Mortgage Debt Fund 622

Type: Debt

Target: $2,000,000

Annual Return: 8.50% - 8.75%

Min-invest Amount: $10,000

Duration: 6 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $2,000,000 |

| Estimated Return | 8.50 – 8.75% Annualized Return*1 |

| Investment Type | First Lien Mortgage |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | December 2024 |

| Investment Timeline | 6 – 18 Months*2 |

| Dividend Schedule | Prepaid Every 6 Month*3 |

*1 8.50% Annualized Return for Investment of 1-19 Units; 8.75% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the 1st dividend period, Borrower owns 2 six-month extension options, and investors will receive dividends accordingly at the same dividend rate.

- The target property is in Bridgeton, St. Louis, Missouri. St. Louis is Missouri's largest metropolitan area, serving as a central transportation hub and the largest port city in the region. The area boasts a thriving, diverse economy with headquarters for six Fortune 500 companies and had a GDP of $209.9 billion in 2022.

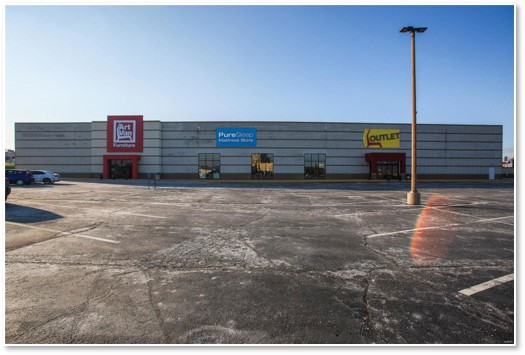

- The target site covers approximately 18,774 square feet, with a total retail space of about 45,134 square feet. Constructed in 1992 and renovated in 2017, all three retail spaces are currently leased. Following a successful acquisition, the borrower plans to renovate the entire property into a trampoline park with commercial potential, aiming to fill a local market gap in children and family entertainment.

| Address | 925 Northwest Plaza Drive, Bridgeton, MO 63074 |

| Area | Bridgeton, St. Louis, Missouri |

| Building Area | 180,774 Sqft |

| Rental Area | 45,134 Sqft |

| Closing Date | December 31st, 2024 |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 1/14/2024 | 12/31/2024 | 6/29/2025 | 181 days | Prepaid Dividend *2 | |

| Second | No Later than 7/14/2025 | 6/30/2025 | 12/30/2025 | 184 days | Extension Option Owned by Developer | |

| Third | No Later than 1/24/2026 | 12/31/2025 | 6/29/2026 | 181 days | Extension Option Owned by Developer*3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, the borrower owns 2 six-month extension options, and investors will receive dividends accordingly at the same dividend rate.

- According to the valuation report provided by Marshall & Stevens, the target property is currently valued at approximately $3,500,000. The property value after acquisition will remain consistent with this current estimate.

- CrowdFunz Fund 622 is providing a $2,000,000 mortgage loan secured by the land and the improvements. The borrower will invest $1,500,000 in equity to acquire the property. Additionally, key individuals from the borrowing party will provide Unlimited Personal Guarantees to further secure investors' interests.

- The property is in Northwest Plaza, Bridgeton, St. Louis, Missouri, which is the largest commercial hub in the suburban area. It is situated near key local thoroughfares, making it just a 20-minute drive to downtown St. Louis, and thereby highly accessible.

- Compared to surrounding areas, the residents are relatively younger, with a median age of 34 years. Families with children constitute 29% of the population, suggesting a strong market potential for the planned trampoline park transformation of the target property.

- The $2,000,000 mortgage loan provided by CrowdFunz Fund 622 will be used entirely for the acquisition of the target property. The target property is currently well-maintained and does not involve construction risks.

- The borrower has sufficient debt repayment capacity. After completing the purchase, the borrower plans to refinance the property either through a government-backed SBA loan or a commercial bank loan. The proceeds from the refinancing, or the cash flow returns from other projects they hold, will be used to repay the loan provided by CrowdFunz Fund 622.

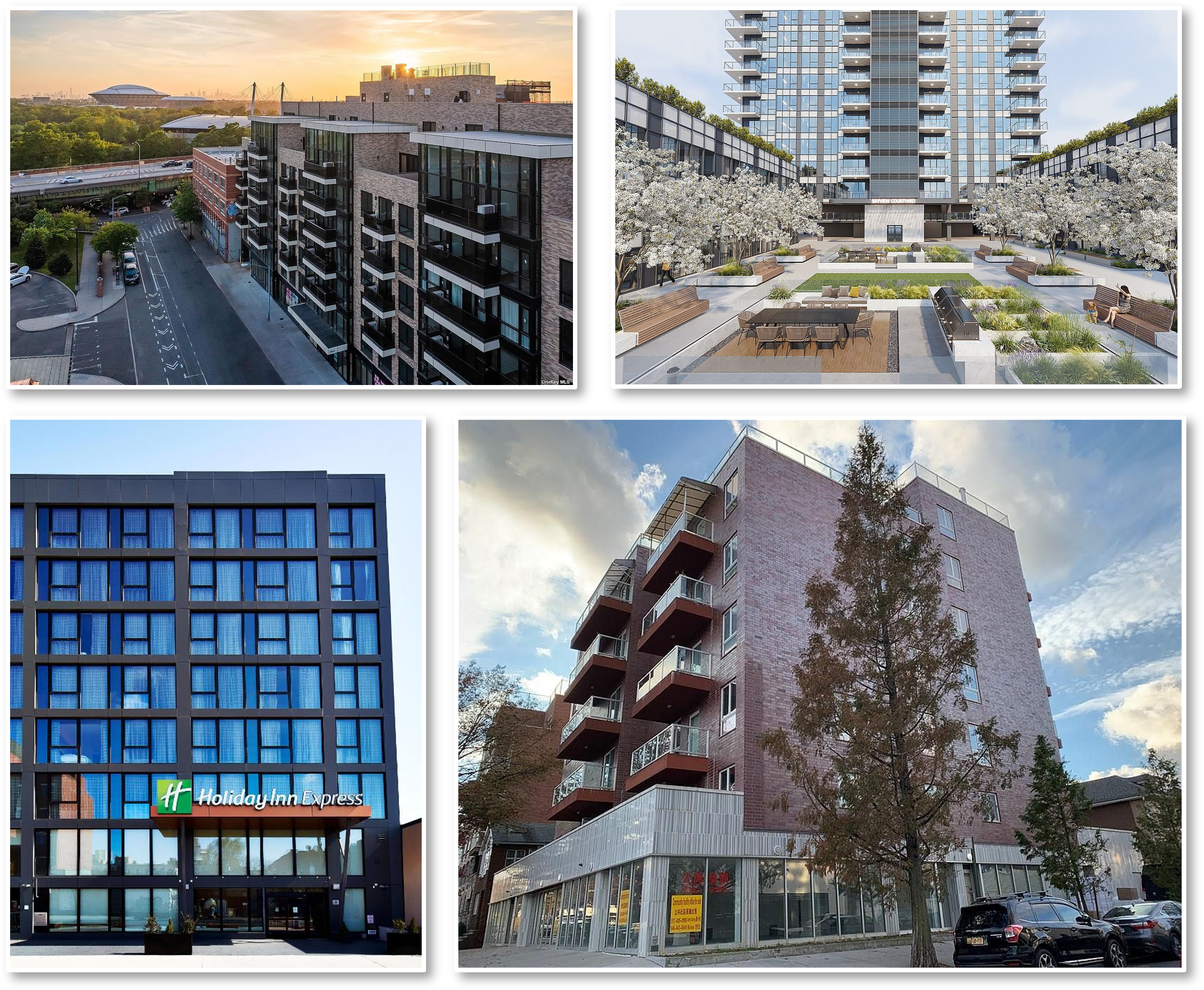

- The borrower has been engaged in the management of restaurant chains, hotel operations, and residential property development and investment in the New York area for over twenty years.

- The restaurant chain operated by the borrowers has seen robust growth in recent years, with strong and stable operating cash flows. They plan to gradually increase investments in hotel and commercial properties, targeting undervalued markets. Through this collaboration, CrowdFunz aims to achieve a win-win outcome for both the borrowers and the investors.

Capital Structure of CrowdFunz Fund 622

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| CrowdFunz 622 Mortgage | $2,000,000.00 | 57.14% | |

| Borrower Equity | $1,500,000.00 | 42.86% | |

| Total: | $3,500,000.00 | 100.00% | |

- The capital structure of the project is clear. Based on the valuation provided by Marshall & Stevens, the market valuation of the property being acquired is approximately $3,500,000.

- The borrowers are contributing $1,500,000 in equity, which represents 42.86% of the total project investment. CrowdFunz Fund 622 will provide a $2,000,000 first-lien mortgage loan, accounting for 57.14% of the total investment. This brings the Loan-to-Cost (LTC) ratio to 57.14%, indicating a healthy level of leverage use.

- CrowdFunz Fund 622 will have the right to use the land and the building as collateral, and key individuals will also provide unlimited personal guarantees. This structure not only secures the loan but aligns the interests of all parties involved, enhancing the project's financial stability and attractiveness to investors.

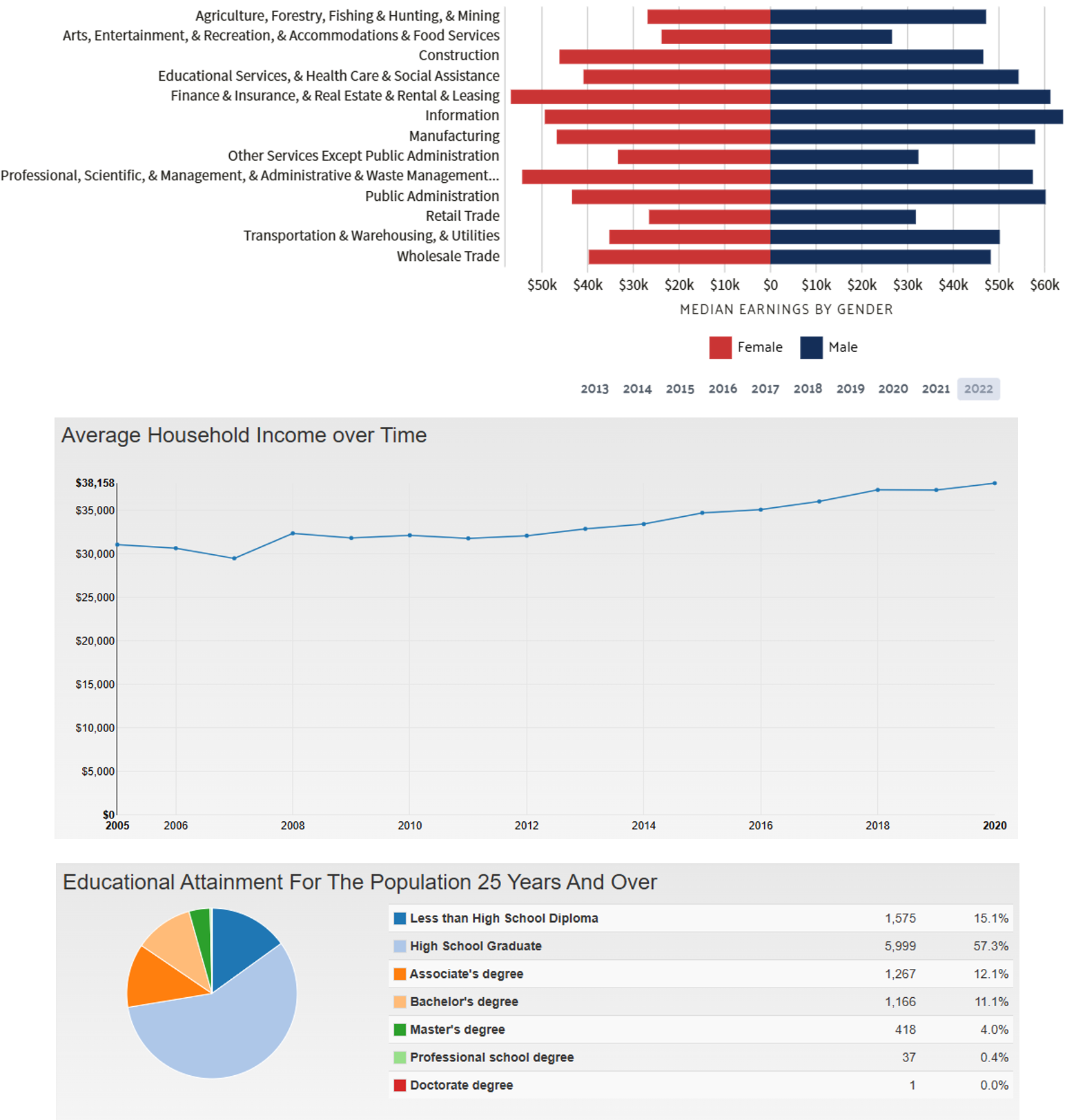

Demographics in Zip Code Area

| Zip Code 63074 | |

|---|---|

| Population | 15,948 |

| Median Age | 34.4 |

| Born Out of State | 6.16 |

| Race | Asian (2.20%) / Caucasian (65.60%) / African American (25.70%) |

| Median Family Income | $35,590 |

| Child-bearing (Under 18) | 29.00% |

| High School Degree | 57.30% |

St. Louis has a population of approximately 281,754 people, with the largest employment sectors being healthcare and social assistance, comprising 17.7% of the workforce. This is followed by the education sector at 11.2%, retail and sales at 8.8%, and manufacturing at 8.5%.

Compared to the higher income levels found on the East and West coasts of the United States, the median household income in St. Louis is relatively lower at $52,941.

As of the end of 2022, the demographic breakdown is approximately 65.60% White, 25.70% African American, and 2.20% Asian.

This area, serving primarily as a residence for the working-class population, reports a lower median family income of about $35,590, and a significant proportion of the population, 57.30%, holds a high school diploma. These demographic details provide insights into the socio-economic backdrop of the area, which is essential for developing and marketing residential and commercial real estate projects effectively.

* Source: United States Zip Codes.org and Data USA, in December 2024

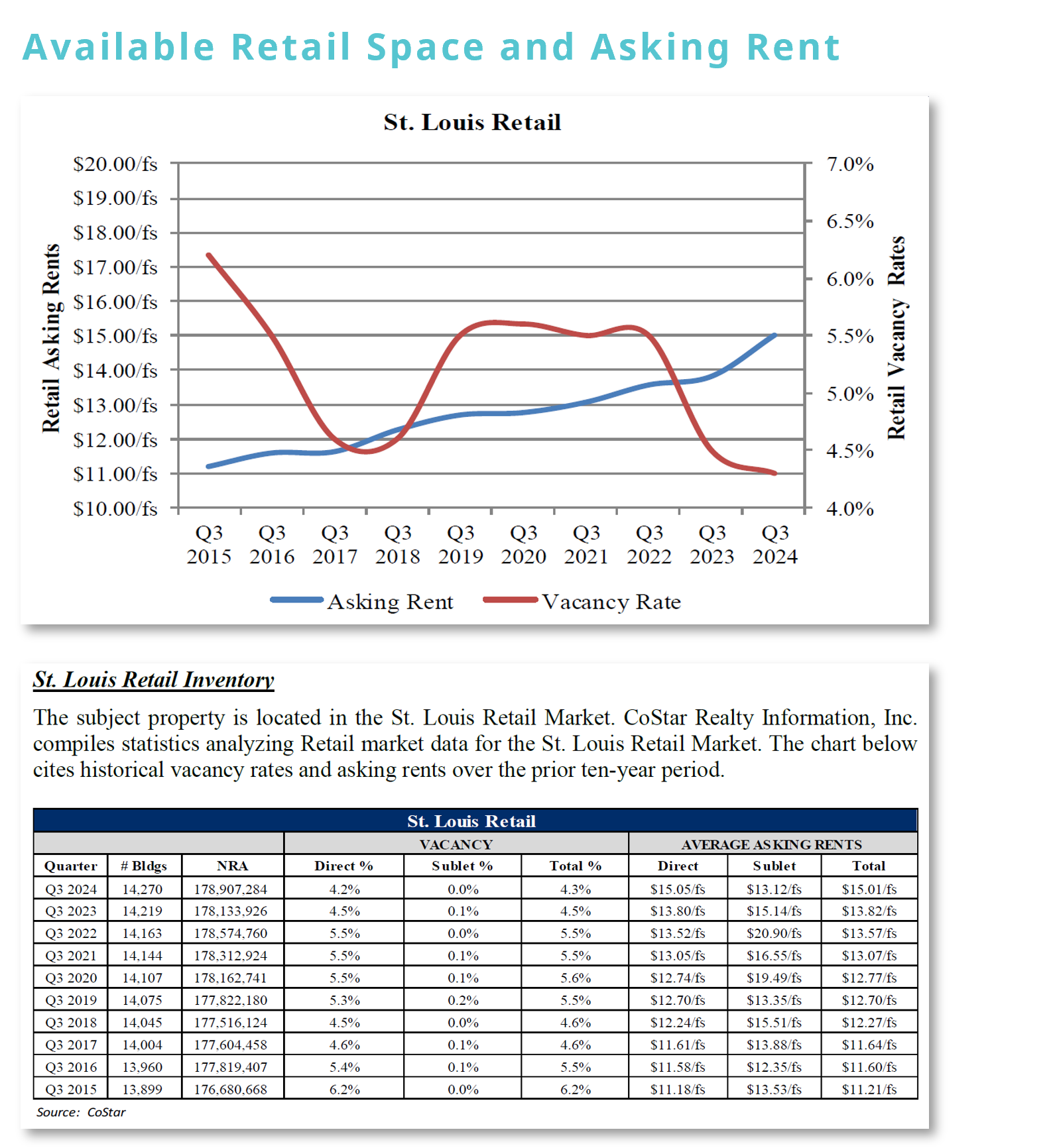

Market Trend for Retail Space Near the Property

According to the valuation report provided by Marshall & Stevens, the retail space in Northwest County, St. Louis, Missouri, saw a positive shift in leasing activity towards the end of 2022 and beginning of 2023. The current average market rent for retail spaces has risen to $15.01 per square foot.

The highest vacancy rate for local retail spaces occurred in 2018, a period marked by the influx of newly built retail properties. By the end of 2022, amidst the conclusion of the pandemic, the vacancy rate peaked at over 15%. However, as the pandemic subsided, the retail leasing market in 2023 and 2024 began to flourish, with the current vacancy rate dropping below 5%.

Despite fluctuations in vacancy rates, the rental prices for retail spaces in the area have not been significantly affected. Over the past five years, rental rates have experienced a gradual and steady increase, with a more notable rise in prices towards the end of 2023. This trend indicates a resilient retail market that has maintained its value growth through varying economic conditions.

* Source: Marshall & Stevens and CoStar

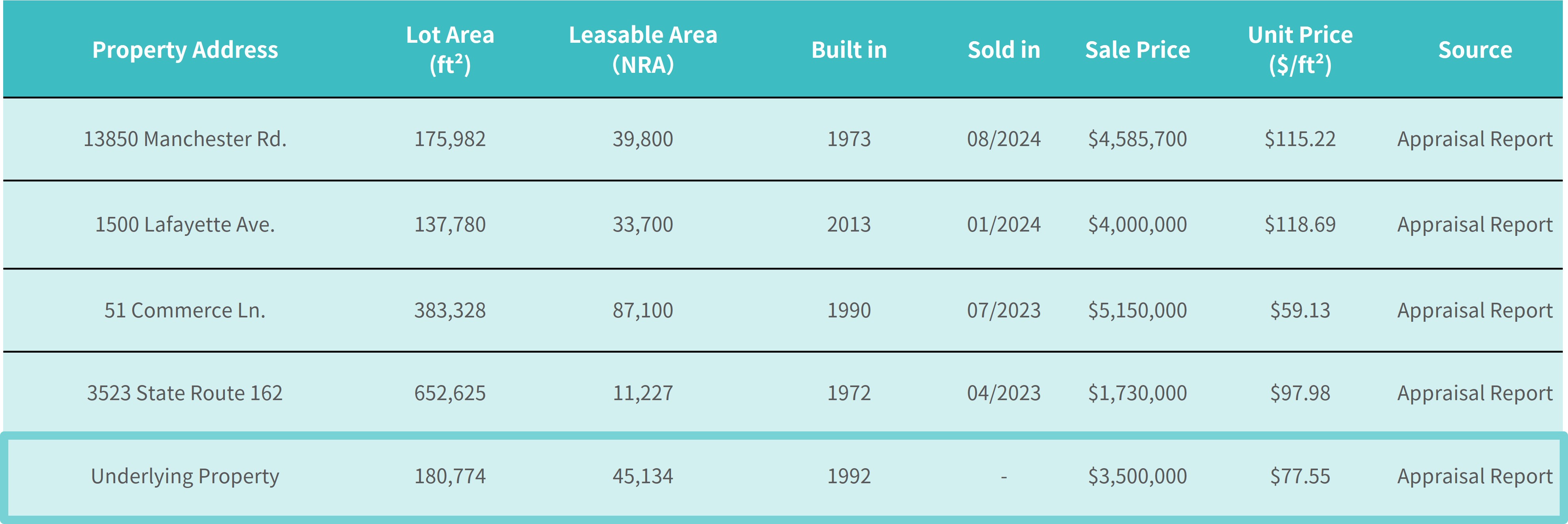

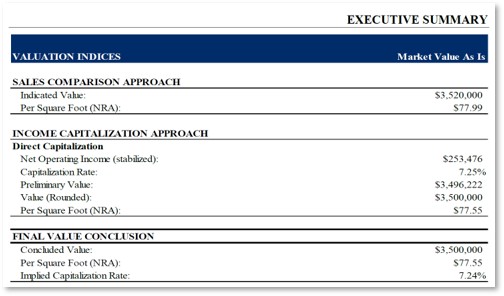

Valuation Analysis of the Property

According to the valuation report provided by Marshall & Stevens, the current valuation of the target property within the project is approximately $3,500,000.00. The property's value post-acquisition is expected to remain consistent with this current appraisal.

CrowdFunz agrees with this valuation, which was derived using a combination of the Sales Comparison Approach and the Income Capitalization Approach. This method considers historical data from similar commercial property transactions recently sold in the area. The assessed value of $3,500,000 is considered reflective of the current market value for the target property, confirming the reliability of the valuation approaches used and supporting the investment decision.

* Source: Appraisal Report provided by Marshall & Stevens

Location

The property is in Northwest Plaza, Bridgeton, St. Louis, Missouri, which is the largest commercial hub in the suburban area. Located near key local transport routes such as N Lindberg Blvd and the Dwight D. Eisenhower Highway, it only takes 5 minutes to reach the I-270 interstate highway. Additionally, downtown St. Louis is just a 20-minute drive away, making the property highly accessible and well-connected to major transport facilities.

Transportation

- N Lindberg Blvd: Near the Property

- Dwight D. Eisenhower Hwy: 2-min driving

- Interstate 270: 5-min driving

Living Facilities

The area has national mega-stores like Lowe’s Outlet Store, Walmart, Kohl’s, The Home Depot, and Menards, which is the largest regional furniture chain store.

This diversity of retail options makes Northwest Plaza a vibrant commercial center, catering to a broad spectrum of consumer needs and preferences, thus enhancing the area's attractiveness for further commercial investment and development.

Entertainment

The Northwest Plaza shopping district, where the project is located, features a wide range of popular American dining chains, including Freddy’s Frozen Custard & Steakburgers, Popeye's, Panda Express, Sherwin Williams, Raising Cane’s, QT, IHOP, McDonald’s, Burger King, and Starbucks, among others.

Developer Company: Vertex Hospitality Group.

Developer Website: https://vertexhg.com/

- CrowdFunz Fund 622 is providing a short-to-mid term mortgage to assist the borrower with the acquisition of target property. The target property is well-maintained, and the project involves no construction risks. The borrower has a strong debt repayment capacity, resulting in a relatively low risk of default after the property acquisition.

- Once the acquisition is completed, the borrower plans to repay the mortgage by refinancing through government-supported SBA loans, commercial bank loans, or cash flow returns from other projects.

- CrowdFunz believes that the target property is well-located and the borrower has strong development capabilities and financial strength. Additionally, the project's capital structure is sound, with a Loan-to-Cost (LTC) ratio of only 57.14%. CrowdFunz Fund 622 will also hold the first lien on the property, and the key persons of the borrower will provide unlimited personal guarantees, further securing the investment. Therefore, CrowdFunz considers the short-to-mid term debt investment to be low risk and well-controlled, making it suitable for investors seeking fixed-income products.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)