Mortgage Debt Fund 617

Type: Debt

Target: $800,000

Annual Return: 7.75%

Min-invest Amount: $10,000

Duration:

| Fund Type | Private Equity Fund |

| Offering Amount | $800,000 |

| Estimated Return | 7.75% Annualized Return |

| Investment Type | First Lien Mortgage |

| Unit Price | 10,000 per Subscription Unit |

| Offering Date | September 2022 |

| Investment Timeline | 12 + 6 + 6 Months |

| Dividend Schedule | Prepaid per 6 Months*1 |

*1 Investors will receive prepaid dividend before every period, if Developer exercises extension rights, investors will receive prepaid dividends accordingly.

- Project is in Rego Park, Queens, near Flushing. Property is by the cross-section of 64th avenue and Queens Boulevard. Developer expects to receive Condo Book in the second quarter of 2023, and TCO in the fourth quarter of 2023.

- When completed, property will have building area of 19,367 SQFT and offer 23 condominium units. There will be a community facility and medical office on the first floor, spanning 3,879 SQFT and 1,170 SQFT, respectively.

| Property Address | 97-30 64th Ave, Flushing, NY 11374 |

| Site Area | Rego Park, Queens, NY |

| Building Area | 19,367 SQFT |

| Living Area | 16,653 SQFT |

| Total Units | 23 Residential Units |

| Estimated TCO | Forth Quarter of 2023 |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 10/11/2022 | 09/27/2022 | 03/26/2023 | 6 Months | Prepaid Dividend | |

| Second | No Later than 04/11/2023 | 03/27/2023 | 09/27/2023 | 6 Months | Prepaid Dividend | |

| Third | No Later than 10/11/2023 | 09/28/2023 | 03/27/2024 | 6 Months | Extension Option Owned by Developer *2 | |

| Forth | No Later than 04/11/2024 | 03/28/2024 | 09/27/2024 | 6 Months | Extension Option Owned by Developer *3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 3 months worth of dividend. After 3 months, dividend will be calculated based on days until developer repays the principal.

*3 After first dividend period, developer owns 3 extension options. If developer exercises the options, investors will receive additional dividend accordingly.

- CrowdFunz Fund 617 will provide $800,000 of First Lien Mortgage Loan to Developer, and CrowdFunz 827 Fund will provide $3,200,000 of equity pledge loan to Developer. Both loans will be used for construction costs going forward.

- As of August 2022, Developer had paid $1,500,000 of construction cost and expects to contribute another $3,000,000 equity. Based on our valuation, current As-Is value of project land and building worth at least $5,000,000, which is more than the $4,000,000 provided by CrowdFunz Fund 827 and 617.

- Project is in Rego Park, Queens. The area is well developed and is a part of central business district. Queens Mall and other small businesses nearby can meet most living needs of residents.

- Property is near the cross section of 495 Highway and Queens Boulevard. The closest subway station is 5-min walk away. Driving to JFK or LGA Airport takes 20 minutes.

- The building’s super structure is completed, and the rest construction is under progress according to plan. At current, Developer expects to receive Condo Book in the second quarter of 2023 and TCO in the fourth quarter of 2023.

- The loans provided by CrowdFunz Fund 827 and CrowdFunz Fund 617 will be used for construction costs moving forward.

- Once the project is completed, Developer would repay the loan from CrowdFunz Fund 617 and 827 by inventory loan from commercial banks and the sales proceeds of condos.

- As a family-operated business, Developer started from small-scale residential developments and has completed over 200,000 SQFT of commercial and residential properties. Developer gradually establishes its name and reputation among Chinese Developers in New York.

- In recent years, Developer had been focused on emerging areas such as Queens in New York. Developer had completed 3 projects in the Rego Park, knowing the demands of local and nearby markets.

Investment Structure of CrowdFunz 617 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| First Lien Mortgage Loan from CrowdFunz Fund 617 | $800,000 | 8.89% |

| Equity Pledge Loan from CrowdFunz Fund 827 | $3,200,000 | 35.56% |

| Developer Equity Contribution | $5,000,000 | 55.56% |

| Total | $9,000,000 | 100.00% |

- Developer expects to contribute $5,000,000 of equity in total, which is accounted for 55.56% in the capital stack, after receiving loan proceeds from CrowdFunz Fund 827 and 617.

- CrowdFunz Fund 827 will provide $3,200,000, which is accounted for 35.56% of the capital stack.

- CrowdFunz Fund 617 will provide $800,000, which is accounted for 8.89% of the capital stack.

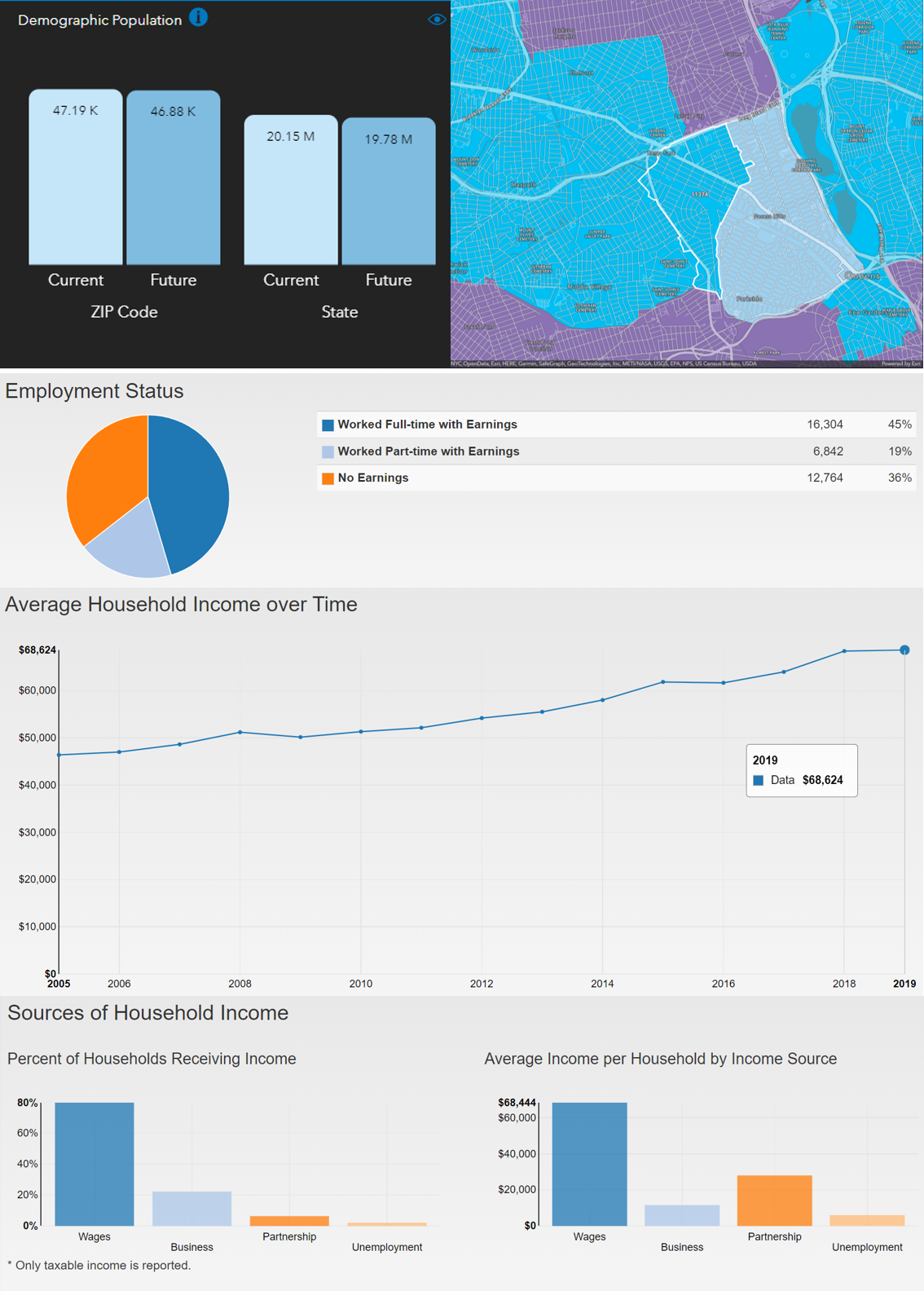

Demographics in the Zip Code

| Zip Code 11374 | |

|---|---|

| Regional Population | 47,297 |

| Median Age | 42 |

| College Education or Above | 59% |

| Race | Asian 26.7%/Caucasian 61.6%/African American 3.0%/Others 5.1% |

| Family Median Income | $52,532 |

| Child-bearing Family | 23% |

| Average Family Size | 2 |

| Buy House to Own | 39% |

Rego Park is between Forest Hills and Elmhurst with only 30-min driving away from Midtown, Manhattan. The area has developed quickly in the last decade. With more business and restaurants catered to Asian residents, the area has attracted more Asian population.

Residents are diverse, with 61.6% Caucasian, 26.7% Asian, and 5.1% other races. The area is highly populated, and 45% of residents commute to work via public transportation.

Most residents are of middle-age and have stable family income. Average age is 42 years old, and 23% of the families bear at least a child. 39% of homes are occupied by owners but most were rented out. Current return-to-office trend is driving the housing demands and support the prices in the area.

* Source: Esri Zip code Lookup; unitedstateszipcodes.org.

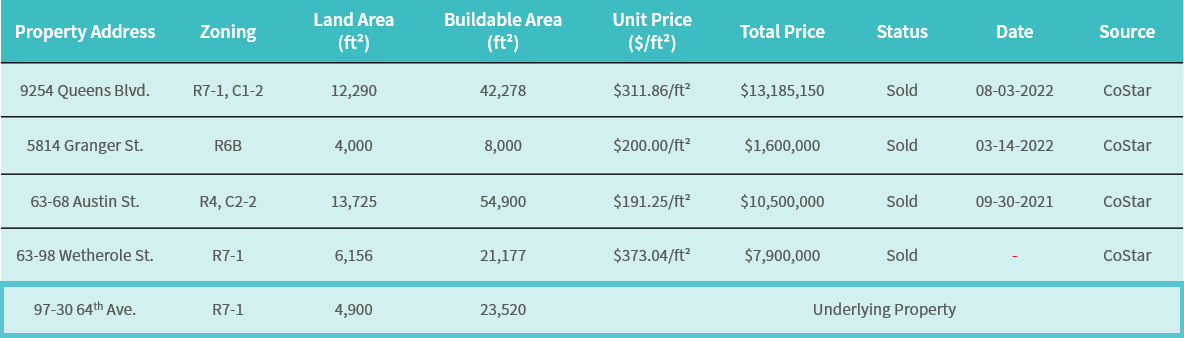

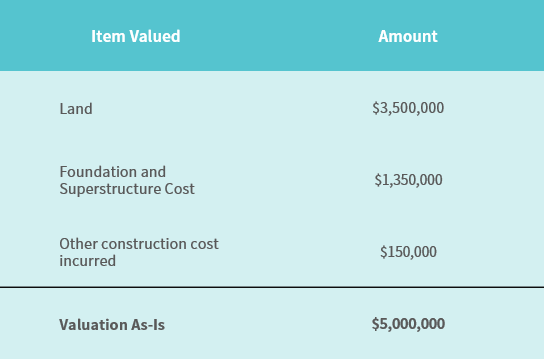

Cost-based Valuation Estimated by CrowdFunz

* Source: Cost information provided by Developer; verified, compiled, and calculated by CrowdFunz.

Since construction is ongoing, CrowdFunz has valued the property by using a conservative cost approach. As of September 2022, property could be valued at $5,000,000.

According to comparable analysis, land could be sold for $210/ft² of each buildable area. With 16,684 ft² total buildable area, the land could be sold for around $3,500,000 on the current market.

Developer has contributed $1,350,000 for foundation and super structure constructions and $150,000 for other cost items. According to cost approach valuation method, the current improvements on land are worth $1,500,000.

Location

Project is in central business district of Rego Park, about 5-min walking from closest M/R subway station and 5-min driving from LIRR station. Project is close to 495 HW and Queens Blvd., an important transportation hub for Queens and Long Island. The area has shopping mall, hospitals, banks, and other essential businesses to support all living needs.

Transportation

- Subway:M/E/R

- Train:LIRR LIRR

- To JFK Airport:7.5 Miles (20-min driving)

- To LGA Airport:4.8 Miles (20-min driving)

Nearby Schools

Rego Park region has 5 public primary schools, 1 private Christian primary school, and 3 public middle schools, to support education needs.

Living Facilities

Rego Park is an emerging area for Asian population and has attracted many Chinese real estate investors and homebuyers. Project is near many Chinese and Mediterranean restaurants.

Recreations

Rego Park area has library, science and art museums, and is close to US Open Tennis stadiums located in Flushing. The area is suitable for families with children.

Developer Company: CKZ Realty LLC.

Developer Website: https://www.greatstoneny.com/

Prior Cooperation: CrowdFunz Fund 804 / CrowdFunz Fund 807 / CrowdFunz Fund 809 / CrowdFunz Fund 812 / CrowdFunz Fund 818 / CrowdFunz Fund 822 / CrowdFunz Fund 823

Starting off from brokerage, CKZ Realty has over 18 years of real estate development experience. Its first development in Elmhurst in 2002 was a huge commercial success. Since then, Developer has been established its name and reputation among Chinese developers and accomplished multiple well-known projects.

- The loan provided by CrowdFunz Fund 617 is a short-term debt investment and will be utilized for construction costs. The projects’ foundation and super structure had been finished. Developer has explicit plan for further progresses and to receive Condo Book in the second quarter of 2023 and TCO in the fourth quarter of 2023.

- After due diligence, CrowdFunz believes that the project is in prime location and has reasonable capital structure and strong developer background. Underlying property is valued at least $5,000,000, which is more than the total loans provided by CrowdFunz Fund 827 and 617.

- CrowdFunz believes that the loan provided by CrowdFunz Fund 617 has investment risk below the industry average and is a great investment opportunity for suitable investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)