Mortgage Debt Fund 621

Type: Debt

Target: $1,250,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 6 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,250,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | First Lien Mortgage |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | October 2024 |

| Investment Timeline | 6 – 18 Months*2 |

| Dividend Schedule | Prepaid Every 6 Month*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the 1st dividend period, Borrower owns 2 six-month extension options, and investors will receive dividends accordingly at the same dividend rate.

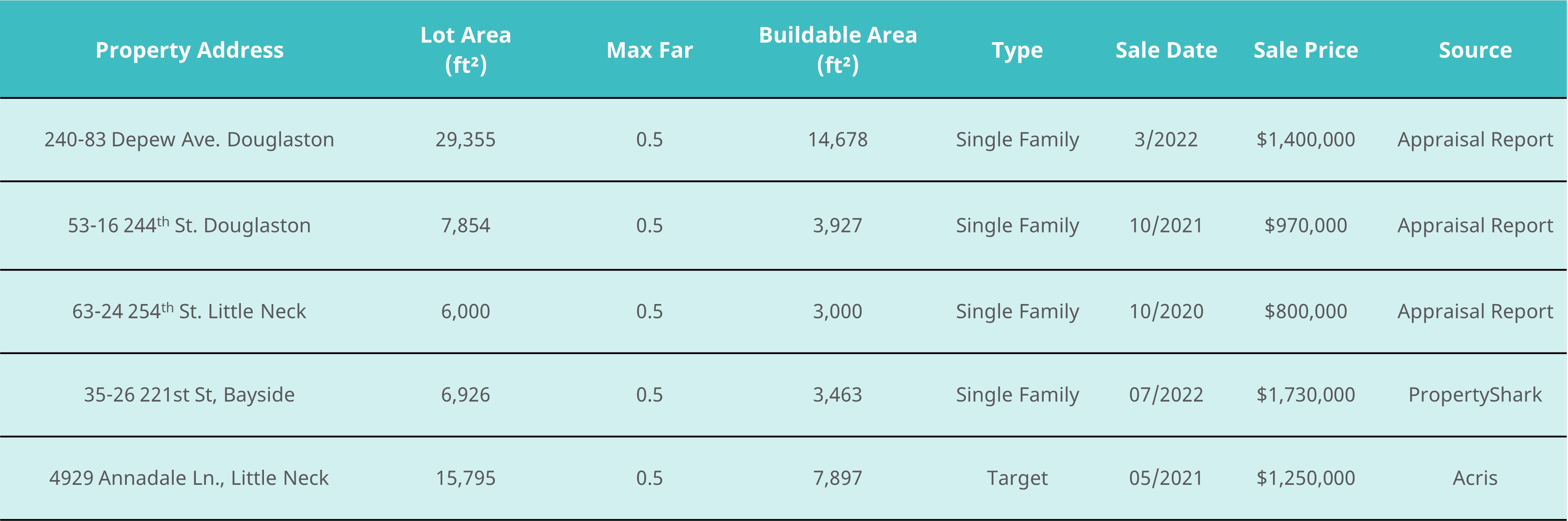

- The underlying property is in the historic and affluent area of Little Neck, Queens, surrounded by luxury single-family houses and inhabited by a wealthy community.

- The site is planned to be developed into a luxury single-family house with a total lot area of 15,795 square feet and a property area of about 5,000 square feet (excluding the basement). The architectural plans were approved in January 2022, and the main structure has been completed. Currently, interior finishing work is underway, and the Certificate of Occupancy is expected to be obtained within the next two quarters.

| Address | 4929 Annadale Lane, Little Neck, NY, 11362 |

| Area | Little Neck, Queens, New York |

| Lot Area | 15,795 Sqft |

| Property Area | 5,000 Sqft |

| Completion | Second Quarter of 2025 |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 11/22/2024 | 11/14/2024 | 5/13/2025 | 181 days | Prepaid Dividend *2 | |

| Second | No Later than 5/22/2025 | 5/14/2025 | 11/13/2025 | 184 days | Prepaid Dividend | |

| Third | No Later than 11/22/2025 | 11/14/2025 | 5/13/2026 | 181 days | Extension Option Owned by Developer*3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, the borrower owns 2 six-month extension options, and investors will receive dividends accordingly at the same dividend rate.

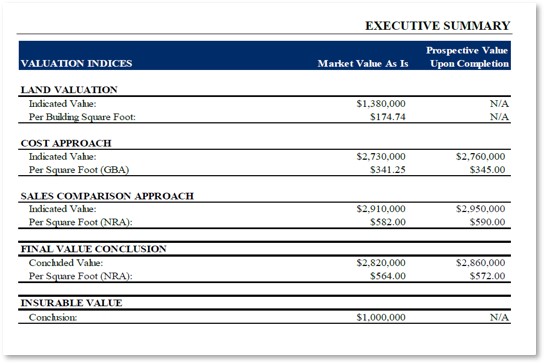

- According to the Appraisal Report provided by Marshall & Stevens, the current valuation of the underlying property is approximately $2,820,000 U.S. Dollars, with an estimated market value of around $2,910,000 upon completion.

- The loan provided by the CrowdFunz Fund 621 is secured by the land and the structure built on it. The borrower has contributed approximately $1,550,000 in equity, which is nearly 1.3 times the loan amount. The key persons will provide an Unlimited Personal Guarantee to further safeguard the interests of investors.

- The property is in Little Neck, Queens, just a 3-minute drive from the LIRR, which provides direct access to Midtown Manhattan within 30 minutes. Additionally, its convenient highway network allows easy access to Long Island and surrounding areas of New York. This area has recently attracted many Chinese families due to its excellent school district, low property tax burden, and convenient living conditions. As a traditional residential community, new luxury homes are scarce here, giving the target project a clear competitive advantage in the market.

- The main construction of the property has been completed, and it is expected to receive a Certificate of Occupancy by early to mid-next year. The loan provided by CrowdFunz Fund 621 will be fully utilized to repay the current loans and cover certain soft costs associated with the project.

- Upon project completion, the borrower plans to repay the loan through either the sale of the property, refinancing through a commercial bank, or cash flow returns from other projects they hold.

- The borrower has been involved in the wholesale and retail of building materials in New York for over 20 years and has actively participated in real estate development projects in Brooklyn and Queens, successfully completing more than ten local construction projects.

- Known for its conservative investment strategy, the financier advances each development project steadily and methodically. Following a commitment to quality, they strictly control the construction quality of each project, building a strong reputation and trust within the industry.

Capital Structure of CrowdFunz Fund 621

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| CrowdFunz 621 Mortgage | $1,250,000.00 | 55.36% | |

| Borrower Equity | $1,550,000.00 | 44.64% | |

| Total: | $2,800,000.00 | 100.00% | |

- The project has a clear capital structure. According to a third-party appraisal report, the estimated market value of the project is approximately $2,860,000, with a total investment of $2,800,000 after the 621 Fund loan is applied.

- The borrower has invested $1,550,000 in equity, accounting for 55.36% of the total project investment.

- CrowdFunz Fund 621 plans to provide a $1,250,000 first-lien mortgage, representing 44.64% of the total project investment. The Loan-to-cost ratio for the project is below the general industry level.

- CrowdFunz Fund 621 will hold the financial claim of the land and building as collateral, and the key persons of the borrowing will also provide an Unlimited Personal Guarantee.

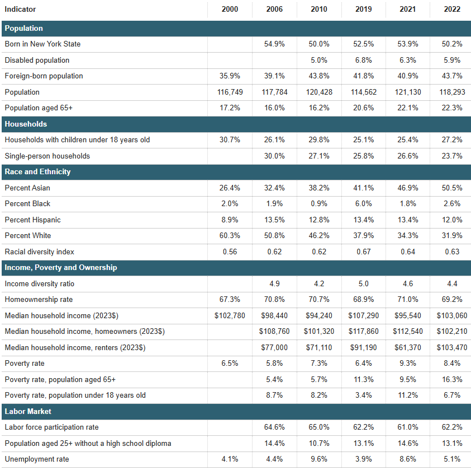

Demographics in Zip Code Area

| Bayside/Little Neck | |

|---|---|

| Population | 118,293 |

| Median Age | 48.91 |

| Born in | New York (50.20%) / Foreign-born (43.70%) |

| Race | Asian (50.50%) / Caucasian (31.90%) / Latino (12.00%) / African American (2.60%) |

| Median Family Income | $103,060 |

| Child-bearing (Under 18) | 27.20% |

| Unemployment Rate | 5.10% |

Little Neck is in Queens between Bayside and Great Neck, covering an area of two square miles. The area offers convenient transportation, with direct access to the Long Island Expressway and efficient public transit that reaches Manhattan in just 30 minutes. Over the past decade, the community has continued to develop, now offering a full range of retail and dining options.

The population in the area has changed rapidly over the past 20 years, with a significant influx of Chinese residents. By the end of 2022, Asians made up 50.20% of the population, while Whites accounted for 31.90%, Hispanics 12.00%, and African Americans 2.60%. This area is a relatively affluent middle-class community with high disposable income.

By the end of 2022, the median household income was approximately $103,060, reflecting residents' strong purchasing power and consumer demand.

* Source: NYU Furman Center, and U.S. Census Bureau, in October 2024

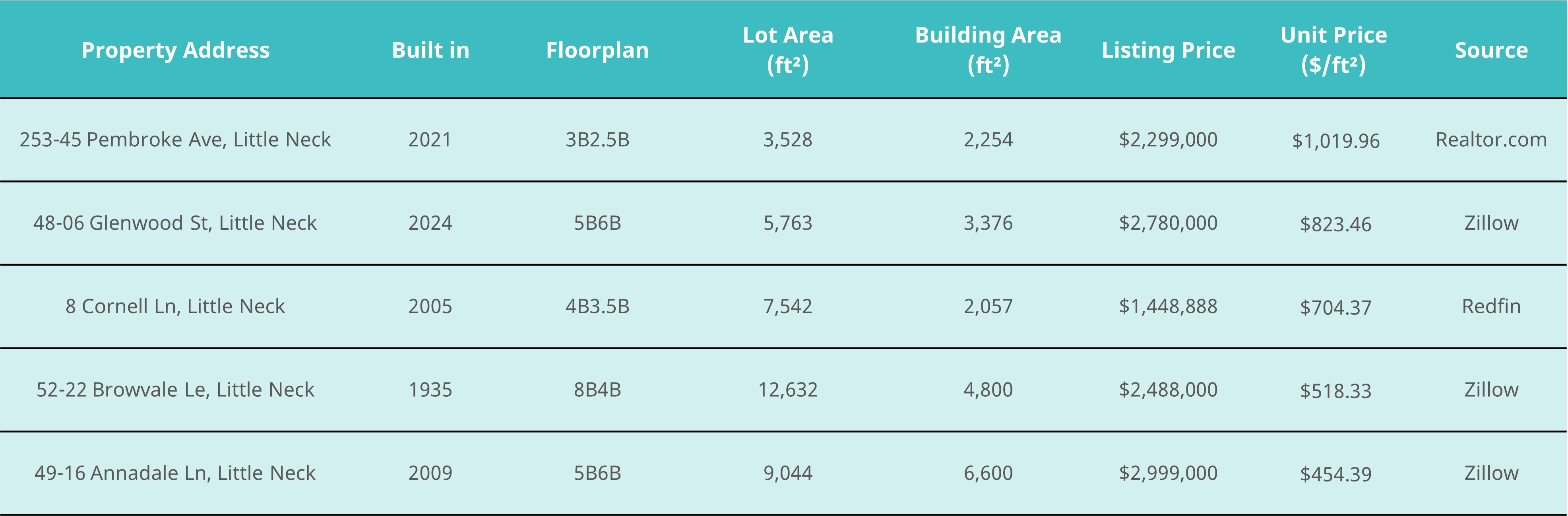

Residential Market Trend

According to data from real estate website PropertyShark, all year-over-year metrics for Little Neck showed growth in the third quarter of 2024. The median home price in the area increased by 12.2% year-over-year, reaching $438,000. The median price per square foot rose by 14.3% to $692, while the number of quarterly transactions increased by 26.7%, totaling 38 units.

Housing in Little Neck mainly consists of single-family detached homes, with a smaller number of townhouses and condominiums. The area is largely owner-occupied, with 69.2% of residents owning their homes for personal use.

* Source: PropertyShark

Valuation Analysis

According to the Appraisal Report provided by Marshall & Stevens, the current valuation of the underlying property is approximately $2,820,000, with an estimated market value of around $2,910,000 upon completion.

Based on the current project progress, CrowdFunz believes that the property value of $2,820,000, as assessed by Marshall & Stevens using a combination of the Cost Approach and Sales Comparison Approach, fairly reflects the market value of the property.

* Source: Appraisal Report provided by Marshall & Stevens

Location

The project is in a prime residential area of Little Neck, just a 5-minute walk from the M/R subway lines and a 5-minute drive from the LIRR, with a 25-minute train ride to Manhattan and a 20-minute drive to both LGA and JFK. Residents can walk to the core commercial district of Queens, with access to shopping, entertainment, and various amenities. Nearby, there are also hospitals, police stations, banks, schools, senior centers, and other essential services.

Transportation

- To LIRR: 0.8 miles(3-min drive)

- To JFK Airport: 12 miles(28-min drive)

- To LGA Airport: 12 miles(25-min drive)

School

This community is part of a top-tier school district in New York City, making it highly competitive among local school districts. According to data from the Great Schools platform, PS94 and PS221 within the district are rated 10 and 9 out of 10, respectively.

Living

The community surrounding the project has a vibrant commercial atmosphere and a lively lifestyle. The project is near the bustling area of Northern Boulevard, offering convenient shopping. As a well-developed community, it boasts banks, supermarkets, clinics, gyms, and shopping centers, providing residents with diverse options for dining and living.

Entertainment

The area around Little Neck includes access to libraries and is close to Flushing Meadows-Corona Park, the Queens Museum of Art, the New York Hall of Science, and the U.S. Open tennis stadium. These diverse recreational facilities make it an ideal location for families with children to settle.

Developer Company: New Empire Corp.

Developer Website: https://www.greatstoneny.com/

- CrowdFunz Fund 621 provides short- to medium-term mortgage for the borrower’s needs. The project’s main construction has been nearly completed, making this debt investment relatively low-risk for default. Upon project completion, the borrower plans to repay the mortgage through either the sale of the property, refinancing with a commercial bank, or cash flow returns from other projects they own.

- CrowdFunz considers the property to be well-positioned in a prime location and aligned with market demand, offering competitive potential once construction is finalized. The project has a sound capital structure, low leverage, and a loan-to-cost ratio (LTC) of only 44.64%, below the industry average. Fund 621 will have a first-lien position, with the borrower also providing an Unlimited Personal Guarantee to further secure the investment.

- Overall, CrowdFunz believes this short-term debt investment through the Fund 621 carries low and manageable risk, making it suitable for investors seeking fixed-income products.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)