Equity Pledge Debt Fund 842

Type: Debt

Target: $3,000,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 6 – 24 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $3,000,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | December 2023 |

| Investment Timeline | 6 – 24 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units;8.75% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend;dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 3 extension options, and investors will receive dividends accordingly at the same dividend rate.

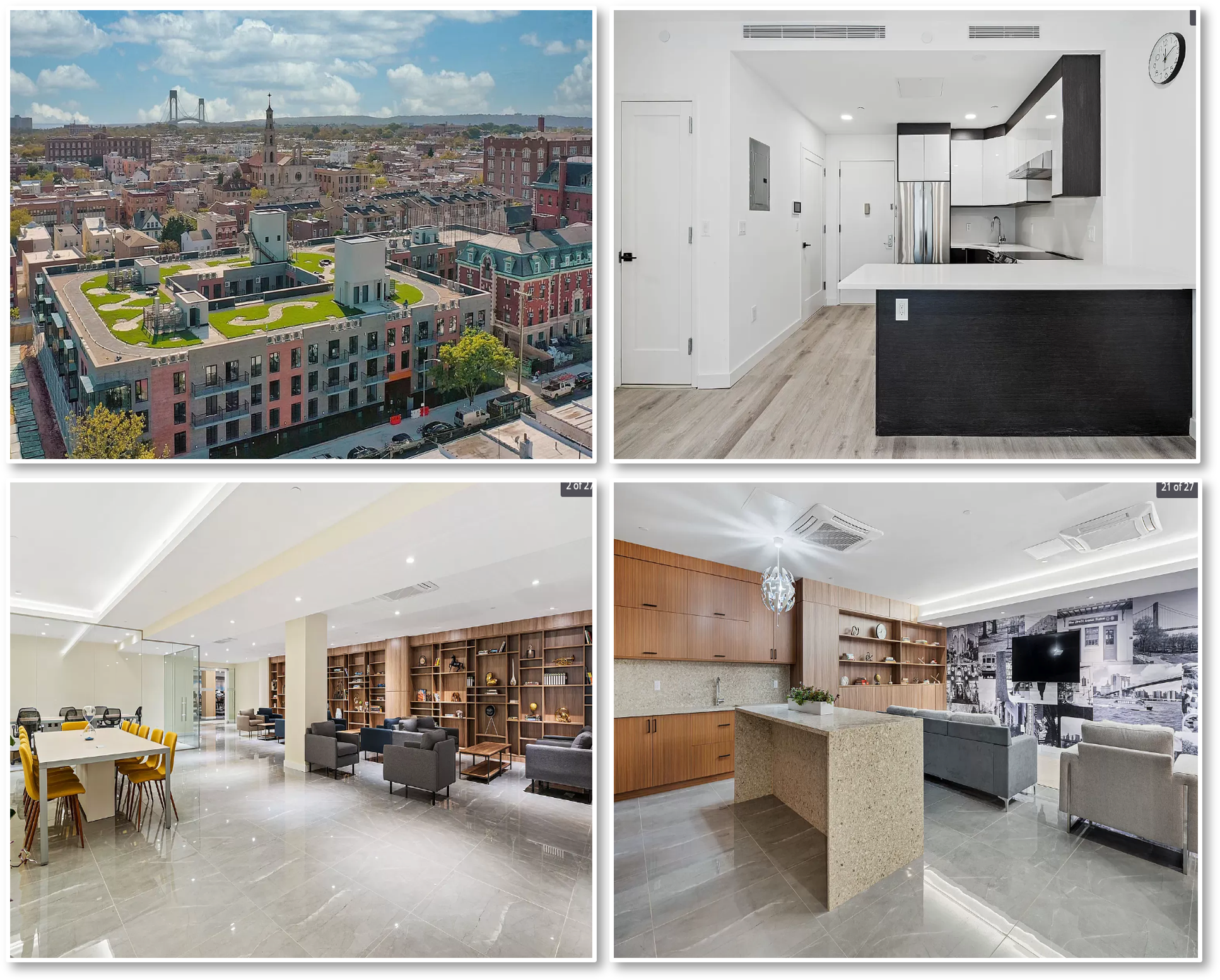

- The underlying property is in Dyker Heights, one of the traditional neighborhoods in Brooklyn. In the last 5 years, more residential properties were built to meet the ever-growing local demands. The area has convenient transportation network and is adjacent to 8th Avenue, the biggest Chinese community in Brooklyn.

- Property is a 3-floor mixed-use building that include 146 condo units, 9 community facility units, and 123 parking lots. The property was finished in 2022. Most condo units were sold as of now, and Developer is pledging the ownership of 23 condo units and 23 parking lots to the fund.

| Address | 1238 63rd St, Brooklyn, NY 11219 |

| Area | Dyker Heights, Brooklyn, New York |

| Lot Area | 66,136 Sqft |

| Intended Use | 146 Condo Units,9 Commercial Centers, and 123 Parking Lots |

| Pledged Units | 23 Condo Units and 23 Parking Lots |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 1/10/2024 | 12/27/2023 | 06/26/2024 | 183 days | Prepaid Dividend *2 | |

| Second | No Later than 7/11/2024 | 06/27/2024 | 12/26/2024 | 183 days | Extension Option Owned by Developer *3< | |

| Third | No Later than 1/10/2025 | 12/27/2024 | 06/26/2025 | 182 days | Extension Option Owned by Developer | |

| Fourth | No Later than 7/11/2025 | 06/27/2025 | 12/26/2025 | 183 days | Extension Option Owned by Developer | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive at least 182 days of dividends. After 6 months, dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

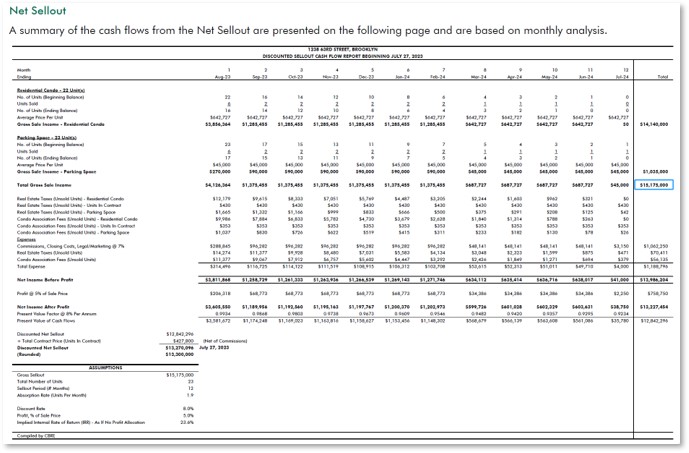

- According to the Appraisal Report provided by CBRE, the 23 condo units and 23 parking lots are valued at$15,175,000.

- The short-term loan provided by CrowdFunz Fund 842 is pledged by 100% ownership of the project entity, which is valued at $6,375,000. Developer’s Key person will also provide unlimited personal guarantee.

- Project is in Dyer Heights, Brooklyn, which is known for its famous Christmas Lights. The property is adjacent to 8th Avenue and between Chinese and Jewish communities. Area is safe and has convenient public transit system.

- As Downtown Brooklyn and Park Slope become more populated, more residential projects have started along side the southbound Subway lanes. Dyker Heights and other emerging areas are attracting more developers and residents.

- Developer plans to use the fund proceeds to repay the existing loan. The ownership of 23 condo units and 23 parking lots will be pledged to Fund 842.

- Developer expects to repay Fund 842 by refinancing with a commercial bank when the interest rate is lower in the next 2 years, or by using the sales proceeds of properties.

- Developer has over 20 years of experience in development, construction, and supply chain management, and had completed multiple projects in the emerging neighborhoods in Brooklyn. The company has established itself as a pre-eminent real estate development group in New York City.

- CrowdFunz Fund 842 marks the first cooperation between Developer and CrowdFunz. CrowdFunz aims to facilitate the process of this project and create value for the investors.

Capital Structure of CrowdFunz 842

Capital Stack

| Capital Stack | Ratio | |

|---|---|---|

| Loan from Commercial Bank | $5,800,000 | 38.22% |

| CrowdFunz Fund 842 Equity Pledge Loan | $3,000,000 | 19.77% |

| Developer Equity | $6,375,000 | 42.01% |

| Total | $15,175,000 | 100.00% |

- The collaterals of Fund 842 are 23 condo units and 23 parking lots in the underlying project. The construction of the project was completed, and the property had obtained Condo Book. The project therefore bears no construction risk.

- According to the Appraisal Report, the underlying property is valued at $15,175,000. After deducting the $5,800,000 remaining loan balance from Commercial Bank, and the $3,00,000 loan amount from CrowdFunz Fund 842, the equity value of the project is around $6,375,000.

- Borrower had pledged 100% ownership of the project entity to Fund 842, and developer’s key person will provide unlimited personal guarantee to the borrowing.

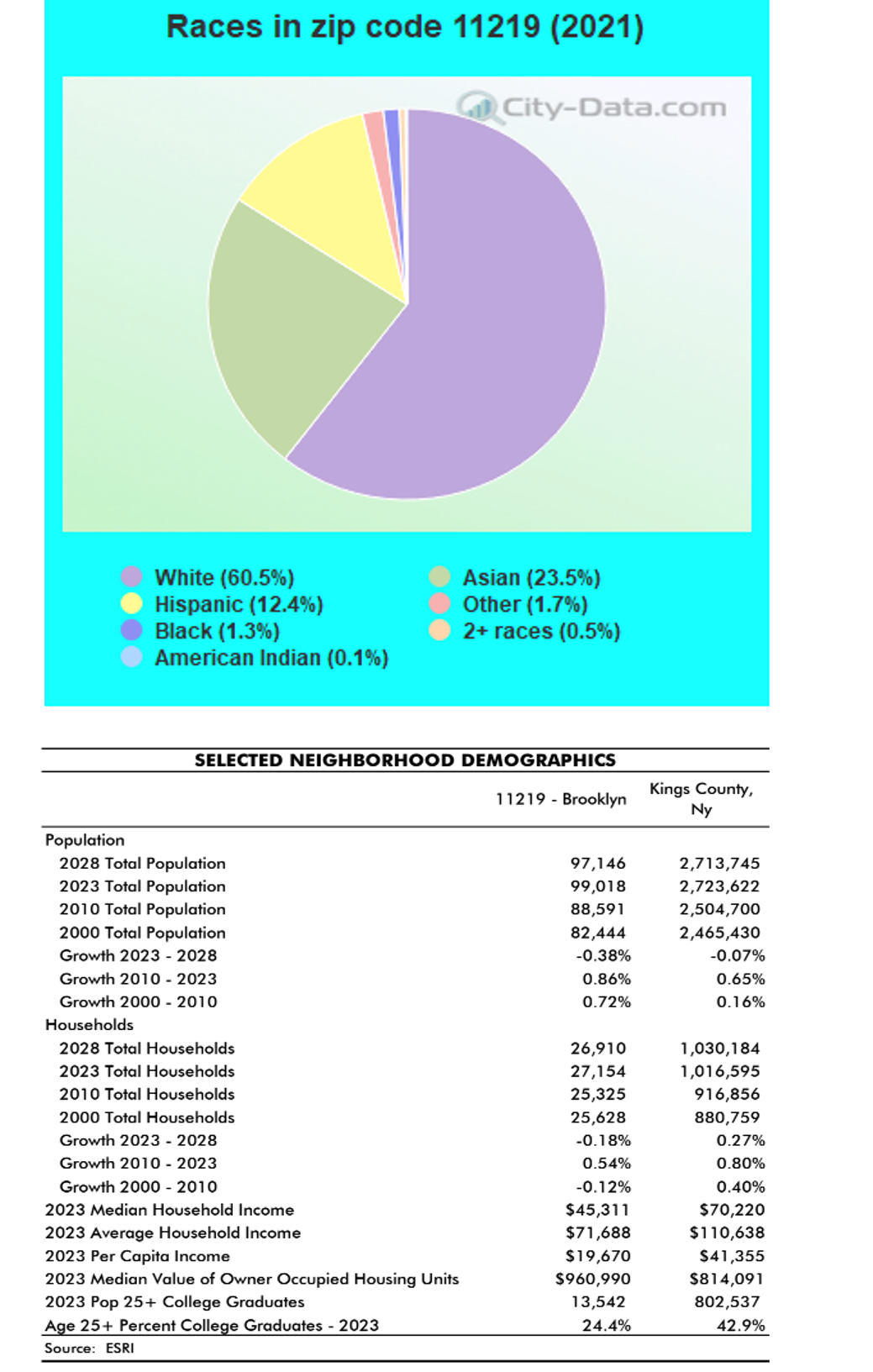

Demographics in the Zip Code

| Zip Code 11219 | |

|---|---|

| Regional Population | 99,018 |

| Total Families | 27,154 |

| High School Education or above | 68.9% |

| Race | Asian(23.5%)/Caucasian(60.5%)/Latino(12.4%) |

| Average Family Income | $71,688 |

| Child-bearing Family | 52% |

| Average Family Size | 3 |

Dyker Heights is a traditional white neighborhood. Many new residential buildings were finished in the past 5 years to meet the growing demands. Area has well-established public transit and is close to the 8th avenue, where the biggest Chinese community in Brooklyn is located.

Residents are diverse and most are Caucasian. Other races include Asian and Latino.

Residents have stable family income, and most are middle-class professionals that work in New York City.

In recent years, more Asians have migrated into the area and brought huge housing demands. Due to supply shortage, local housing prices has been steadily increasing.

* Source: CBRE Appraisal Report and citydata.com.

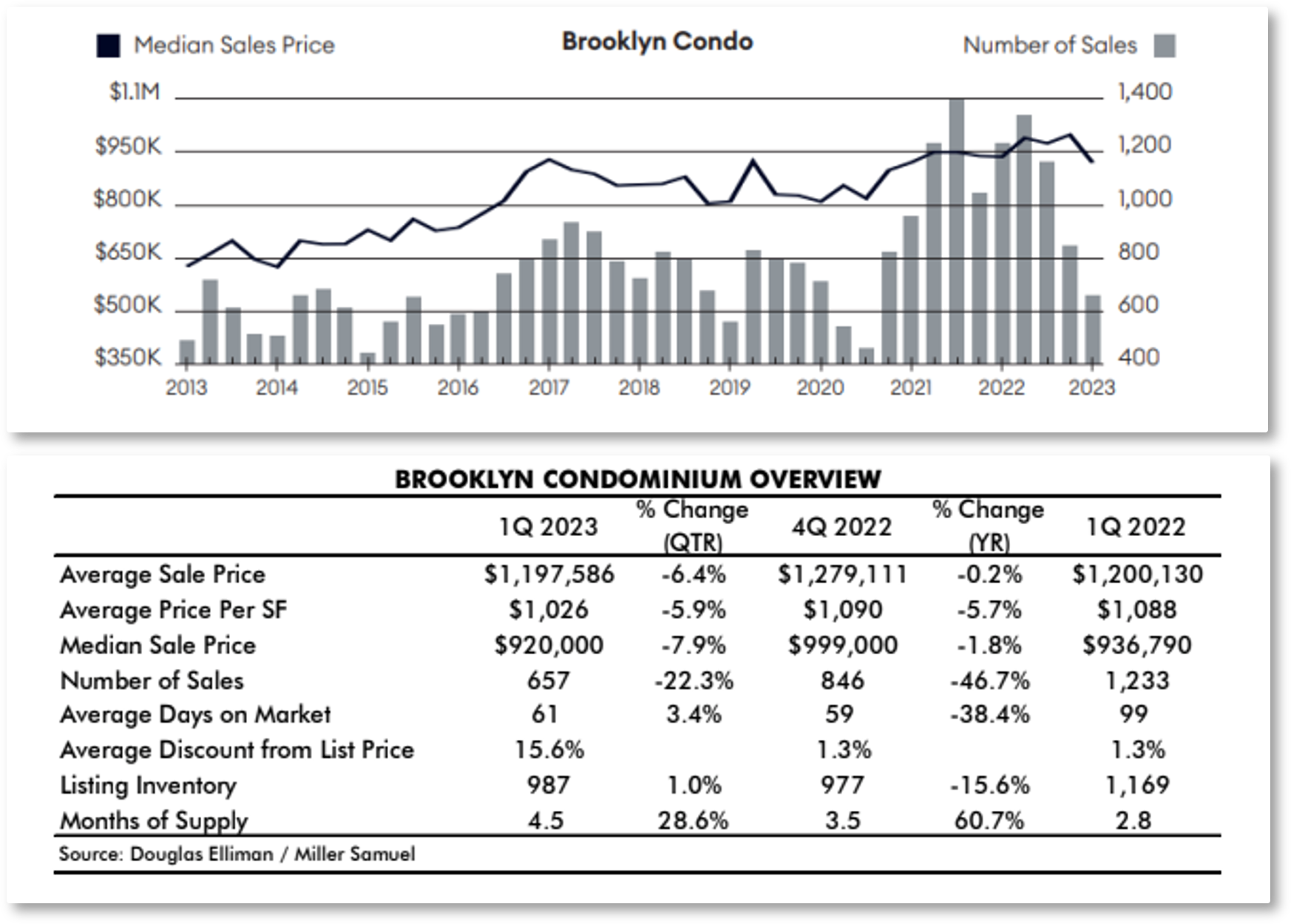

Residential Property Market in Brooklyn

According to the Appraisal Report provided by CBRE and data compiled by Douglas Elliman, in the first quarter of 2023, the number of home listings decreased, yet the average asking price increased at a steady pace in Brooklyn.

Despite a nearly doubled mortgage interest rate, the median housing price still increased to the third highest level. Median home price increased by 0.2% YoY to $950,000 and is 18.1% higher than pre-pandemic level.

Dyker Heights is a white-dominant area and is close to Chinese community near the 8th Avenue. Area attracted a lot of Asian residents for its safety and convenient transportation and living facilities.

* Source: Appraisal Report from CBRE.

Valuation – Sales/Income Approach

* Source: Appraisal Report from CBRE.

Location

The property is surrounded by well-developed public transportation. N,Q,W,D trains are all within 5-minute walking distance. It takes 20-minute subway to arrive in Lower Manhattan and 35-minute drive to arrive at JFK Airport.

Transportation

- Subway: N、Q、W、D(5-min walking distance)

- To Lower Manhattan:20-minute subway

- To JFK Airport: : 35-minute drive

- To LGA Airport:30-minute drive

Nearby Schools

In the core area of Dyker Heights, there is a wide selection of high-quality primary, middle, and high schools nearby to meet resident education needs.

Living Facilities

The community has well-established Asian businesses to meet various living needs, including Chinese and Korean supermarkets, restaurants, and shopping centers.

Recreations

Property is near museums, sports stadiums, and other entertainment venues. Well-known attractions include Brooklyn Museums, Sunset Park, Dyker Beach Park, New York Aquarium, and Barclays Center.

Developer Company: Leeboy Group.

Developer Website: https://www.leeboygroup.com/

Leeboy Group has over 20 years of experience in construction, development, and supply chain management, and had become a pre-eminent real estate development group.

The company started its business from Water throat construction materials and began to construct small-scale developments 20 years ago.

Today, the company has completed over 200,000 sqft of commercial and residential properties, including multiple successfully projects in Brooklyn and other emerging communities. The CEO Guan Yu Li had garnered great reputation among Chinese developers.

- CrowdFunz Fund 842 originates short-to-middle term loan for the borrower. CrowdFunz chose the ownership of 23 condo units and 23 parking lots as collateral to reduce associated investment risks. Developer expects to repay Fund 842 by refinancing with a commercial bank when the interest rate is lower in the next 2 years, or by using the sales proceeds of properties.

- The loan originated by CrowdFunz Fund 842 has a low LTV that is below 58%, and the underlying property bears no construction risks.

- CrowdFunz believes that under the loan agreement with clear legal rights and obligations, the short-term debt invested by Fund 842 has controllable risks and a low probability of default, making the fund a feasible real estate investment opportunity for retail investors.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)