Equity Pledge Debt Fund 839

Type: Debt

Target: $8,000,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 12 – 30 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $8,000,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | October 2023 |

| Investment Timeline | 12 – 30 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend. After 12 months. Dividends will be calculated in terms of days until principal is repaid.

*3 Investors will receive prepaid dividend before every period of 6 months.

- Property is in Hudson Yards on the west side of Manhattan. Hudson Yards is one of the biggest local redevelopment areas, and its property value appreciates at a fast rate. The area is popular among large tech companies and home buyers for its high-quality buildings and convenient access to Subway Line 7.

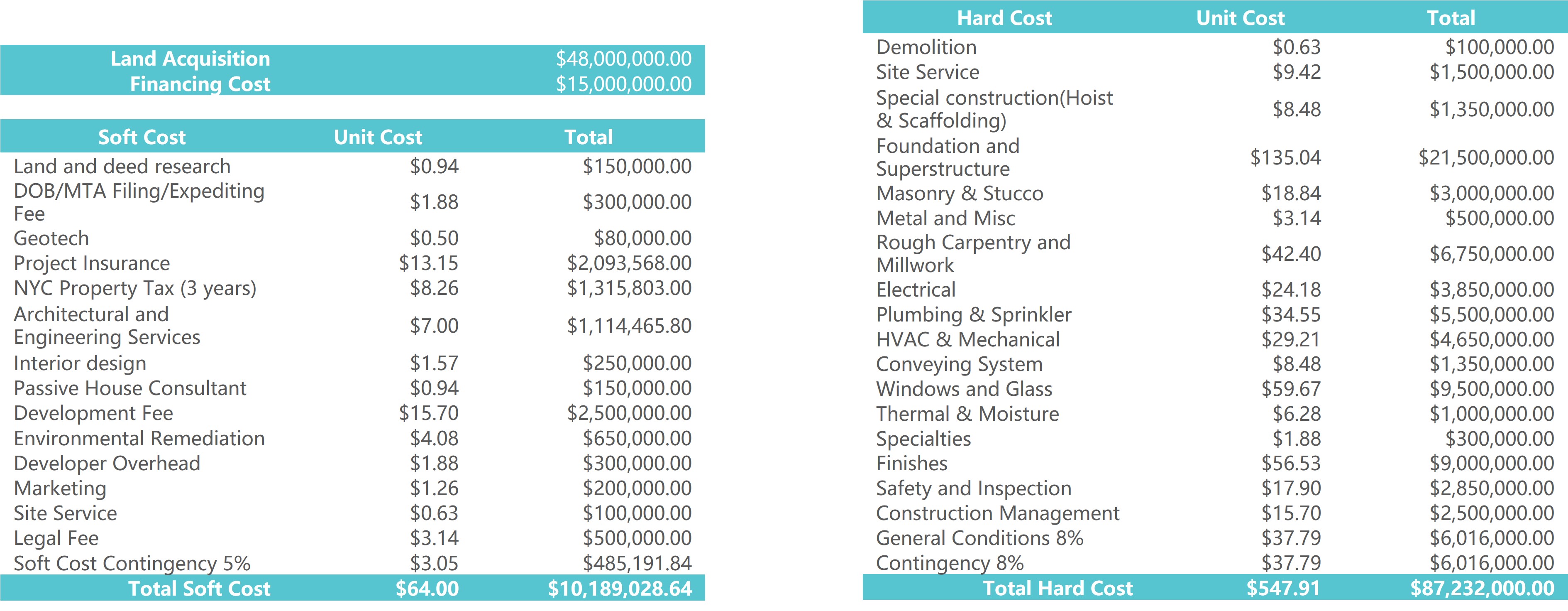

- Developer purchased the lot for $48,000,000 in May 2022 and intended to develop a 11-floor and a 12-floor mixed-use buildings. The demolition works had been completed, and the construction of foundation is entering the final phase. Based on the plan, all residential units will hold for sale once the construction completed.

| Address | 489 & 501 9th Avenue, New York, NY, 10018 |

| Area | Hudson Yards, Manhattan, New York |

| Lot Area | 16,479 Sqft |

| Building Area | 158,613 Sqft |

| Intended Use | 122 Condo Units,5 Commercial Units. 2 Community Centers, 25 Storage Units |

| Construction Duration | 22 Months |

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Phase | Amount | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | First | $2,000,000 | No Later Than 10/15/2023 | 10/1/2023 | 9/30/2024*2 | 366 Days | Prepaid Dividend |

| Second | $2,000,000 | No Later Than 11/15/2023 | 11/1/2023 | 9/30/2024 | 335 Days | Prepaid Dividend | |

| Third | $2,000,000 | No Later Than 12/15/2023 | 12/1/2023 | 9/30/2024 | 305 Days | Prepaid Dividend | |

| Forth | $2,000,000 | No Later Than 1/15/2024 | 1/1/2024 | 9/30/2024 | 274 Days | Prepaid Dividend | |

| Second | - | - | No Later Than 10/15/2024 | 10/1/2024 | 3/31/2025 | 182 Days | Extension Option Owned by Developer *3 |

| Third | - | - | No Later Than 4/15/2025 | 4/1/2025 | 9/30/2025 | 182 Days | Extension Option Owned by Developer *3 |

| Fourth | - | - | No Later Than 10/15/2025 | 10/1/2025 | 3/31/2026 | 182 Days | Extension Option Owned by Developer *3 |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 First round of investors will receive at least 366 days of dividends. After 12 months, dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 3 extension options, and investors will receive dividends accordingly at the same dividend rate.

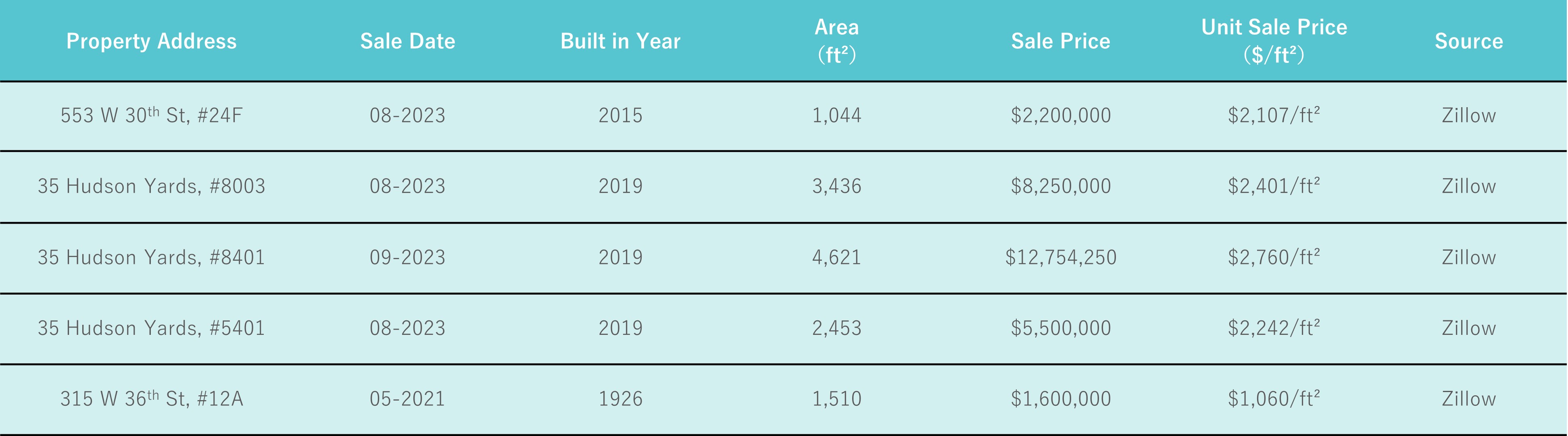

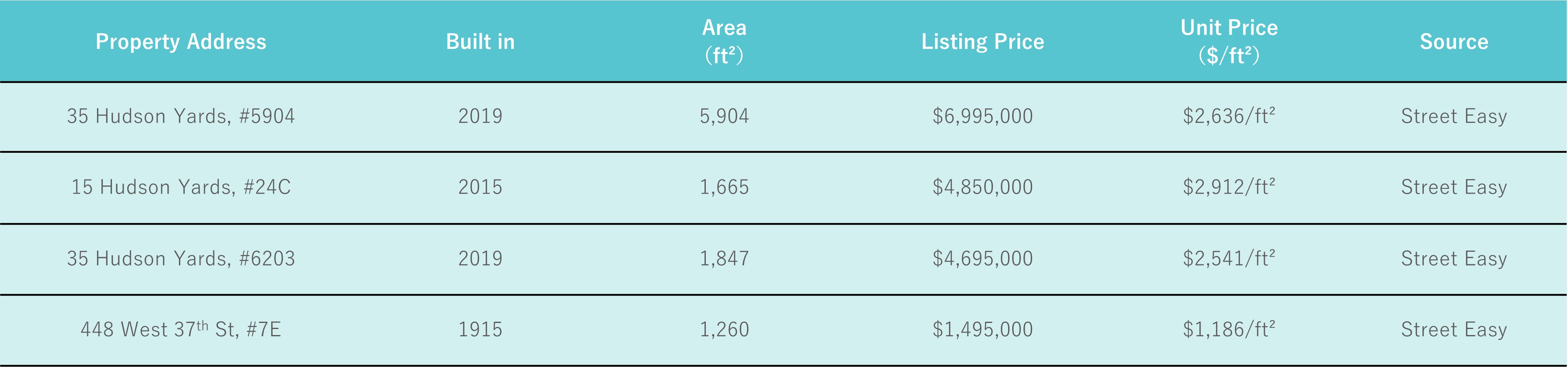

- According to Appraisal Report provided by Archstone Group NYC, as of February 2023, the lot is worth $50,800,000. Once completed, the property could be valued at $231,100,000.

- The loan provided by CrowdFunz Fund 839 is a short-to-middle term loan and is collateralized by 100% equity of the project. Developer had contributed $50,050,000 of equity, which is 6 times the loan amount. In addition, the borrower’s key person would provide unlimited personal guarantee.

- Project is in the quickest-developing area, Hudson Yards, Manhattan. It is close to numerous bus, subway, and train lines that allow residents conveniently commute to other areas of Manhattan, Queens, and Long island. Project is 25-min driving from Newark International Airport, 30-min driving to LGA, and 45-min driving to JFK.

- In the past 10 years, Hudson Yards had received tremendous support from NY State, New York City, and MTA. As more high-income residents flood into the area, both condo and rental units are in shortage and poised for future growth in value.

- Borrower will use the loan provided by CrowdFunz Fund 839 to cover early construction costs, including excavation and other soft costs.

- Borrower plans to repay the loan provided by CrowdFunz Fund 839, by using the loan proceeds from a commercial bank or by using other sources of fund.

- The project is handled by a seasoned Chinese developer that has over 30 years of real estate experience. Developer had successfully completed numerous projects including retail, large-scale residential and mixed-use properties that spread across Queens, New York.

- Developer had cooperated with CrowdFunz via CrowdFunz Fund 606 and other funds. It is known for highly efficient construction and project execution, property management, and successful exit strategies.

Investment Structure of CrowdFunz 839 Fund

CAPITAL STACK

| Capital Stack | Ratio | |

|---|---|---|

| Mortgage from Commercial Bank | $103,000,000 | 63.96% |

| CrowdFunz Fund 839 Equity Pledge Loan | $8,000,000 | 4.98% |

| Developer Equity | $50,050,000 | 31.06% |

| Total | $161,050,000 | 100.00% |

- Developer had contributed $50,050,000 of equity, which is accounted for 31.06% in the capital stack.

- The $8,000,000 loan provided by CrowdFunz Fund 839 is accounted for 4.98% in the capital stack.

- Based on the capital stack, the Loan-to-Cost of the project is 68.94%. Based on the property valuation of $220,900,000, the Loan-to-Value is 50.25%.

- Borrower had pledged 100% equity of the property, and its key person would provide unlimited personal guarantee.

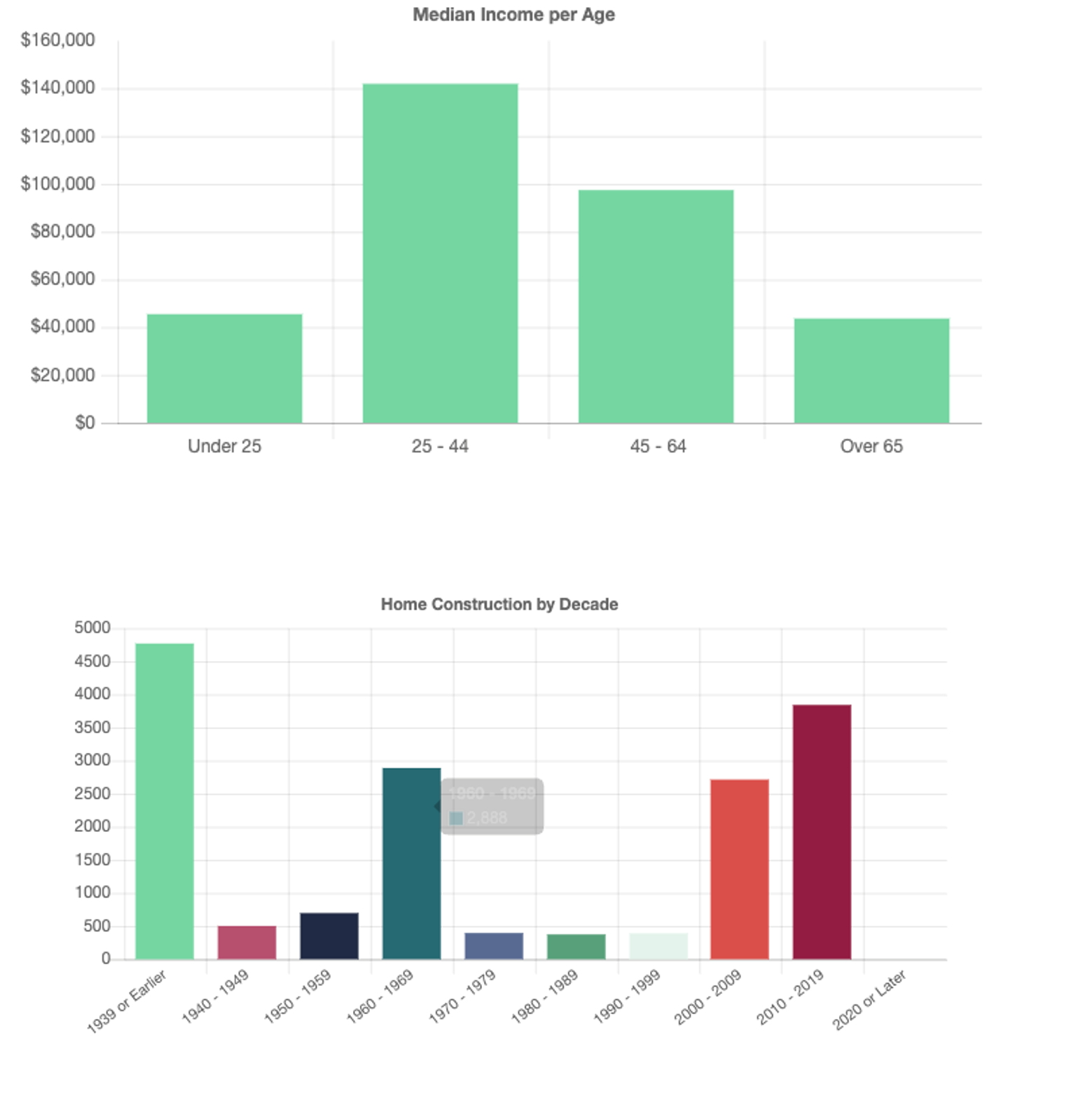

Demographics in the Zip code

| Zip Code 10018 | |

|---|---|

| Regional Population | 26,966 |

| Median Age | 35.8 |

| High School Education or above | 97.19% |

| Workplace | Metropolitan(99.8%) |

| Family Median Income | $170,154 |

| White Collar/Blue Collar | 95.24%/4.76% |

| Child-Bearing Family | 12.11% |

| Average Family Size | 2 |

| Rental | 73.52% |

Hudson Yards had seen fast development, and numerous large-scale projects have been completed in the past 10 years. As more companies move into the area, high-end restaurants and shopping centers were built to accommodate the luxurious lifestyle of wealthy individuals and young professionals.

Most residents in Hudson Yards are young and have high spending power. The ethnic backgrounds are also well-diversified.

The average age is 35.8; 12.11% of the families have children. Most residents choose to rent. There is big supply shortage of luxury condos and rental buildings.

* Data Source: Point2homes.com, in September 2023.

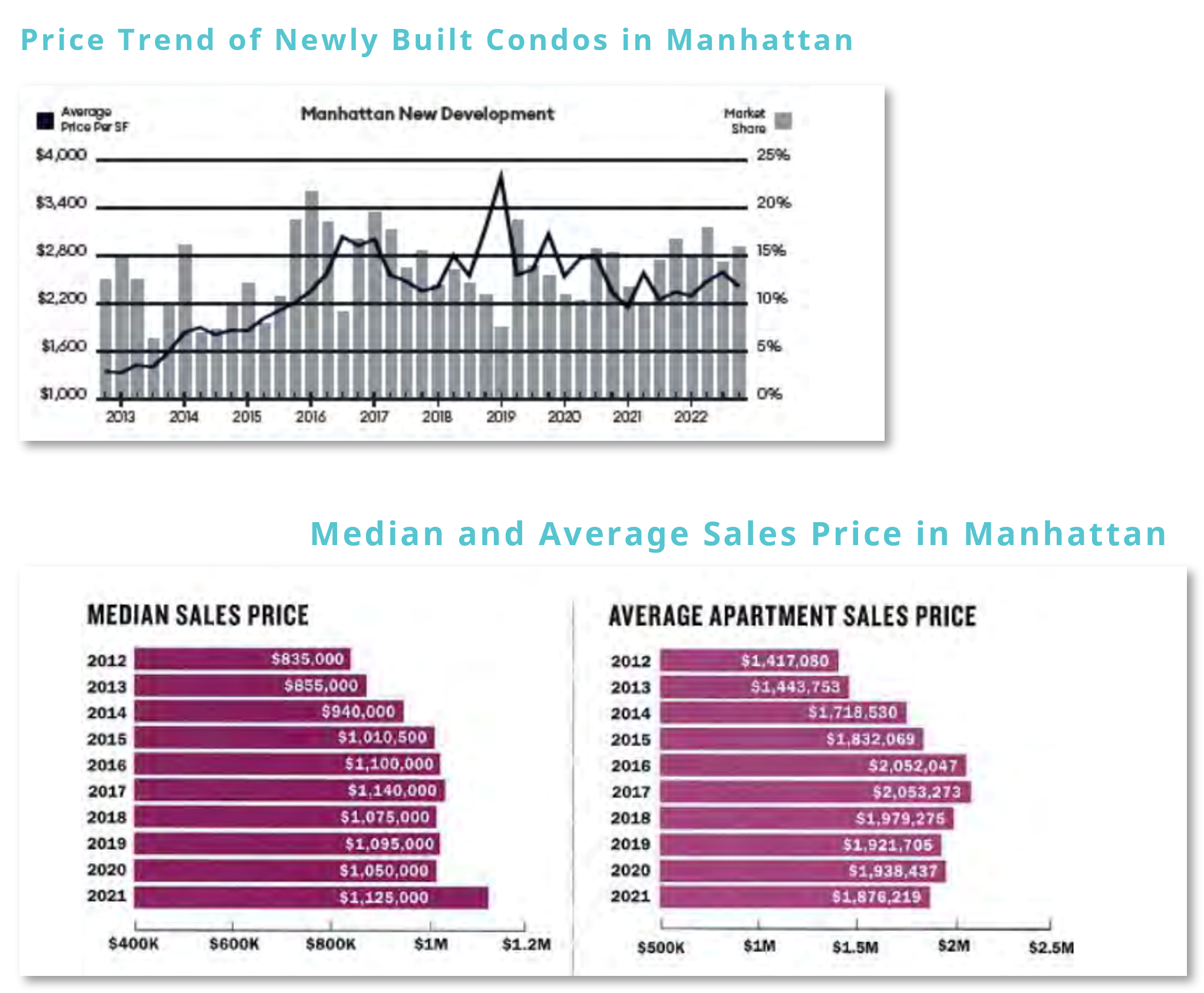

Current Market Overview

According to Appraisal Report provided by Archstone Group NYC, the average sale price of new Manhattan condos is significantly higher than pre-pandemic level, and the demand for small residential units has reached 11-year high.

According to the data provided by Douglas Elliman, as of the fourth quarter of 2022, the average sale price of new condos in Manhattan had reached $1,982/Sqft. Sales of newly built condos is accounted for 15.9% of the whole market.

According to the data in Appraisal Report provided by Archstone Group NYC, number of homes sold in Midtown West is accounted for 40%.

* Source: Appraisal Report provided by Archstone Group NYC.

Location

Project is on 9th Avenue in between 37th and 38th street. Penn Station and Time Square are within walking distance. Various transportation choices grant residents easy access to different areas of Manhattan, Queens, and Brooklyn.

Transportation

- Subway:7, A,C,E,1,2,3 (5-minute walking)

- To EWR Airport:25-minute Subway

- To JFK Airport:30-minute Drive

- To LGA Airport:40-minute Drive

Schools

Hudson Yards has Success Academy Charter School, one of the highest-performing and the largest charter schools in New York. It offers K-4 primary school and Grade 5-8 middle school education. The school is highly rated by parents.

Living Facilities

In addition to well-developed public transportation, the local business environment is vigorous. More wealthy individuals are moving into the safe and luxurious area.

Entertainment

The surrounding recreation facilities are improving to fit residents’ needs. Museums, gyms, and entertainment venues nearby are within walking distance.

Developer Company: TW HY 9 Holding LLC. / W 37 Venture LLC.

Prior Cooperation: CrowdFunz Fund 606 / CrowdFunz Fund 806 / CrowdFunz Fund 810 / CrowdFunz Fund 813 / CrowdFunz Fund 817 / CrowdFunz Fund 824 / CrowdFunz Fund 829

The development is led by a seasoned Chinese American development group. The company has over 30 years of experience in residential building development.

Developer had completed numerous properties, including retail, large-scale residential, and mixed-use buildings, in Queens and other emerging markets in New York City.

Developer had developed over 5 million Sqft of real estate in major cities in China and the United States.

In the past 20 years, Developer has been more sophisticated in property acquisition, development, management, and sales.

- The short-to-middle term Mezzanine loan provided by CrowdFunz Fund 839 will help Borrower fund the initial construction costs and working capital. Borrower plans to repay the loan with construction loan from a commercial bank or by using other sources of fund.

- Borrower’s established goodwill, the collateralized equity value that is 6 times the loan amount, and unlimited personal guarantee, support the borrowing.

- CrowdFunz believes that under the loan agreement with clear legal rights and obligations, the short-term debt invested by Fund 839 has controllable risks and a low probability of default, making the fund a feasible real estate investment opportunity for retail investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)