First Lien Mortgage Debt Fund 619

Type: Debt

Target: $3,300,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 12 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $3,300,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | September 2024 |

| Investment Timeline | 12 – 18 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 1 extension option, and investors will receive dividends accordingly at the same dividend rate.

- The project is in Rego Park, Queens, at the intersection of 64th Street and Queens Boulevard, close to Highway 495. The construction has been completed, and the project Condominium Offering Plan was filed in July 2024. The final inspection by the New York City Department of Building is expected to be completed in October 2024, after which a Temporary Certificate of Occupancy will be issued.

- The property is a 7-story mixed-use building, with approximately 19,025 square feet of residential space, including 23 condominium units. The ground floor features 3,717 square feet of retail space and 7 parking lots.

| Address | 97-30 64th Avenue, Flushing, NY 11374 |

| Area | Rego Park, Queens, New York |

| Building Area | 19,025 Sqft |

| Retail Area | 3,717 Sqft |

| Intended Use | 23 Condominium Units, 1 Retail Unit, 7 Parking Lots |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 10/1/2024 | 9/20/2024 | 3/19/2025 | 181 days | Prepaid Dividend *2 | |

| Second | No Later than 4/1/2025 | 3/20/2025 | 9/19/2025 | 184 days | Prepaid Dividend | |

| Third | No Later than 10/1/2025 | 9/20/2025 | 3/19/2026 | 181 days | Extension Option Owned by Developer*3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 1 extension options, and investors will receive dividends accordingly at the same dividend rate.

- CrowdFunz will invest in the project through Fund 619 and Fund 850 through layered investments. Fund 619 will provide a first lien mortgage in total of $3.3 million , and Fund 850 will provide a equity pledge loan in total of $1.1 million. The layered debt investment constitutes an inventory loan, ensuring that CrowdFunz is the sole creditor.

- According to the valuation report provided by the third-party appraisal agency Marshall & Stevens, the current market value of the target project is approximately $16,710,000, which is 3.8 times the total investment amount of Fund 619 and Fund 850.

- The target project is in Rego Park, Queens, situated in the core commercial street of the community. It is adjacent to major shopping malls in Queens, Ney York, fulfilling residents' needs for shopping, entertainment, and daily living.

- The property is located at the intersection of Highway 495 and Queens Boulevard, just a 5-minute walking distance to the subway station, offering excellent connectivity. It is a 20-minute driving to LGA, JFK, or Flushing, and a 30-minute subway ride to Manhattan. Additionally, it is very convenient to reach Long Island by transferring to the LIRR.

- The borrower plans to use the loan proceeds provided by the two CrowdFunz funds to repay the existing loan close to maturity, as well as to cover the soft costs related to sales.

- The borrower intends to repay the loans through the proceeds from the sale of condominiums and the retail space after obtaining the Temporary Certificate of Occupancy, or from the cash flows of other projects.

- The developer is a family-run business with deep roots in the local market. To date, they have developed or hold over 200,000 square feet of commercial and residential properties. In recent years, the developer has targeted several emerging communities in Queens. They have a thorough understanding of the local market conditions as well as residential and commercial demands.

- The developer has cooperated with CrowdFunz in Fund 804, 807, 809, 812, 822, 823, 617, 827, 841, and 843, and had fulfilled all loan obligations on time.

Capital Structure of CrowdFunz 619

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| CrowdFunz 619 Mortgage | $3,300,000 | 19.75% | |

| CrowdFunz Fund 850 Equity Pledge Loan | $1,100,000 | 6.58% | |

| Developer Equity | $11,310,000 | 73.67% | |

| Total | $16,710,000 | 100.00% | |

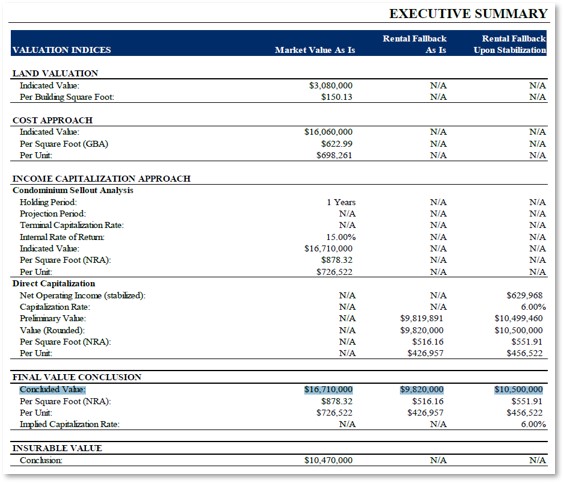

- According to the valuation report provided by appraiser Marshall & Stevens, the current market value of the property is approximately $16,710,000.

- The capital structure of the project includes a mortgage in total of $3,300,000 from Fund 619 and an equity pledge loan in total of $1,100,000 from Fund 850. After deducting these loans, the developer's equity value is approximately $16,710,000. The Loan-to-value (LTV) ratio of the project is only 26.33%, indicating low default risk.

- In addition, key individuals will sign personal guarantees, ensuring timely payment of principal and interest. If there are repayment issues, the funds will take legal action to claim their personal assets to repay investors.

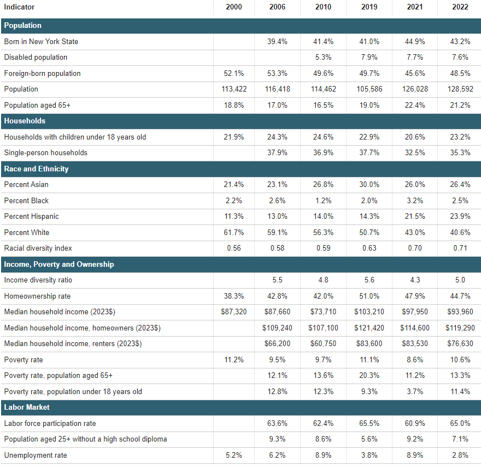

Demographics in Zip Code Area

| Rego Park/Forest Hills | |

|---|---|

| Population | 128,592 |

| Median Age | 43.60 |

| Born in | New York(49.60%)/ Out of the U.S.(22.50%) |

| Race | Asian(26.0%)/Caucasian(43.00%)/Latino(21.50%)/African American(3.20%) |

| Median Family Income | $93,960 |

| Child-bearing (Under 18) | 20.6% |

| Unemployment Rate | 2.6% |

Rego Park offers convenient transportation with direct access to the LIRR and public transit options. Over the past decade, the area has developed rapidly, with a full range of retail and dining options catering to the daily needs of Asian residents.

The population in Rego Park is diverse, with 43.00% White, 26.00% Asian, 21.50% Hispanic, and 3.20% Black residents. The area is populated, with 45% of residents being full-time workers who commute by public transportation.

The community is mainly composed of middle-aged families with stable incomes, with an average age of about 44 years. Families with children make up 20.60% of the population, and the homeownership rate is 44.70%.

The population in this area has seen steady growth in recent years, driven by strong demand from first-time homebuyers, contributing to stable housing prices.

* Source: NYU Furman Center and U.S. Census Bureau, in September 2024

Residential Market Trend in Prospect Heights

Rego Park, located in the central area of Queens, shares similarities with the neighboring Forest Hills, with a high proportion of Jewish residents. The area has well-developed shopping districts, convenient facilities, and is known for its good public safety, making it a traditional residential community in Queens. In recent years, it has attracted many local professionals to settle down.

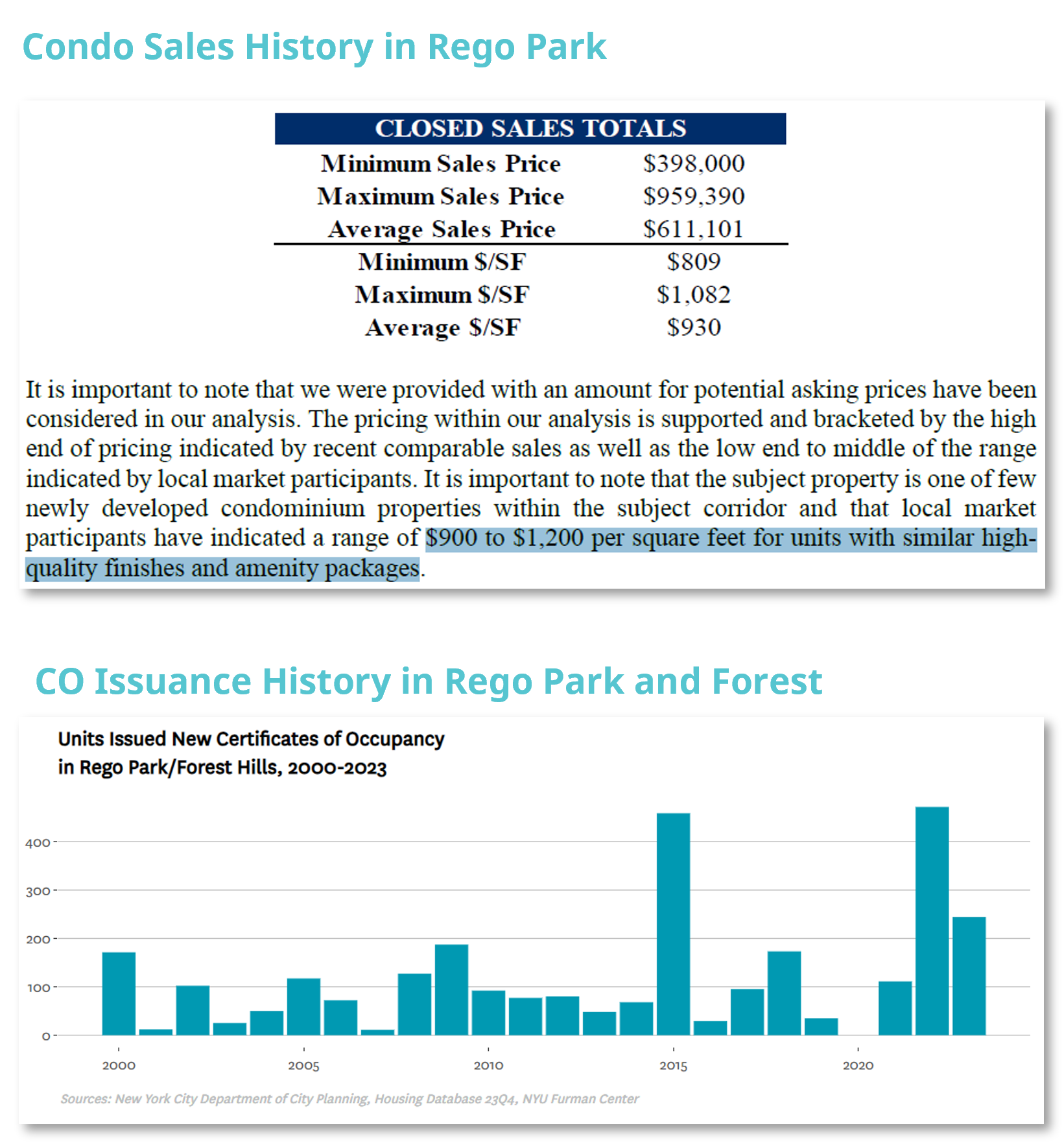

According to the valuation report by Marshall & Stevens, the market for condominiums in Rego Park has been very strong in past years. Although the housing sales volume was affected during the pandemic, the recovery of the local business districts and the anticipated significant interest rate cuts have created a positive market outlook for the future.

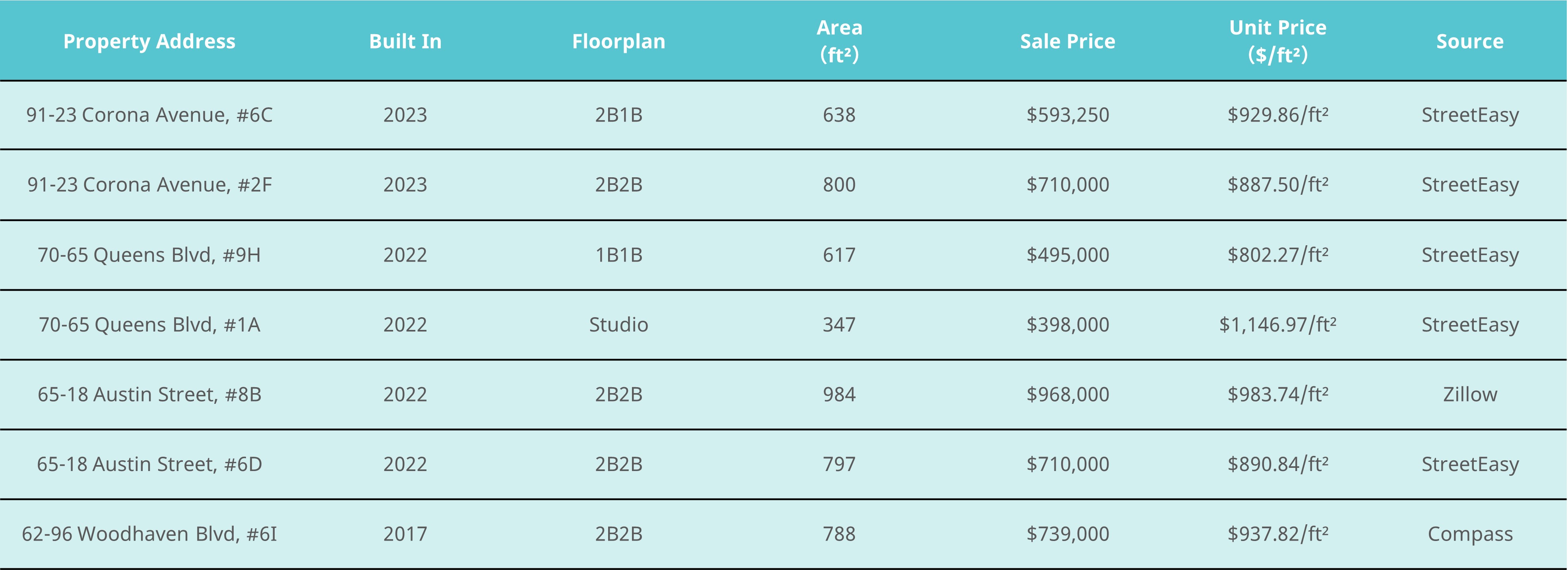

The current average price for comparable condominiums in the Rego Park area is about $611,101 per unit, with an average price of $930 per square foot. Given the limited supply of new condominium units, prices for comparable units generally fall within the ideal range of $900 to $1,200 per square foot.

* Source: NYU Furman Center and U.S. Census Bureau.

Valuation Analysis

The underlying property is a 7-story mixed-use building. The construction has been completed, and the project Condominium Offering Plan was filed in July 2024. The final inspection by the New York City Department of Building is expected to be completed in October 2024, after which a Temporary Certificate of Occupancy will be issued.

According to the valuation report provided by Marshall & Stevens, the current market value of the property is approximately $16,710,000, with an average price of $878.32 per square foot (Details shown on the right).

Based on the current project progress, CrowdFunz believes that the project’s valuation is close to its final sales value. The $16,310,000 property value, assessed using the Income Capitalization Approach by Marshall & Stevens, aligns with the actual value of the project.

* Source: Appraisal Report Provided by Marshall & Stevens

Location

The project is in the central area of Rego Park, just a 4-minute driving to the LIRR station, and a 30-minute subway ride to Manhattan. The site is close to major transportation routes, providing a 20-minute driving to both LGA and JFK airports. The area is also well-served with malls, hospitals, police stations, banks, schools, and senior centers, offering comprehensive community services.

Transportation

- Subway:M/E/R

- Train: LIRR

- To JFK Airport:7.5 miles (20-min Driving)

- To LGA Airport:4.8 miles (20-min Driving)

Schools

Rego Park has 5 public elementary schools, 1 private Catholic elementary school, and 3 public middle schools, providing ample educational options for local children.

Living Facilities

Rego Park, as an emerging Asian community, has attracted many Chinese homebuyers and investors in recent years, including many new immigrants. The nearby Queens Boulevard features several Chinese, Central American and Mediterranean cuisine options.

Entertainment

Rego Park is near local libraries and close to Flushing Meadows-Corona Park, the Queens Museum of Art, the Science Museum, and the U.S. Open tennis courts. These abundant recreational facilities make the area ideal for families with children looking to settle down.

Developer Company: New Empire Corp.

Developer Website: https://www.greatstoneny.com/

Prior Cooperation: CrowdFunz Fund 804 / CrowdFunz Fund 807 / CrowdFunz Fund 809 / CrowdFunz Fund 812 / CrowdFunz Fund 818 / CrowdFunz Fund 822 / CrowdFunz Fund 823 / CrowdFunz Fund 617 / CrowdFunz Fund 827 / CrowdFunz Fund 841 / CrowdFunz Fund 843

- CrowdFunz Fund 850 provides the borrower with a short-to-medium-term inventory loan. CrowdFunz has selected the developer’s completed property as collateral, further reducing the investment risk. Upon completion of the project, the developer will repay the loans from Fund 619 and Fund 850 through sales proceeds of the condominium units or cash flow from other projects.

- With the $1.1 million equity pledge loan from Fund 850 and the $3.3 million mortgage loan from Fund 619, the overall LTV ratio for the project is only 26.33%, indicating a low risk of default.

- The target property is in Rego Park, Queens, New York, with prime location. Rego Park is in the heart of Queens, with a high proportion of Jewish residents, well-developed shopping districts, and good public safety, making it a traditional residential community in Queens.

- As a result, CrowdFunz considers this short-term debt investment by Fund 850 to be low-risk and suitable for investors seeking fixed-income products.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)