Equity Pledge Debt Fund 852

Type: Debt

Target: $1,300,000

Annual Return: 8.25% - 8.50%

Min-invest Amount: $10,000

Duration: 12 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,300,000 |

| Estimated Return | 8.25 – 8.50% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | February 2025 |

| Investment Timeline | 12 – 18 Months*2 |

| Dividend Schedule | Prepaid Every 6 Month*3 |

*1 8.25% Annualized Return for Investment of 1-19 Units; 8.50% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 1 extension option, and investors will receive dividends accordingly at the same dividend rate.

- The property is in Astoria, Queens, New York City, a 10-minute walking from the N/W Astoria-Ditmars metro station and a 15-minute subway ride to Midtown Manhattan. It is also a 5-minute driving to Grand Central Parkway and Highway 278. The area has seen rapid real estate appreciation over the past decade and offers convenient public transportation for commuting to Manhattan and other areas of New York City.

- The property is a four-story condominium building with 24 condominiums, 12 storage spaces, and 16 parking lots. The project began in late 2021 with land acquisition and planning. Construction had been completed, and the condominium offering plan was successfully filed with New York State in August 2024. The project is awaiting a Certificate of Occupancy from the NYC Department of Building, expected in early 2025. Sales has begun in late 2024, with five condominiums under contract.

| Address | 20-08 Steinway Street, Astoria, NY 11105 |

| Area | Astoria, Queens, New York |

| Lot Area | 10,000 Sqft |

| Max FAR | 23,260 Sqft |

| Intended Use | 24 Condominiums, 12 Storage Spaces,16 Parking Lots |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 2/25/2025 | 2/13/2025 | 8/12/2025 | 181 days | Prepaid Dividend *2 | |

| Second | No Later than 8/25/2025 | 8/13/2025 | 2/12/2026 | 184 days | Extension Option Owned by Developer | |

| Third | No Later than 2/25/2026 | 2/13/2026 | 8/12/2026 | 181 days | Extension Option Owned by Developer*3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 12 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the second dividend period, the borrower owns 1 extension options, and investors will receive dividends accordingly at the same dividend rate.

- CrowdFunz Fund 852 will originate a short- to mid-term loan to cover the project's carrying costs and soft costs during the condominium sales phase, assisting the developer in completing unit sales successfully.

- The fund will provide a loan in total of $1,300,000. The underlying project currently has a mortgage in total of $9,550,000. Additionally, key person of the borrower will provide an unlimited personal guarantee for this loan.

- The project is in Astoria, one of Queens' rapidly developing neighborhoods, adjacent to the fast-growing Long Island City. With excellent public transportation access, it is near the N and W metro lines and multiple bus routes, providing convenient transportation to Manhattan, various Queens neighborhoods, and Long Island. The site is just a 10-minute driving from LaGuardia Airport and 25 minutes from JFK International Airport.

- In recent years, Queens has experienced significant growth, with population density catching up to Manhattan’s prime residential areas. The local population has stable and steadily increasing incomes. As the next subway stop after Long Island City, Astoria offers strong investment potential, with rising demand and increasing residential developments, making it a prime area for future growth.

- The developer plans to use the entire short- to mid-term loan from CrowdFunz Fund 852 to cover the project's carrying costs and soft costs during the condominium sales phase.

- Upon successful completion of unit sales, the developer intends to repay the loan using proceeds from the condominium sales.

- The project's developer is a new local real estate firm in New York City. Their first development is The Sophie Condominium at 20-08 Steinway Street. To establish a strong reputation in the Queens market, the developer has prioritized high-quality materials and craftsmanship. The project features mid-to-high-end materials and premium European-brand finishes, aiming to deliver a cost-effective yet high-quality flagship development.

- CrowdFunz Fund 852 is the first cooperation between CrowdFunz and the borrower. Both parties seek to successfully complete the project while providing investors with attractive opportunities to benefit from local real estate market growth.

Capital Structure of CrowdFunz Fund 852

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| Commercial Bank Mortgage | $9,550,000 | 45.48% | |

| CrowdFunz Fund 852 Equity Pledge Loan | $1,300,000 | 6.19% | |

| Equity value | $10,150,000 | 48.33% | |

| Total Capital | $21,000,000 | 100.00% | |

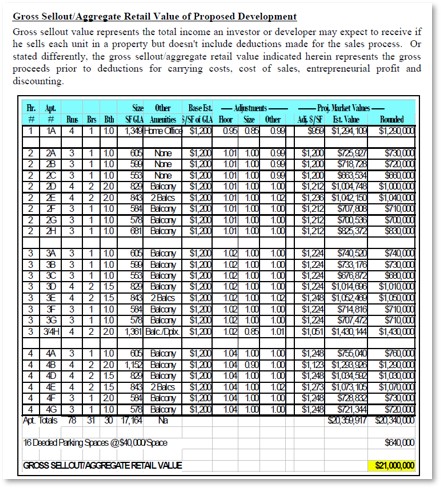

- According to an appraisal report provided by Real Estate Appraisal Solutions, the market value of the property upon completion is estimated at $21,000,000 US dollars.

- In the capital structure of this project, the mortgage originated by commercial bank is in total of $9,550,000, accounting for 45.48% of the total capital; the equity pledge loan issued by CrowdFunz Fund 852 is in total of $1,300,000, representing 6.19% of the total capital. Excluding the loans, the developer's equity value in the project is approximately $10,150,000, or 48.33% of the total capital.

- For this financing, the key person of the borrower will provide an unlimited personal guarantee, committing to pay the principal and interests to the fund on time. In case of repayment delinquencies, CrowdFunz Fund 852 will pursue legal actions to seize the personal assets of the guarantor to repay investors.

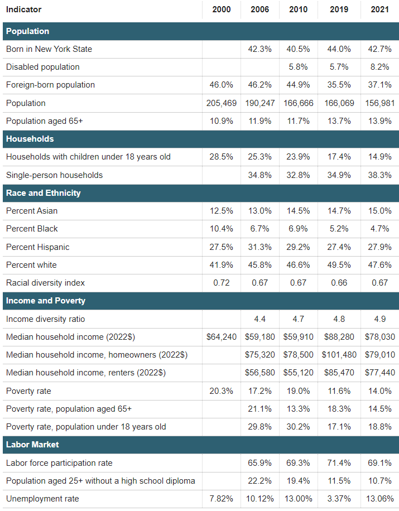

Demographics in Zip Code Area

| Long Island City/Astoria | |

|---|---|

| Population | 156,981 |

| Median Age | 34 |

| Born in | New York State (42.70%) / Out of State (20.20%) / Out of the U.S. (37.10%) |

| Race | Caucasian (47.60%) / Latino (27.90%) / Asian (15.00%) / African American (4.70%) |

| Median Family Income | $78,030 |

| Child-bearing (Under 18) | 14.9% |

| Unemployment Rate | 13.06% |

Long Island City and Astoria have become top choices for high-quality real estate development in New York City. As more projects are established in the area, Long Island City is attracting a growing number of businesses and residents, making it one of the preferred locations for new investors and immigrants.

The population in Long Island City and Astoria is notably younger, consisting mainly of diverse, professional white-collar workers with stable incomes and strong purchasing power. The average resident age is approximately 34 years old, with families having children under 18 making up 14.9% of the population.

The housing market is predominantly rental-based, with an increasing number of luxury rental apartments and condominiums. Housing inventory remains low, demand from potential buyers is strong, and prices continue to rise.

* Source: NYU Furman Center, and U.S. Census Bureau,in February 2025.

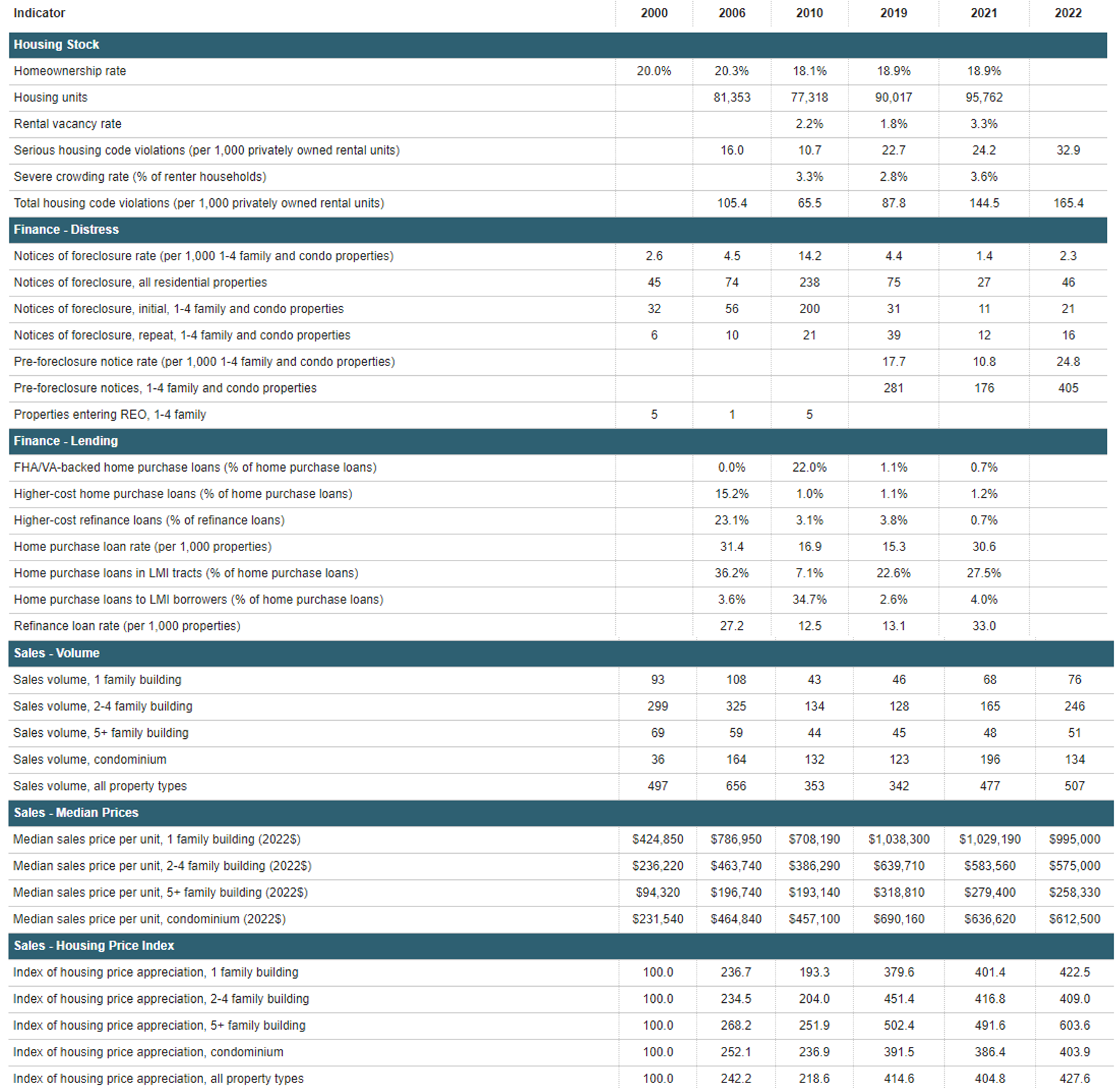

Residential Market Trend in Astoria

According to the latest data from the American Community Survey conducted by the U.S. Census Bureau, as of the end of 2021, the homeownership rate in the Long Island City/Astoria district was 18.90%, with the housing market predominantly consisting of rental apartments. The district had a total of 95,762 registered housing units, with a rental vacancy rate of only 3.30%, outperforming the Queens average.

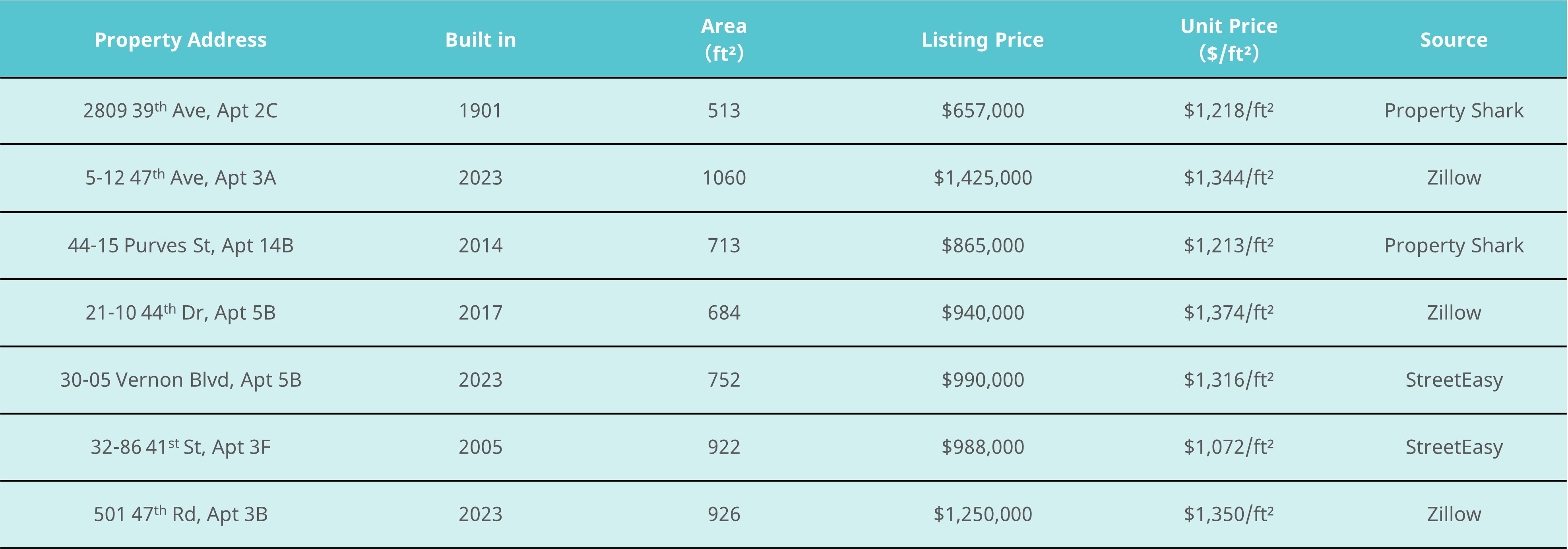

In recent years, the most transacted residential properties in the area have been 2-4 family homes, followed by condominiums. By the end of 2022, 134 condominium units were sold. With the completion of several mid- to high-end condominium projects, housing prices in Long Island City have strengthened, with both median home prices and price per square foot rising significantly. By the end of 2022, the median sales price for single-family homes in the area was $995,000, while condominiums had a median sales price of $612,500.

Since 2010, New York City has rezoned nearly 250 blocks in Astoria, paving the way for larger residential developments near the East River. In recent years, the city's newly planned East River Ferry service has also provided additional commuting options for new residents beyond the subway system.

* Source: NYU Furman Center, in February 2025.

Valuation Analysis of the Property

According to a valuation report provided by Real Estate Appraisal Solutions, the market value of the property upon completion is estimated to be approximately $21,000,000.

Considering market uncertainties, CrowdFunz has conservatively adjusted the estimated price per square foot and projects the property’s market value to range between $19,300,000 and $21,000,000.

After a comprehensive review, CrowdFunz believes that the third-party valuation of $21,000,000 can reflect the property’s actual market value and aligns with the fund’s underwriting standards for loan originations.

* Source: Appraisal Report provided by Real Estate Appraisal Solutions.

Location

The project is in the core area of Astoria, Queens, just across the river from Midtown Manhattan. It has excellent public transportation, being close to the N and W subway lines and several bus routes. The location offers quick and convenient connections to Manhattan, Queens, and Brooklyn. it is only 10 minutes driving to LaGuardia Airport and 25 minutes driving to JFK International Airport.

Transportation

- Subway: N/W (5-min walking to station)

- To Midtown: 15-min subway

- To JFK: 25-min driving

- To LGA: 10-min driving

School

Astoria has a well-established educational system, with multiple elementary, middle, and high schools located within the area to meet residents' educational needs. Additionally, the neighborhood is home to several vocational training institutions, providing young professionals with opportunities for career development and skill enhancement.

Living Facilities

The area offers a wide range of restaurants and supermarkets catering to the diverse needs of residents. Most residential properties in the neighborhood consist of traditional rental units and co-ops, providing both longtime homeowners and newly settled young New Yorkers with a convenient and comfortable living environment.

Entertainment

The development of entertainment and recreational facilities around the project continues to cater to the needs of the younger generation. Various parks, sports centers, and museums are within walking distance, providing ample leisure options. Additionally, the area's convenient transportation network helps ease the commuting burden for professionals working in Manhattan.

Borrower:2008 Steinway LLC.

Website:https://sophiecondos.com/

General Contractor:Efin Management Corp.

Website:https://www.efinmanagement.com/

- CrowdFunz Fund 852 is providing a short- to mid-term mezzanine loan to the developer, covering carrying costs and soft costs during the condominium sales phase. The loan will be repaid using the proceeds from the sale of condominium units.

- The project has already entered the sales phase, eliminating construction risk. As of February 2025 , five condominium units have been under contract, and the sales progress remains strong.

- The underlying project has a low debt leverage, reducing default risk. The current Loan-to-Value (LTV) ratio is 51.67%, which is below industry standards for real estate development projects, indicating strong developer equity.

- Located in the core areas of Astoria, Queens, the property benefits from prime location and excellent transportation access. Astoria is a well-established residential neighborhood that has attracted increasing real estate development due to its strategic location and accessibility.

- Given these factors, CrowdFunz considers Fund 852 to have low default risk, making it suitable for investors seeking stable, fixed-income products.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)