Equity Pledge Debt Fund 847

Type: Debt

Target: $1,600,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 6 – 24 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,500,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | May 2024 |

| Investment Timeline | 6 – 24 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units;8.75% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan;

*3 After the second dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

- The project’s target property is in Bensonhurst, Brooklyn, New York, near the main traffic artery I287. Bensonhurst is a high-quality community with Italian, Jewish, and Chinese residents. Recently, new housing developments have driven by growing demands. The area has convenient public transportation and is close to Brooklyn’s largest Chinese community on 8th Avenue, attracting many Asian residents.

- The property is a 4-story mixed-use building, comprising 13 condominiums, a community facility, and 11 parking lots. Completed and on sale since 2023, the project has seven units under contract, with closing expected in June.

| Address | 1548-1554 72nd Street, Brooklyn, NY 11228 |

| Area | Bensonhurst, Brooklyn, New York |

| Lot Area | 8,000 Square Feet |

| Intended Use | 13 Condominium Units, 1 Community Center, and 11 Parking lots |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 6/11/2024 | 05/28/2024 | 11/27/2024 | 184 days | Prepaid Dividend *2 | |

| Second | No Later than 12/12/2024 | 11/28/2024 | 05/27/2025 | 181 days | Prepaid Dividend | |

| Third | No Later than 06/11/2025 | 05/28/2025 | 11/27/2025 | 184 days | Extension Option Owned by Developer | |

| Fourth | No Later than 12/12/2025 | 11/28/2025 | 05/27/2026 | 181 days | Extension Option Owned by Developer | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the second dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

- Marshall & Stevens valued the project, including 13 condominiums, a community center, and 11 parking lots, at $10,200,000 market value.

- CrowdFunz Fund 847 used 100% ownership equity of the project as collateral to originate a $3,770,884 short-term loan; the key individual of the project will provide an unlimited personal guarantee for the borrowing.

- The property is in Bensonhurst, Brooklyn, between the large Chinese community on 8th Avenue and a traditional Jewish community. It has good security and convenient transportation, just a 3-minute walking distance to the Metro line D.

- As Brooklyn's most densely populated area, with the growth of Downtown Brooklyn and Park Slope, new developments are extending south along Metro lines. Bensonhurst and nearby areas are steadily developing, with new housing projects meeting local demand.

- The developer plans to use the loan provided by CrowdFunz Fund 847 entirely for the acquisition of a new land development. CrowdFunz has chosen a completed project as collateral to control investment risk. After completing the acquisition, the developer plans to repay the short-term loan from the 847 Fund with either low-interest long-term loans from commercial banks when rates drop or proceeds from property sales.

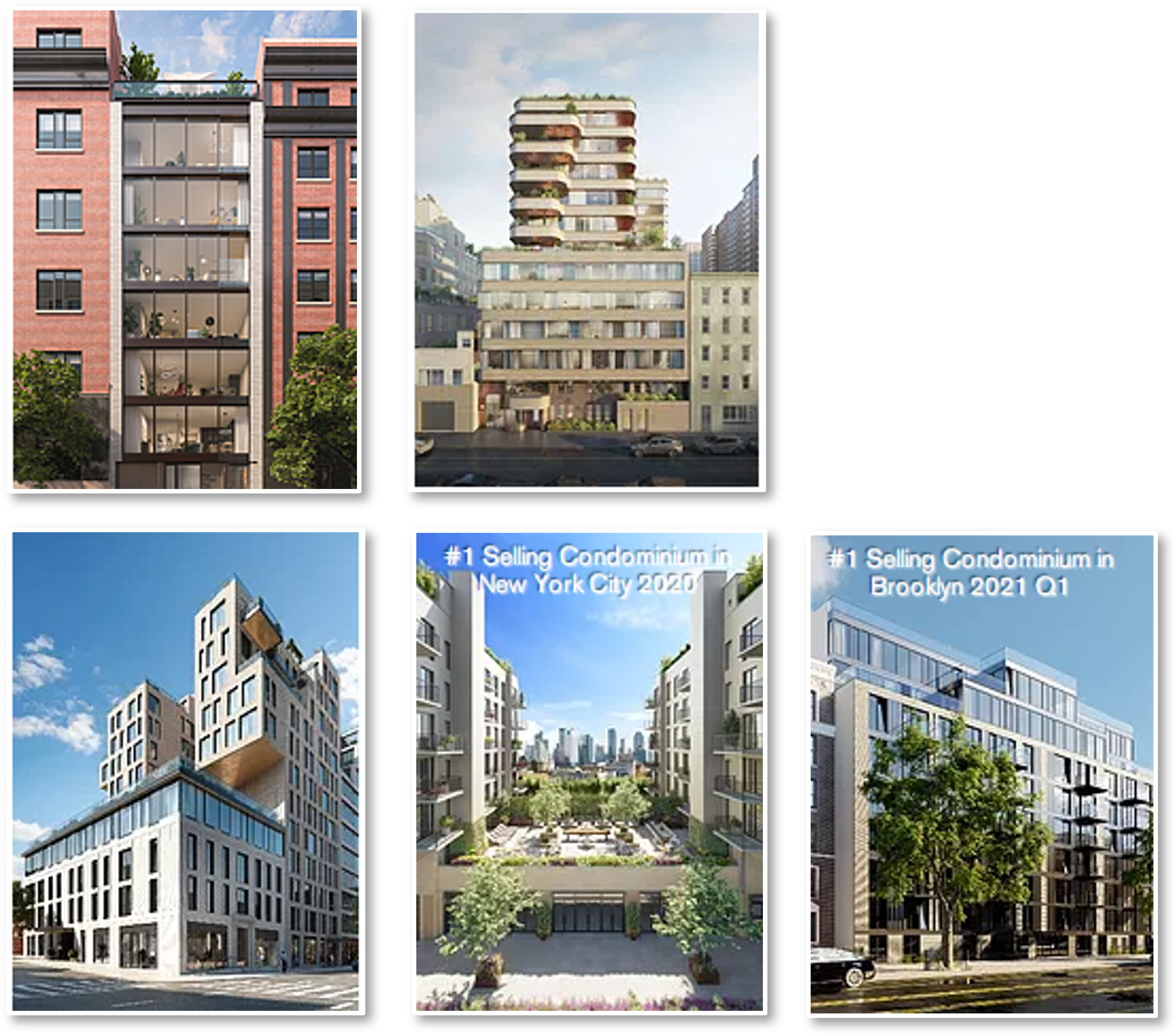

- Developer, with over 30 years in the NYC real estate market, is highly reputable and has completed successful projects across the five boroughs, focusing on large-scale commercial-residential developments.

- The developer is good at cash flow management, controlling construction progress and costs effectively, and has established reputation in the local Chinese real estate community. Developer has partnered with CrowdFunz many times, successfully repaying previous funds (Fund 604, 805, 826, and 819), and proving strong development capabilities and good reputation.

Capital Structure of CrowdFunz 847

Capital Stack

| Capital Stack | Percentage | |||

|---|---|---|---|---|

| Commercial Bank Loan | Mortgage Balance | $4,209,116 | 48.32% | |

| Credit Facility | $720,000 | |||

| CrowdFunz Fund 847 | $1,500,000 | 14.70% | ||

| Developer Equity | $3,770,884 | 36.97% | ||

| Total | $10,200,000 | 100.00% | ||

- CrowdFunz Fund 847 project involves a successfully developed and owned mixed-use building with 13 condominiums, a community center, and 11 parking lots. The construction is completed, and seven condominiums are under contract. The fund's investment does not involve construction risks and meets CrowdFunz risk management standards.

- According to a third-party appraisal report, the property's current market value is approximately $10,200,000. The property has a $4,209,116 mortgage loan and a $720,000 credit facility secured by the community center, totaling $4,929,116. CrowdFunz Fund 847 offers $1,500,000 loan. Excluding the loans, the developer's equity is approximately valued at $3,770,884.

- Additionally, the key individual of the project will provide a personal guarantee, committing to timely pay the principal and interests to Fund 847. If repayment issues arise, CrowdFunz Fund 847 will pursue personal assets through legal procedures to repay investors.

Demographics in Zip Code Area

| Bensonhurst | |

|---|---|

| Population | 206,519 |

| Median Age | 40 |

| Born in | New York (39.9%) / Out of the U.S. (55.1%) |

| Race | White(36.6%) / Asian(38%) / Latino(19.8%) / African American(1.4%) |

| Median Family Income | $59,390 |

| Child-bearing(Under 18) | 33.9% |

| Unemployment Rate | 11.74% |

Bensonhurst, Brooklyn, is a traditional white community with increasing new housing to meet growing demands. It has convenient public transportation and is near Brooklyn's largest Chinese community on 8th Avenue, attracting many Chinese homebuyers.

The area is ethnically diverse, primarily white, but also including Hispanic, Asian, and other residents.

Residents are mostly middle-aged families with stable incomes, with an average age of 40, and 33.9% have children under 18.

Recently, many new Asian residents have moved in, boosting the rental market. Due to low housing inventory and rising buyer demand, property prices are increasing.

* Source: NYU Furman Center, and U.S. Census Bureau in May 2024

Residential Property Market in Bensonhurst

According to the third-party valuation by Marshall & Stevens, Bensonhurst's population change since 2020 is only -0.2%, indicating a very stable market.

Despite mortgage rates nearly doubling in 2023, the median home price reached the third-highest point in history. The median price in Brooklyn remains at $950,000, up 18.1% from pre-pandemic levels.

Bensonhurst, a well-established white community near the largest Chinese community on 8th Avenue, offers good security and convenient commuting. The community has attracted more young Chinese residents.

* Source: Appraisal Report provided by Marshall & Stevens

Valuation Analysis

* Source: Appraisal Report provided by Marshall & Stevens

Location

The property has convenient and accessible transportation. It's a 3-minute walking distance to the Metro line D, 25 minutes by taking Metro to downtown Manhattan, 45 minutes by driving to LaGuardia Airport, and 35 minutes to JFK International Airport.

Transportation

- Subway: Line D (2-min walking)

- To Downtown Manhattan:25-min driving

- To JFK: 35-min driving

- To LGA:45-min driving

Schools

The project is in Bensonhurst, with several elementary, middle, and high schools nearby. It also has many language learning centers and early education institutions, ensuring comprehensive educational opportunities for children.

Living Facility

The community is near a Chinese business district with convenient amenities, including Chinese and Korean supermarkets, various restaurants, and a large shopping center for daily needs.

Entertainment

The project is near many museums, sports venues, and entertainment spots. Highlights include the Brooklyn Museum, Sunset Park, Dyker Beach Park, New York Aquarium, and Barclays Center, home of the Brooklyn Nets.

Developer Company: New Empire Corp.

Developer Website: https://www.newempirecorp.com/

Prior Cooperation: CrowdFunz Fund 604 / CrowdFunz Fund 805 / CrowdFunz Fund 819 / CrowdFunz Fund 826 / CrowdFunz Fund 828 / CrowdFunz Fund 832

- CrowdFunz Fund 847 provides short-to-midterm loans to a completed residential project, a community center, and 11 parking lots as collateral. The developer plans to repay the loan with long-term commercial bank loans or property sales when interest rates drop.

- The developer has development experience, good credit, and a solid reputation. The project's capital structure is reasonable, with a low loan-to-value ratio of 63.03%, and no additional construction or development risks.

- The property is in the prime Bensonhurst area of Brooklyn, an established community. The building, completed in 2024, has strong sales, with over half of the condos about to close. CrowdFunz believes the debt investment has a low default risk, suitable for investors seeking fixed-income products.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)