CrowdFunz 817 Phase 2

Type: Debt

Target: $2,400,000

Annual Return: 8% - 8.25%

Min-invest Amount: $10,000

Duration: 10 - 22 Months

Fund Type: Equity Pledge Debt Fund

Offering Amount: $2,400,000 U.S. Dollars (First batch of $1,000,000;Second batch of $1,000,000;Third batch of $400,000)

Estimated Return: 8.00% - 8.25% Annualized Return*1

Investment Type: Equity Pledge Loan

Unit Price: $10,000 per Subscription Unit

Offering Date: July 2021

Investment Horizon: 10 - 22 Months(10+6+6 Months)

Dividend Schedule: Prepaid before per Period

*1 8% Annualized Return For Investment of 1-19 Units;8.25% Annualized Return for investment above 20 Units.

Address: 4530 Pearson Street, Long Island City, NY, 11101

Area: Long Island City, Queens, New York

Lot Size: 20,270 SF

Zoning: M1-5/R7-3 (FAR =5)

Salable Size: 100,538 SF

Building Size: 138,648 SF

Market Value after Operation: $140,600,000 (From the appraisal provided by Marshall & Stevens, January 2021)

In this project, the developer started land acquisition and architecture works in 2019. After work permit issued by government agencies, the initial construction began in the first quarter of 2021. The foundation and its structure are currently under construction, and the holistic foundation is estimated to be completed by the end of May 2021.The proposal of the development is 25-floor building with a total of 100,538 saleable square feet, containing 130 condominiums and 15 parking lots. The project is expected to be completed in the third quarter of 2023. Based on developer's plan,Condo Book will be issued in 2022,and the condominium sales and closings will be executed as soon as Certificate of Occupancy being approved.

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Round of Investment | Funding Amount | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | Batch I | $1,000,000 | No Later Than 8/19/2021 | 8/5/2021 | 5/31/2022 | 300 Days | Pre-Paid Dividend |

| Batch II | $1,000,000 | No Later Than 9/19/2021 | 9/5/2021 | 5/31/2022 *2 | 269 Days | Pre-Paid Dividend | |

| Batch III | $400,000 | No Later Than 10/19/2021 | 10/5/2021 | 5/31/2022 | 239 Days | Pre-Paid Dividend | |

| Second | No Later Than 6/14/2022 | 6/1/2022 | 11/30/2022 | 6 Months | Extension Options Owned by Developer | ||

| Third | No Later Than 12/14/2022 | 12/1/2022 | 5/31/2023 | 6 Months | Extension Options Owned by Developer | ||

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 After the expiration of the first Dividend Period, the developer has the option to extend the borrowing 3 times. If the developer chooses to extend, the investors will receive dividends at the same rate of return during the postponement.

Sufficient Value in the Collateral

According to the appraisal provided by Marshall & Stevens Valuation Consulting in January 2021, the value of the property is estimated in $140,600,000 after completion.

The short-to-mid-term loan provided by CrowdFunz 817 Phase 2 Fund is pledged by the borrowing entity’s 100% ownership interests. By July 2021, the equity investment in borrowing entity is over $11.43 million, which is 5 times of the loan provided by CrowdFunz 817 Phase 2 Fund. In addition, to protect the interests of fund investors, the developer also provides unlimited personal guarantees in this borrowing.

Prime Location, In Demand Market

The project location is in Long island City, Queens, a prime and up trending area, and it’s on the other side of East River, directly facing the United Nation headquarter. The surrounding public transportation is well-developed, and there are 7 subway lines and multiple bus lines covered. The residents can reach various communities in Queens, Brooklyn, and Manhattan. It also takes about 20-minutes driving from the site to LGA airport and 30-minutes to JFK airport.

Long Island City has become one of the most booming areas nearby Manhattan. Commute convenience has made the area development rapidly and attracts many young professionals in financial and IT industries to live here. The population density has been catching up with the traditional prime neighborhoods in Manhattan. The population has steady and growing income in general. The commercial and residential developments of the area is expected to be prosperous.

Transparent Fund Usage, Explicit Exit Strategy

Currently, the architecture plan and the construction loan have been approved. The loan originated by CrowdFunz 817 Phase 2 Fund will be used for the early-stage construction, and it will help the developer maintain a healthy financial level in order to obtain further loan disbursement from the bank smoothly. As of July 2021, the developer has contributed $11.43 million cash in equity, and the equity will keep increasing along with the development. Investment process of CrowdFunz 817 Phase 2 Fund is controlled strictly based on the actual progress of the project, proposed to disburse in three phases supporting construction foundation constructions.

Seasoned Developer with Approved Experience

This development is led by a seasoned Chinese American development group and an emerging New York local developer. The whole team has commercial real estate development experience for over 3 decades. The development team has completed numerous projects including retail complex, mega residential, and mixed-use buildings in various uprising areas in Queens. In 2017, the leading Chinese American developer has cooperated with CrowdFunz in CrowdFunz Fund 606, paying back interest and principal on time. Based on prior records, the developer’s project has met the market needs; the units sold out quickly, and some projects have become local landmarks. We believe that CrowdFunz 817 Phase 2 Fund will help developer gain success in Long Island City market while being rational investment opportunity for fund investors.

| Capital Stack during Phase II | Percentage | |

|---|---|---|

| Mortgage Originated by Commercial Bank | $25,692,000 | 65% |

| Loan Issued by CrowdFunz 817 Phase 1 Fund | $2,400,000 | 6.07% |

| Total Equity Investment by Developer | $11,434,154 | 28.93% |

| Total | $39,526,154 | 100.00% |

| Proposed Capital Stack during Phase II | Percentage | |

|---|---|---|

| Total Mortgage Originated by Commercial Bank | $64,230,000 | 64.35% |

| Total Loan Issued by CrowdFunz 817 Phase 1 and Phase 2 Funds | $6,000,000 | 6.01% |

| Total Equity Investment by Developer | 29,585,385 | 29.64% |

| Total | $99,815,385 | 100.00% |

In the capital stack of this project, commercial bank has already originated $64,275,000 construction loan, held first lien position and not exceeded 65% of total capital.CrowdFunz 817 Phase 1 Fund already originated a total of $3,600,000 loan to support the development, and CrowdFunz 817 Phase 2 Fund will contribute another $2,400,000 equity pledge loan. The total $6,000,000 loan offered by 817 Phase 1 Fund and 817 Phase 2 Fund is accounted for 6.01% of total capital, pledged by 100% ownership interests of the entire project entity, and secured by unlimited personal guarantee from developer’s key persons.In the worst case of default, CrowdFunz 817 Phase 1 Fund and Phase 2 Fund will have the rights to directly take over 100% ownership interests of the project entity and claim the losses against the guarantors who signed the personal guarantees in borrowing. As of July 2021, the paid-in equity from the two subsidiaries has reached US$29,585,385, which is close to five times of the loans originated by CrowdFunz 817 Phase 1 Fund and Phase 2 Fund.

| Source of Capital | Percentage | |

|---|---|---|

| Total Mortgage Originated by Commercial Bank | $64,230,000 | 64.35% |

| Total Loan Issued by CrowdFunz 817 Phase 1 and Phase 2 Funds | 6,000,000 | 6.00% |

| Total Equity Investment by Developer | 29,585,385 | 29.65% |

| Total | $99,815,385 | 100.00% |

In project budgeting, the first lien mortgage from commercial bank is the main capital source. $6 million loan issued by CrowdFunz 817 Phase 1 and Phase 2 Fund is used for early-to-mid stage construction costs like foundation and structures. The equity investment by the development team is used for acquisition of the land, including but not limited to acquisition, design of architectural plan, insurance etc.

| Use of Capital | Percentage | Land Cost | $32,344,168 | 32.50% |

|---|---|---|

| Construction Cost | $50,002,500 | 50.23% |

| Soft Cost | $9,225,980 | 9.27% |

| Financing Cost | $7,960,000 | 8.00% |

| Total | $$99,532,648 | 100.00% |

As of July 2021, the paid-in capital from the development team has been used for land acquisition, architectural plan, application fee for government agencies like DOB and MTA, construction insurance and other soft costs; the actual expenses are about $29.59 million. Partial early-stage construction costs were already covered by the loan issued by CrowdFunz 817 Phase 1 Fund, and the rest of costs will be supported by the loan issued by CrowdFunz 817 Phase 2 Fund.

| Use of CrowdFunz 817 Phase 2 Fund | Percentage | |

|---|---|---|

| Underground Construction Cost | Fund Capital | |

| Pile work | $1,200,000 | 50.00% |

| Foundation Concrete | $800,000 | 33.33% |

| Lower floor superstructure | $400,000 | 16.67% |

| Total | $2,400,000 | 100% |

* Data Provided by Developer in May 2021.

The capital offered by CrowdFunz 817 Phase 2 Fund is mezzanine loan, up to $2,400,000. The loan is expected to be used for the underground construction costs.

Currently, all the necessary work has been done prior to the construction, including but not limited to, approval of architectural plan, government permits, environmental test, insurance, demolition, shoring, excavating, and supporting, dewatering etc. The developer has invested over $29.59 million cash into this project; the $2.4 million loan issued by CrowdFunz 817 Phase 2 Fund will be disbursed in 3 phases according to the progress of the foundation. The project will obtain further construction loans from bank until completion of the project.

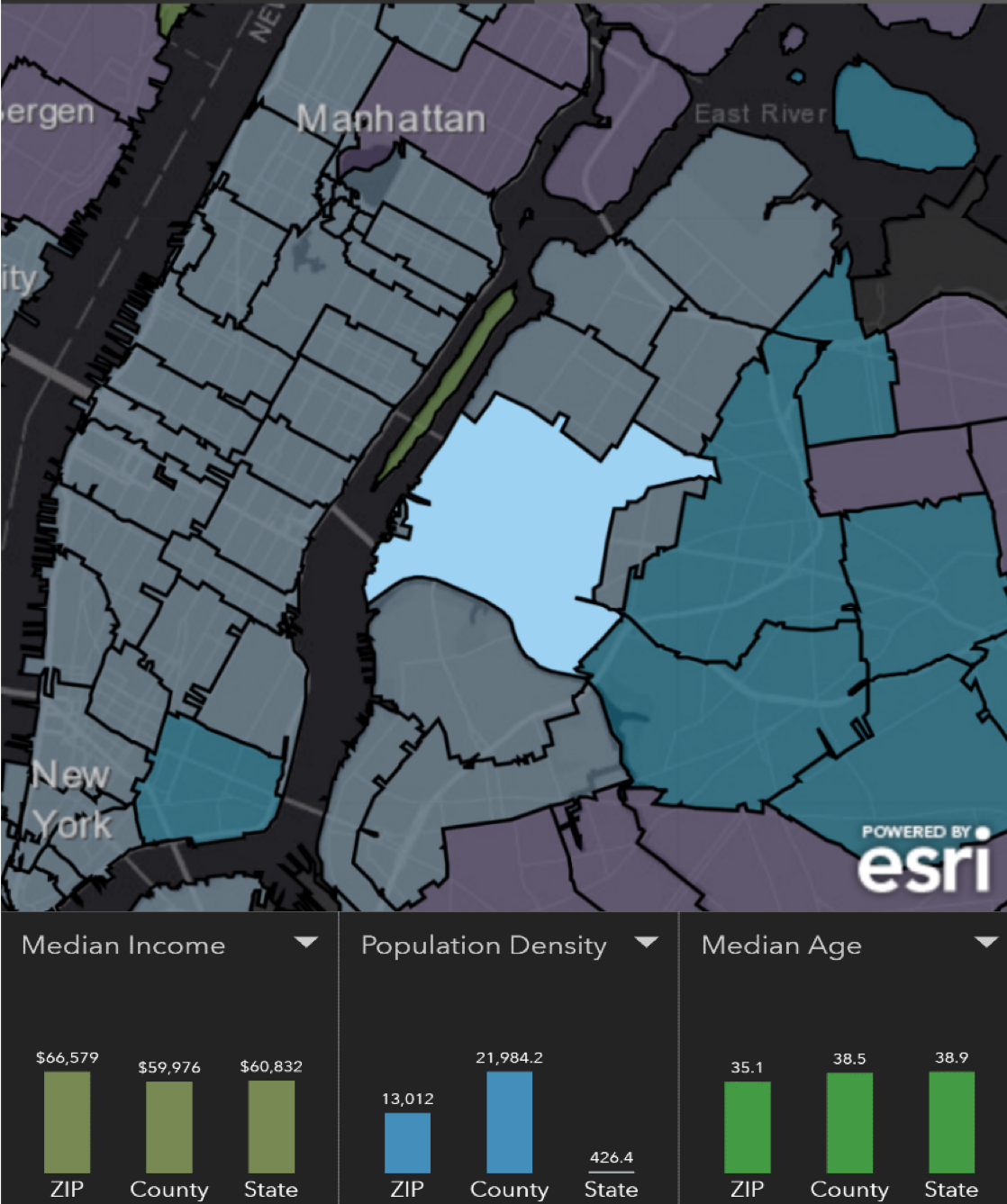

Demographics:

| Zip Code 11101 | |

|---|---|

| Regional Population | 31,366 |

| Median Age | 35 |

| High School Education or Above | 69.8% |

| Workplace | Metropolitan(99.8%) |

| Family Median Income | $66,579 |

| White Collar/Blue Collar | 90.5%/9.5% |

| Child-Bearing Family | 23.6% |

| Average Family Size | 2.21 |

| Average Housing Price | $975,000 |

Due to its premium geographic location, Long Island City has become one of the hottest areas absorbing new real estate developments in New York. Meanwhile, more companies and residents have chosen Long Island City as the destination for business and living.

Younger population dominants in the area, and most residents are middle class professionals with jobs and stable incomes. The ethnic backgrounds are also well-diversified.

The average age is 35; 23% of the families have children. Self-residence is the main demand for tenants. Due to the low housing inventory available for sale and high needs from buyers, the property prices are constantly going up.

* Data Source: United States Zip Codes. Org. & Esri Zip Code Lookup, American Community Survey, May 2021.

Location:

The site location is in the prime area of Long island City, Queens. The surrounding public transportation is well-developed with 7 subway lines and multiple bus lines. The residents can reach various communities in Queens, Brooklyn, and Manhattan. It takes about 15-minute driving from the site to LGA airport and 25-minute to JFK airport.

Transportation:

Subway: M, R, E, G, 7, N, W (5-min Walking Distance)

Bus: Q32, Q60, Q67, Q101, Q102

To Midtown Manhattan: About 10 Minutes

To JFK Airport: 15 Miles (About 25-min Driving)

To LGA Airport: 7 Miles (About 15-min Driving)

Nearby Schools:

The basic education system in the area covers many elementary schools, junior high schools, and high schools, fitting the residents’needs on children’s education. There are also many technical schools to meet young professionals’ self-development demands.

Living Facilities:

Despite convenient transportation, the business environment in Long Island City is booming, and living facilities are increasing like new stores and supermarkets. The area is safe and good to live in, attracting large amount of young generation around 30-year-old to relocate here.

Recreation:

The surrounding recreation facilities are also improving to fit residents 'needs. Museums, gyms, and entertainment venues nearby are within walking distance.

Developer Company: Pearson JV LLC.

Prior Cooperation: CrowdFunz Fund 606, CrowdFunz Fund 806, CrowdFunz Fund 810, CrowdFunz Fund 813

The development is led by a seasoned Chinese American development group and an emerging New York local developer. The whole team has commercial real estate development experience for over 3 decades.

The development team has completed numerous projects including retail complex, mega residential, and mixed-use buildings in various emerging areas in Queens and New York.

Besides local markets, the team has developed over 5 million square feet of projects in the United State and China.

The team is actively engaged in not only development but acquisition, property management and sales in the past 20 years, generating constant profits for partners and investors.

Successful Projects By Developer:

The loan originated by CrowFunz 817 Phase 2 Fund is a short-to-mid term debt investment which helps the developer fill foundation construction costs after obtaining approval of architect plan and construction loan and help the project keep healthy liquidity and working capital.

We believe that the underlying project of 817 Phase 2 Fund is solid, and we trust the developer’s reputation and credibility. From the perspective of capital stack, first lien construction loan is below 65% of total capital, and the developer 'equity has been raised to $11.43 million, which is 5 times greater than total capital provided by CrowdFunz 817 Phase 2 Fund. Unlimited personal guarantee is also attached.

The capital contributions from CrowdFunz 817 Phase 2 Fund will be controlled strictly based on the actual progress of the construction, helping developer achieve the goals while controlling the risks for investors.

We believe that the risk-return balance in CrowdFunz 817 Phase 2 Fund is rational. sufficient collateral based on bilateral agreements may also mitigate uncertainty before the date of maturity.

| RISK CATEGORY | 0 | 1 | 2 | 3 | 4 |

|---|---|---|---|---|---|

| Sponsor | |||||

| Experience | 1-3 Years | 3-5 Years | 5-10 Years | 10-15 Years | 15+ Years |

| Tracking Record | 0-3M | 3-10M | 10-30M | 30-50M | 50M+ |

| Credit Score | Low | Accept | Fair | Good | Excellent |

| Financials | |||||

| Investor Equity | 1-20% | 20-30% | 30-40% | 40-50% | 50-60% |

| Loan-to-cost ratio | 85-100% | 70%-85% | 65%-70% | 50-65% | 1-50% |

| Financial claims | Common Equity | Preferred Equity | Equity pledge debt | Secondary lien debt | First lien debt |

| Location | |||||

| Location | Sub Rural | Rural | Regional center | Suburban | Core Urban |

| Walk Score | <40 | 40-55 | 55-70 | 70-85 | 85-100 |

| Supply & Demand | S>>D | S>D | S≈D | S<D | S<<D |

| Property Status | |||||

| Development Phase | 0-20% | 20-40% | 40-60% | 60-80% | 80-100% |

| Property as Collateral | No | Extremely insufficient | Relatively insufficient | Relatively sufficient | Extremely sufficient |

| Investment Term | >48 Months | 37-48 Months | 25-36 Months | 13-24 Months | <12 Months |

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)