Equity Pledge Debt Fund 812

Type: Debt

Target: $1,300,000

Annual Return: 7.75% - 8%

Min-invest Amount: $10,000

Duration: 6 - 18 months

Offering Amount: $1,300,000

Estimated Return: 7.75% - 8.00% Annualized Return1

Investment Type: Equity Pledge Loan

Unit Price: $10,000 per Subscription Unit

Offering Date: October 2020

Investment Horizon: 6 - 18 Months(6+3+3+6 Months as Periods)

Dividend Schedule: Prepaid before per Period

1 7.75% Annualized Return for Investment of 1-19 Units; 8.00% Annualized Return for Investment above 20 Units.

Site Location: 42-43 27th Street, Long Island City, NY 11101

Region: Long Island, Queens, New York

Land Area: 1,865 Square Feet(25 Ft x 77.75 Ft)

Zoning: M1-5/R7-3(Commercial & Residential FAR =5)

Building Area: 7,180 Square Feet

Land Closing Date: June 2014

Land Closing Price: $1,680,000.00

- The site is located at the central area of Long Island City. The developer purchased the land for Phase I development on June 2014, completed the construction, and started property operations in 2018. The property in Phase I development is a building in 6 floors high, with commercial leasing space on the first floor and residential rental units through second to sixth floor.

- The surrounding of the development has many recreational facilities and shops including supermarkets, restaurants and bars; the nearly communities are filled with young and energetic residents mainly working in Manhattan or studying in the universities in the metropolitan area.

- The transportation for the site is convenient. Taking 5 minutes, tenants can walk to 7 subway lines. The commute is 10 minutes to Midtown Manhattan and 25 minutes to Flushing, Queens. It takes 20 minutes driving to LaGuardia Airport and 50 minutes to JFK Airport.

The developer plans to conduct two phases of real estate development in this area:

Phase 1: Build a multi-family rental apartment with one retail space on the first floor at 42-43 27th Street. The land for Phase I was purchased in September 2014, and the property construction was completed in 2018 and started operations. The property of Phase I consists of 7 residential units and 1 retail space. The leases of all units and the retail space had been signed in 2019. The current rental income of the property is stable, and the operations are in good condition.

Phase 2: the two lots, 42-62 & 42-64 Hunter Street, will be used to build similar property type as the completed property in Phase I, including multi-family rental apartments and 1 retail space. About the two pieces of land developed in the Phase II, 42-62 Hunter Street was purchased in October 2019 for US$2.99 million, and 42-64 Hunter Street was purchased in July 2020 for US$2.55 million. The two lots are closely connected and backed by the property developed in Phase I.

The funds invested by Crowdfunding Fund 812 will be in the form of a loan for developer’s Phase II development. The property completed in Phase I will be considered as collateral since its owning entity, Greenland 27 LLC. Pledge the company’s 100% to CrowdFunz Fund 812.

| Expected Dividend Calendar | |||||

|---|---|---|---|---|---|

| Round | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | No Later than 2020/10/23 | 2020/10/8 | 2021/4/8 *2 | 6 Months | Prepaid Dividend |

| Second | No Later than 2021/4/23 | 2021/4/9 | 2021/7/8 | 3 Months | The develop has the option on extension |

| Third | No Later than 2021/7/23 | 2021/7/9 | 2021/10/8 | 3 Months | The develop has the option on extension |

| Fourth | No Later than 2021/10/23 | 2021/10/9 | 2022/4/8 | 6 Months | The develop has the option on extension |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 After the expiration of the first Dividend Period, the developer has the option to extend the borrowing 3 times. If the developer chooses to extend, the investor will receive dividends at the same rate of return during the postponement.

Well-operating Property, Sufficient Value Collateralized

- For evaluating the value of the collateral, the property has had stable rental income since its operation. The residential tenants are white-collar workers; the commercial tenant on first-floor, Koufuku Market, is one of the few Asian grocer in the community and has performed well during the pandemic.

- According to the valuation provided by the third-party appraiser, EAST COAST, in September 2020, the property built in Phase I is currently worth $5,230,000 and will be worth $6,480,000 after the property receiving the 421-a Tax Exemption.

- Based on the financial data released by the developer, the current annual revenue for the operating property is $388,296.00, and the annual net operating income is $273,438.71, with a net income margin of 70.42%

- Currently, the developer is applying for the 421-a real estate tax abatement for the property built in Phase i. The approval is expected to be authorized within 6-8 months. By then, the property tax will be reduced to $8000.00 per year, and the annual net operating income will raise to $333,095.71, with a net income margin of 85.78%.

Prime Location, Strong Demand

- The development is located between Queens Plaza and Court Square in Long Island City. There are many subway lines such as E, M, R, 7, G, etc., bus like Q32, Q60, Q66, and train lines as MONTAUK, OYSTER BAY, and PORT WASHINGTON, making residents easily commute to most of the locations in the metropolitan area.

- In recent years, the communities in Long Island City have gradually become a gathering place for young generations, and the surrounding business environment has been more matured. The demand for housing has grown steadily. According to statistics from Trulia and Zillow, the median house sale price in Long Island City is $874,837, and the median monthly rent is $2,798, which has been incrementally increased in the past five years.

Clear Debt Spending, Straight Exit Strategy

The loan disbursed by CrowdFunz Fund 812 will be used for the Phase II of development, and the items of expenses are clear. Meanwhile, the developer is currently applying for the 421-a real estate tax abatement for the property built in Phase I. and The tax abatement is expected to be approved within 6-8 months. At that time, the property tax will be significantly reduced, and the developer will use the property as collateral to apply for refinance from banks. The cash subsidy from refinance will be directly used to payback the loan originated by CrowdFunz Fund 812.

Seasoned Developer, Concrete Capabilities

The developer has run its business in the New York real estate market for many years, establishing a good reputation on developing small and meddle size properties. Its prior completed projects are located across all boroughs of New York. For real estate financing, the developer has cooperated with CrowdFunz many times, including Fund 804, Fund 807 fund, and Fund 809. In those past funds, CrowdFunz has established a trustworthy cooperative relationship with the developer, backed by its development capabilities and business reputation.

| Capital Stack | Percentage | |

|---|---|---|

| Mortgage originated by Emerald Creek | $3,300,000 | 50.93 % |

| Loan originated by CrowdFunz | $1,300,000 | 20.06 % |

| Developer’s Equity | $1,880,000 | 29.01 % |

| Property Value of Phase I * | $6,480,000 | 100.00% |

| Purposes of Debt | Percentage | |

|---|---|---|

| Demolition | $200,000 | 15.38 % |

| Architectural | $250,000 | 19.23 % |

| Land Development | $800,000 | 61.54 % |

| Working Capital | $50,000 | 3.85 % |

| Equity Pledge Loan | $1,300,000 | 100.00% |

* According to the valuation provided by the third-party appraiser, EAST COAST, in September 2020, the property of Phase I is currently worth $5,230,000, and it will be worth $6,480,000 after receiving the 421-a Tax Abatement. At present, the developer has entered the approval process applying for 421-a.

The project has a clear capital structure. The Phase I of the project had been completed and is operating well. The CrowdFunz Fund 812 possesses the financial claim on its pledged 100% ownership interests.

The mortgage originated by Emerald Creek is $3.3 million, accounting for 50.93% of the capital stack as the first position; the loan originated by CrowdFunz Fund 812 is $1.3 million with equity pledge, accounting for 20.06% of the capital stack as the second position. After the approval of 421-a, the value of the developer’s equity is $3.2 million, accounting for 29.01%.

The loan originated by CrowdFunz Fund 812 will be used for the Phase II of the development, of which $200,000 is planed for the demolition of the current buildings, $250,000 is proposed for architectural design, $800,000 is used for land development, and $50,000 is reserved for the demand for liquidity in the process

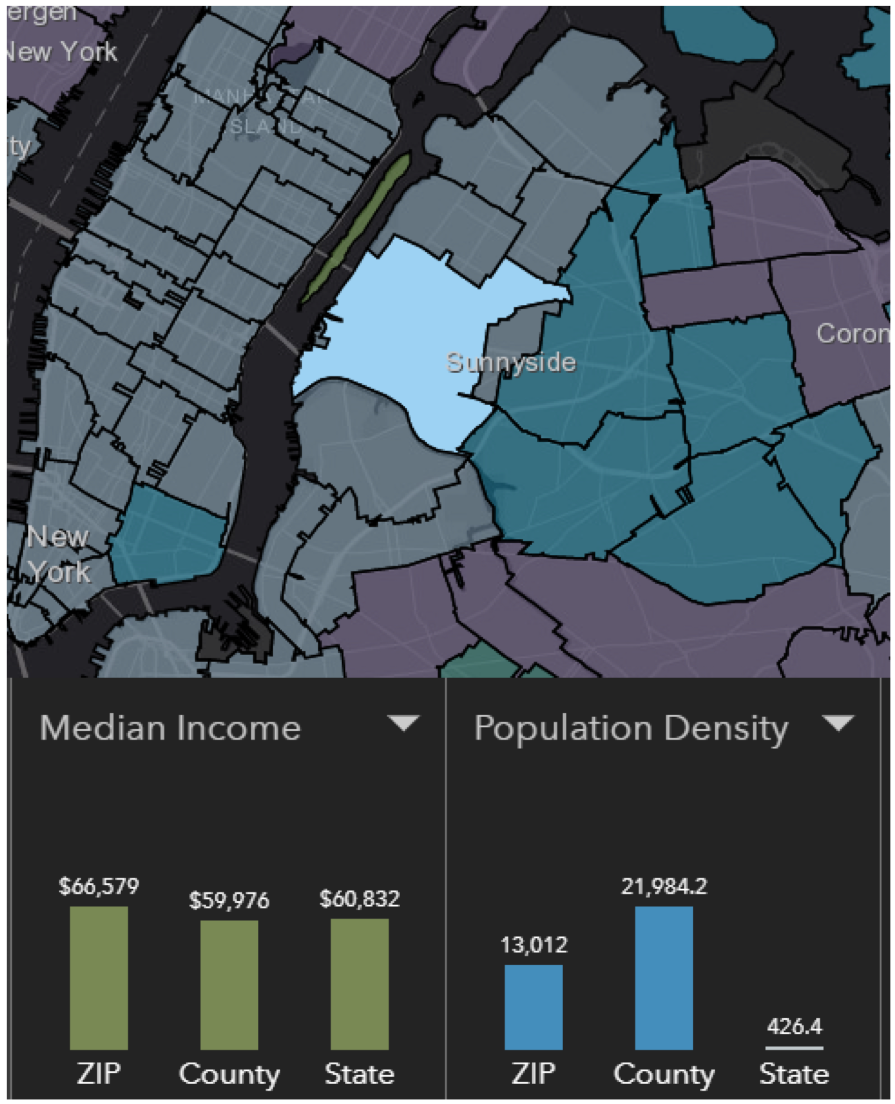

Demographics in the Zip Code:

| Within 11101 | |

|---|---|

| Population | 50,713 |

| Age | 34.1 |

| High school and above Education | 93.9% |

| Ethnicity | Mainly White and Asian |

| Medianホusehold Income | $66.579 |

| White-collar/Blue-collar | 89.2%/10.8% |

| Family with Child | 23.5% |

| Average Family Size | 2.24 |

| Primary Residence | 69.3% |

This zip code is dominated by white and Asian population with a high proportion of white-collar workers; most of residents are middle-class workers in Manhattan.

Residents in the zip code are well-educated, higher than the overall level of New York and Queens; median household income is also higher than Queens and New York State.

Residents are generally young generations, with an average age of 34.1 years; most families are just married; only 1/4 of families have children.

The rate of self-occupied residence has been increasing in recent years, and the main population of young homeowners and tenants provide the community medium-and-long-term momentum on development.

* Data Source: Property Shark, Esri Zip code Lookup, September 2020

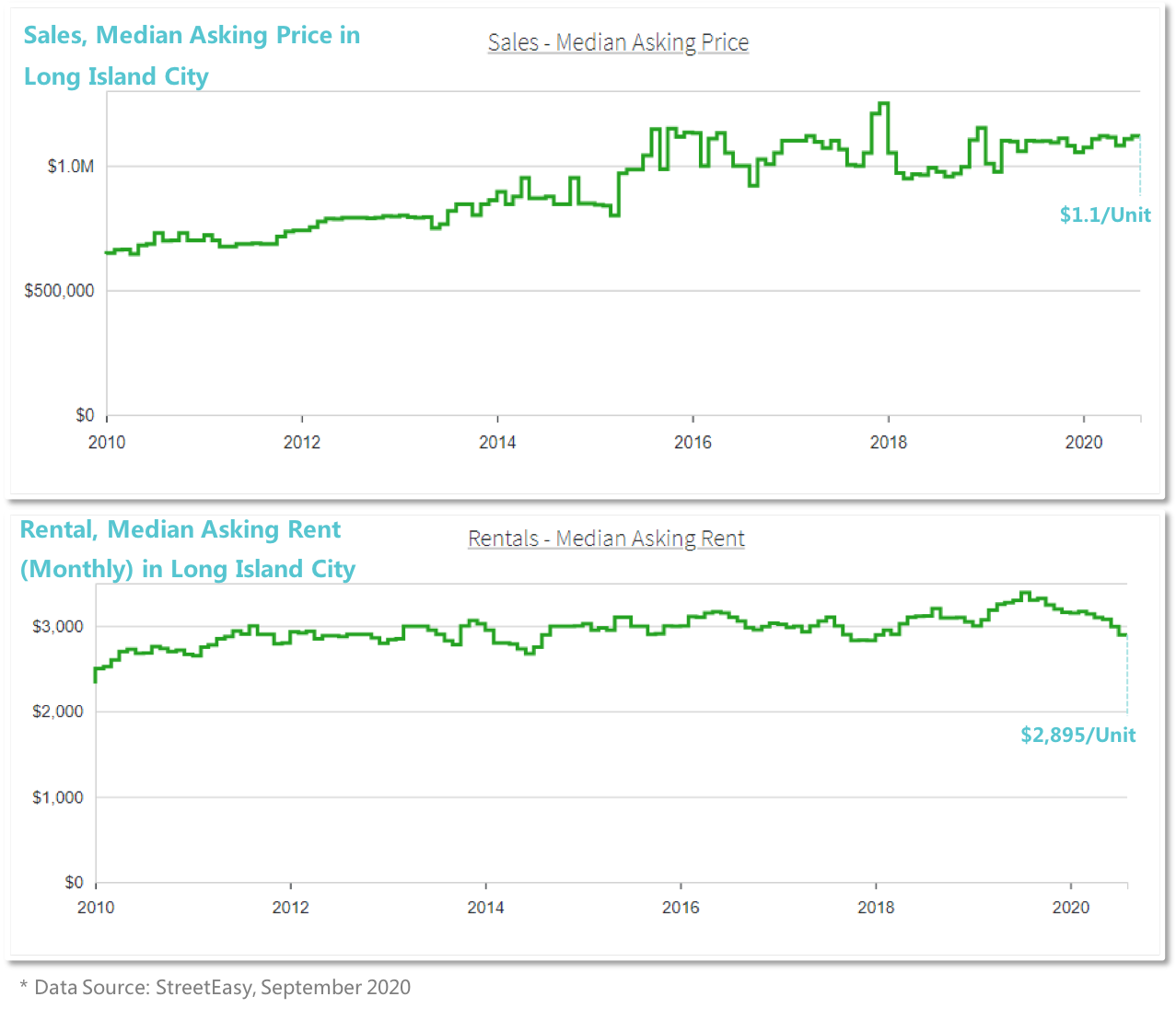

Residential Real Estate Perspective:

In the residential market, the housing rental and house sales in the long Island City have been very active in the past 5 years. The average selling price of residential units has increased significantly; the residential rental market has continued to maintain healthy.

Affected by the pandemic in 2020, Long Island City has experienced a small decrease in monthly rents due to sufficient rental supply and sellers’ active market strategies. For the property collateralized in CrowdFunz Fund 812, its rental units are relatively less than larger apartments, with a cost-effective pricing. Thus, the current rental revenue is not impacted by the issues, supporting by the remained rental prices.

Current Residential Rental Prices of the Underlying Property:

Studio: $66.67 per SF/Year (About $ 2,333/Month)

2B2B: $50.37 per SF/Year (About $ 3,758/Month)

As of August 2020, the Capitalization Rate of residential rental properties in Queens is approximately 3.95-5.03% *1

* 1 Source: Greystone; Regional Spotlight: 3 Trends for NYC Multifamily in 2020

Comparable Residential Rental Units Nearly

| Address | Built Year | Ft² | Story | Units | Distance to Project | Unit Type | Number of Rooms | Average PPSFPY |

| 42-50 27 St. #9D | 2017 | 410 | 9 | 32 | 0.2 mile | Studio | 1 | $67.32 |

| 11-35 45 Ave. #4H | 2014 | 485 | 6 | 38 | 0.5 mile | Studio | 1 | $56.29 |

| 42-37 27 St. #8A | 2014 | 580 | 8 | 55 | 0.3 mile | Studio | 2 | $44.88 |

| 42-14 Crescent St. #5D | 2016 | 376 | 13 | 48 | 0.1 mile | Studio | 1 | $73.40 |

| 25-10 38th St. | 2018 | 430 | 8 | 19 | 0.7 mile | Studio | 3 | $53.7 |

| 42-61 Hunter St. | 2009 | 725 | 3 | 8 | 0.1 mile | 2B1B | 3 | $42.21 |

| 42-51 Hunter St. #2B | 2007 | 1285 | 7 | 24 | 0.5 mile | 2B2B | 3 | $40.72 |

| 21-30 44th Dr. #8J | 2019 | 1089 | 8 | 85 | 0.3 mile | 2B2B | 2 | $55.10 |

| 46-20 11 St. #5C | 2019 | 937 | 7 | 42 | 0.7 mile | 2B2B | 2 | $57.00 |

| 27-05 41st Ave. | 2019 | 676 | 6 | 44 | 0.2 mile | 2B2B | 6 | $51.3 |

| 42-60 Crescent St. #6C | 2014 | 1088 | 10 | 37 | 0.1 mile | 2B2B | 4 | $48.53 |

* Data Source: Property Shark, September 2020;Óummarized and calculated by CrowdFunz Holding LLC.

* The Average Rental Prices per Square Foot per Year of the Comparable Residential Rental Units are: Studio: $49.14/Sf/Y; 2B2B: $59.12/Sf/Y

* The Average Rental Prices per Square Foot per Year of the underlying property are: Studio: $66.07/Sf/Y; 2B2B: $50.37/Sf/Y

Comparable Residential Units Sold Nearby

| Address | Property Type | Ft² | Story | Number of Units | Distance to Project | Unit Type | Number of Rooms | Date Sold | Sold Price | Average PPSF |

| 42-14 Crescent St. #8C | Condo | 503 | 13 | 48 | 0.2 mile | Studio | 1 | 08/30/2020 | $475,000 | $944.33 |

| 41-04 27th St. #8B | Condo | 462 | 9 | 32 | 0.4 mile | Studio | 1 | 12/18/2019 | $671,026 | $1,452.43 |

| 11-30 45 Rd. #1A | Condo | 434 | 6 | 24 | 0.6 mile | Studio | 1 | 04/02/2020 | $590,000 | $1,359.45 |

| 21-20 45 Rd. #1 | Condo | 784 | 4 | 6 | 0.5 mile | Studio | 1 | 07/27/2020 | $745,000 | $950.26 |

| 21-26 45 Rd. #1 | Condo | 784 | 4 | 6 | 0.4 mile | Studio | 1 | 08/21/2020 | $700,000 | $892.86 |

| 2626 Jackson Ave. APT#602 | Condo | 1048 | 12 | 43 | 0.1 mile | 2B2B | 2 | 07/21/2020 | $1,080,000 | $1,030.53 |

| 11-25 45 Ave. #5B | Condo | 1100 | 6 | 45 | 0.5 mile | 2B2B | 4 | 08/11/2020 | $1,290,000 | $1,172.73 |

| 41-26 27th St. #5E | Condo | 1033 | 10 | 66 | 0.2 mile | 2B2B | 4 | 06/17/2020 | $978,000 | $946.76 |

| 13-33 Jackson Ave. #9C | Condo | 1019 | 11 | 56 | 0.6 mile | 2B2B | 2 | 05/16/2020 | $1,500,000 | $1,472.03 |

| 5-30 47th Ave. #3B | Condo | 1068 | 4 | 6 | 0.9 mile | 2B2B | 2 | 01/08/2020 | $1,250,000 | $1,170.41 |

| 21-20 45 Rd. #5 | Condo | 1292 | 4 | 6 | 0.5 mile | 2B2B | 2 | 07/27/2020 | $1,349,000 | $1,044.12 |

* Data Source: Property Shark, September 2020;Óummarized and calculated by CrowdFunz Holding LLC.

* The Average Prices per Square Foot of the Comparable Residential Units Sold are: Studio: $ 1119.86/Sf; 2B2B: $ 1142.04/Sf

* The Average Prices per Square Foot of the underlying property are: Studio: $ 1328.02/Sf : 2B2B: $ 1003.41/Sf

Comparable Residential Units on Sale Nearby

| Address | Property Type | Ft² | Story | Number of Units | Distance to Project | Unit Type | On Sale Price | Average PPSF |

| 21-19 46th Ave. #1 | Condo | 770 | 4 | 6 | 0.5 mile | Studio | $745,000.00 | $967.23 |

| 42-14 Crescent St. #7C | Condo | 503 | 13 | 48 | 0.1 mile | Studio | $480,000 | $954.27 |

| 27-28 Thomson Ave. #127 | Condo | 865 | 8 | 237 | 0.3 mile | Studio | $895,000 | $944.33 |

| 42-50 27th St. #6-C | Condo | 929 | 9 | 32 | <0.1 mile | 2B2B | $1,1700,000 | $1,259.42 |

| 4415 Purves St. #10A | Condo | 965 | 15 | 48 | 0.2 mile | 2B2B | $1,220,000 | $1,264.25 |

| 41-18 27th St. #1A | Condo | 930 | 9 | 14 | 0.2 mile | 2B2B | $925,00 | $994.62 |

* Data Source: Property Shark, September 2020;Óummarized and calculated by CrowdFunz Holding LLC.

* The Average Price per Square Foot of the Comparable Residential Units on Sale is: $ 1064.03 /Sf.

* The Estimated Average Price per Square Foot of the underlying property is: $ 1216.49 /Sf.

* The Estimated Average Price of the underlying property is higher than the Average Price of similar properties in the area.

The Circumstance of Nearby Commercial Leasing:

According to the current commercial property leasing information in the surrounding market, the major commercial properties currently being leased are offices, and small-to-medium-sized leasing spaces that can be used for retail are mostly located in properties over 30 years old and with a limited number available.

In the future, the population in communities at Long Island City will continue to rise. The demand for retail space for supermarkets and convenient stores is consistent, aligning with the communities 'growth. The retail space, similar to the one on the first floor of the underlying project, has certain market potential while more small residential properties with retail space will help the community be flourish.

Market Condition of Comparable Retail Spaces:

Number of Researched Properties: 13

Median Rental Price per Square Foot per Year: $39.7/Sf/Y

Rental Price Range: $14 - $72/Sf/Y

Median Rental per Lease: $6,469/Month

Median Rental Area: 2,350 Sf

Comparable Retail Spaces Nearby

| Address | Built Year | Ft² | Story | Distance to Project | Rental per Month | Zoning | Estimated PPSF or Sale | Average PPSFPY |

| 11-11 44th Dr. | 2015 | 500 | 3 | 0.5 mile | $1,875 | O5 | $1434.26/ft2 | $45/ft2 |

| 47-61 Pearson Pl. | 2015 | 5,000 | 4 | 0.9 mile | $10,417 | M1-4 | $498.02/ft2 | $25/ft2 |

| 43-32 22nd St. | 1950 | 700 | 5 | 0.4 mile | $2,450 | B | $836.65/ft2 | $42/ft2 |

| 13-05 44th Ave. | 2010 | 1,600 | 2 | 0.4 mile | $22,725 | M1-4 | $577.74/ft2 | $29/ft2 |

| 37-14 34th St. | 2020 | 13,104 | 6 | 0.4 mile | $3,867 | M | $498.01/ft2 | $25/ft2 |

| 2409-2411 41st Ave. | 1986 | 1,500 | 2 | 0.8 mile | $27,300 | C | $1,115.54/ft2 | $56/ft2 |

| 2207 41st Ave. | 2017 | 2,500 | 4 | 0.3 mile | $7,000 | C | $567.78/ft2 | $28.5/ft2 |

| 25-10 38th St. | 2018 | 2,799 | 8 | 0.6 mile | $10,000 | D6 | $854.03/ft2 | $42.87/ft2 |

* Data Source: Property Shark, September 2020;Óummarized and calculated by CrowdFunz Holding LLC.

* The Actual Leasing Price per Square Foot per Year of the underlying property is: $ 104.80/Sf/Y , which is higher than the spaces in older buildings;

* The Estimated Price per Square Foot for Sale of the underlying property is: $ 2087.80/Sf , which is higher than the spaces in older buildings as well.

Geographic Location:

The development is in the central area of Long Island, next to the Queensboro Bridge, which is the entrance from Manhattan to Queens. The surrounding areas are well-developed, densely populated, safe and suitable for business and living. The buildings in the community are mainly commercial offices and apartment towers. This area has become one of the best emerging communities in Queens over the past decade.

Transportation:

Subway: W、N、M、R、E、G、Line 7(5 minutes walking distance)

Bus: QM1、QM31、Q32、Q60、Q66、Q69(5 minutes walking distance)

Train: MONTAUK、OYSTER BAY、PORT WASHINGTON

To Manhattan Midtown: 2-3 miles (15 minutes driving)

To JFK Airport: 15.8 miles (About 45 minutes driving)

To LaGuardia Airport: 4.6 miles (About 25 minutes driving)

Schools:

There are many education institutions in Long Island City area, and many elementary schools, junior high schools, and high schools have settled to meet the educational needs of children. Both LaGuardia University and Cornell Medical College are within 2 miles of the nearby area, adding value to the area's rental potential.

Diet & Living:

The retail environment is maturing, supporting for more convenient living. The area contains kinds of American and Asian supermarkets, and 24-hour convenient stores to meet the needs of diet shopping. Starbucks and bars are distributed among the area as well. Due to the ethnic diversity of residents, there are many choices of restaurants such as Chinese, Greek, European, and American cuisines.

Recreation:

There are many museums, sports venues and recreational sites near the project. If residents want to enjoy recreational activities, it is convenient to run along the coast, to exercise at the gyms, and to ride bicycles along the riverside. If residents want to participate outdoor sports, the community’s football and basketball courts are all within 2 miles nearby.

Developer Company: GS Main Street Realty

Prior Cooperation: CrowdFunz Fund 804, 807, and 809

GS Main Street Realty was established in 1999, focusing on small boutique residential buildings. Its successfully developed properties are distributed in Queens, New York, including Flushing, Elmhurst, and Long Island City. At present, the developer has been developed and held more than 200,000 square feet in its projects.

The company has more than two decades of local experience in developing multi-family condominiums and apartments. In 2009, it began to expand the scale and type of real estate development. With focused development on mixed commercial and residential properties, GS Main Street Realty has become one of the representatives of emerging Chinese developers in the New York area in the past 10 years.

Relying on its experience and development capabilities, the developer has established a good reputation on investment opportunities to its small-to-medium-sized projects. Also, in the past 2 years, CrowdFunz has built up collaborative relation with the developer through CrowdFunz Fund 804, 807, and 809. The CrowdFunz Fund 812 offered this time will provide investors new opportunities to earn short-term but stable incomes.

Previous Developments:

The approach that Crowdfunz Fund 812 invests in this project is to provide a short-term loan to the project company through the form of equity pledge. To control the main risks in this type of investment is to evaluate the collateral of the loan. Crowdfunz believes that the current collateral is sufficient to protect the security of the principals because of the following three reasons:

- The property, completed in Phase I and owned by the entity pledged to CrowdFunz Fund 812, is well-operated and will soon appreciate its value while the future leasing is also optimistic;

- The expenses on using the loan is clear, and the repayment and exit method are straight. Obeying legal documents in cooperation with the developer, CrowdFunz Fund 812 may protect its investors at the worst cases of default or insolvency.

- The developer has cooperated with CrowdFunz for many times. As the Fund Manager, CrowdFunz has seen its quality-assured developments and strict obligation fulfillments on financial transactions, proving that the developer’s goodwill and credit are worthy to trust by investors.

In 2020, the Manhattan real estate market will be severely affected by the pandemic, including the residential market. However, the surrounding satellite areas with convenient transportation has obtained development opportunities based on living costs and the overall community environments, and Long Island City is one of the areas. Long Island City is closely adjacent to Manhattan, and its community facilities, street environment, buildings, and lifestyles all show a growing vitality. In the third quarter of 2020, the entire area has been restored to alive faster than many communities in Manhattan. There are many real estate projects under construction in Long Island City, which demonstrates it a key area for the future development in Queens, New York. Under the ongoing Fed’s low interest rate policies, there will be more young people working in Manhattan who choose to settle in Long Island City, cultivating and promoting the regional residential ecosystem.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-2 yrs | 3-5 yrs | 6-10 yrs | 10+ yrs | |

| Tracking Record | 0-3M | 3-10M | 10-50M | 50M+ | |

| Credit Score | Accept | Fair | Good | Excellent | |

| Financials | |||||

| Investor Equity% | <20% | 20%-30% | 30%-40% | 40%-50% | 50%-60% |

| Loan Senior Crowdfunz | 70%-79% | 60%-69% | 50%-59% | 1%-49% | 0% |

| Location | |||||

| Location | Rural | Suburban | Core Urban | ||

| Walk Score | 0-49 | 50-69 | 70-89 | 90-100 | |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Type | |||||

| Development Phase | Ground Up | Value-added | Stablized | ||

| Property as Collateral | No | Yes | |||

| Occupancy | Low | Moderate | High | Very High | |

| Investment Term | 60+ Mths | 25-60 Mths | 13-24 Mths | < 12 Mths | |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)