Equity Pledge Debt Fund 825

Type: Debt

Target: $1,000,000

Annual Return: 7.25% - 7. 50%

Min-invest Amount: $10,000

Duration: 3 - 12 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,000,000 U.S. Dollars |

| Estimated Return | 7.25% - 7.50% Annualized Return *1 |

| Investment Type | Acquisition Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | August 2022 |

| Investment Horizon | 3 - 12 Months *2 |

| Dividend Schedule | Prepaid per 3 Months *3 |

*1 7.25% Annualized Return For Investment of 1-19 Units;

7.50% Annualized Return for investment above 20 Units.

*2 Investors will receive a minimum of 3 months of dividends. After 3 months, dividends will be calculated in terms of days till the developer repays the loan.

*3 Investors will receive prepaid dividends every 3 months, if the developer chooses to extend the term.

- The property is in Flushing, one of the biggest Chinese communities in New York. The building is at the cross of Roosevelt Avenue and Parsons Boulevard. The property was completed in 2008 and received Certificate of Occupancy from Department of Building.

- The property is a 7-floor, mixed-use building that features 40 condo units, totaling 29,076 SQFT. The building includes 6,765 SQFT of office space and 2,601 SQFT of parking space. Unit 6A has 2B2B layout, totaling 761 SQFT; unit 7B has 2B2B layout, totaling 674 SQFT. Both units had been leased by creditworthy tenants.

| Property Address | 3834 Parsons Boulevard, Queens, NY |

| Site Area | Flushing, Queens, New York |

| Building Size | 47,637 SQFT |

| Living Area | 29,076 SQFT |

| Total Units | 40 Units |

| Completion Time | March 14th, 2008 |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 9/7/2022 | 8/23/2022 | 11/22/2022 | 3 Months | Prepaid Dividend | |

| Second | No Later than 12/7/2022 | 11/23/2022 | 2/22/2023 | 3 Months | Extension Option Owned by Developer *2 | |

| Third | No Later than 3/7/2023 | 2/23/2023 | 5/22/2023 | 3 Months | Extension Option Owned by Developer *3 | |

| Forth | No Later than 6/7/2023 | 5/23/2023 | 8/22/2023 | 6 Months | Extension Option Owned by Developer *3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 3 months worth of dividend. After 3 months, dividend will be calculated based on days until developer repays the principal.

*3 After first dividend period, developer owns 3 extension options. If developer exercises the options, investors will receive additional dividend accordingly.

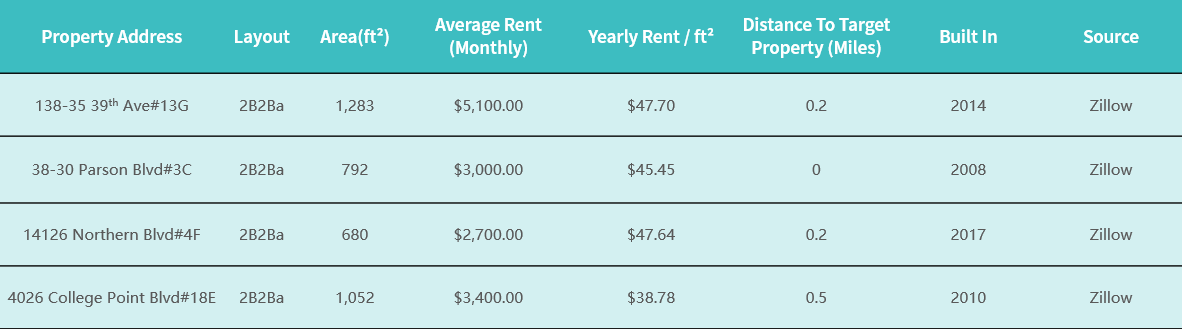

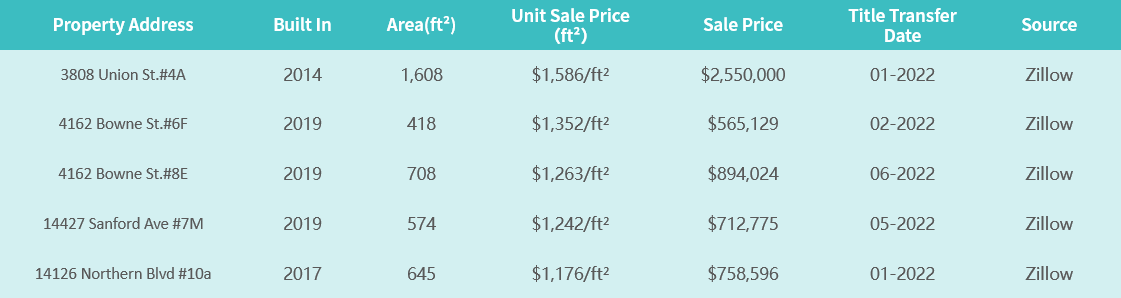

- Based on market research, the collateralized properties are valued at $1,375,000, which is sufficient to cover the loan amount provided by CrowdFunz 825 Fund.

- The loan provided by CrowdFunz 825 Fund has a two-layer protection: 1. Ownership of existing properties; 2. Borrower’s unlimited personal guarantee.

- The collateralized properties are in core area of Flushing. The community is full of businesses and has high density of population. The area has become one of the most popular investment targets among Chinese community.

- Residents are mostly Chinese with strong spending power and financial savings. Local real estate has seen strong demand by homebuyers and investors.

- The loan provided by CrowdFunz 825 Fund will be distributed to the borrower all at once, to assist the next acquisition.

- The borrower needs urgent acquisition financing before bank re-financing which will be finalized in the fourth quarter. After obtaining loan from bank, developer will use the proceed to repay the loan provided by CrowdFunz 825 Fund.

- The borrower has over 15 years of experience in investment in New York, especially in purchasing and flipping properties, and has good relationship with Chinese developers. The borrower maintains a long-term view and conservative style in all its investments.

- It is the first cooperation between CrowdFunz and the developer. We wish to capitalize on this new style of funding, to benefit both parties, and most importantly, our investors.

Investment Structure of CrowdFunz 825 Fund

CAPITAL STRUCTURE

| Capital Stack | Ratio | |

|---|---|---|

| Loan Issued by CrowdFunz 825 Fund | $1,000,000 | 72.72% |

| Market Value of Property Pledged by Developer | $1,375,000 | 100.00% |

- Developer collateralized properties at 38-34 Parson. Since the title transfer in 2008, the properties had no mortgage nor received any complaints. Tenants are creditworthy and maintains the property well.

- Collateralized properties have market value of $1,375,000. The loan provided by CrowdFunz 825 Fund is around 72.72% of its market value. If the borrower defaults on the loan, CrowdFunz 825 Fund will receive the title of the property.

- In addition, the borrower has signed Personal Guarantee, to further secure the loan provided by CrowdFunz 825 Fund.

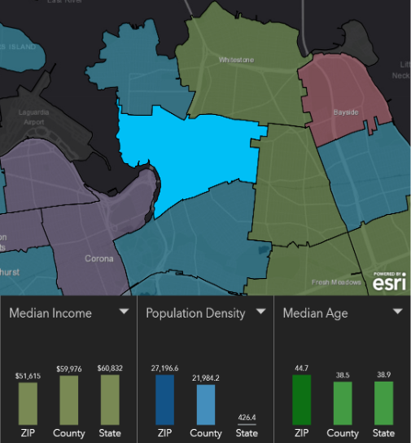

Demographics in the Zip Code

| Zip Code 11354 | |

|---|---|

| Regional Population | 55,200 |

| Median Age | 44.7 |

| High School Education or above | 73% |

| Race | Asian(63%)Caucasian(16%)Latino(16%) |

| Family Median Income | $51,615 |

| White Collar / Blue Collar | 84.9%/15.1% |

| Child-bearing Family | 25.2% |

| Average Family Size | 2.7 |

| Buy House to Own | 39% |

With strong network of business, transportation, and education, the area had become one of the most popular destinations for Chinese community and an attractive real estate market.

Residents are mainly Asian, which makes up over 60% of regional population.

Local families have stable income and sound financial health. Real estate market is mainly focused on Rental properties. New immigrants in recent years had propelled the rental market further. With limited supply and high buying demand, investing in local real estate is becoming more attractive.

* Source: United States Zip Codes. Org. & Esri Zip Code Lookup,In January 2021.

Location

Area has strong network of transportation. Project is 8-min walk away from 7 train station, and 30-min drive away from Midtown Manhattan. Driving to LGA Airport takes only 5 minutes.

Transportation

- Subway:7 Train(7-min walk to station)

- Bus:Q19、Q20、Q25、Q34、Q50 (2-min walk to station)

- To Midtown Manhattan:11 miles( About 30-min drive )

- To JFK Airport:8.7 miles( About 20-min drive )

- To LGA Airport:2.7 miles(About 5-min drive)

Nearby Schools

Properties are in core area of Flushing. There is a wide selection of high-quality primary, middle, and high schools nearby to meet education needs, as shown on the map.

Living Facilities

Community is full of Chinese businesses to meet all needs, including Chinese and Korean supermarkets, restaurants, and shopping centers.

Recreations

There are museums, gyms, and recreation centers nearby, including science museums, tennis center, art center, and zoo.

- CrowdFunz 825 Fund will provide the borrower a short-term acquisition loan. The borrower is ready for new investment and will use two condo units as collateral to receive funding. After bank re-financing completed, the borrower will use proceeds to repay the loan issued by CrowdFunz 825 Fund.

- We believe that the collateral of CrowdFunz 825 Fund are solid. The collateralized properties of CrowdFunz 825 Fund has no construction risks and is in prime location in Flushing, Queens, which makes them be liquid real estate assets.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)