Equity Pledge Debt Fund 848

Type: Debt

Target: $3,000,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 12 – 24 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $3,000,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | May 2024 |

| Investment Timeline | 12 – 24 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

- The property is in Flushing, Queens. It is adjacent to College Point Boulevard and the I-678 highway. It is very close to LGA and Citi Field, making it a preferred hotel location for many travelers and airline crew members coming to New York.

- The five-story hotel building has 88 hotel rooms, a convention center, and parking area. The hotel has been steadily operated by the world-renowned Marriott for many years, with annual operating income growing steadily. The hotel's current average nightly rate is among the highest for similar hotels in the area.

| Address | 28-66 College Point Blvd, Queens, NY 11354 |

| Area | Flushing, Queens, New York |

| Lot Area | 23,600 Sqft |

| Building Area | 29,175 Sqft |

| Intended Use | 88 Hotel Rooms, Conference Center, and Parking Area |

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Phase | Amount | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | First | $1,500,000 | No Later Than 6/20/2024 | 6/6/2024 | 12/5/2024 | 183 Days | Prepaid Dividend*2 |

| Second | $1,500,000 | No Later Than 7/4/2024 | 6/20/2024 | 12/5/2024 | 169 Days | Prepaid Dividend | |

| Second | - | - | No Later Than 12/20/2024 | 12/6/2024 | 6/5/2025 | 182 Days | Prepaid Dividend |

| Third | - | - | No Later Than 6/20/2025 | 6/6/2025 | 12/5/2025 | 183 Days | Extension Option Owned by Developer *3 |

| Fourth | - | - | No Later Than 12/20/2025 | 12/6/2025 | 6/5/2026 | 182 Days | Extension Option Owned by Developer *3 |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

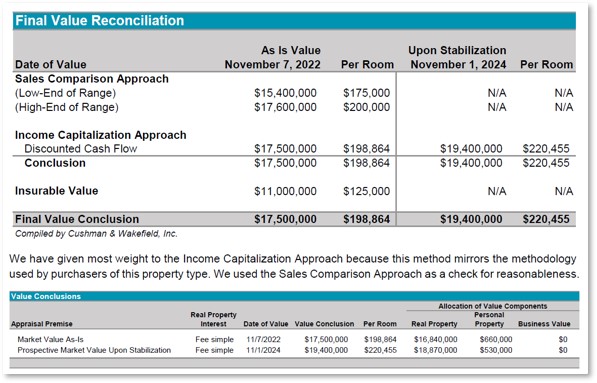

- According to the Appraisal Report provided by Cushman & Wakefield, the market value of this project is approximately $19,400,000. The loan issued by CrowdFunz 848 is secured by 100% of the equity in the project company, which is valued at approximately $7,150,000. Additionally, the borrower has provided an Unlimited Personal Guarantee. The borrower's current personal net worth is approximately 80 times the loan.

- The property is in the core area of College Point in Flushing, with a bus stop right downstairs and just a 5-minute driving distance to LGA and the Main Street subway station.

- In the last 12 months, the hotel average occupancy rate is approximately 85.3%. With the post-pandemic recovery of New York City tourism industry and the hotel's recent renovations with new facilities and environment, the future occupancy rate and profitability of the hotel might be further improved.

- The borrower plans to use the loan provided by CrowdFunz Fund 848 on a new land acquisition. CrowdFunz has selected an existing property with sufficient cash flow as collateral to reduce investment risk.

- The borrower plans to refinance from a commercial bank or using cash flow from other projects to repay the loan provided by CrowdFunz Fund 848.

- The seasoned Chinese developer has over 20 years of development experience. They have completed and successfully exited numerous projects throughout Queens, including hotels, retail complexes, large residential buildings, and large mixed-use real estate developments.

- The developer have successfully cooperated with CrowdFunz in Fund 806 (repaid), 808 Fund (repaid), and 816 Fund (repaid), demonstrating excellent borrowing credibility to CrowdFunz and its investors.

Capital Structure of CrowdFunz 848

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| Mortgage Balance | $9,250,000 | 47.60% | |

| CrowdFunz Fund 848 Equity Pledge Loan | $3,000,000 | 15.50% | |

| Developer Equity | $7,150,000 | 36.90% | |

| Total | $19,400,000 | 100.00% | |

- The underlying project is the Fairfield Inn by Marriott NY LGA Airport/Flushing, a hotel owned and operated by the borrower under the Marriott brand. The hotel has an average annual occupancy rate of 85.3%, with stable income.

- According to the appraisal report, the market value of the property is $19,400,000. The current mortgage balance is $9,250,000, and the loan provided by CrowdFunz Fund 848 is $3,000,000. After deducting the loans, the equity value is $7,150,000, which is more than twice the loan amount of the Fund 848.

- Additionally, the borrower has signed a Personal Guarantee, If there are repayment issues, CrowdFunz Fund 848 can pursue legal procedures to claim the borrower's personal assets for repayment to the investors.

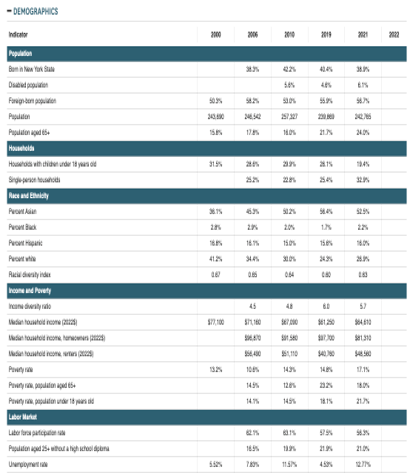

DEMOGRAPHICS IN THE ZIP CODE

| Flushing/Whitestone | |

|---|---|

| Population | 242,765 |

| Median Age | 44 |

| Born in | New York(38.90%)/ Out of the U.S.(56.70%) |

| Race | Asian(32.50%)/White(26.90%)/Latino(16.00%)/African American(2.20%) |

| Median Family Income | $64,610 |

| Child-bearing (Under 18) | 19.4% |

| Unemployment Rate | 12.77% |

Flushing is one of the fastest-developing areas in New York City over the past 20 years. Its convenient transportation and proximity to LGA have attracted many Asian immigrants to settle here.

The area has a distinctly diverse population, with Asian residents being the majority. However, it also includes residents from other ethnic groups, including Hispanics and Caucasians.

The local population primarily consists of middle-aged families with stable incomes, with an average age of about 44 years. Most residents are hardworking new immigrants. Households with children under 18 account for 19.4%, and the housing market mainly features independent property ownership apartments.

Over the past decade, Flushing has undergone significant changes, with a large influx of new Asian residents, driving a hot rental market. Due to the low inventory of homes for sale and strong demand from potential buyers, property prices in the area have been continuously rising.

* Source: NYU Furman Center, and U.S. Census Bureau in May 2024.

Residential Property Market in Flushing

According to data from the American Community Survey conducted by the National Bureau of Statistics, as of the end of 2021, the homeownership rate in the Flushing/Whitestone area is 52.20%, with the housing market predominantly consisting of independently owned apartments. There are 98,610 registered housing units in the area.

From 2006 to 2021, the median rent in the area increased from $1,630 to $1,770 per month, a rise of 8.6%. The rental vacancy rate is only 3.60%, better than the average for Queens.

Between 2010 and 2020, a total of 3,165 new housing units with four or more families were built in the Flushing area, of which 84% were market-rate units.

According to the appraisal report provided by Cushman & Wakefield, the residential, retail, warehouse, and commercial real estate sectors in the area show steady upward trends. The hotel industry has an average occupancy rate of 80%, outperforming the average levels of other areas in New York City in the post-pandemic era.

*Source: NYU Furman Center, in May 2024.

Profitability Analysis

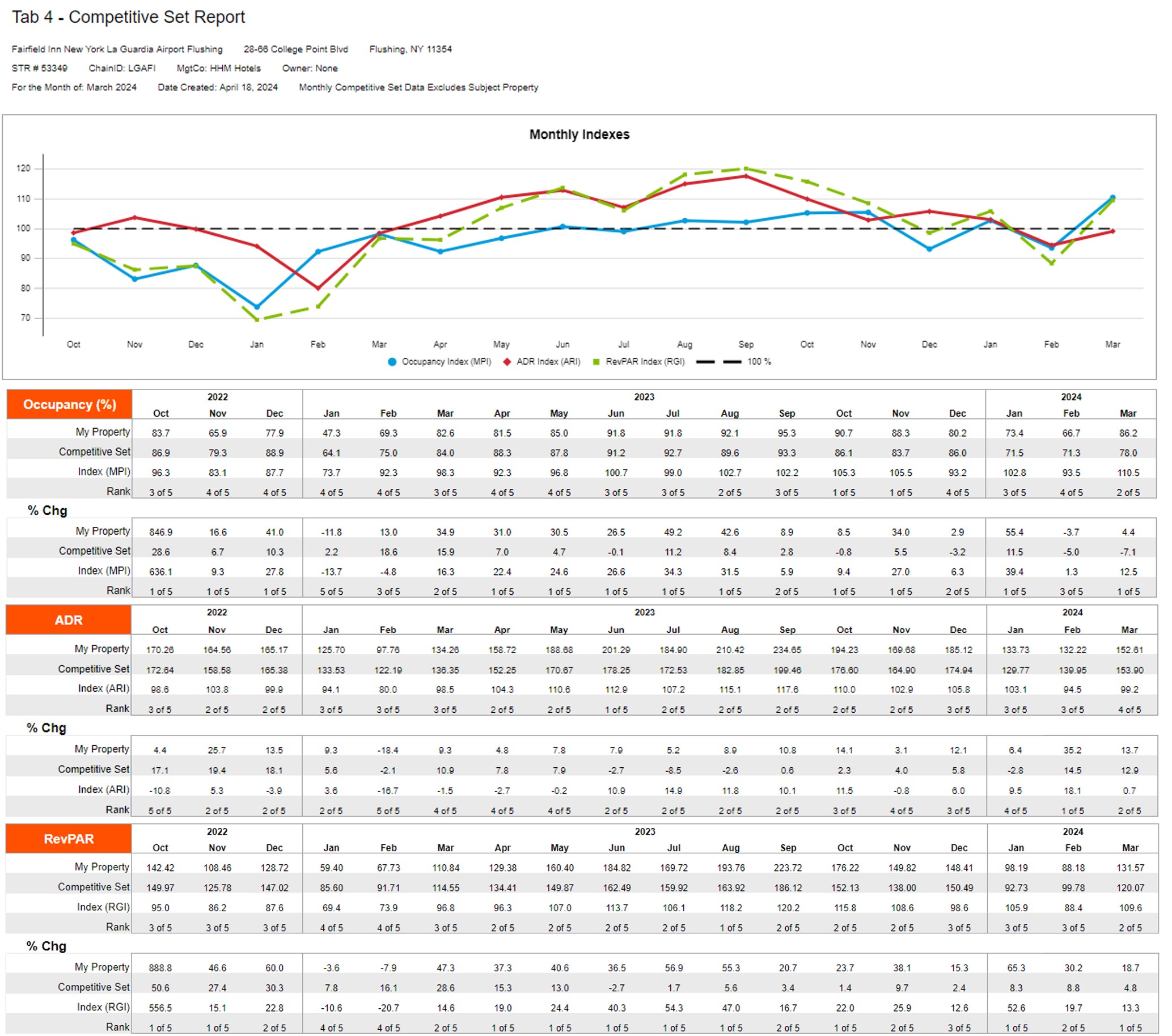

Currently, there is a significant increase in the demand for mid- to high-end chain hotel accommodations in the LGA and Flushing areas. As of April 2024, the growth rate over the past 12 months is approximately 6.2%. In contrast, the supply of rooms in these hotels has a growth rate of only 0.7% over the same period. This supply-demand gap benefits the target project.

With the recovery of New York City's local tourism industry, hotel occupancy rates are gradually returning to previous levels. As of April 2024, the city-wide hotel occupancy rate is 82.4%. The target project has achieved an occupancy rate of 85.3% over the past 12 months.

As of April 2024, the revenue growth rate of mid- to high-end chain hotels in the LGA and Flushing areas is 17.9% over the past 12 months, indicating a strong recovery in profitability. The target project's revenue growth rate is even higher at 34.3%, outperforming the market segment.

*Source: Data provided by borrower and compiled by STR, Inc.

Profitability Analysis

Currently, there is a significant increase in the demand for mid- to high-end chain hotel accommodations in the LGA and Flushing areas. As of April 2024, the growth rate over the past 12 months is approximately 6.2%. In contrast, the supply of rooms in these hotels has a growth rate of only 0.7% over the same period. This supply-demand gap benefits the target project.

With the recovery of New York City's local tourism industry, hotel occupancy rates are gradually returning to previous levels. As of April 2024, the city-wide hotel occupancy rate is 82.4%. The target project has achieved an occupancy rate of 85.3% over the past 12 months.

As of April 2024, the revenue growth rate of mid- to high-end chain hotels in the LGA and Flushing areas is 17.9% over the past 12 months, indicating a strong recovery in profitability. The target project's revenue growth rate is even higher at 34.3%, outperforming the market segment.

*Source: Data provided by borrower and compiled by STR, Inc.

Income Analysis

* Source: Appraisal Report provided by Cushman & Wakefield.

Location

The project site has a 5-minute bus ride to the Metro Line 7 subway station, reaching Midtown Manhattan in 20 minutes, and 5-minute driving to LaGuardia Airport. Additionally, it has 1-minute walking distance to several major bus route stops.

Transportation

- Subway:7 Train

- To Midtown: 20-min train

- To JFK Airport:18-min driving

- To LGA Airport:5-min driving

Schools

There are several elementary, middle, and high schools within the area to meet the educational needs of children. Additionally, there are numerous language learning centers and early education institutions to ensure the well-rounded development of children.

Living Facilities

The area includes various Chinese and Korean supermarkets, a wide range of Chinese and fast-food restaurants, and a large shopping center nearby, meeting daily dining and shopping needs for residents.

Recreations

The project is close to a variety of museums, sports venues, and entertainment facilities. The New York Hall of Science, New York Badminton Center, National Tennis Center, Queens Museum, Queens Zoo, and Citi Field are all within proximity.

Developer Company: United Construction & Development Group.

Developer Website: https://unitedgroupny.com/

Prior Cooperation: CrowdFunz Fund 806 / CrowdFunz Fund 808 / CrowdFunz Fund 816 / CrowdFunz Fund 835

- CrowdFunz selects hotel properties with stable cash flows and long-term holdings by the borrower as the underlying project, reducing the investment risk. The borrower plans to refinance at a lower interest rate or use cash flow from other projects to repay the loan.

- The borrower has ample experience and good credit, with a good reputation in the industry. Additionally, the project's capital structure is reasonable. The loan-to-value ratio (LTV) for the project is relatively low, at only 63.14%, and the property does not have additional construction or development risks.

- The hotel currently has an average annual occupancy rate of approximately 85.3%, with stable and rising cash flows and significant profitability.

- CrowdFunz believes that the medium- to short-term debt investment of the 848 Fund carries a low default risk, making it suitable for investors seeking fixed-income products.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)