Condo Development Preferred Equity 811

Type: Preferred Equity

Target: $3,000,000

Annual Return: 8.0 - 8.5%

Min-invest Amount: $10,000

Duration: 12 - 18 months

Total Investment: $3,000,000 *

* First Round: Funding Amount: $1,500,000, Funding Deadline: 01/20/2020

* Second Round: Funding Amount: $1,500,000, Funding Deadline: 02/20/2020

Expected Annualized Return: 8.0% - 8.5% 1

Investment Type: Preferred Equity 2

Minimum Investment: $10,000

Investment Duration: 12 - 18 Months 3

Payment Period: Prepaid Interest Every Six Months

1 Subscribers will enjoy 8%/year excepted annual return for investment $10,000-$290,000. Subscribers will enjoy 8.5%/year expected annual return for investment on & above $300,000.

2 This project is preferred equity project. The developers 'equity of $13.5M lays last in the capital stack. Before fully paying investors and interests, the developers cannot exit. This is to ensure investors 'interests and the developers also provide unlimited personal guarantee.

3 The developer can choose extend another 6 months at the end of 12th month, Crowdfunz reserves the right of final explanations.

Address: 173-175 Chrystie St, New York, NY 10002

Area: Lower East Side, New York, NY

Land Size: 4,346 SF(38.5*117.6 FT)

Zoning:C6-3A (Residential + Commercial Times 6.5)

Building Size: 28,249 SF

Transaction Time: Oct. 2014

- Subway about 15mins ride to midtown, 10mins to ferry,15mins to BK downtown and 40 mins to Flushing, Queens.

- The project is located on Chrystie St and the tenants will face to the park to enjoy very rare green view in Manhattan. There is rich history in the surrounding district and there are full of fine dining and art centers. About 5mins walk to reach 6 subway lines to reach anywhere in NYC.

- The developer purchased this land for $15.5M in Oct, 2014, about $575/SF. The construction started from Feb., 2017. It’s going to be a high-end 10 floors-residential building by April, 2020. The developer has put $13.5M into this project and also need $3M preferred equity from Crowdfunz to finish the construction.

| Interest Payment Timetable * | ||||||||

|---|---|---|---|---|---|---|---|---|

| Payments | Round of Investors | Funding Amount | Funding Deadline | Payment Date | Bearing Date *1 | Due Date | Interest Period | Notes |

| 1st Batch | First Round Investors | 1.5M | 2020-01-20 | 2020-01-20 | 2020-02-14 | 2020-08-11 | 6.5 Months | Pre-paid Interest |

| Second Round Investors | 1.5M | 2020-02-20 | 2020-02-20 | 2020-02-20 | 2020-08-11 | 5.5 Months | Pre-paid Interest | |

| 2nd Batch | All Investors | 2020-08-12 | 2020-08-12 | 2021-02-14 | 6 Months | Pre-paid Interest | ||

| 3rd Batch *2 | All Investors | 2021-02-15 | 2021-02-15 | 2021-08-11 | 6 Months | Pre-paid Interest | ||

* Timetable will be updated periodically, please find latest version on our website

*1 If the Payment date falls into holidays or weekends, distributions will be processed by the next business day

*2 The 3nd Batch payment will be determined by developer’s deferred option

Location

The project is located in LES, facing the park and next to Chinatown and Little Italy. The community has rich history and there are shopping malls, museums, bars and restaurants nearby. 5mins walk to 4 nearby subway stations, 15 mins to seaport and 20 mins subway ride to midtown.

Developer Background

The developer team is made with local top Jewish and Chinese. The majority developments are in Manhattan and LIC. Now they are designing and developing a site which is over 1.2M SF mixed use near LIC riverside。The developers are local and has great resources and rich development experiences.

Fund Use

The fund is used for building interior work. Preferred equity is after bank loan but prior to developer’s equity in capital stack. The developer cannot exit before fully paying investors.

Fund Safety Measurement

The $3M preferred equity will prior to the developers’$13.5M and the developer will provide partial pledge which is over $4M. Besides that, the developer will also provide 9 digits unlimited personal guarantee to ensure the safety of investors.

Exit Strategy

The developer can pay back investors through refinancing after project’s completion. Or the developer can sell condos to pay back investors. Or the developers can pay back investors through other projects. *

* The delay of the principle payment from borrower (Developer) will trigger double interest penalty which the investor shall receive double interest (15%/year) on any unpaid principle from the due date to the date of receiving payment in full which subject to the payment of the borrower on daily bases.

| Fund Sources | |||

|---|---|---|---|

| Fund Structure | Ratio | Status | |

| Bank Loan | $27,500,000 | 62.5% | Ready |

| Preferred Equity | $3,000,000 | 6.8% | Processing |

| Developer Equity | $13,500,000 | 30.7% | Spent |

| Total | $44,000,000 | 100.00% | |

| Fund Usage | |||

|---|---|---|---|

| Fund Usage | Amount | Ratio | Status |

| Land Cost | $15,500,000 | 35% | Spent |

| Total Hard Cost | $16,500,000 | 38% | Partially Spent |

| Total Soft Cost | $8,000,000 | 18% | Partially Spent |

| Financing and Interest Cost | $4,000,000 | 9% | Partially Spent |

| Total | $44,000,000 | 100% | |

This project has got $27.5 M bank loan which ranks the highest in capital stack. The developer has poured $13.5 M into this project which ranks the lowest in capital stack. The $3M of preferred equity from Crowdfunz lays middle in the capital stack which is lower than the bank loan but higher than the developer own capital. The developer’s equity will exit the last to ensure investors 'interest.

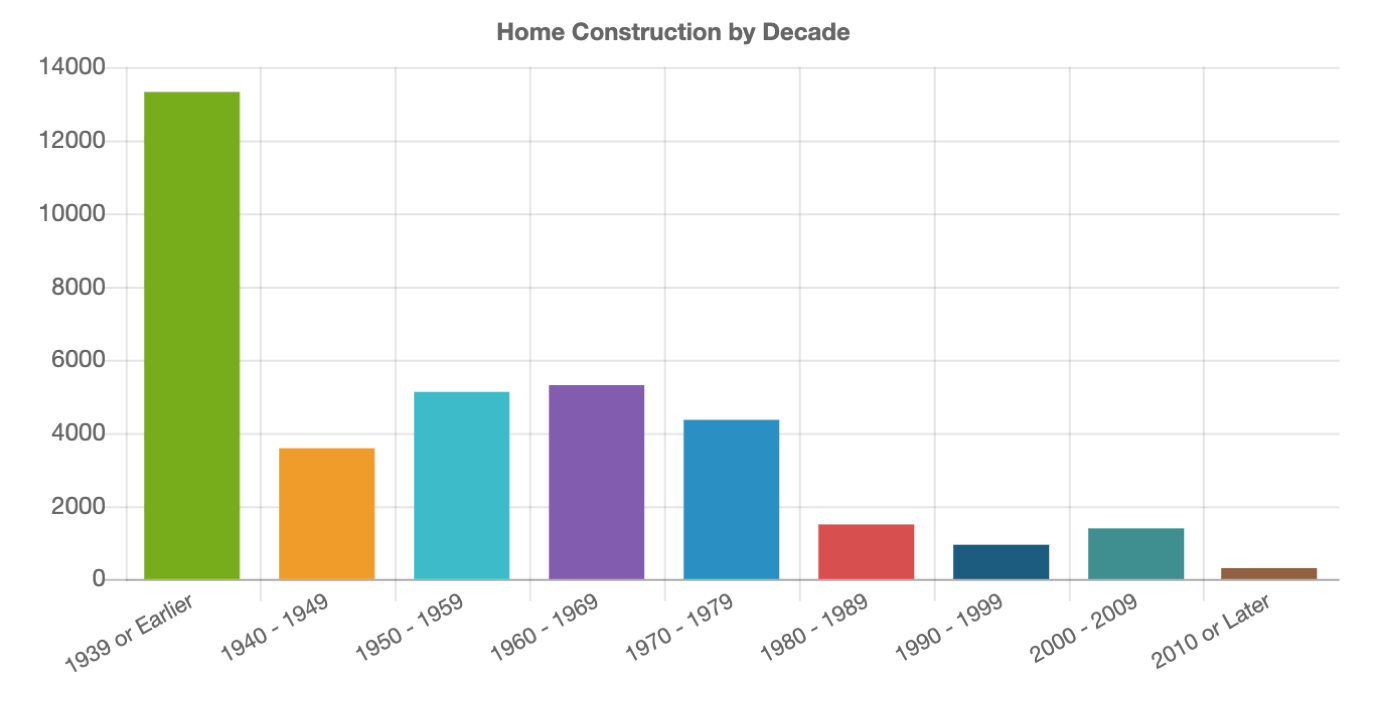

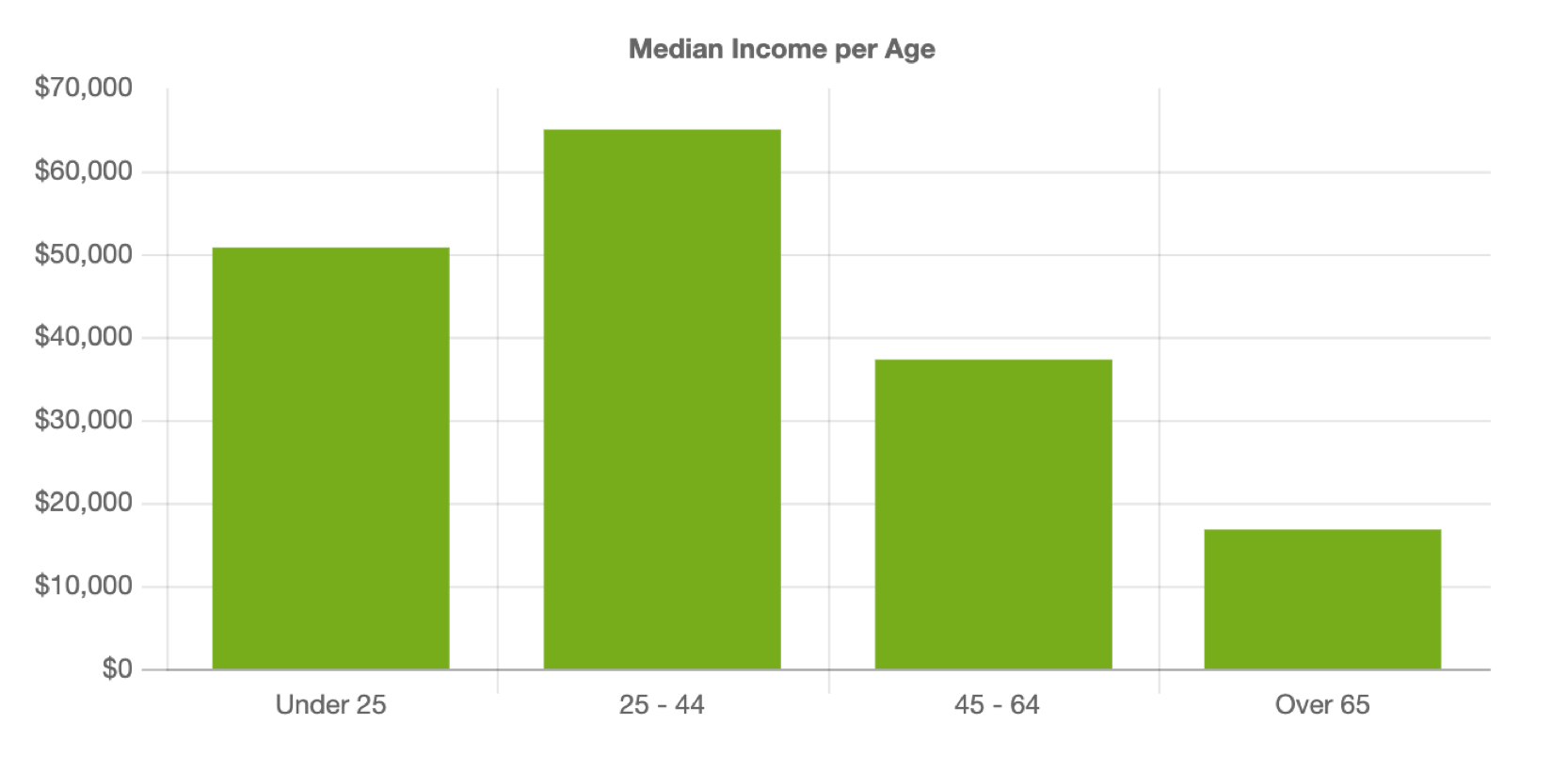

Demographics in Lower East Side:

| Zip Code 10002 | |

|---|---|

| Total Population | 77,925 |

| Median Age | 41.8 |

| High School & Higher Education | 81.51% |

| Races | Asian, White, Black or African American |

| Median Family Income | $65,718 |

| Unemployment Rate | 8.3% |

| Family with Children | 18.56% |

| Average Family Member | 2 |

| Self-occupation Rate | 49.88% |

* Data Source: Organized Based on Public Data from Point 2 Homes & NICHE

Project 811 Condo Sales and Rental Analysis:

According to surrounding condo and rental market, the majority is high-end condo. The majority rental buildings are upgraded in 1990s. Units are old and compact:

- Number of Units: 45

- Market Time: Oct, 2019

- Price/SF: $970-$5265

- Medium Price: $3,065,000

- Medium Price/SF: $2,000

- Medium Rental: $3,400

* Source:StreetEasy

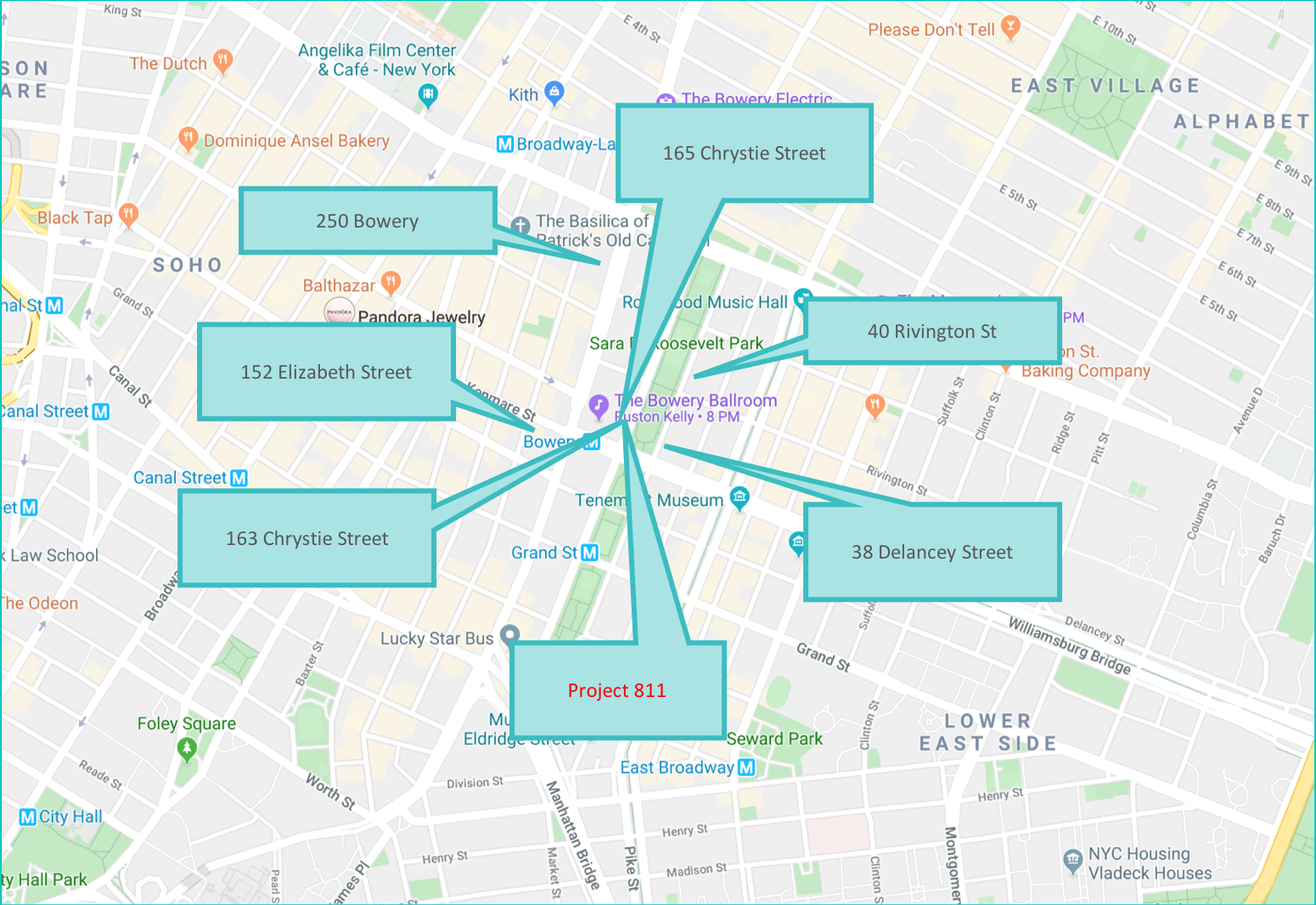

Geographic Location:

The project is located in Chrystie St, facing the park and people can enjoy very rare green view in Manhattan. Very rich history in this community and there are full of fine dining and art centers. 5mins walking to 6 subway lines and you can reach anywhere in the city.

Located in the core are in LES in Manhattan. There are shopping, entertainment, living facilities, hospitals and police stations nearby.

Transportation:

Subway: B/D/J/Z/F/M

Train: 15 Mins to Penn Station

JFK: 18.5Miles (About 30Mins Drive)

LGA: 9.2Miles (About 20Min Drive)

Developer: ACMOS LLC

Project Area: Manhattan, LIC and Etc.

Project Type: High-end Residential, Hotels, Mixed Use and Office.

Project Display:

Mr. Azoulay is found and CEO of ACMOS LLC. ACMOS is a real estate company that provides comprehensive services and devotes to residential development. He is in charge of the company’s strategic direction and overall management. Mr. Azoulay is also in charge of every phrases from acquisition, financing to construction.

Mr. Azoulay has vast experiences in new developments. From concept to completion, he anticipated various projects including design pricing, sales and pricing. Here are the projects he anticipated:

| 255 Bowery | 117 E 29th Street | 427 E 12th Street |

| 16 W 21st Street | 165 Chrystie Street | 306 E 82nd Street |

| 241 W 107th Street | 263 Bowery | 1444 3rd Ave |

1. Since the second quarter of 2018, the U.S. real estate market has been in adjusting period. The price growth rate fell from the pick at the end of 2017, and the sales prices moderately declined. Looking forward to the trends in the next 2 years, the real estate industry will face higher costs of borrowing due to incremental interest rates, and the overall market might turn back to a more rational position which is based on affordability and supply and demand. In such market trends, CrowdFunz will mainly focus on debt investment opportunities as the core of strategy, adopting conservative loan agreements to build partnerships with real estate developers, and reduce uncertainty from fluctuant market adjustment which may lower the profitability of CrowdFunz’s investors.

2. The mission of CrowdFunz is to offering fixed income products that have controllable value-at-risk, conforming to the demands of investors who would like to minimize their risk profiles. CrowdFunz also insists on selecting real estate projects with low loan-to-value ratio and high collateral as a part of core criteria of debt investment.

3. Compared to other regional real estate markets in the U.S., the market environment of New York city generally has relatively lower volatility and downward interval; the real estate market at New York city has strong local economic support and steady residential and commercial demands. By regional market familiarity and professional understanding of real estate development, CrowdFunz carefully selects those fundraising projects of which the underlying assets or development plans possess great business fundamentals and potentials.

4. As a result of our conservative strategy, CrowdFunz 810 was successfully passed our risk filtering processes and due diligence. CrowdFunz securitized the borrowing to private equity investment opportunities and introduces it to all CrowdFunz’s clients and potential investors. We believe that the strong market fundamentals in Jamaica real estate market, the developer’s reliable track of record, and dependable feasibility of the operational planning of the development may support the success of investment for investors who are looking for moderate risk-return trade-off.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-2 yrs | 3-5 yrs | 6-10 yrs | 10+ yrs | |

| Tracking Record | 0-3M | 3-10M | 10-50M | 50M+ | |

| Credit Score | Accept | Fair | Good | Excellent | |

| Financials | |||||

| Investor Equity% | <20% | 20%-30% | 30%-40% | 40%-50% | 50%-60% |

| Loan Senior Crowdfunz | 70%-79% | 60%-69% | 50%-59% | 1%-49% | 0% |

| Location | |||||

| Location | Rural | Suburban | Core Urban | ||

| Walk Score | 0-49 | 50-69 | 70-89 | 90-100 | |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Type | |||||

| Development Phase | Ground Up | Value-added | Stablized | ||

| Property as Collateral | No | Yes | |||

| Occupancy | Low | Moderate | High | Very High | |

| Investment Term | 60+ Mths | 25-60 Mths | 13-24 Mths | < 12 Mths | |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)