Equity Pledge Debt Fund 832

Type: Debt

Target: $4,000,000

Annual Return: 8.50 - 8.75%

Min-invest Amount: $10,000

Duration: 12 – 30 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $4,000,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | April 2023 |

| Investment Timeline | 12 – 30 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend. After 12 months, dividends will be calculated in terms of days, till principal is repaid.

*3 dividends will be calculated in terms of days, till principal is repaid.

- Property is in Kips Bay, Manhattan, a quiet yet bustling neighborhood. Area has well-developed public transit and infrastructures and has multiple top-tier hospitals and medical facilities. Residents have education and medical backgrounds and earn above-average income. Paired with limited housing supply, the area is deemed one of the most underrated communities and full of growth potential.

- Developer purchased the lot for $14,800,000 in August 2021. Demolition of previous 3-floor building was finished, and developer plans to build a 12-floor apartment building with 59 Condo units. Foundation, excavation, and construction are expected to begin in Q2 2023, and the project is proposed to be completed in January 2025.

| Property Address | 429 2nd Avenue, New York, NY 10010 |

| Site Area | Kips Bay, Manhattan, NY |

| Lot Area | 5,982 Sqft |

| Building Area | 60,618 Sqft |

| Intended Use | 59-Unit Condo (12 Floors) |

| Construction Duration | 22 Months |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 5/4/2023 | 4/20/2023 | 10/19/2023 | 183天 | Prepaid Dividend *2 | |

| Second | No Later than 11/4/2023 | 10/20/2023 | 4/19/2024 | 183天 | Prepaid Dividend *2 | |

| Third | No Later than 5/4/2024 | 4/20/2024 | 10/19/2024 | 183天 | Extension Option Owned by Developer *3 | |

| Forth | No Later than 11/4/2024 | 10/20/2024 | 4/19/2025 | 182天 | Extension Option Owned by Developer *3 | |

| Fifth | No Later than 5/4/2025 | 4/20/2025 | 10/19/2025 | 183天 | Extension Option Owned by Developer *3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 12 months of dividends. After 12 months, dividends will be calculated in terms of days till Developer repays the loan.

*3 After the second dividend period, Developer owns three extension options, and investors will receive dividends accordingly at the same dividend rate.

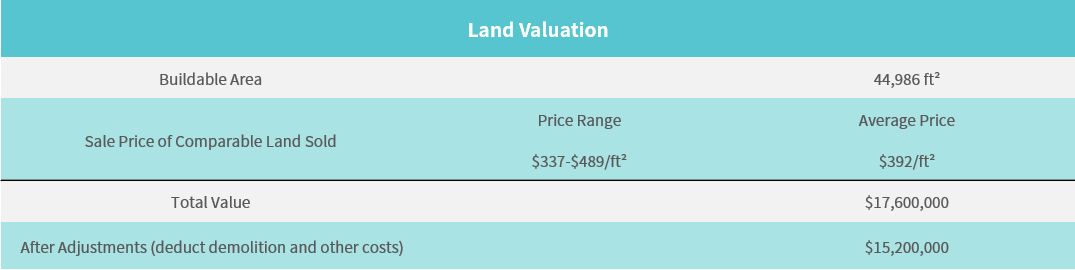

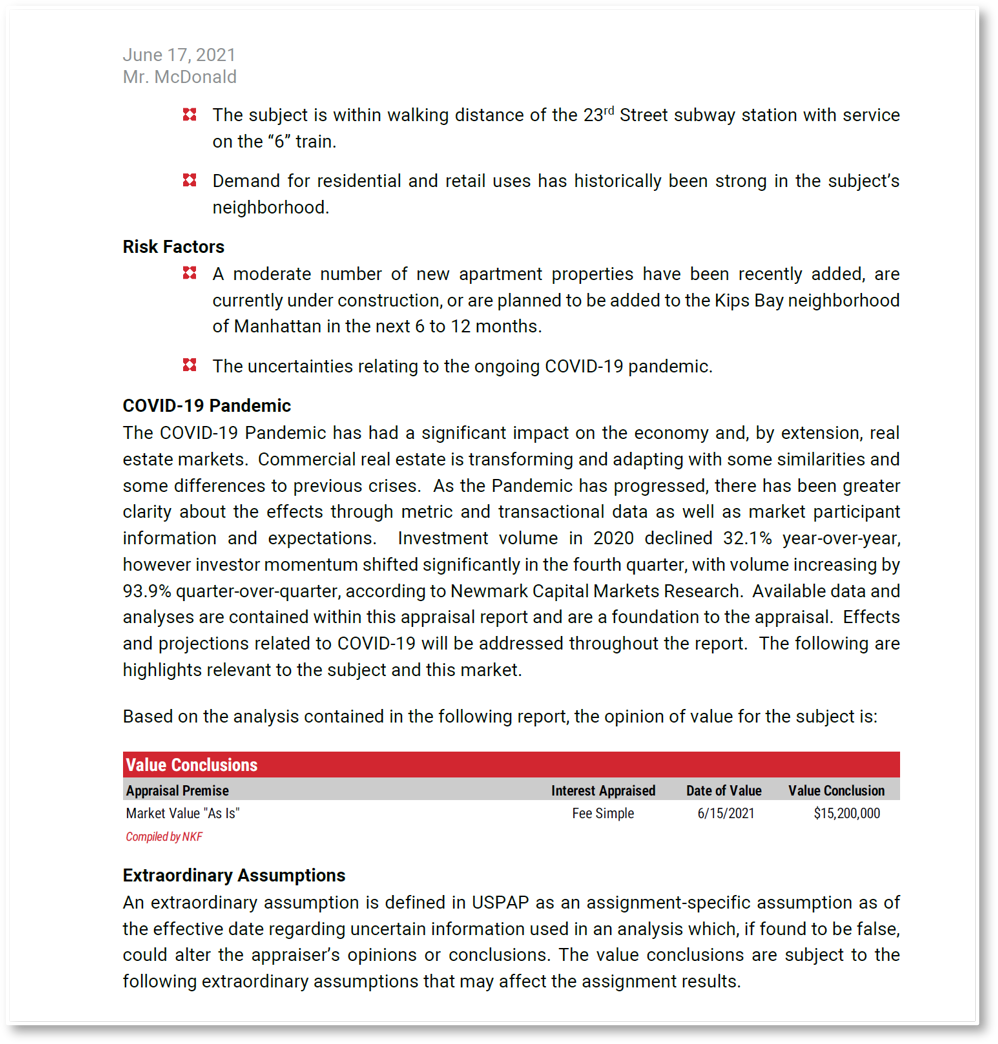

- According to Appraisal Report provided by Newmark Knight Frank, as of June 2021, the property was valued at $15,200,000.

- The short-to-mid term loan provided by CrowdFunz Fund 832 is secured by Developer’s equity in the project entity. As of March 2023, Developer had contributed $20,750,000 of equity and expects to contribute an additional $3,600,000. Total equity contribution is 6 times the loan originated by Fund 832. Developer will also provide Unlimited Personal Guarantee for additional security.

- Project is in Kips Bay, Manhattan, by Second Avenue and between 24th and 25th streets. Proximity to Midtown Manhattan and developed transit system enable tenants convenient commutes to other areas in New York City.

- As more residents and professionals return to New York City, population densities of most areas are rapidly recovering to pre-pandemic levels. Area residents are from education and medical backgrounds, granting them strong spending power.

- Developer plans to use the loan provided by CrowdFunz Fund 832 on excavation, superstructure, and other soft costs.

- Once the development is finished, Developer would refinance with a commercial bank, use cashflow from other projects, or sell condo units to repay the loan provided by CrowdFunz Fund 832.

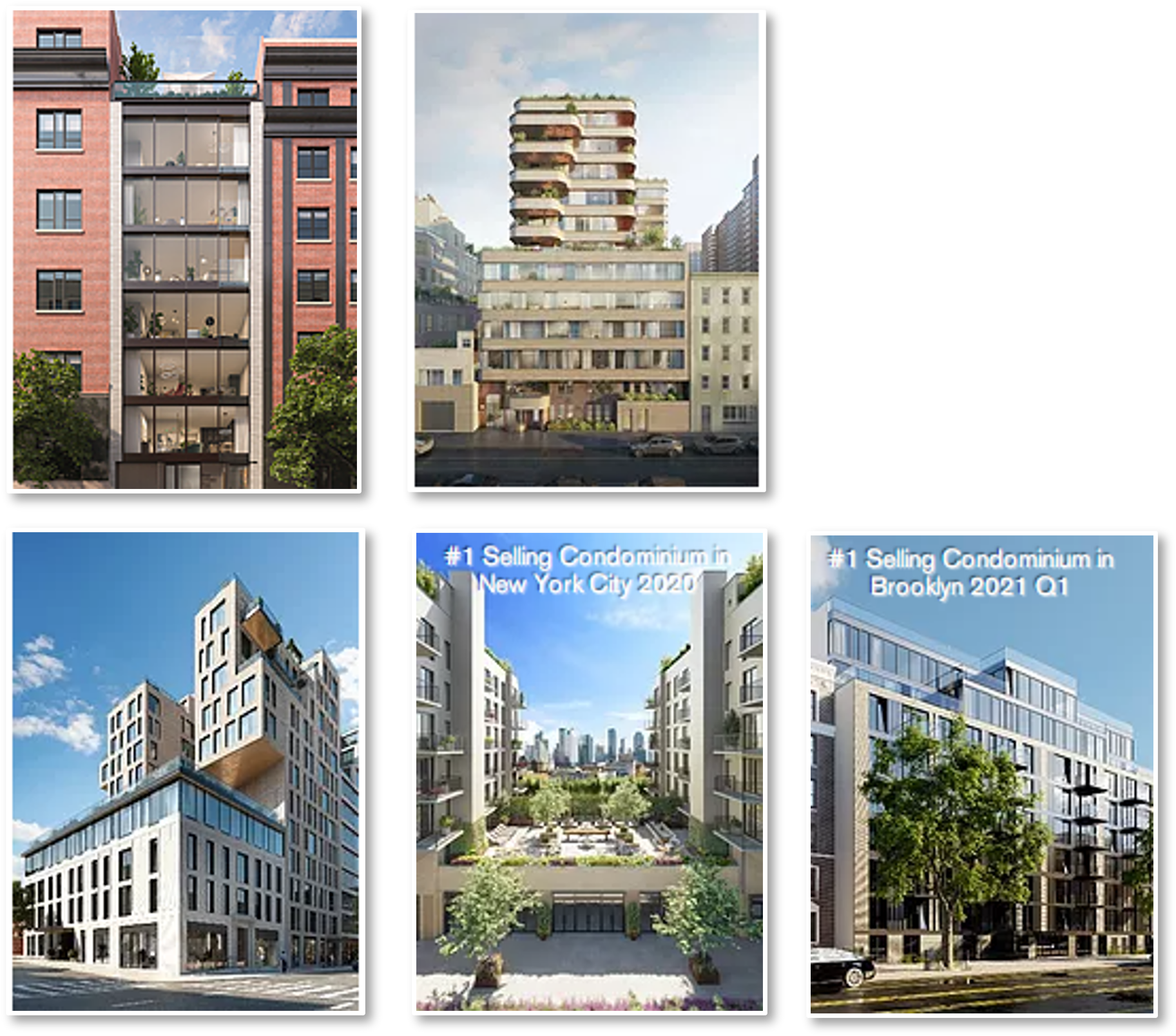

- Developer has over 30 years of experience in New York real estate market and established reputation from its successful projects in all five boroughs in New York. Its goodwill is attributed to the unique development strategy, aesthetic architectural design, and effective project management.

- The developer has also cooperated with CrowdFunz prior in Fund 604, Fund 805, and Fund 819, showing its trustworthy credits.

Investment Structure of CrowdFunz 832 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Mortgage from Commercial Bank | $42,000,000 | 60.31% |

| CrowdFunz Fund 832 Equity Pledge Loan | $4,000,000 | 5.74% |

| Developer Equity Contribution | $23,637,779 | 33.94% |

| Total | $69,637,779 | 100.00% |

- Developer had contributed $20,750,000 and plans to contribute another $3,600,000 into the project entity. The total equity is accounted for 33.94% in the capital stack.

- CrowdFunz Fund 832 will lend $4,000,000 short-term bridge loan in two phases, which is accounted for 5.74% in the capital stack.

- Developer had pledged 100% equity of the entity owning the project, and its key person would provide Unlimited Personal Guarantee.

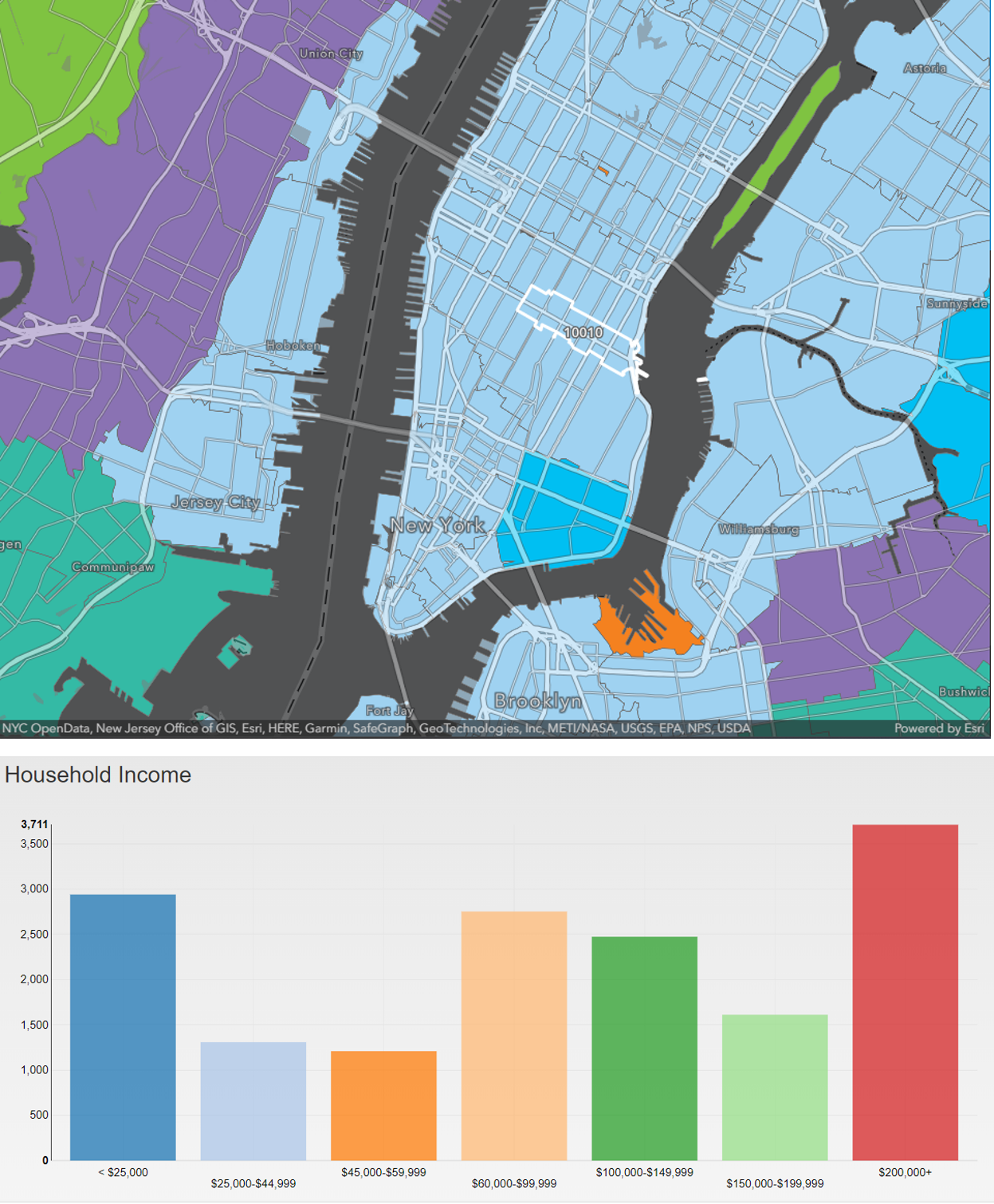

Demographics in the Zip code

| Zip Code 10010 | |

|---|---|

| Regional Population | 31,834 |

| Median Age | 34 |

| High School Education or above | 97% |

| Married | 35.35% |

| Family Median Income | $97,955 |

| White Collar/Blue Collar | 97.32%/2.68% |

| Child-Bearing Family | 11.61% |

| Caucasian | 73.80% |

| Asian | 14.40% |

Residents in the Zip Code has stable jobs and above-average spending power. Thriving environment for tech, finance, medical, and education has attracted more young professionals and facilitated gentrification. White collar is accounted for 97.32% of local workforce.

Residents have an average age of 34; 11.61% of families are child-bearing; 68% of residents rent houses. 25% of buildings were built before 1940, most of the remaining were built before 1980, making way for new developments that could have great growth potential.

* Data Source: United States Zip Codes. Org. & Esri Zip Code Lookup, American Community Survey as of March 2023

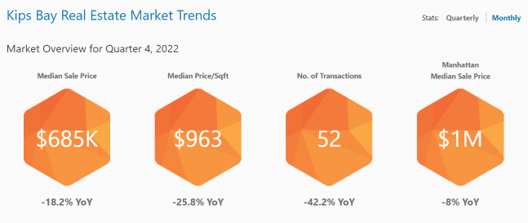

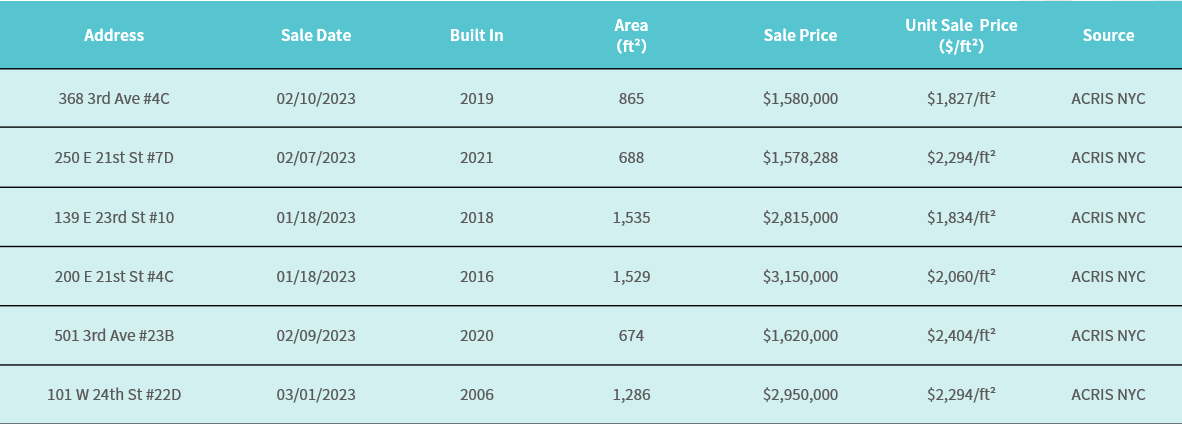

Current Market Overview – Residential Development

As of December 2022, median home sale price was $685,000, 18.2% lower YoY. Median unit sale price went down 25.8% YoY. Rising mortgage rate and home shortage forced many buyers out of the market and drove down home price to an undervalued level.

According to data compiled by PropertyShark, 52 residential units were sold in Kips Bay in the 4th quarter of 2022, down 42.2% YoY. Most sold units were outdated due to lack of new developments.

* Source: PropertyShark.

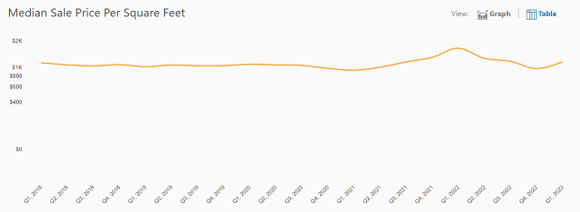

Valuation – Cost Approach

* Source: Appraisal Report, data compiled and calculated by CrowdFunz.

Location

Kips Bay is in east side of Manhattan and adjacent to East River. It is close to the business district where Madison Square Park and the National Museum of Mathematics are located. Project area has strong commercial environment and transportation network. It takes 15 and 30 minutes driving to LGA and JFK Airports.

Transportation

- Subway:6,N, Q, R, W (3-5min walk)

- To JFK Airport:30-minute driving

- To LGA Airport:15-minute driving

Nearby Schools

Kips Bay has multiple time-honored schools, including Mary Lindley Murray elementary school, The 47 American Sign Language & English Lower School, Simon Baruch Middle School, and municipal-sponsored Baruch College.

Living Facilities

Area has high population density, developed businesses, multiple shopping malls, and comprehensive living facilities. There are over 30 unique restaurants mainly located on Third and Second Avenue. Air quality is superior due to high greenery coverage and proximity to East River.

Recreations

Kips Bay has two municipal libraries and quickly developing recreation sites. Family-friendly Parks, gyms, and museums are within walking distance.

Developer Company: New Empire Corp.

Developer Website: https://www.newempirecorp.com/

Prior Cooperation: CrowdFunz Fund 604 / Fund 805 / Fund 819

Founded in 1997, New Empire Corp. has more than 20 years of development experience in the New York real estate market. Its past projects are in Brooklyn, Manhattan, and Queens.

With the purpose of creating a luxurious and comfortable living environment, its 34th Street project in Long Island City and the Ocean Avenue project in Brooklyn won the best sales awards in New York City and Brooklyn.

Under the leadership of Bentley Zhao, CEO, and Kevin Zhao, Vice President, the company has designed and built more than 100 residential and hotel projects, enabling New Empire Corp. to achieve impressive results.

- Developer will use the loan provided by CrowdFunz Fund 832 to secure short-to-mid term liquidity, covering the costs of excavation, foundation, superstructure, and other soft costs.

- CrowdFunz will continue to monitor the project construction processes and to follow up the updates of the project financial status, ensuring the loan repayments on time.

- Developer has established reputation and proven expertise, and the equity contribution in the underlying project is more than 6 times the loan offered by Fund 832.

- CrowdFunz believes that the loan provided by CrowdFunz Fund 832 has investment risk below industry average and is a great investment opportunity for suitable investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)