Tracking Record | 0-3M | 3-10M | 10-50M | 50M+ | |

| Credit Score | Accept | Fair | Good | Excellent | |

| Property as Collateral | No | Yes | |||

| Financials | |||||

| Investor Equity% | >60% | 50%-60% | 40%-50% | 25%-40% | <25% |

| Loan Senior Crowdfunz | 70%-79% | 60%-69% | 50%-59% | 1%-49% | 0% |

| Location | |||||

| Location | Rural | Suburban | Core Urban | ||

| Walk Score | 0-49 | 50-69 | 70-89 | 90-100 | |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Type | |||||

| Development Phase | Ground Up | Value-added | Stablized | ||

| Occupancy | Low | Moderate | High | Very High | |

| Investment Term | 60+ Mths | 25-60 Mths | 13-24 Mths | < 12 Mths | |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)