Equity Pledge Debt Fund 816

Type: Debt

Target: $4,000,000

Annual Return: 8% - 8.25%

Min-invest Amount: $10,000

Duration: 6 - 18 Months

Offering Amount: $4,000,000 U.S. Dollars

Estimated Return: 8.00% - 8.25% Annualized Return*1

Investment Type: Equity Pledge Loan

Unit Price: $10,000 per Subscription Unit

Offering Date: March 2021

Investment Horizon: 12 - 18 Months(6+3+3+6 Months)

Dividend Schedule: Prepaid before per Period

Special offer: 3%Condominium Purchase Discount*2

*1 8% Annualized Return For Investment of 1-19 Units;8.25% Annualized Return for investment above 20 Units.

*2 3% Condominium Purchase Discount applied to Investor subscripting more than 25 units.

Address: 86-55 Queens Blvd, Elmhurst, NY, 11373

Area: Elmhurst, Queens, NY

Lot Size: 21,552 Square Ft.(70.81*205.5 FT)

Zoning: R6, C4-2(FAR is 4.8 times)

Building Size: 7,686 Square Ft.(The rest of the building size has been transferred to the Phase I project)

Closing Price of Land: $14,250,000(2018)

Market Value after Operation: $31,800,000(Appraisal from CBRE in Sep,2020)

The developer has purchased the property in 2018 at a price of $14,250,000 and demolished the existing restaurant. The proposed architectural plan was approved by DOB and partial building area has transferred to phase I development (CrowdFunz Fund 806). Affected by the pandemics, the construction just resumed lately.

The proposal development is 4-floor building with a total of 37,686 square feet community facility and parking garage The project is expected to be finished in 2023 . After completion, the ground floor will be a parking garage, first floor will be community facility and parking garage with 8,561 square ft, the second floor will be a parking garage, third floor will be community facility with 14,290 square feet, and fourth floor will be community facilities with 14,834 square feet.

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Round of Investment | Funding Amount | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | Phase I | $1,500,000 | No Later Than 3/25/2021 | 3/10/2021 | 9/10/2021 | 6 Months | Pre-Paid Dividend |

| Phase II | $1,500,000 | No Later Than 4/25/2021 | 4/10/2021 | 9/10/2021 *2 | 5 Months | Pre-Paid Dividend | |

| Phase III | $1,500,000 | No Later Than 5/25/2021 | 5/10/2021 | 9/10/2021 | 4 Month | Pre-Paid Dividend | |

| Second | No Later Than 9/25/2021 | 9/10/2021 | 12/10/2021 | 3 Month | Extension Options Owned by Developer | ||

| Third | No Later Than 12/25/2021 | 12/10/2021 | 3/10/2022 | 3 Month | Extension Options Owned by Developer | ||

| Fourth | No Later Than 3/25/2022 | 3/10/2022 | 9/10/2022 | 6 Month | Extension Options Owned by Developer | ||

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 After the expiration of the first Dividend Period, the developer has the option to extend the borrowing 3 times. If the developer chooses to extend, the investors will receive dividends at the same rate of return during the postponement.

Sufficient Value in the Collateral

According to the appraisal provided by CBRE in September 2020, after completion, the value of the property is estimated in $29.2 million. When the operation runs smoothly, the value of the property will be estimated in $31.8 million.

Based on the sales projection from the appraisal,the value of the community facilities is around $17,900,000。The value of each parking lot is $40,000,and the total value of 227 parking lots is $9,100,000.

The short-term loan provided by CrowdFunz Fund 816 is pledged by the borrowing entity’s 100% ownership interest. The developer’s own equity investment is over $9 million, which is 2.25 time of the loan provided by CrowdFunz Fund 816.. In addition, to protect the interests of fund investors, the developers also provides unlimited personal guarantees in this borrowing.

Prime Location, In Demand Market

The development is in the prime area in Elmhurst, Queens. The surrounding public transportation is well developed, offering Metro Line M/R, over ten other subway lines and bus line like Q59. The tenants can reach various communities in Queens or take trains directly to Manhattan or Long Island. It also takes about 10-minutes driving from the site to LGA airport and 20-minutes to JFK airport.

The development is in the prime and convenient location in Elmhurst Chinatown. Elmhurst is vibrant in businesses and growing community with a large population density which the majority is Chinese. Most projects like this are exclusively rental. And it only takes 5-minutes driving from the site to Costco, Queens Plaza and Elmhurst Hospital.

Transparent Fund Usage, Explicit Exit Strategy

Currently, the architecture plan has been approved and construction loan application is in process. The loan issued by CrowdFunz Fund 816 will be used for the foundation work like excavating and shoring according to actual working progress. After completion of the foundation, the developer will be funded from the construction loan issued by the bank, then the developer will be able to pay off the loan from CrowdFunz Fund 816.

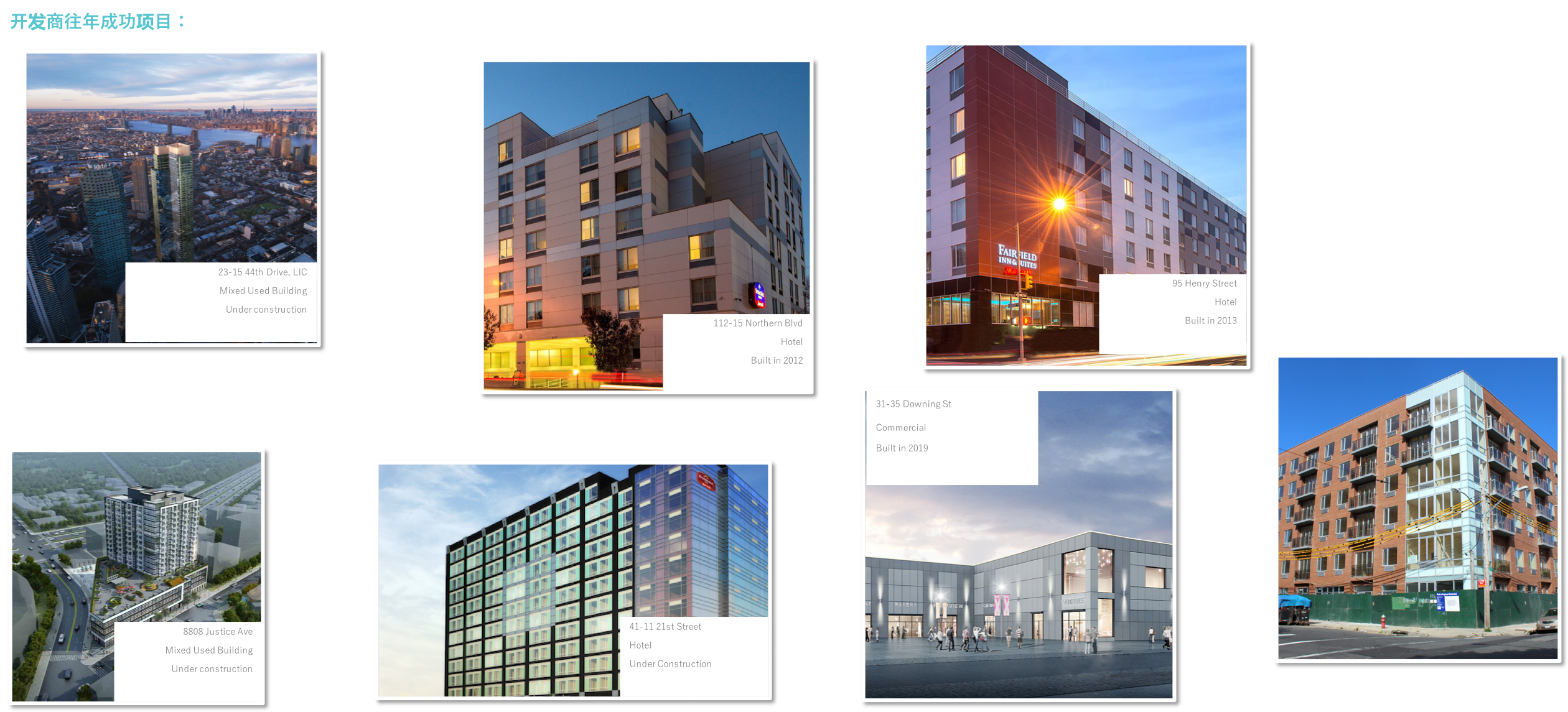

Seasoned Developer with Approved Experience

The developer has been deeply involved in real estate market of New York City for 20 years. It is well-known and has a good reputation in the local market. Its successful projects in the past are mainly concentrated in Queens. In recent years, it has extended the developments in hotels, retail complex, mega residential and mixed-used projects. In addition, the developer has successfully cooperated with CrowdFunz Holding LLC. through CrowdFunz Fund 806 and Fund 808. And Fund 808 is projected to exit at the first quarter of 2021. Based on current cooperation, the developer’s past records, its development strength, and business reputation, we believe that CrowdFunz Fund 816 will help create a deeper cooperative relationship and consolidate the developer as the No.1 in the Chinese community in NYC.

| Source of Capital | Percentage | |

|---|---|---|

| Mortgage Originated by bank | $20,000,000 | 60.6% |

| Loan Originated by CrowdFunz Fund 816 | $4,000,000 | 12.1% |

| Developer’s Equity Investment | $9,000,000 | 27.3% |

| Total | $33,000,000 | 100.00% |

After financing from CrowdFunz Fund 816, the total source of capital consists of a $20,000,000 first lien mortgage originated by bank, accounted for 60.6%, a $4,000,000 loan originated by CrowdFunz Fund 816, accounted for 12.1%. In the case of default, CrowdFunz Fund 816 has the right to directly take over the borrowing entity’s 100% ownership interest and the key shareholder’s personal asset, liquidating for investment repayments. By Feb 2021, the developer has invested $9 million cash in this project which is pledged to CrowdFunz Fund 816.

| Use of Capital | Percentage | |

|---|---|---|

| Expenses | ||

| Land Cost | $14,250,000 | 39.23% |

| Construction Cost | $19,475,625 | 53.61% |

| Soft Cost | $700,000 | 1.93% |

| Financing Cost | $1,900,000 | 5.23% |

| Total | $36,325,625 | 100.00% |

The developer purchased the property in 2018 and kept operating until now. Currently, the construction loan of $20,000,000 has been applied to bank and it is planned to pay back land loan and construction costs. The loan issued by CrowdFunz Fund 816 will be used for excavating and building foundation. According to the schedule, the whole project will be finished in 2023.

| Fund Usage | Percentage | |

|---|---|---|

| Underground Construction Cost | By CrowdFunz Fund 816 | |

| Shoring/ Pile work | $800,000 | 20% |

| Excavating/ Grading | $1,600,000 | 40% |

| Foundation/ Underpinning | $1,600,000 | 40% |

| Total | $4,000,000 | 100% |

* Data Provided by Developer

We projected that the total loan originated by CrowdFunz Fund 816 is up to $4,000,000 in three disbursements. The loan is expected to be used for the underground construction cost.

Currently, all the necessary work has been done prior to the construction, including but not limited to: approval of architectural plan, government agencies, environmental test, insurance, demolition, shoring, excavating and support, dewatering etc.. The developer has invested over $9 million cash into this project. The loan issued by CrowdFunz Fund 816 will disburse in different phases according to the progress of the foundation. The construction loan from bank will facilitate until completion of the project.

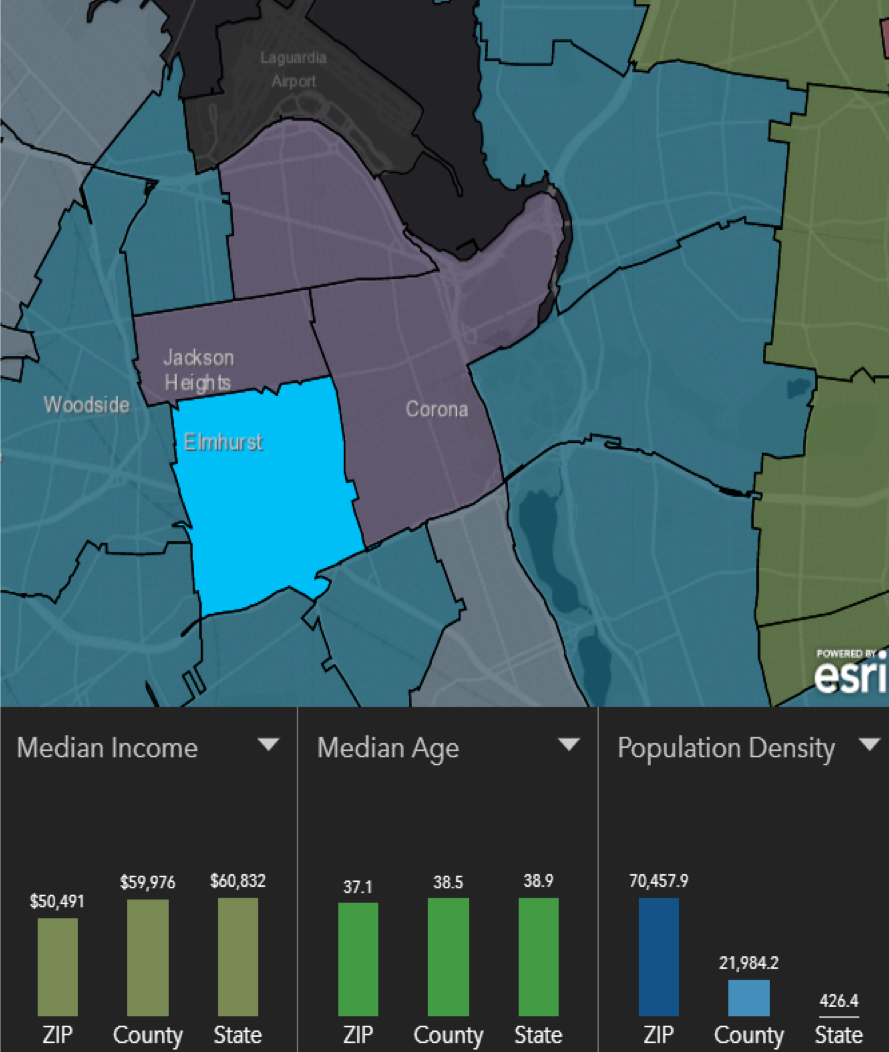

Demographics:

| Zip Code 11373 | |

|---|---|

| Regional Population | 94,437 |

| Median Age | 38.2 |

| High School Education or Above | 71% |

| Ethnics | Asian(48.47%), White(7.15%), Latino(40.96%) |

| Family Median Income | $69,948 |

| White Collar/Blue Collar | 77%/22.9% |

| Child-Bearing Family | 33.2% |

| Average Family Size | 3.1 |

| Primary residence | 29.9% |

Elmhurst has great foundation for living and businesses, with convenient traffic, excellent education system and well-developed facilities. The area becomes one of the top choices for many Asian enterprises and residents. Chinese investments and immigrations are extremely active in the area. There are more and more luxury apartments and large shopping malls constructed here, and the communities are experiencing the gentrification and modernization.

The population is diversified in this region. Most of the residents are Asian; other groups include Latinos, Middle Easterners, Europeans, and African Americans.

The residents in the region are mainly middle-age families with stable income. The average age is 36 and 1/3of the families have children. The primary residence rate in the region is only 30%, which indicates strong demand for residential rental. Many new immigrants also make the rental market very hot. Due to the low housing inventory available for sale and high needs of buyers, the house prices are constantly going up. Investing in the real estate market in this region has certain potential.

* Data Source: United States Zip Codes. Org. & Esri Zip Code Lookup, 2021 02.

Location:

The surrounding public transportation of the site is well-developed, right next to the subway station of Metro Line M/R. And there are more than 10 other subway lines and bus line like Q58. The tenants can reach various communities in Queens or take trains directly to Manhattan or Long Island. It also takes about 10-minutes driving from the site to LGA airport and 20-minutes to JFK airport.

Transportation:

Subway: M、R(About 3-Min Walking)

Bus: Q29、Q53、Q58、Q59、Q60

To Midtown Manhattan: 7 Miles(About 18-Min Drive)

To JFK Airport: 8 Miles(About 20-Min Drive)

To LGA Airport: 4.5 Miles(About 10-Min Drive)

Nearby Schools:

There is an integrated basic education system in Elmhurst area, covering many elementary schools, junior high schools, and high schools. The schools can fit the residents 'needs on children's education. Many schools like Elm Tree Elementary School,Jewish Institute Of Queens,NYC School Construction Authority,International High School For Health Sciences etc.

Living Facilities:

The development is in the prime and convenient location in Elmhurst Chinatown. Elmhurst is vibrant in businesses and growing community with a large population density which the majority is Chinese. Most projects like this are exclusively rental. And it only takes 5-minutes driving from the site to Costco, Queens Plaza and Elmhurst Hospital.

Recreation:

There are museums, gyms and entertainment venues nearly. The Corona park is one of the cultural landmarks in this region. There are also New York Hall of Science , New York Badminton Center, National Tennis Center, Queens Museum, Queens Zoo and Citi Field close by.

Developer Company: United Construction & Development Group

Website: https://unitedgroupny.com/

Prior Cooperation: CrowdFunz Fund 806/ CrowdFunz Fund 808

United Construction & Development Group was established in 1990. It focuses on commercial and residential development projects. Led by founder Chris Xu, successfully developed properties are spread in New York City. At present, the developer has worked on over two million square feet of real estate developments, and LIC Skyline Tower is this developer’s masterpiece.

Relying on the successful development track record ,well-seasoned experiences and great commercial credit history , the developer has helped partners and investors generate fortune in return.

Successful Projects By Developer:

Based on approval of architect plan and construction loan combined with efficient fund invested by the developer, the loan originated by CrowFunz Fund 816 is a short-term debt investment which helps the developer fill foundation construction costs.

We believe that the underlying development of CrowdFunz Fund 816 is solid, and we trust the developer’s reputation and credibility. From the perspective of the capital stack in this project, the first lien construction loan debt ratio is below 60%, and the developer 'equity is around $9 million, which is 2.25 times greater than the loan provided by CrowdFunz Fund 816. And the developer also offers unlimited personal guarantee. The overall investment risk of CrowdFunz Fund 816 is relatively lower than the industrial level.

The whole investment process of CrowdFunz Fund 816 is controlled strictly based on the actual progress of the project into three phases. After completion of the foundation, some available fund will be used for the main structure development to help the developer achieve the goals and control the risk of the debt investment.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-3 Years | 3-5 Years | 5-10 Years | 10-15 Years | 15+ Years |

| Tracking Record | 0-3M | 3-10M | 10-30M | 30-50M | 50M+ |

| Credit Score | Low | Accept | Fair | Good | Excellent |

| Financials | |||||

| Investor Equity | 1-20% | 20-30% | 30-40% | 40-50% | 50-60% |

| Loan-to-cost ratio | 85-100% | 70%-85% | 65%-70% | 50-65% | 1-50% |

| Financial claims | Common Equity | Preferred Equity | Equity pledge debt | Secondary lien debt | First lien debt |

| Location | |||||

| Location | Sub Rural | Rural | Regional center | Suburban | Core Urban |

| Walk Score | <40 | 40-55 | 55-70 | 70-85 | 85-100 |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Status | |||||

| Development Phase | 0-20% | 20-40% | 40-60% | 60-80% | 80-100% |

| Property as Collateral | No | Extremely insufficient | Relatively insufficient | Relatively sufficient | Extremely sufficient |

| Investment Term | >48 Months | 37-48 Months | 25-36 Months | 13-24 Months | <12 Months |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)