Equity Pledge Debt Fund 833

Type: Debt

Target: $1,800,000

Annual Return: 8.25 - 8.50%

Min-invest Amount: $10,000

Duration: 6 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,800,000 |

| Estimated Return | 8.25 – 8.50% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | April 2023 |

| Investment Timeline | 6 – 18 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.25% Annualized Return for Investment of 1-19 Units; 8.50% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend. After 12 months; dividends will be calculated in terms of days, till principal is repaid.

*3 Investors will receive prepaid dividend before every period of 6 months.

- Four properties are valued at $16,040,000 in total. Developer will pledge equities of project entities for loan provided by CrowdFunz Fund 833 and will use proceeds to purchase and redevelop a mixed-use property in central Brooklyn.

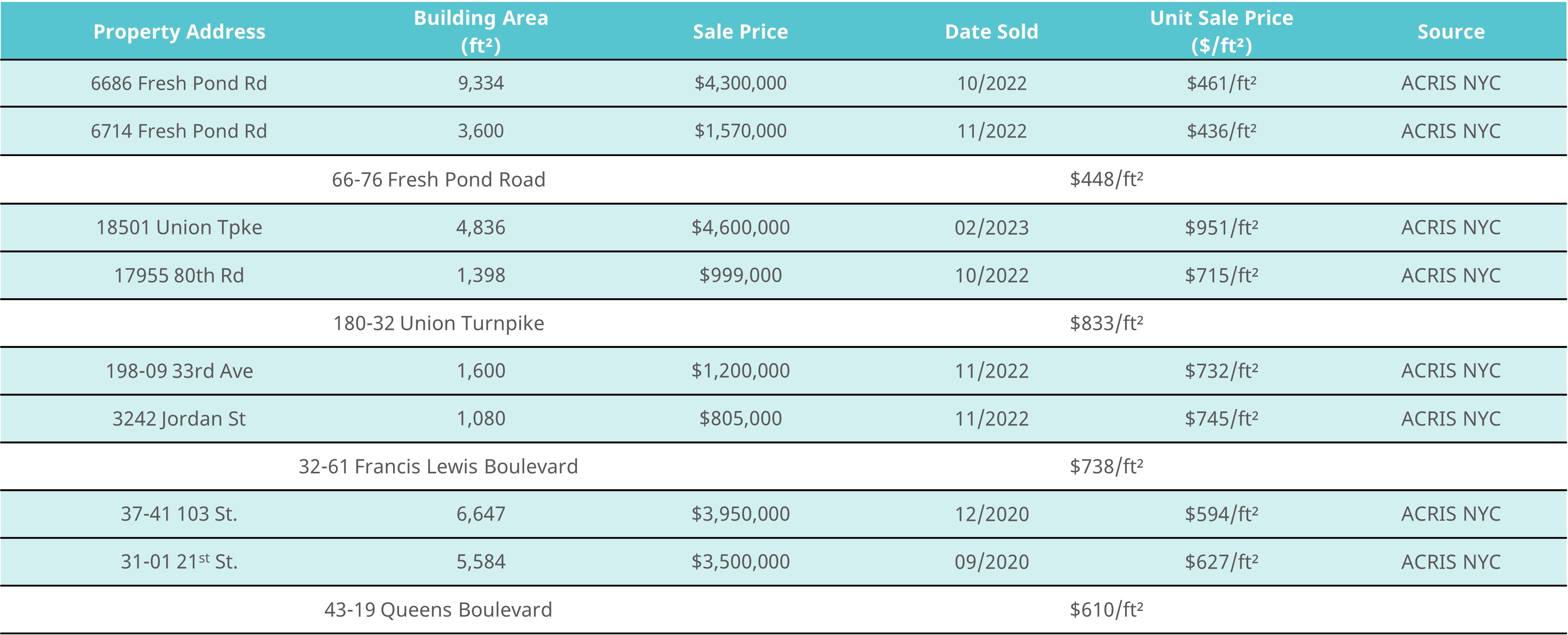

| Property Address | 66-76 Fresh Pond Road, Flushing 180-32 Union Turnpike, Queens 32-61 Francis Lewis Boulevard, Flushing 43-19 Queens Boulevard, Long Island City |

| Area | Queens, New York |

| Lot Area | 2499 Sqft / 8959 Sqft / 6041 Sqft / 2300 Sqft |

| Building Area | 5000 Sqft / 4400 Sqft / 4632 Sqft / 5865 Sqft |

| Use | Residential / Commercial For Rent |

| Purchased In | 2017/2000/1998/2015 |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 5/1/2023 | 4/14/2023 | 10/13/2023 | 183 days | Prepaid Dividend *1 | |

| Second | No Later than 10/30/2023 | 10/14/2023 | 4/13/2024 | 183 days | Extension Option Owned by Developer *3< | |

| Third | No Later than 4/29/2024 | 4/14/2024 | 10/13/2024 | 183 days | Extension Option Owned by Developer | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 6 months of dividends. After 6 months, dividends will be calculated in terms of days till Developer repays the loan.

*3 After the second dividend period, Developer owns two extension options, and investors will receive dividends accordingly at the same dividend rate.

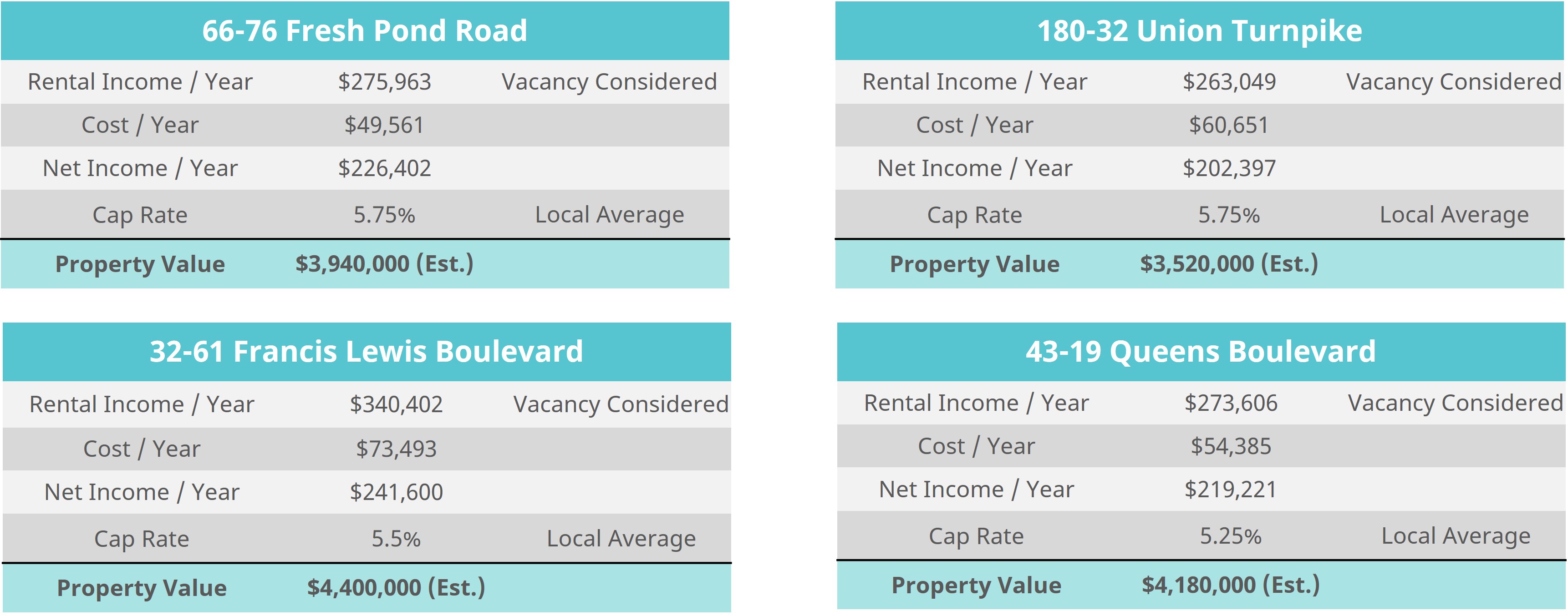

- Developer will pledge 100% of the equities of 4 project entities to receive the short-to-midterm bridge loan provided by CrowdFunz Fund 833. Currently, the 4 properties are valued at $16,040,000. Developer’s equity contribution is $7,204,094, which is about 4 times the loan amount.

- In addition, Developer will provide Unlimited Personal Guarantee, which is estimated to be more than 8 times the loan amount offered by Fund 833.

- 4 underlying properties are in central areas of Queens and are close to well-developed public transactions.

- Developer had held and operated the 4 underlying properties for multiple years and made them generate stable cash flows. All 4 properties are 100% leased and well-operated; Developer’s business acumen had created appreciation of those 4 properties.

- Developer plans to use the loan provided by CrowdFunz Fund 833 to acquire a mixed-use property in central Brooklyn.

- After purchasing target property, Developer could refinance with a commercial bank or use cashflow from other projects, to repay the loan provided by CrowdFunz Fund 833.

- Developer had completed multiple mid-to-large scale commercial developments mostly in Brooklyn and Queens. With over 30 years of experience in local real estate development, Developer had earned great reputation for its market expertise and project execution.

- Developer had cooperated with CrowdFunz previously in Fund 821 and had shown great creditworthiness.

Investment Structure of CrowdFunz 833 Fund

Capital Stack

| Capital Stack | Ratio | |

|---|---|---|

| Mortgage from Commercial Bank | $7,035,906 | 43.86% |

| CrowdFunz Fund 833 Equity Pledge Loan | $1,800,000 | 11.22% |

| Developer Equity Contribution | $7,204,094 | 44.91% |

| Total | $16,040,000 | 100.00% |

- 4 Underlying properties are well-operated and are generating stable cashflow indicating a creditworthiness of Developer.

- Underlying properties are totally valued at $16,040,000 in total, with mortgage that has a remaining balance of $7,035,906. Excluding the mortgage remaining, the equity value is about 4 times of the loan amount provided by CrowdFunz Fund 833.

- Developer had pledged 100% equities of four project entities, and its key person would provide Unlimited Personal Guarantee.

66-76 Fresh Pond Rd

Underlying project 1 is in Ridgewood of southern Queens, New York. M train station is 1-min walk away, while it takes 24-min subway to reach Manhattan. It takes 25 and 30 minutes to drive to LGA and JFK.

Transportation

- Subway: M Train

- To JFK: 30-min driving

- To LGA:25-min driving

180-32 Union Turnpike

Underlying project 2 is located at Fresh Meadows in northeastern Queens, New York. There are multiple bus lanes nearby that allow easy commuting to Manhattan, Queens, and Brooklyn. Driving to LGA and JFK takes only 10 and 20 minutes.

Transportation

- Bus Lanes: Q64,Q65,QM4,QM44

- To JFK: 20-min driving

- To LGA:10-min driving

32-61 Francis Lewis Blvd

Underlying property 3 is located in Bayside, in northeast of Queens, New York. LIRR station and bus station are 8-min and 3-min walking distance. Project is near a key transportation hub of I-295 and Northern Blvd。

Transportation

- Subway: 7(Flushing Main St)

- Train: LIRR

- To JFK: 30-min driving

- To LGA:25-min driving

43-19 Queens Blvd

Underlying property 4 is in Sunnyside, nearby Long Island City and Woodside of Queens, New York. It takes 15-min subway to reach Midtown Manhattan. Bus allows easy access to other areas in Queens. It takes 20 and 30 minutes to arrive at LGA and JFK.

Transportation

- Subway: 7 (1-min walk)

- To JFK: 30-min driving

- To LGA:20-min driving

Developer Company: AMPIERA GROUP.

Developer Website: https://www.ampiera.com/

Prior Cooperation: CrowdFunz Fund 821

Ampiera is headquartered in Queens, New York. Since founding, Ampiera has focused on Condominium developments in New York and gradually get involved into office and other commercial properties in the recent decade.

Ampiera has its expertise in identifying undervalued areas and is known for its strategic acquisition, development, and management of undervalued properties. Company’s Key developments include the building leased to Bank of China, and big scale commercial developments in Bay Ridge and Long Island City, New York.

- The short-term acquisition loan provided by CrowdFunz Fund 833 will help Developer fund new acquisition. Developer will pledge 100% equity of 4 existing entities and will also provide Unlimited Personal Guarantee to secure the borrowing.

- The loan provided by CrowdFunz Fund 833 has comparatively low LTV. CrowdFunz chose four completed and well-operated properties in established areas as the underlying properties to minimize financial risk.

- CrowdFunz believes that the loan provided by CrowdFunz Fund 833 has investment risk below industry average and is a great investment opportunity for suitable investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)