Equity Pledge Debt Fund 849

Type: Debt

Target: $5,000,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 12 – 30 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $5,000,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | July 2024 |

| Investment Timeline | 12 – 30 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 3 extension options, and investors will receive dividends accordingly at the same dividend rate; if the third extension option is executed, investors will receive extra 0.25% dividend rate.

- The project is in Prospect Heights, Brooklyn, New York City. It is adjacent to the downtown Brooklyn and Brooklyn Heights areas. Prospect Heights is a rapidly developing community with beautiful surroundings. In recent years, many new residential properties have emerged in the area to meet the growing housing demands.

- Construction began in late 2023, with the demolition of existing structures already completed and foundation work nearly finished. The project has successfully obtained a sales license from the New York State Department of Real Estate Finance. Completion is expected in 2026.

| Address | 757 Flatbush Ave, Brooklyn, NY 11228 |

| Area | Prospect Heights, Brooklyn, New York |

| Lot Area | 40,000 Sqft |

| Intended Use | 132 Condominium Units, 3,366 Sqft Retail Space, 76 Parking Spots |

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Phase | Amount | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes |

| First | First | $1,500,000 | No Later Than 8/2/2024 | 7/22/2024 | 1/21/2025 | 184 Days | Prepaid Dividend*2 |

| Second | $1,500,000 | No Later Than 9/2/2024 | 8/22/2024 | 1/21/2025 | 153 Days | Prepaid Dividend | |

| Third | $1,500,000 | No Later Than 10/2/2024 | 9/22/2024 | 1/21/2025 | 122 Days | Prepaid Dividend | |

| Second | - | - | No Later Than 2/2/2025 | 1/22/2025 | 7/21/2025 | 181 Days | Prepaid Dividend |

| Third | - | - | No Later Than 8/2/2025 | 7/22/2025 | 1/21/2026 | 184 Days | Extension Option Owned by Developer *3 |

| Fourth | - | - | No Later Than 12/20/2025 | 1/22/2026 | 7/21/2026 | 181 Days | Extension Option Owned by Developer *3 |

| Fifth | - | - | No Later Than 8/2/2026 | 7/22/2026 | 1/21/2027 | 184 Days | Extension Option Owned by Developer *3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 3 extension options, and investors will receive dividends accordingly at the same dividend rate;

if the third extension option is executed, investors will receive extra 0.25% dividend rate

- According to the appraisal provided by Marshall & Stevens, as of July 2024, the current market value of the property is approximately $26,310,000. Upon completion of the development, the property value is expected to be around $107,380,000.

- The short-term loan issued by CrowdFunz Fund 849 will use 100% equity of the project entity as collateral. The current equity is valued at $11,310,000. Additionally, the key individual will provide an unlimited personal guarantee for this loan.

- The project property is in Prospect Heights, Brooklyn, New York City, near Downtown Brooklyn and Lower Manhattan. It has convenient transportation, being a 2-minute walking distance from the Q subway line station.

- As Brooklyn is the most densely populated borough of New York City, the development momentum of Downtown Brooklyn and Park Slope is strong. New real estate development projects are gradually extending south along the subway lines. Areas like Prospect Heights and surrounding communities are developing rapidly, with new residential projects emerging to meet the market demand of local homebuyers.

- The borrower plans to use the loan entirely for the initial construction costs including excavation and other construction expenses, as well as part of the soft costs.

- The borrower expects to repay the short-term loan from the CrowdFunz Fund 849 by using funds from construction loans that will be gradually disbursed during the mid-to-late stages of the project, or from the cash flows of other projects.

- The family-owned development company has been deeply involved in the New York real estate market for over 30 years. They have high industry recognition and reputation in the local market. Their successful projects are spread across all five boroughs of New York City, focusing on large-scale mixed-use real estate developments worth tens of millions of dollars.

- The developer demonstrates excellent cash flow management, strict control over construction progress, and outstanding cost management, making them prominent among local Chinese real estate developers. Previous cooperations with CrowdFunz include fund 604, 805, 826, and 819.

Capital Structure of CrowdFunz 849

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| Land Loan | $10,000,000 | 38.01% | |

| CrowdFunz Fund 849 Equity Pledge Loan | $5,000,000 | 19.00% | |

| Developer Equity | $11,310,000 | 42.99% | |

| Total | $26,310,000 | 100.00% | |

- According to the appraisal provided by Marshall & Stevens, the current market value of the property is approximately $26,310,000.

- In the current capital structure of the project, the total amount of land loan provided by a commercial bank is $10,000,000, and the total amount of the loan issued by CrowdFunz Fund 849 is $5,000,000. The developer's current equity is approximately valued at $11,310,000.

- The key individual of the borrower will sign a personal guarantee, committing to timely payment of principal and interest to the fund. If there are repayment issues, the CrowdFunz Fund 849 will pursue legal action to claim the individual's personal assets to repay the investors.

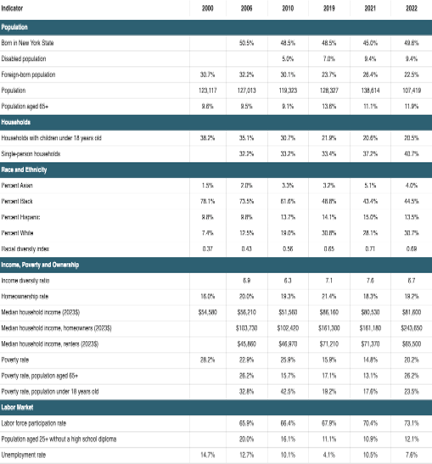

Demographics in Zip Code Area

| Crown Heights/Prospect Hieghts | |

|---|---|

| Population | 206,519 |

| Median Age | 35 |

| Born in | New York(49.60%)/ Out of the U.S.(22.50%) |

| Race | Asian(4.0%)/Caucasian(30.70%)/Latino(13.50%)/African American(44.50%) |

| Median Family Income | $81,600 |

| Child-bearing (Under 18) | 20.5% |

| Unemployment Rate | 7.6% |

Prospect Heights in Brooklyn is named after the landmark Prospect Park. Established in 1867 and covering an area of 236 hectares, the park was designed by the same architects as Central Park in New York City.

The area has convenient public transportation systems and facilities due to its proximity to Downtown Brooklyn and Lower Manhattan. Over the past five years, there has been a surge in new residential development projects to meet the growing housing demand.

The residents are primarily middle-aged families with stable incomes, with an average age of about 35 years. Most are hardworking local middle-class individuals, and 20.5% of families have children under 18 years old.

In recent years, a significant number of white-collar workers from Manhattan have started moving into the area, driving up rental and housing prices steadily.

* Source: NYU Furman Center and U.S. Census Bureau, in July 2024.

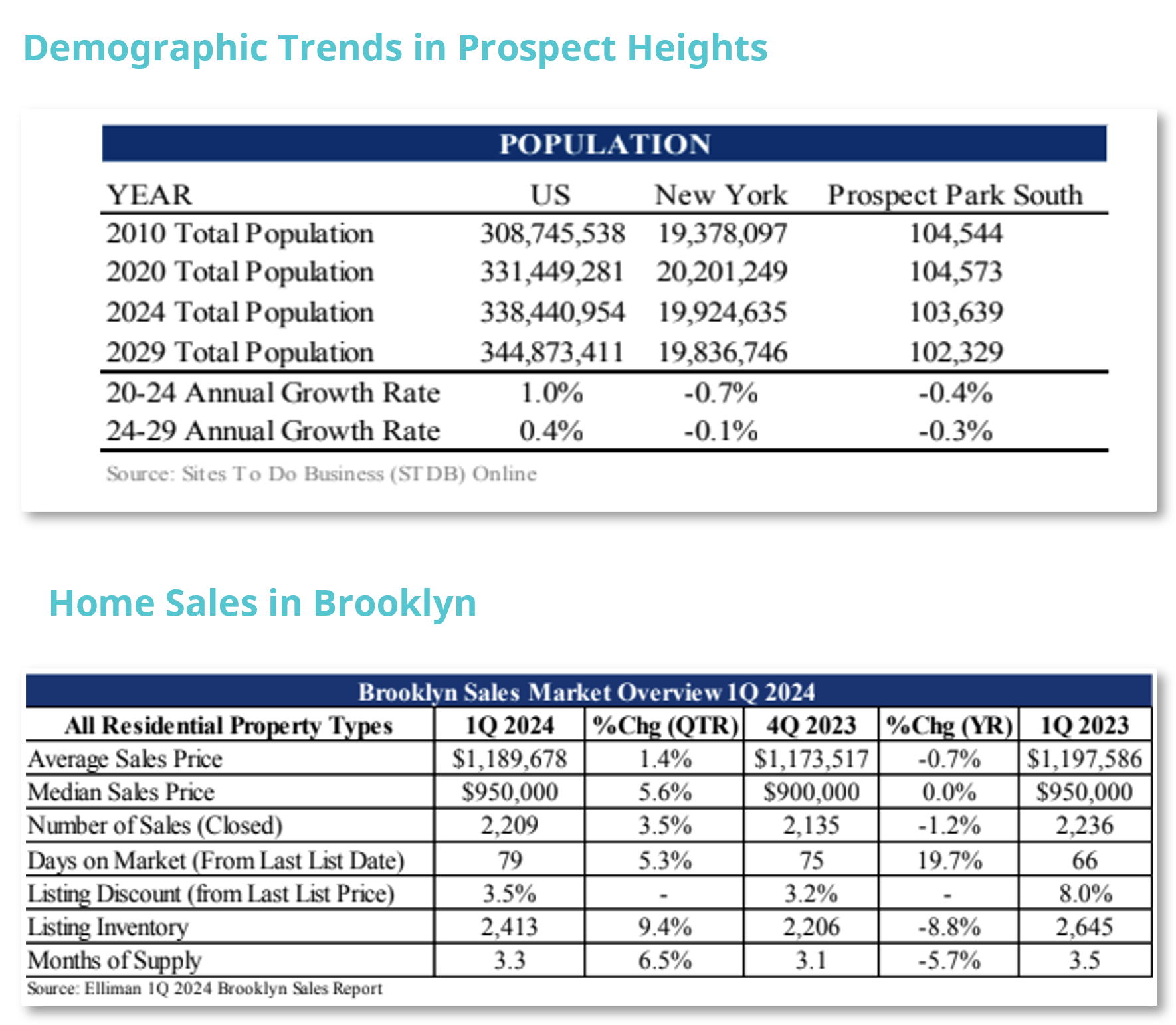

Residential Market Trend in Prospect Heights

According to the third-party appraisal by Marshall & Stevens, since the pandemic in 2020, the population of Prospect Heights has only decreased by 0.4%. This stability contrasts with the population outflow in many other areas of New York City and coupled with the relatively young demographic of residents, contributes to the steady development of the local housing market.

Despite mortgage rates in the US nearly doubling in 2023 compared to the previous year, the median home prices in Prospect Heights have risen to the third highest in history. The median home price in Brooklyn has remained stable at around $950,000, an 18.1% increase from pre-pandemic levels.

Compared to other areas of Brooklyn, Prospect Heights boasts a beautiful environment, excellent community safety, and convenient commuting options. Its housing prices are more affordable compared to the higher prices in nearby Downtown Brooklyn and Williamsburg, making it an attractive destination for young middle-class professionals.

* Source: Marshall & Stevens.

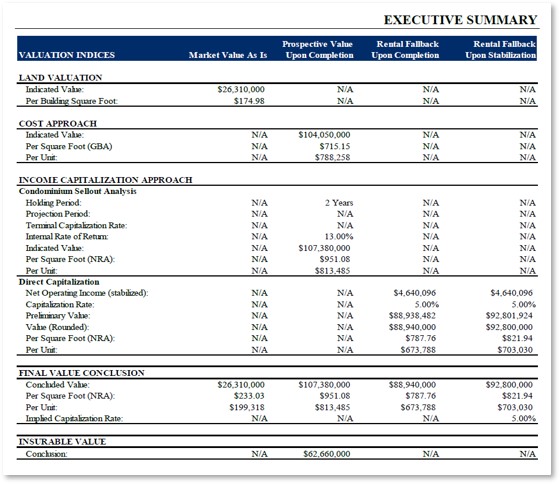

Valuation Analysis

The underlying property is a 9-story mixed-use building. The project has completed the demolition of the original ground structures and has successfully registered its Condo Book. The foundation is about to be completed, with the project expected to be finished in 2026.

According to the appraisal provided by Marshall & Stevens, the current market value of the lot is approximately $26,310,000. Upon completion, the market value of the project is estimated to be around $107,380,000.

Given that the construction work for the project has not yet fully commenced, CrowdFunz believes that the land value of $26,310,000 assessed by Marshall & Stevens aligns with the actual market value of the project at its current stage.

* Source: Appraisal Report from Marshall & Stevens

Location

The property is in the central area of Brooklyn, with convenient transportation. It has a 2-minute walking distance to the subway Q line station, taking 15 minutes to reach Lower Manhattan. Driving to LaGuardia Airport takes 30 minutes, and to John F. Kennedy International Airport takes 40 minutes.

Transportation

- Subway:Q line (2-min walk)

- To Downtown Manhattan: 15-minute subway

- To JFK Airport:30-minute driving

- To LGA Airport:40-minute driving

Schools

Several elementary, middle, and high schools are situated in the area, meeting children's educational needs. Additionally, there are numerous language learning centers and various early education institutions nearby to ensure the comprehensive development of children.

Living Facilities

The community surrounding the project provides convenient living conditions and proximity to Chinese immigrant neighborhoods. The area includes various Chinese and Korean supermarkets and restaurants. Additionally, there are large shopping centers nearby to meet the daily dining and living shopping needs.

Entertainment

The project is near various museums, sports venues, and entertainment facilities. The nearby Brooklyn Museum is a cultural landmark of the area and the second-largest museum in New York, after MoMA. Sunset Park and Dyker Beach Park, the New York Aquarium, and the Barclays Center, home to the Brooklyn Nets, are also located nearby.

Developer Company: New Empire Corp.

Developer Website: https://www.newempirecorp.com/

Prior Cooperation: CrowdFunz Fund 604 / CrowdFunz Fund 805 / CrowdFunz Fund 819 / CrowdFunz Fund 826 / CrowdFunz Fund 828 / CrowdFunz Fund 832

- The loan provided by CrowdFunz Fund 849 is intended to provide short- to medium-term liquidity to the developer. This loan helps ensure adequate cash flow during the early stages of construction. The developer plans to repay the loan using either bank construction loans or cash flow from other projects.

- The developer has sufficient experience and good credit, with a positive reputation in the industry. The project's capital structure is reasonable, with a loan-to-cost ratio of approximately 57.1%. The equity value exceeds twice the amount of the loan issued by the 849 Fund, making it feasible to provide liquidity to the developer. Additionally, the developer offers an unlimited personal guarantee.

- CrowdFunz believes that under the terms of the loan agreement and with clear legal responsibilities, the risk of default for this loan is lower than the industry average, making it a worthwhile investment.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)