Condo Development Preferred Equity 809

Type: Preferred Equity

Target: $500,000

Annual Return: 8.0%

Min-invest Amount: $10,000

Duration: 6 - 9 months

Total Investment:$500,000 *

* Project 809 has only one round of capital raising, expected finished by 10/24/2019 or reaches the targeted investment amount first

Expected Annualized Return:8.0% 1

Investment Type: Preferred Equity 2

Minimum Investment: $10,000

Investment Duration: 6 - 9 Months 3

Payment Period: Semi-Annual Payment in Advance

1 Subscribers will enjoy 8.%/year expected annual return.

2 Investor of Preferred Equity 809 will take priority of compensation & claim rights over common equity. The net equity value is $2.5 Million. Besides, the developer will provide unlimited personal guarantee. (According to the third-party appraisal report,this property is estimated $5M. $2M land loan has been secured.)

3 The investment duration is 6 to 9 months. CrowdFunz reserves the right of final explanations.

Address: 97-44/48 64th Ave, Rego Park, NY 11374

Area: Rego Park, Queens, NY

Land Size: 4,900 SFT(49*100 FT)

Zoning: R7-1 (Residential 3.44 Community Facility 1.0)

Building Size: 21,756 SFT

Transaction time: Oct, 2019

- The property is located in Rego Park, Queens. The developer bought 97-48 64th Ave on Sep, 2012 with $735K. They acquired 97-44 64th Ave by October, 2019. The property value is estimated $5M and the developer has been approved with $2M land loan by the bank. CrowdFunz will raise $500,000 as preferred equity for this developer.

- Located next to the core business district in Rego Park,adjacent to several major shopping malls, living facilities and entertainment. It is by the intersection of I-495 and Queens Blvd, 5 mins walking distance to the subway station. Now there are only two two-family houses in this property but seven-floor apartment building can be built in the future.

- 20 mins drive to LGA, JFK or Flushing. Also transfer is available in Forest Hills to LIRR if going to Long Island.

* According to BBG appraisal report in Oct, 2019,this property value is $5M.

* This project has been approved with $2M land loan by the bank,Crowdfunz will raise $500,000 as preferred equity.

| Expected Schedule of Interest Payment * | |||||||

|---|---|---|---|---|---|---|---|

| Payment | Round of Investors | Funding Deadline | Payment Date | Bearing Date *1 | Due Date | Interest Period | Notes |

| 1st Batch | All Investorss | 2019-10-24 | 2019-10-24 | 2019-10-24 | 2020-4-9 | 5.5 months | Distributed |

| 2nd Batch *2 | All Investorss | 2020-4-10 | 2020-4-10 | 2020-7-9 | 3 months | Distributed | |

* Timetable will be updated periodically, please find latest version on our website

*1 If the Payment date falls into holidays or weekends, distributions will be processed by the next business day

*2 The 3rd Batch payment will be determined by developer’s deferred option

Premium Location

Located next to the core business district in Rego Park,adjacent to several major shopping malls, living facilities and entertainment. It is by the intersection of I-495 and Queens Blvd, 5 mins walking distance to the subway station. 20 mins drive to JFK or LGA.

Industry-Leading Developer

The developer is a family-run business. It has completed or owned over 200,000 SFT business and residential properties. This developer has also completed or owned three properties in this block.

Solid Fund Structure

Preferred Equity 809 fund will be used for this property acquisition bridge financing. The fund has a lower priority than senior debts, but a higher priority compared with common equity from developer.

Fund Security Measurement

The preferred equity will enjoy priority compensation and claim rights over $2.5 million net equity+ developer unlimited personal guarantee; Purchasing price is $230/SQF which is much lower than market price. The pledged equity has strong anti-risk ability.

Clear Exit Strategy

The developer accumulated experiences in multiple local projects, which makes it easier to acquire construction loan to pay back to investors. Or the developer can sell this property to pay back to investors. Or the developer can sell his LIC and Flushing properties to pay back to investors.

* The delay of the principle payment from borrower(Developer) will trigger double interest penalty which the investor shall receive double interest (16-17%/year) on any unpaid principle from the due date to the date of receiving payment in full which subject to the payment of the borrower.

| Fund Sources | |||

|---|---|---|---|

| Fund Structure | Ratio | Statues | |

| Land Loan | $2,000,000 | 40% | Approved |

| Preferred Equity | $500,000 | 10% | In Progress |

| Developer Equity | $2,500,000 | 50% | Ready |

| Total | $5,000,000 | 100.00% | |

| Fund Usage | |||

|---|---|---|---|

| Fund Usage | Amount | Ratio | Status |

| Land Acquisition | $5,000,000 | 100% | Transaction When Fund Ready |

| Total | $5,000,000 | 100% | |

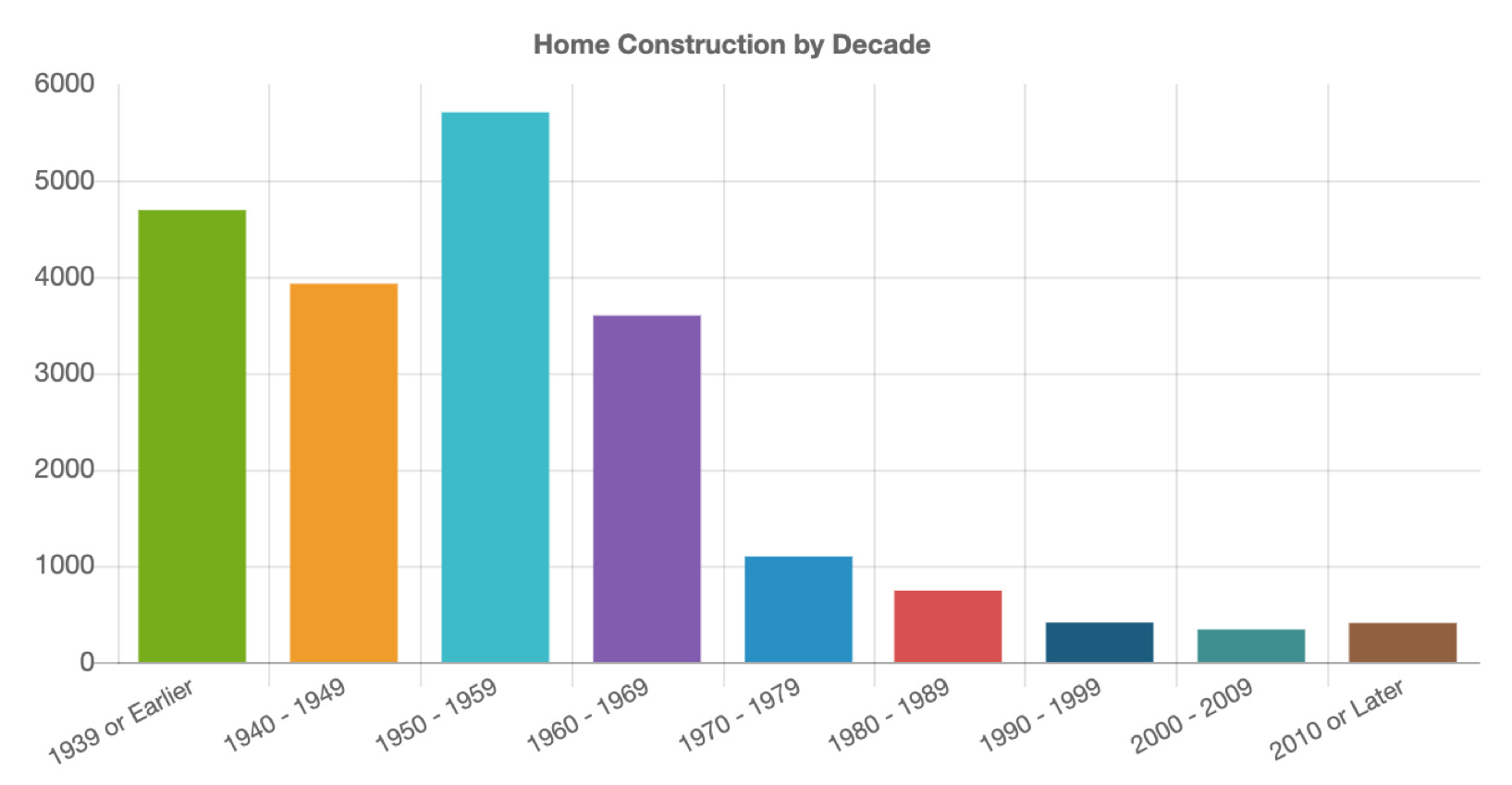

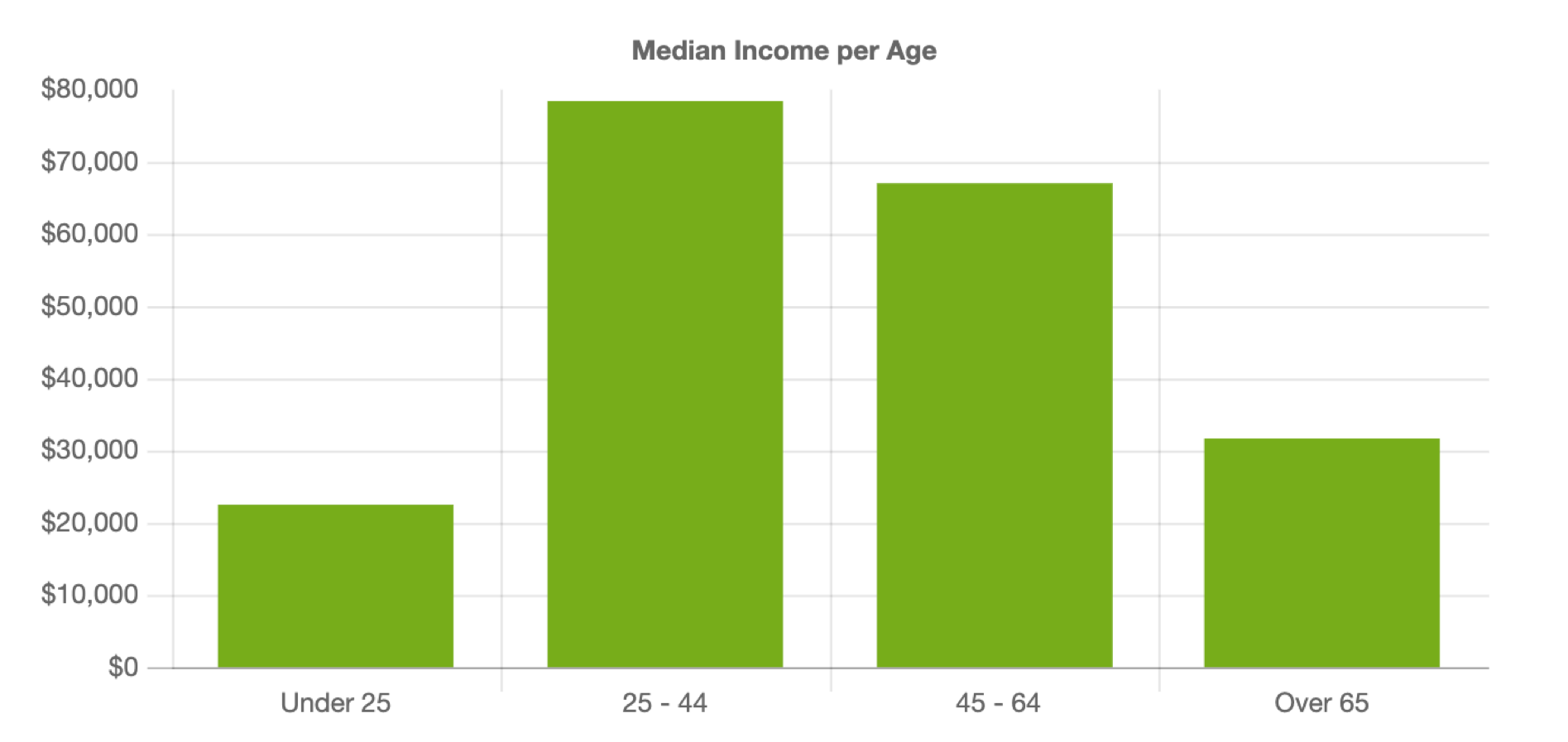

Demographics in Rego Park:

| 11374 Zip Code | |

|---|---|

| Total Population | 43,540 |

| Median Age | 44 |

| High School or Higher Education | 94.83% |

| Races | Asian, Hispanic, White, African |

| Median Family Income | $56,863 |

| Unemployment Rate | 4.74% |

| Family with Children | 18.86% |

| Average Family Member | 2 |

| Self-occupation Rate | 46.58% |

* Data Source:Collected & Compiled from open data from Point 2 Homes & NICHE

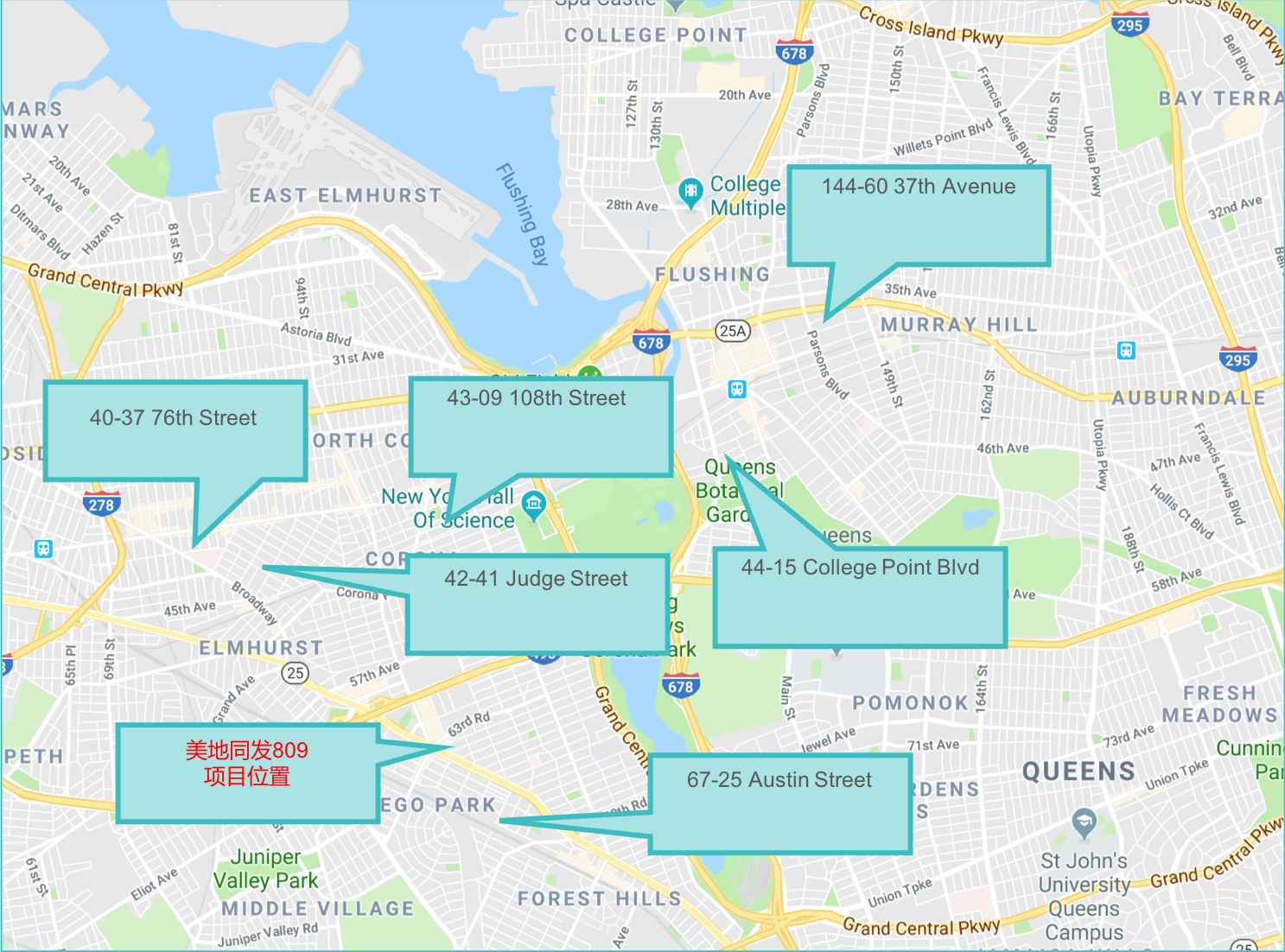

Surrounding Market Price Comparison

Selecting properties with similar zoning from mid of 2018 to Oct 2019, particularly nearby Rego Park, alone highways and subway lines, we recorded 6 representative cases as following:

- Number of Transactions: 6

- Transactions Period: Aug, 2018-October, 2019

- Zoning:R6/R6B

- Price Range: $240/sf~$248/sf

| Project 809 Surrounding Cases Analysis | |||||||

|---|---|---|---|---|---|---|---|

| Address | Transaction time | Transaction price | Lot Size | Zoning | FAR | Buildable Area | Price/SF |

| 43-09 108th Street | 1/15/2019 | $1,200,000 | 2,500 | R6B | 2.0 | 5,000 | $240 |

| 144-60 37th Avenue | 8/7/2018 | $6,300,000 | 8,100 | R6 | 2.43 | 19,683 | $320 |

| 40-37 76th Street | 8/20/2019 | $2,260,000 | 3,980 | R6B/C2-3 | 2.0 | 7,960 | $284 |

| 44-15 College Point Blvd | 7/22/2019 | $13,600,000 | 9,480 | R6 | 3.0 | 28,440 | $478 |

| 6725 Austin Street | For Sale | $7,800,000 | 3,000 | R7-1 | 4.44 | 13,320 | $586 |

| 4241 Judge Street | For Sale | $1,798,000 | 2,500 | R7B | 3.2 | 8,000 | $225 |

| Address | Price/SF(No adjustment) | Project Ratio | Transaction time ratio | Expected Price/SF | Location Ratio | Zoning Ratio | Size Ratio | Public Facilities Ratio | Total Ratio | Price/SF |

| 43-09 108th Street | $240 | 0% | 2.1% | $240 | 0% | 0% | 5% | 5% | 10% | $264 |

| 144-60 37th Avenue | $320 | 0% | 3.4% | $320 | 0% | 0% | 0% | 0% | 0% | $320 |

| 40-37 76th Street | $284 | 2% | 0.3% | $290 | 0% | 0% | 5% | 0% | 5% | $304 |

| 44-15 College Point Blvd | $478 | 1% | 0.5% | $483 | 0% | 0% | -5% | -10% | -15% | $411 |

| Low | $240 | Low | $264 | |||||||

| High | $478 | High | $411 | |||||||

| Average | $331 | Average | $325 | |||||||

| Median | $302 | Median | $312 |

Geographic Location:

Located next to the core business district in Rego Park. It is by the intersection of I-495 and Queens Blvd, 5 mins walking distance to the subway station. 20 mins drive to JFK and LGA.

It is adjacent to several major shopping malls, living facilities, banks and entertainment.

Transportation:

Subway:M/R

Train:LIRR

JFK: 7.5 Miles(about 20 mins drive)

LGA: 4.8 Miles(about 20 mins drive)

Developer: GS Main Street Realty

Founded Time: 1999

Project Location: Flushing, Elmhurst, Rego Park, LIC and nearby area

Project Type: Residential Houses, Condominiums, Community Facility, Mixed-use Retail/Office Buildings, Hotel and Commercial Buildings

Project Display:

Starting in real estate since 1999,GS Main Street Realty has already been developing projects in Manhattan, Queens, Bronx. Especially in Elmhurst, GS has abundant experiences in developing multi-family and condo projects. GS has already developed and owned over 200K residential + commercial properties. It has been one of the fastest growing developers in recent ten years.

This developer has great reputation prestige in medium and small property investment market. It has established fine relationship with vast investors after many projects like Crowdfunz 804 and 807.

1. Since the second quarter of 2018, the U.S. real estate market has been in adjusting period. The price growth rate fell from the pick at the end of 2017, and the sales prices moderately declined. Looking forward to the trends in the next 2 years, the real estate industry will face higher costs of borrowing due to incremental interest rates, and the overall market might turn back to a more rational position which is based on affordability and supply and demand. In such market trends, CrowdFunz will mainly focus on debt investment opportunities as the core of strategy, adopting conservative loan agreements to build partnerships with real estate developers, and reduce uncertainty from fluctuant market adjustment which may lower the profitability of CrowdFunz’s investors.

2. The mission of CrowdFunz is to offering fixed income products that have controllable value-at-risk, conforming to the demands of investors who would like to minimize their risk profiles. CrowdFunz also insists on selecting real estate projects with low loan-to-value ratio and high collateral as a part of core criteria of debt investment.

3. Compared to other regional real estate markets in the U.S., the market environment of New York city generally has relatively lower volatility and downward interval; the real estate market at New York city has strong local economic support and steady residential and commercial demands. By regional market familiarity and professional understanding of real estate development, CrowdFunz carefully selects those fundraising projects of which the underlying assets or development plans possess great business fundamentals and potentials.

4. As a result of our conservative strategy, CrowdFunz 809 project was successfully passed our risk filtering processes and due diligence. CrowdFunz securitized the borrowing to private equity investment opportunities and introduces it to all CrowdFunz’s clients and potential investors. We believe that the strong market fundamentals in Elmhurst real estate market, the developer’s reliable track of record, and dependable feasibility of the operational planning of the development may support the success of investment for investors who are looking for moderate risk-return trade-off.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-2 yrs | 3-5 yrs | 6-10 yrs | 10+ yrs | |

| Tracking Record | 0-3M | 3-10M | 10-50M | 50M+ | |

| Credit Score | Accept | Fair | Good | Excellent | |

| Financials | |||||

| Investor Equity% | <20% | 20%-30% | 30%-40% | 40%-50% | 50%-60% |

| Loan Senior Crowdfunz | 70%-79% | 60%-69% | 50%-59% | 1%-49% | 0% |

| Location | |||||

| Location | Rural | Suburban | Core Urban | ||

| Walk Score | 0-49 | 50-69 | 70-89 | 90-100 | |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Type | |||||

| Development Phase | Ground Up | Value-added | Stablized | ||

| Property as Collateral | No | Yes | |||

| Occupancy | Low | Moderate | High | Very High | |

| Investment Term | 60+ Mths | 25-60 Mths | 13-24 Mths | < 12 Mths | |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)