Mortgage Debt Fund 620

Type: Debt

Target: $5,000,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 12 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $5,000,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | First Lien Mortgage |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | September 2024 |

| Investment Timeline | 12 – 18 Months*2 |

| Dividend Schedule | Prepaid per 6 Months*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units.

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the 12th dividend period, Borrower owns 1 six-month extension option, and investors will receive dividends accordingly at the same dividend rate.

- The property is in the Cypress Hills area of Brooklyn, near Highland Park. It is situated at the intersection of Van Siclen Avenue and Fulton Street, close to the J/Z subway station and major roads like Jackie Robinson Parkway and Atlantic Avenue.

- The developer purchased the land in February 2023 and began the construction works. The capping and copings of the building has been completed, and the Temporary Certificate of Occupancy is expected to be obtained in one year. The proposed completion of the project is in November 2025. The proposed property is an 8-story mixed-use building with 51 rentable residential units, 1,628 square feet community facility space, and 19 parking lots.

| Address | 2795 Fulton Street, Brooklyn, NY 11207 |

| Area | Cypress Hill, Brooklyn, New York |

| Building Area | 48,038 Sqft |

| Retail Area | 29,357 Sqft |

| Intended Use | 51 Rental Units, 1 Community Center, 19 Parking Lots |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 11/11/2024 | 10/04/2024 | 11/03/2024 | 31 days | Paid Monthly*2 | |

| Second | No Later than 12/11/2024 | 11/04/2024 | 12/03/2024 | 30 days | Paid Monthly | |

| Third | No Later than 01/11/2025 | 12/04/2024 | 01/03/2025 | 31 days | Paid Monthly | |

| fourth | No Later than 02/11/2025 | 01/04/2025 | 02/03/2025 | 31 days | Paid Monthly | |

| fifth | No Later than 03/11/2025 | 02/04/2025 | 03/03/2025 | 28 days | Paid Monthly | |

| sixth | No Later than 04/11/2025 | 03/04/2025 | 04/03/2025 | 31 days | Paid Monthly | |

| seventh | No Later than 05/11/2025 | 04/04/2025 | 05/03/2025 | 30 days | Paid Monthly | |

| eighth | No Later than 06/11/2025 | 05/04/2025 | 06/03/2025 | 31 days | Paid Monthly | |

| Ninth | No Later than 07/11/2025 | 06/04/2025 | 07/03/2025 | 30 days | Paid Monthly | |

| Tenth | No Later than 08/11/2025 | 07/04/2025 | 08/03/2025 | 31 days | Paid Monthly | |

| Eleventh | No Later than 09/11/2025 | 08/04/2025 | 09/03/2025 | 31 days | Paid Monthly | |

| Twelfth | No Later than 10/11/2025 | 09/04/2025 | 10/03/2025 | 30 days | Paid Monthly | |

| Thirteenth | No Later than 11/11/2025 | 10/04/2025 | 11/03/2025 | 31 days | Extension Option Owned by Borrower*3 | |

| Fourteenth | No Later than 12/11/2025 | 11/04/2025 | 12/03/2025 | 30 days | Extension Option Owned by Borrower | |

| Fifteenth | No Later than 01/11/2026 | 12/04/2025 | 01/03/2026 | 31 days | Extension Option Owned by Borrower | |

| Sixteenth | No Later than 02/11/2026 | 01/04/2026 | 02/03/2026 | 31 days | Extension Option Owned by Borrower | |

| Seventeenth | No Later than 03/11/2026 | 02/04/2026 | 03/03/2026 | 28 days | Extension Option Owned by Borrower | |

| Eighteenth | No Later than 04/11/2026 | 03/04/2026 | 04/03/2026 | 31 days | Extension Option Owned by Borrower | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the 12th dividend period, Borrower owns 1 six-month extension option, and investors will receive dividends accordingly.

- CrowdFunz Fund 620 in partnership with Popular Bank, will invest in the project's Special Purpose Vehicle (SPV) to provide the developer a first-lien mortgage loan in total of $18,500,000. Of this, Fund 620 will contribute $5,000,000 investment, while Popular Bank will provide $13,500,000 investment.

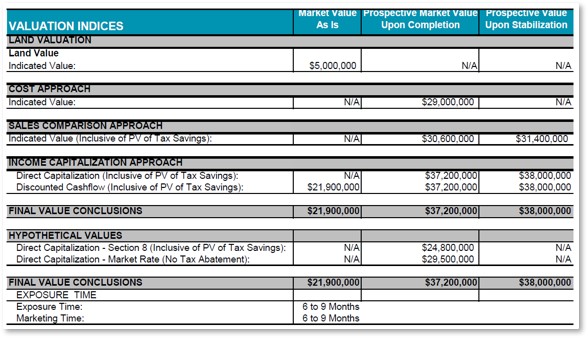

- According to the appraisal report provided by Cushman & Wakefield, the property's current market value is approximately $21,900,000, with an estimated market value of $38,000,000 once the project is completed and fully leased.

- The property is in the Cypress Hills neighborhood of Brooklyn, near the green space of Highland Park. The surrounding area consists of traditional local residential communities, with supermarkets, convenience stores, and other amenities within walking distance. It is only ten blocks from East New York, Brooklyn&rsquo's regional hub.

- The property is situated at Van Siclen Avenue and Fulton Street intersection, adjacent to the MTA J/Z subway station, and close to major roads like Jackie Robinson Parkway and Atlantic Avenue. The subway station is just a one-minute walk away, providing a 45-minute ride to Midtown Manhattan&rsquo's Penn Station. The East New York train station is a 10-minute walk, offering easy access to various parts of NYC. To Downtown Manhattan is 35 minutes driving away, and to JFK Airport is a 25-minute driving.

- The developer plans to use part of the investment from the CrowdFunz Fund 620 to repay existing loans, with the remainder allocated to cover the construction and soft costs of the project.

- Upon obtaining the TCO, the developer expects to repay the loan either through refinancing with a commercial bank or by utilizing cash flow returns from other projects they own.

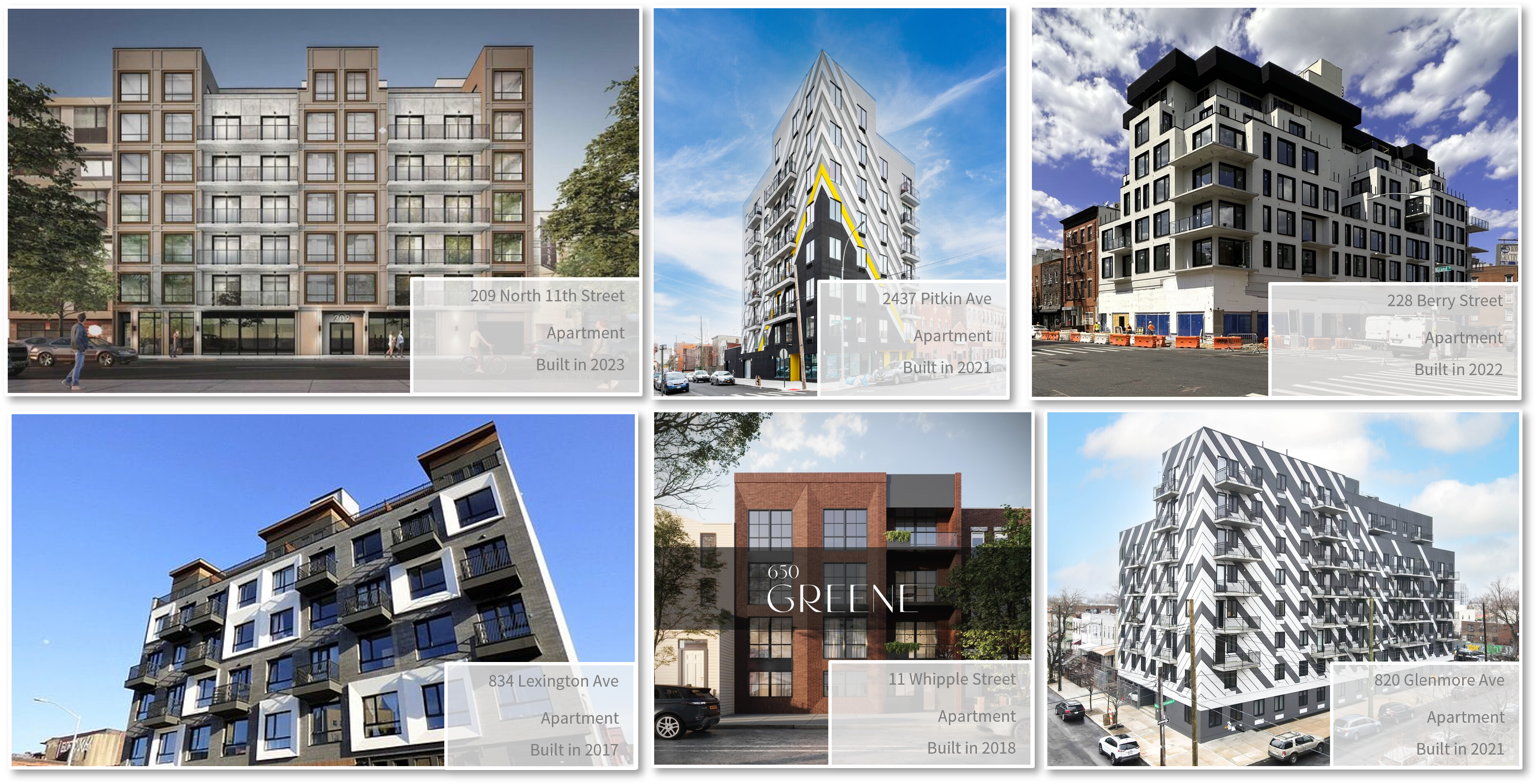

- The developer for this project is a traditional Jewish family-owned company in New York City, with decades of experience in the local residential market. The Developer has a strong track record and a deep understanding of local market demands, and it has completed 78 real estate projects across the five boroughs of NYC, primarily focusing on multi-family residential buildings, rental apartments, and small to mid-sized hotels.

- The Developer&rsquo's past development portfolio is worth over $1.455 billion, with approximately 1,890 completed units. The rental properties and hotels generate over $3.686 million in monthly revenue, reflecting strong financial condition and excellent debt repayment ability.

Capital Structure of CrowdFunz 620

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| CrowdFunz Fund 620 | $5,000,000 | 22.83% | |

| Popular Bank | $13,500,000 | 61.64% | |

| Developer Equity | $3,400,000 | 15.53% | |

| Total | $21,900,000 | 100.00% | |

- According to the valuation report provided by Cushman & Wakefield, the current market value of the property is approximately $21.9 million before completion, with an estimated value of $38 million once the project is finished and fully leased.

- The capital structure includes a $5 million mortgage investment from CrowdFunz Fund 620, making up 22.83% of the capital. Popular Bank is providing a $13.5 million mortgage investment, accounting for 61.64% of the structure, while the developer's equity is around $3.4 million, representing 15.53% of the total.

- The current loan-to-value ratio is relatively high at 84.47%, but the developer has a strong financial background, with sufficient liquidity and debt repayment capacity to support this high-leverage strategy. For the joint mortgage investment with Popular Bank, the developer’s key person will provide a unlimited personal guarantee. The key person’s net worth is over $366 million.

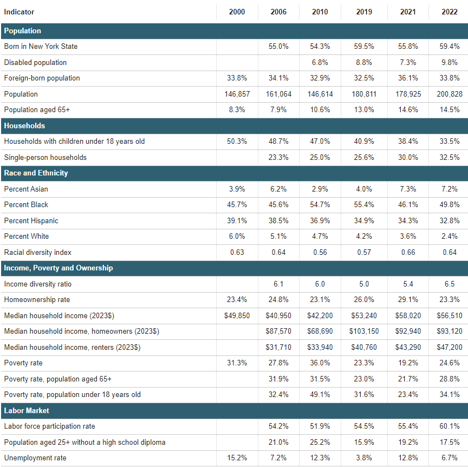

Demographics in Zip Code Area

| East New York/Starrett | |

|---|---|

| Population | 200,828 |

| Median Age | 35.40 |

| Born in | New York(59.40%)/ Out of the U.S.(33.80%) |

| Race | Asian(7.20%)/Caucasian(2.40%)/Latino(32.80%)/African American(49.80%) |

| Median Family Income | $56,510 |

| Child-bearing (Under 18) | 34.10% |

| Unemployment Rate | 6.70% |

Cypress Hills belongs to East New York/Starrett area, and it has a diverse population, including African American, Dominican, Puerto Rican, South Asian, Caribbean, and Caucasian residents.

In the broader East New York/Starrett City area, African Americans make up 49.80% of the population, followed by Latinx residents at 32.80%. Asians and Caucasians are minority groups, representing 7.20% and 2.40%, respectively.

Over the past decade, the median age of residents has decreased, largely due to the influx of new immigrants, with the current average age being around 35. Families with children make up 33.50% of the population, and the homeownership rate is low at 23.30%, with most residents renting. The area has experienced significant population growth over the last decade, leading to steady increases in both housing prices and rental rates.

* Source: NYU Furman Center and U.S. Census Bureau, in September 2024

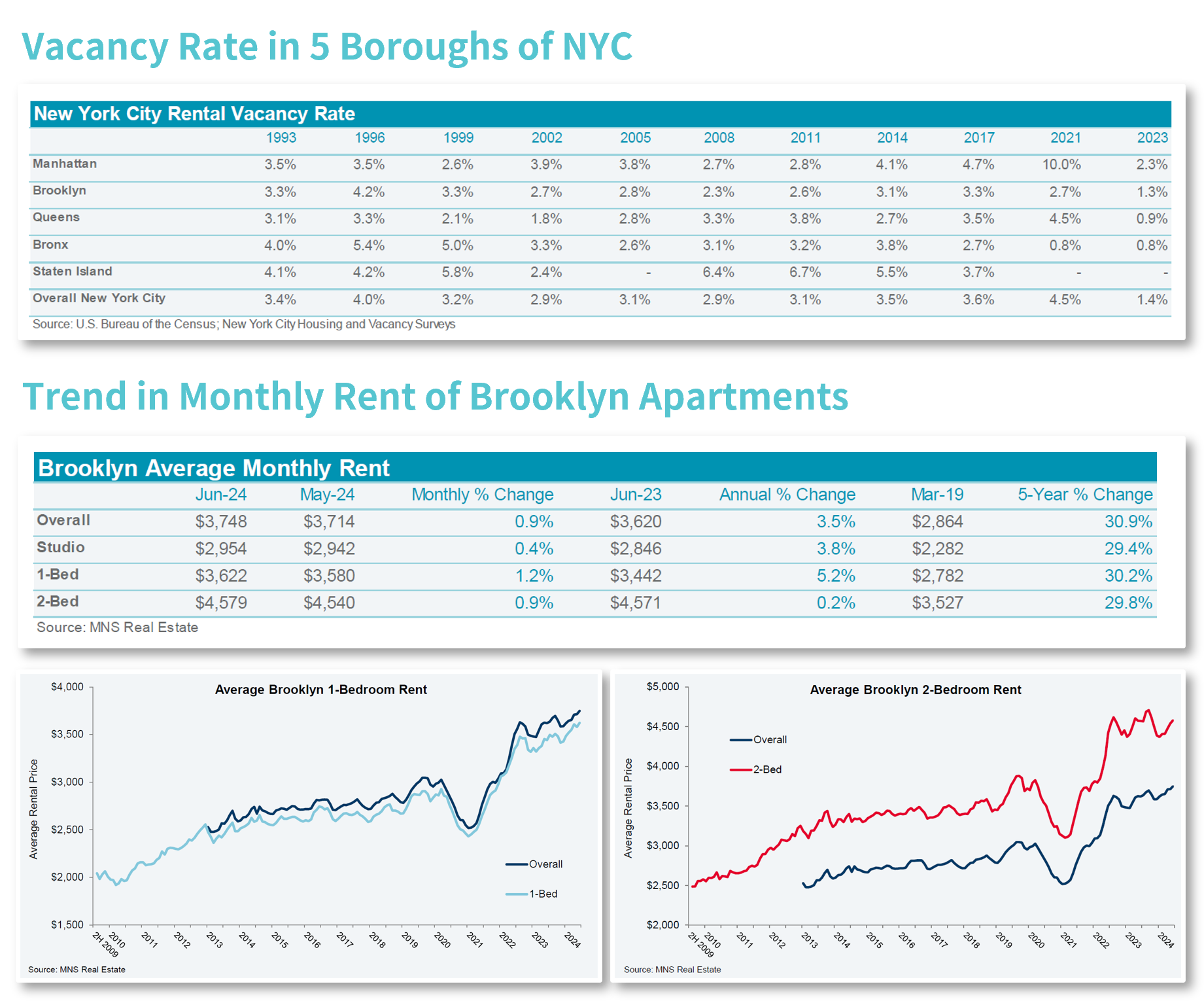

Residential Market Trend in Cypress Hill

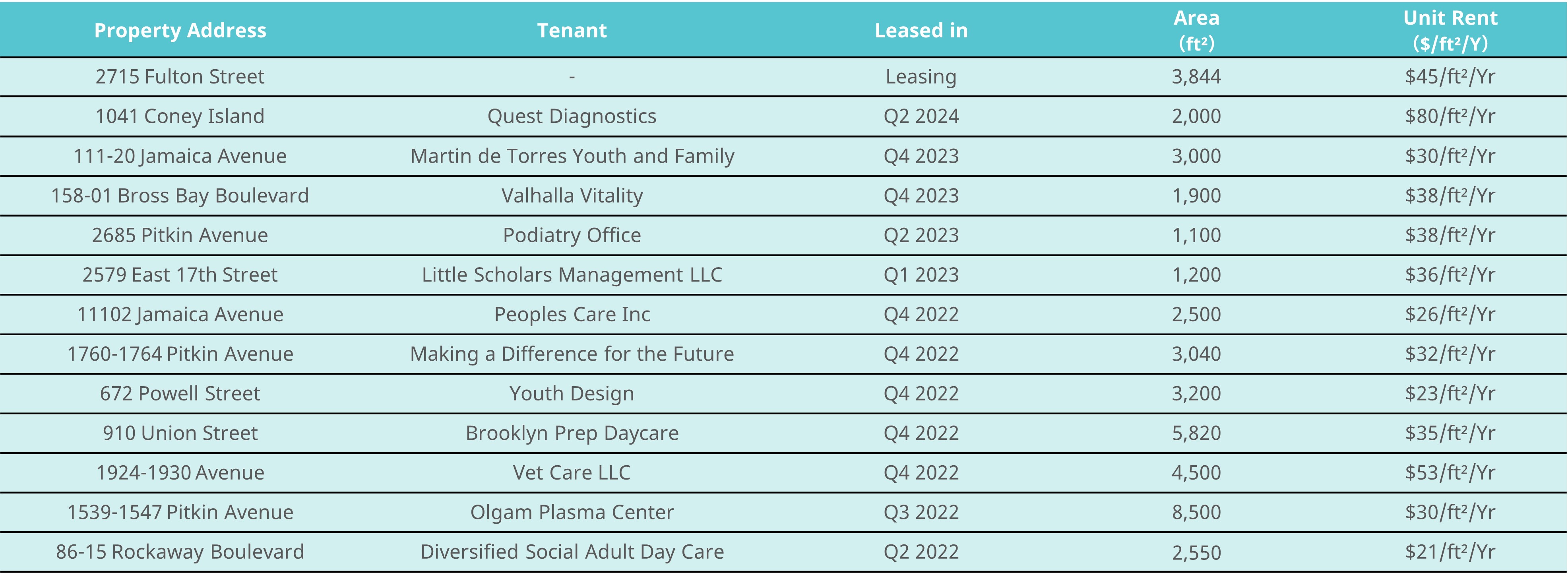

Cypress Hills, is a densely populated region where real estate is primarily residential. More than half of the land in the area is zoned for various types of housing. In addition to residential buildings, the northwest and southern parts of the region feature older industrial complexes, while commercial spaces and retail stores are concentrated along major avenues. New real estate developments are also primarily situated along these main roads.

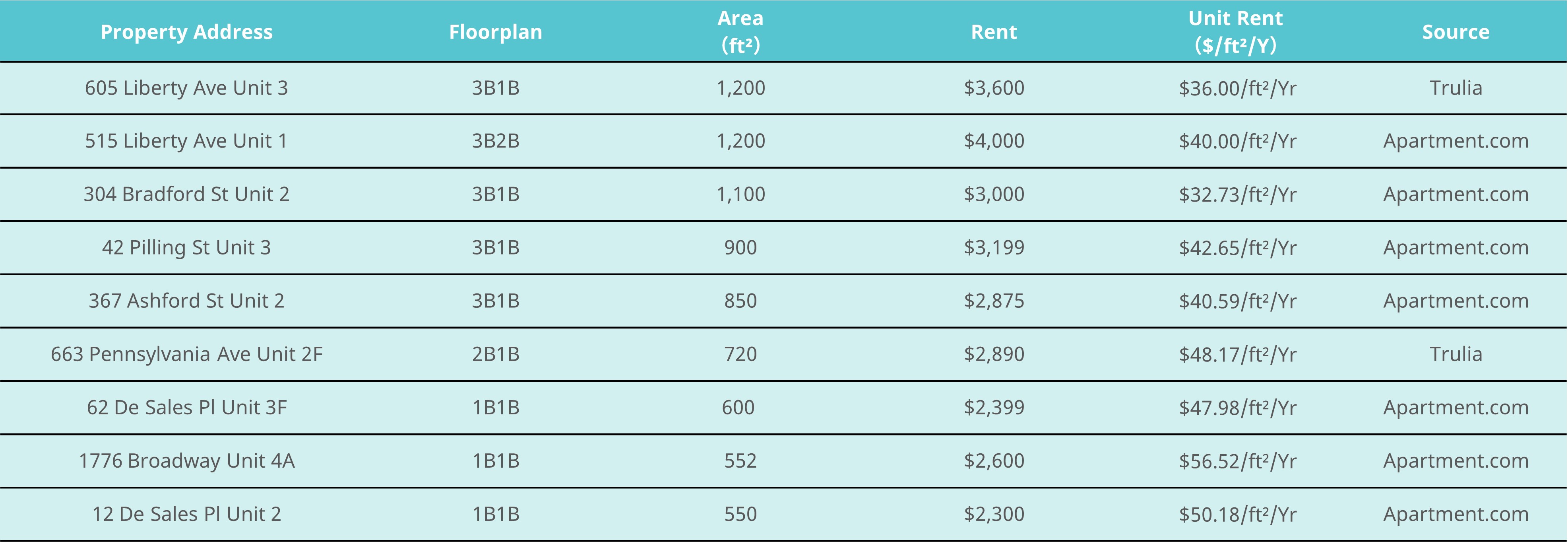

According to the appraisal report provided by Cushman & Wakefield, Brooklyn currently has a low vacancy rate for rental apartments, around 1.3%, indicating a tight supply and demand for rental housing. The proposed 8-story rental apartment building at the subject property, known for its affordability, meets the strong demand for affordable housing, especially for new immigrants. Its excellent transportation access also makes the property highly competitive in the local market, with positive expectations for stable and long-term rental income.

* Source: Appraisal Report provided by Cushman & Wakefield.

Valuation Analysis

The proposed property will be an 8-story mixed-use building, featuring 51 rental units, 1 community facility, and 19 parking lots. The developer purchased the land in February 2023 and began the construction works. The capping and copings of the building has been completed, and the Temporary Certificate of Occupancy is expected to be obtained in one year. The proposed completion of the project is in November 2025.

According to the appraisal report provided by Cushman & Wakefield, the current market value of the property is approximately $21.9 million, with an estimated value of $38 million once the project is completed and fully leased. Based on the project's current progress, CrowdFunz believes that Cushman & Wakefield's valuation of $21.9 million, determined by using the Income Capitalization Approach, reflects the market value of the property in its unfinished state.

* Source: Appraisal Report provided by Cushman & Wakefield

Location

The project is in the Cypress Hills neighborhood of Brooklyn, New York City, near the green space of Highland Park, offering a pleasant and serene environment. The surrounding area consists of traditional local residential communities, with supermarkets, convenience stores, and other amenities within walking distance. It is just a few blocks from East New York, the regional center of Brooklyn.

Transportation

- Subway:J/Z Metro Lines

- Train: LIRR East New York

- To JFK Airport:5.7 Miles (25-minute driving)

- To LGA Airport:11.2 Miles (40-minute driving)

Schools

The Cypress Hills area falls under New York City's District 19, a traditional residential community with abundant educational resources, featuring a total of 36 different middle and elementary schools serving the district. Notable schools in the area include public elementary schools P.S. 65 and P.S. 108 Sal Abbracciamento, as well as the private elementary school The Fresh Creek School, all of which are considered quality educational institutions in the community.

Living Facilities

Cypress Hills is a traditional residential community in Brooklyn's East New York area, with development dating back to the mid-17th century. The local commercial area is well-established, primarily serving a population of Latinx and African American residents. The neighborhood is known for its numerous Jamaican-style restaurants.

Entertainment

The Cypress Hills area offers convenient access to libraries, community centers, and Highland Park for outdoor leisure. Residents can also visit the Gateway Center, a large shopping mall that opened in 2002, as a popular destination for shopping and dining. Since the area's rezoning in 2016, it has attracted several mid-to-high-end residential developments and new residents. This growth has brought a variety of fitness centers and recreational venues catering to younger consumers, enhancing the neighborhood’s appeal.

Developer Company: 2795 Fulton ST LLC.

- CrowdFunz Fund 620 provides financing for the short- to medium-term mortgage loan needed by the borrower. To mitigate investment risk, CrowdFunz is partnering with Popular Bank to jointly invest in the project's Special Purpose Vehicle (SPV). At the conclusion of the project, the developer will repay the mortgage loan by refinancing with a commercial bank or by using cash flow returns from other projects.

- The developer has a strong financial background. Although the project currently has a high loan-to-value (LTV) ratio of 84.47%, the developer's liquidity and debt repayment ability are sufficient to support the high-leverage strategy. For this joint mortgage loan investment with Popular Bank, the key individual from the developer’s team will provide a personal unlimited guarantee. This individual has a net worth exceeding $366 million, making the likelihood of malicious default low.

- As a result, CrowdFunz believes that the short-term debt investment of the Fund 620 carries relatively low and manageable risk, making it suitable for investors seeking fixed-income products.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)