Equity Pledge Debt Fund 836

Type: Debt

Target: $2,200,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 6 – 12 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $2,200,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | July 2023 |

| Investment Timeline | 6 – 12 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 6 months of dividend. After 6 months, dividends will be calculated in terms of days, till principal is repaid.

*3 Investors will receive prepaid dividend before every period of 6 months.

- Project is in Sunnyside, Queens, adjacent to the fast-developing Long Island City. The values of local realties have been quickly growing for the past decade due to its convenient access to public transit and facilities and the growing rental demands from young professionals.

- Developer purchased the project lot in April 2022 for $11,000,000 and had started foundation works in June 2023. The construction is expected to be completed in second quarter of 2025. The 8-floor building will feature 63 residential rental units, 5 commercial leasing units, 24 parking lots, and 33 bike spots. Properties will have 421-a tax abatement.

| Address | 45-02 Queens Blvd, Sunnyside, NY, 11104 |

| Area | Sunnyside, Queens, New York |

| Lot Area | 13,035 Sqft |

| Building Area | 84,584 Sqft |

| Intended Use | 63 Residential Rental Units, 5 Commercial Rental Units, 24 Parking Spots, and 33 Bike Spots |

| Construction Duration | 22 Months |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 8/3/2023 | 7/25/2023 | 1/24/2024 | 184 days | Prepaid Dividend *2 | |

| Second | No Later than 2/3/2024 | 1/25/2023 | 7/24/2024 | 182 days | Extension Option Owned by Developer *3< | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 184 days of dividends. After 6 months, dividends will be calculated in terms of days till Developer repays the loan.

*3 After the first dividend period, Developer owns 1 extension option, and investors will receive dividends accordingly at the same dividend rate.

- International, as of May 2023, project land is valued at $13,300,000, and property could be valued at $55,100,000 post completion.

- The loan provided by CrowdFunz Fund 836 is pledged with 100% equity of the project entity. Developer had contributed $12,500,000, which is 5 times the loan amount. In addition, Developer will provide Unlimited Personal Guarantee.

- Sunnyside has tremendous growth potential due to its proximity to Long Island City and convenient public transit. Driving to LGA and JFK Airport takes 10 minutes and 25 minutes from the project site.

- In recent years, Queens areas along the East River, especially Long Island City and Sunnyside, have been quickly developed. Local population density and resident family income have been gradually catching up to those in Manhattan. Since the shortage of newly built homes, apartment developments become investment opportunities.

- Developer will use the loan provided by CrowdFunz Fund 836 to cover initial construction costs, including excavation and other soft costs.

- Developer plans to repay the loan provided by CrowdFunz Fund 836 within a year, by using construction loan provided by commercial bank or other sources of fund.

- Developer had completed multiple mid-to-large scale commercial projects in New York and had earned reputation for its 30-year expertise in real estate development and outstanding project execution.

- Developer and CrowdFunz had cooperated in CrowdFunz Fund 832 (Completed) and Fund 833 (Fund Raised). Two parties are looking forward to extending strong alliance through CrowdFunz Fund 836 and to creating value for the investors.

Investment Structure of CrowdFunz 836 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Construction Loan from Commercial Bank | $25,000,000 | 62.97% |

| CrowdFunz Fund 836 Equity Pledge Loan | $2,200,000 | 5.54% |

| Developer Equity Value | $12,500,000 | 31.49% |

| Total | $38,200,000 | 100.00% |

- Developer had contributed $12,500,000 of equity, which is accounted for 31.49% in the Capital Stack.

- The $2,200,000 short-term loan provided by CrowdFunz Fund 836 is accounted for 5.54% in the Capital Stack.

- The loan provided by CrowdFunz Fund 836 is pledged with 100% equity of the project entity. Developer’s key person will provide Unlimited Personal Guarantee.

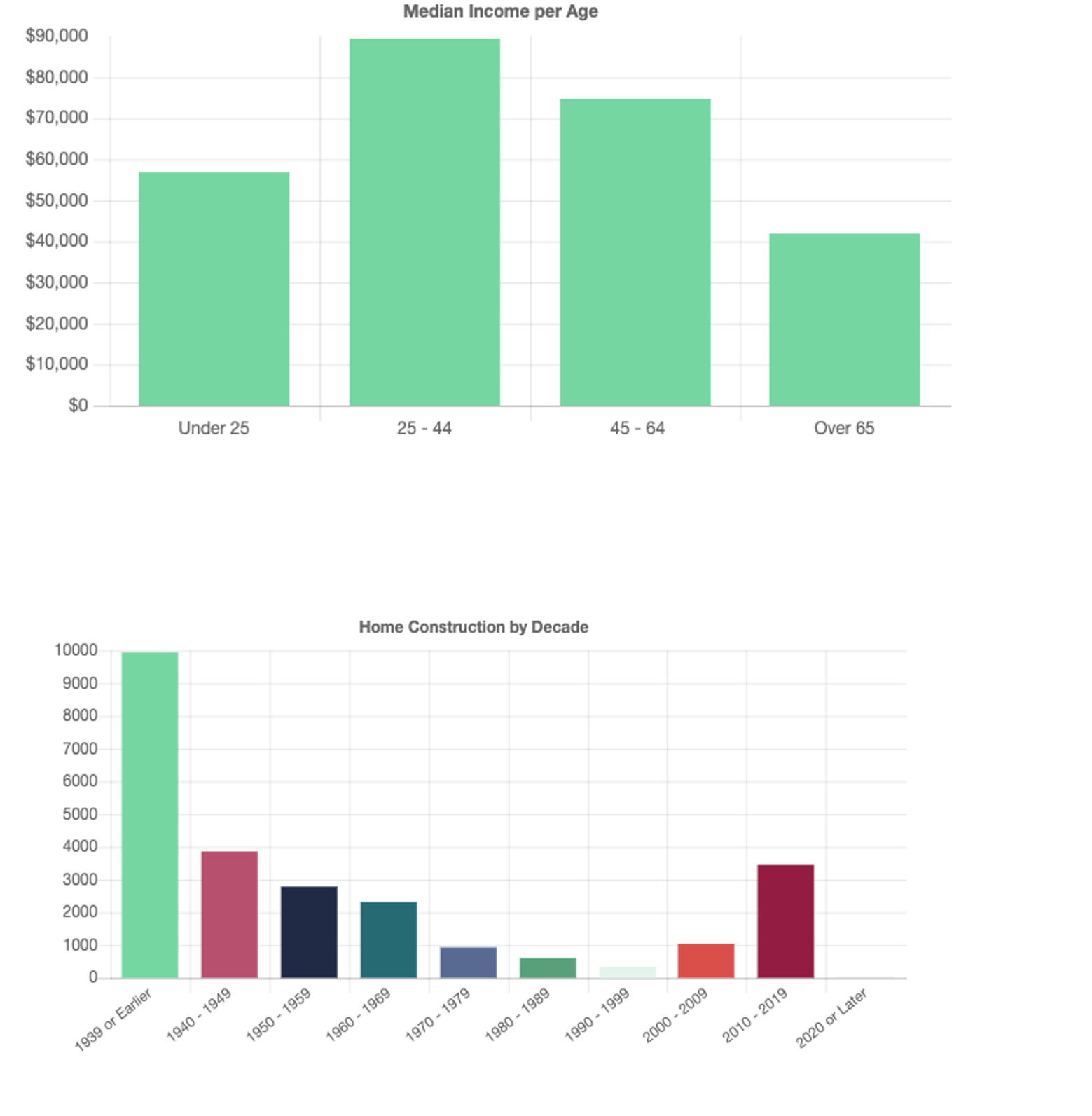

DEMOGRAPHICS IN THE ZIP CODE

| Zip Code 11104 | |

|---|---|

| Population | 52,348 |

| Median Age | 35 |

| High School Degree or Above | 64.96% |

| Commute Area | Metropolitan (99.8%) |

| Average Family Income | $83,303 |

| White / Blue Collar | 82.81%/17.19% |

| Child-bearing Family | 22.84% |

| Average Family Size | 2 |

| Rental | 74.73% |

Known for its prime location and convenient public transit, Sunnyside has attracted new real estate developments and residents in recent year。

Most residents in Sunnyside are young professionals from diverse backgrounds with stable income and spending power。

Residents are on-average of 39 years old; child-bearing family is accounted for 22.84%. Most residents rent their homes due to high buying demands and shortage of residential units。

* Source: Point2homes.com in July 2023

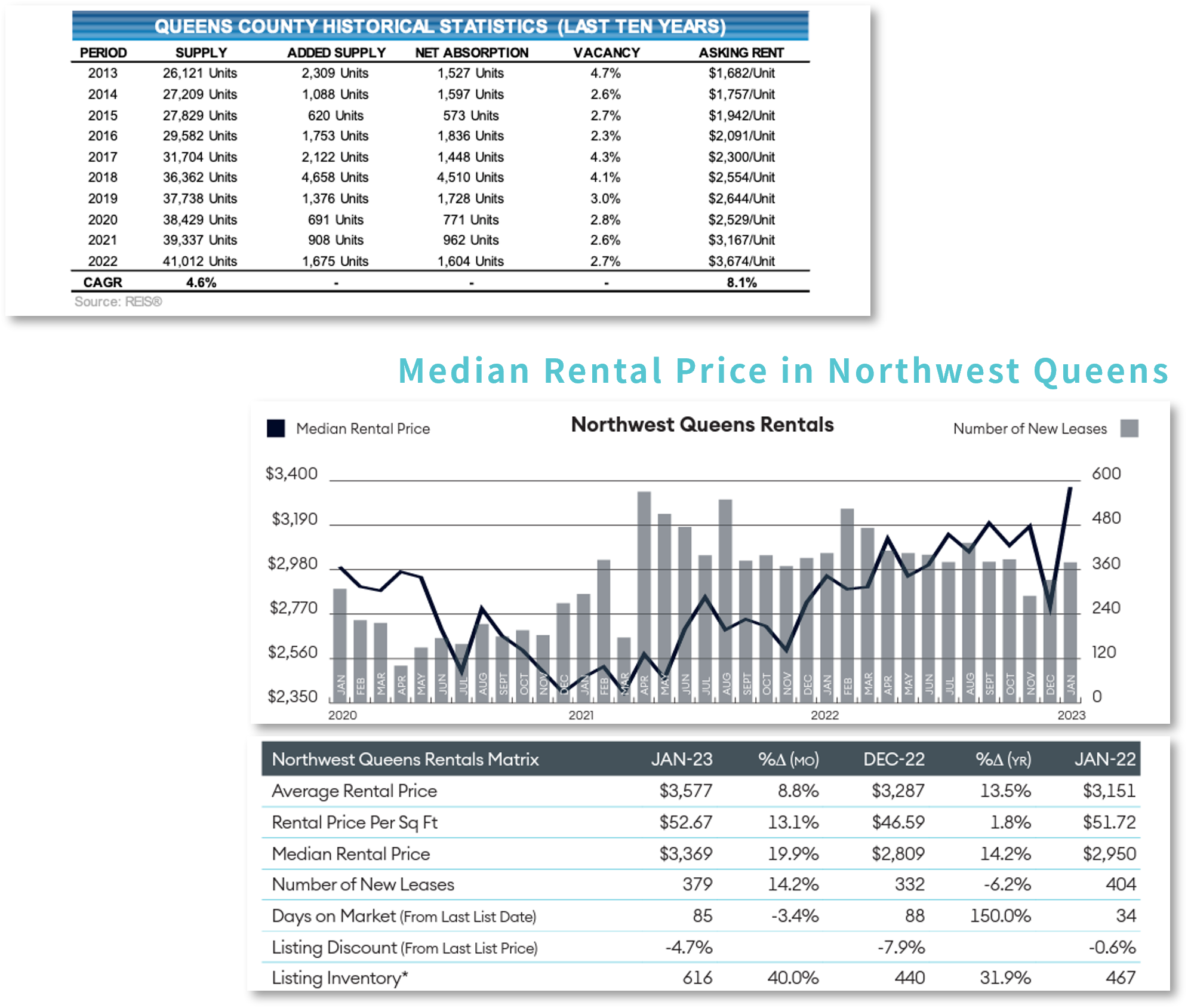

Rental Market Trend in the Area

According to market data from CoStar, rental apartments in Sunnyside have strong demands. The past decade had seen 223 new properties and 7,309 rental units, yet vacancy rate is merely 0.60%. In addition, compared to 1.27% in the 2000-2010 period, the vacancy rate has dropped further, highlighting the vitality of the local rental housing market。

According to Rental Market Report provided by Douglas Elliman, in the first quarter of 2023, the average rent in Long Island City, Astoria, Sunnyside, and Woodside had increased to $3,577 per month, which is recovered from the impact of pandemic and has reached new high。

* Source: Appraisal Report, Colliers International.

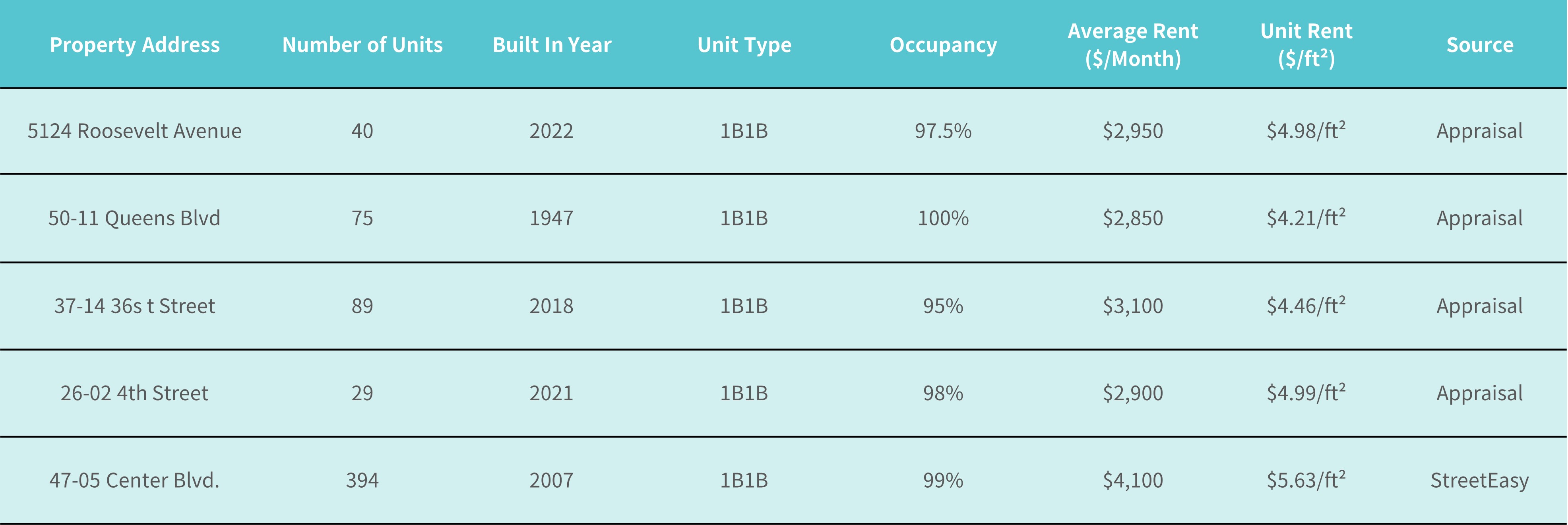

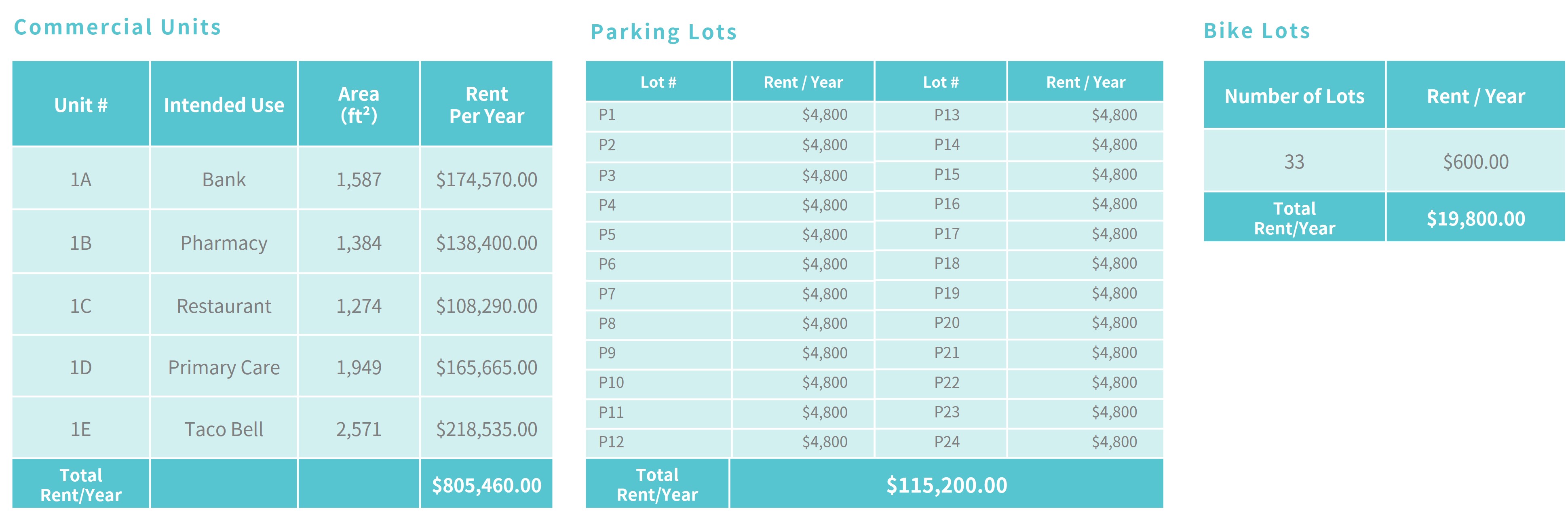

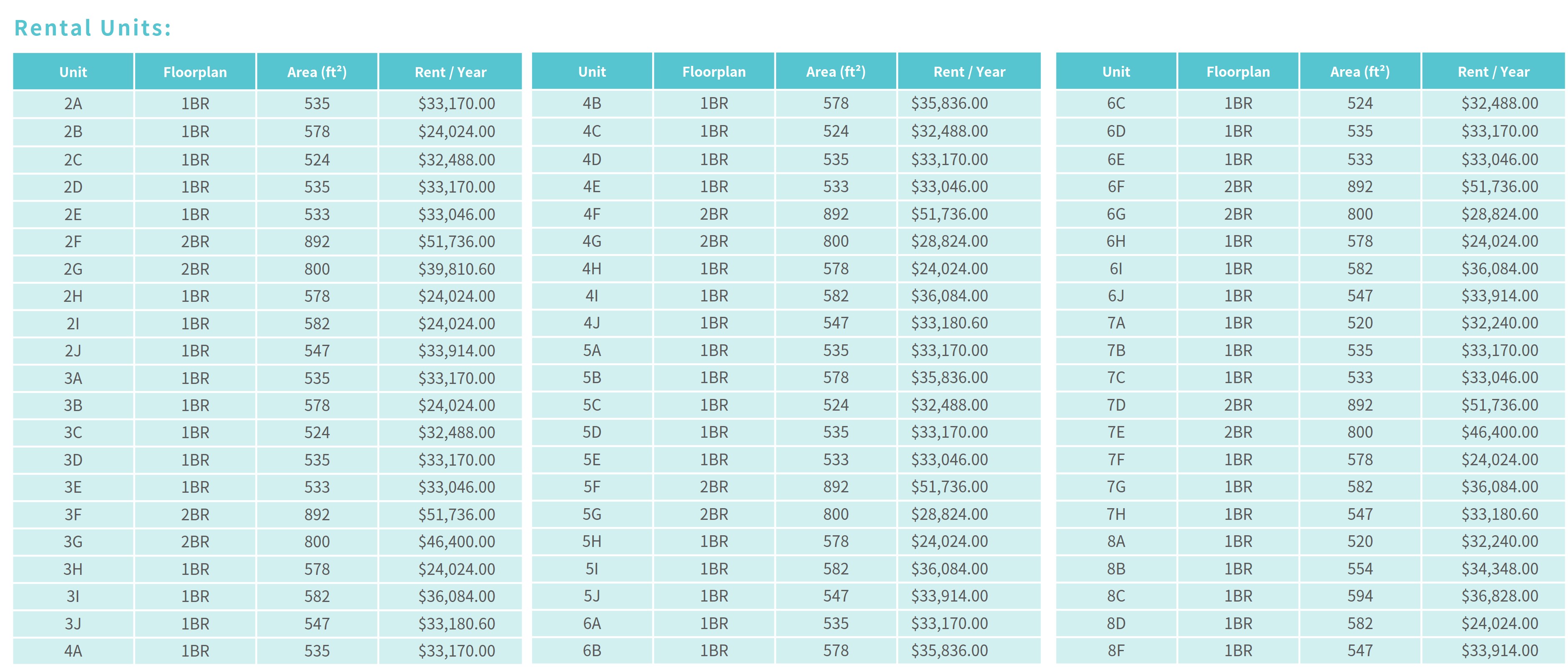

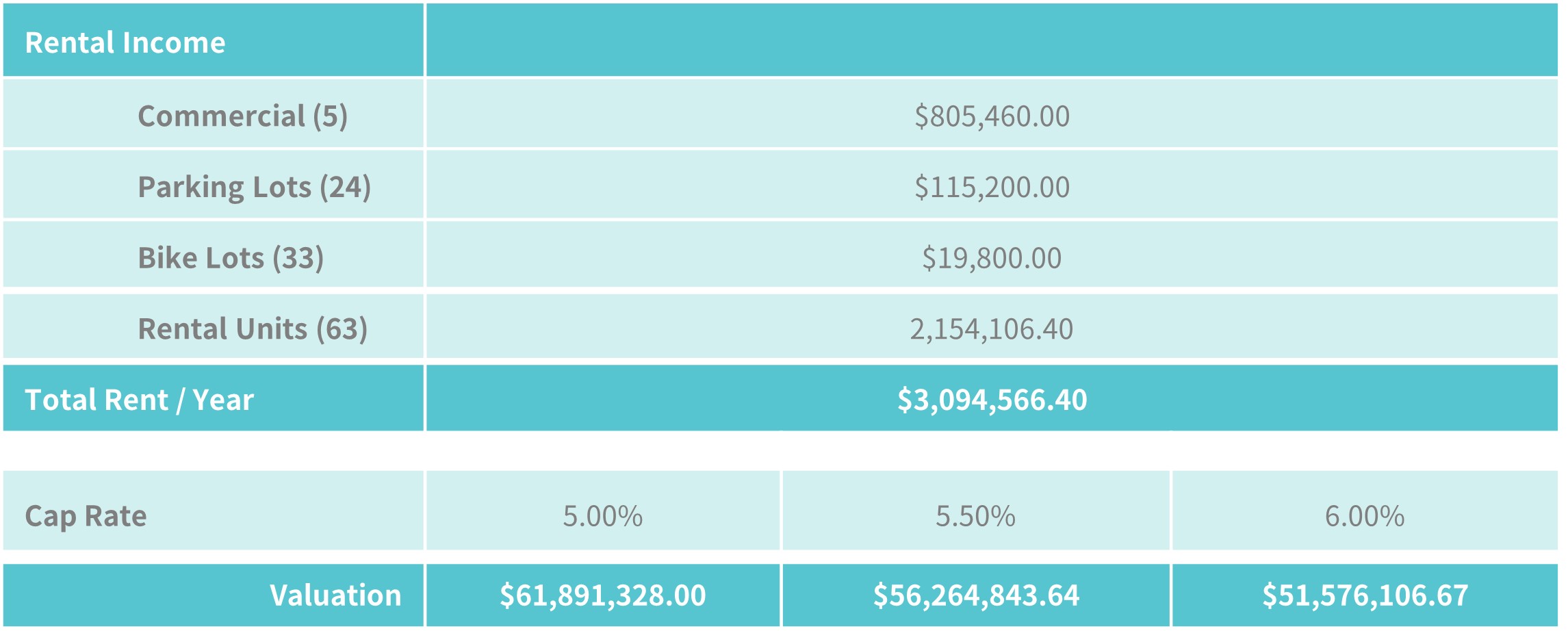

Income Approach

* Source: Rent estimation and data provided by Developer.

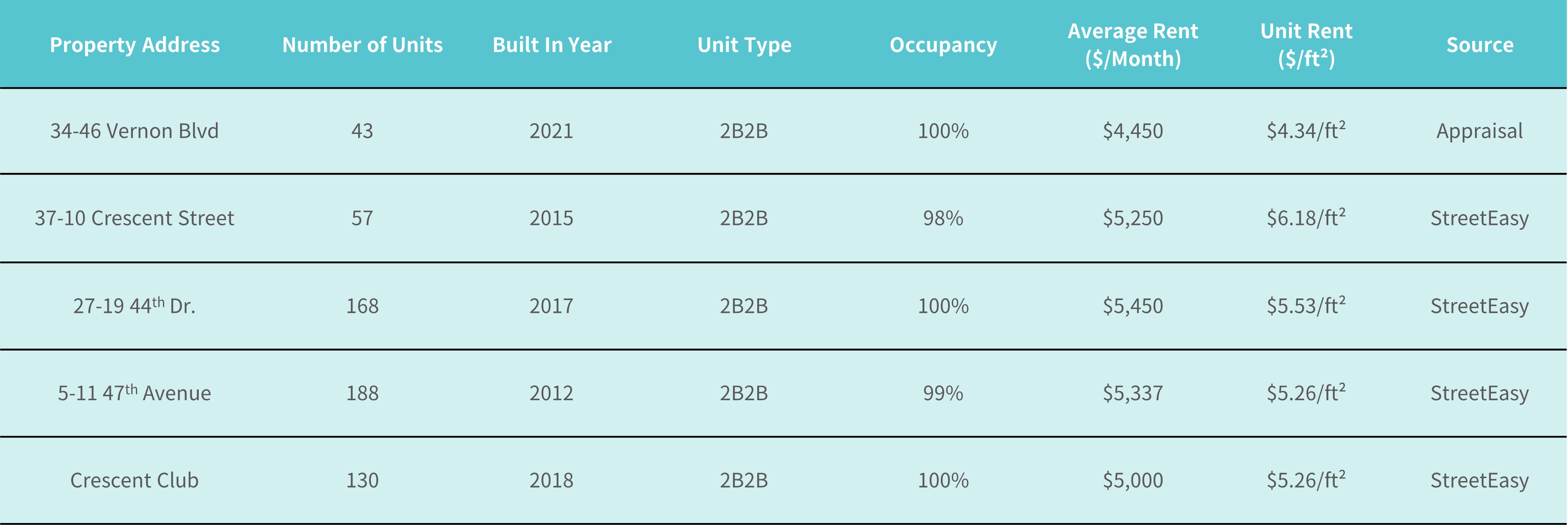

Income Approach

* Source: Rent estimation and data provided by Developer; valuation is calculated by CrowdFunz.

Location

The project is located in the core area of Sunnyside, Queens. The site is surrounded by well-developed public transportation and is close to subway line 7 and several bus lines. Driving to LGA and JFK Airport from the site takes 10 minutes and 25 minutes.

Transportation

- Subway:Line 7 (1-minute walk)

- To Midtown Manhattan: 12-minute Metro

- To JFK Airport:25-minute Drive

- To LGA Airport:10-minute Drive

Schools

Sunnyside has established education system that include elementary schools, middle school, and high school, to meet education needs. Adult schools are also available for professionals who are looking to expand their careers.

Living Facilities

Sunnyside has ample businesses and living facilities to support all needs. More residents around 30 years old have moved into the area for its safety and convenience.

Entertainment

Local entertainment venues include parks, gyms, and museums that are all within walking distance.

Developer Company: AMPIERA GROUP.

Developer Website: https://www.ampiera.com

Prior Cooperation: CrowdFunz Fund 821 / CrowdFunz Fund 833

Ampiera is headquartered in Queens, New York. Since founding, Ampiera has focused on Condominium developments in New York and gradually get involved into the development and management of office and other commercial properties in the recent decade.

Ampiera has its expertise in identifying undervalued areas and is known for its strategic acquisition, development, and management of undervalued properties. The company’s Key developments include the building leased to Bank of China in Flushing, Queens, and large scale commercial developments in Bay Ridge and Long Island City, New York.

- The short-term loan provided by CrowdFunz Fund 836 will help Developer complete the initial phase of construction. Developer’s established goodwill, the collateralized equity value, which is 5 times the loan amount originated by Fund 836, and Developer key person’s unlimited personal guarantee, support the borrowing.

- Developer plans to repay the loan originated by CrowdFunz Fund 836 within a year, by using construction loan provided by commercial bank or other sources of fund. CrowdFunz believes that under the loan agreement with clear legal rights and obligations, the short-term debt invested by Fund 836 has controllable risks and a low probability of default, making the fund a feasible real estate investment opportunity for retail investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)