Mortgage Debt Fund 623

Type: Debt

Target: $4,750,000

Annual Return: 8.25% - 8.50%

Min-invest Amount: $10,000

Duration: 6 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $4,750,000 |

| Estimated Return | 8.25 – 8.50% Annualized Return*1 |

| Investment Type | First Lien Mortgage |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | March 2025 |

| Investment Timeline | 6 – 18 Months*2 |

| Dividend Schedule | Prepaid Every 6 Month*3 |

*1 8.25% Annualized Return for Investment of 1-19 Units; 8.50% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the 6th dividend period, Borrower owns 2 six-month extension options, and investors will receive dividends accordingly at the same dividend rate.

- This project property is in the Cypress Hills area of Brooklyn, near Highland Park and close to the J train’s Cleveland St station (about a 5-minute walking) and Broadway Junction (about a 15-minute walking). It is also near major roads Jackie Robinson Pkwy and NY-27.

- The land was purchased in March 2023, construction has topped out, and the elevator has been installed. Full completion is expected to be completed in 2025, with a Temporary Certificate of Occupancy projected by late 2025 or early 2026, and leasing is set to begin in 2026. The 12-story rental building will include 49 rental apartments, 1,502 square feet of retail space, and 25 bicycle spots.

| Address | 3051 Atlantic Avenue, Brooklyn, New York 11208 |

| Area | Cypress Hills, Brooklyn, New York |

| Building Area | 40,700 Sqft |

| lot Area | 4,814 Sqft |

| Intended Use | 49 Rental Units, 1,502 Sqft of Retail Space, 25 Bicycle Spots |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 04/10/2025 | 03/26/2025 | 03/31/2025 | 6 days | Paid Monthly*2 | |

| Second | No Later than 05/10/2025 | 04/01/2025 | 04/30/2025 | 30 days | Paid Monthly | |

| Third | No Later than 06/10/2025 | 05/01/2025 | 05/31/2025 | 31 days | Paid Monthly | |

| fourth | No Later than 07/10/2025 | 06/01/2025 | 06/30/2025 | 30 days | Paid Monthly | |

| fifth | No Later than 08/10/2025 | 07/01/2025 | 07/31/2025 | 31 days | Paid Monthly | |

| sixth | No Later than 09/10/2025 | 08/01/2025 | 08/31/2025 | 31 days | Paid Monthly | |

| seventh | No Later than 10/10/2025 | 09/01/2025 | 09/30/2025 | 30 days | Extension Option Owned by Borrower*3 | |

| eighth | No Later than 11/10/2025 | 10/01/2025 | 10/31/2025 | 31 days | Extension Option Owned by Borrower | |

| Ninth | No Later than 12/10/2025 | 11/01/2025 | 11/30/2025 | 30 days | Extension Option Owned by Borrower | |

| Tenth | No Later than 01/10/2026 | 12/01/2025 | 12/31/2025 | 31 days | Extension Option Owned by Borrower | |

| Eleventh | No Later than 02/10/2026 | 01/01/2026 | 01/31/2026 | 31 days | Extension Option Owned by Borrower | |

| Twelfth | No Later than 03/10/2026 | 02/01/2026 | 02/28/2026 | 28 days | Extension Option Owned by Borrower | |

| Thirteenth | No Later than 04/10/2026 | 03/01/2026 | 03/31/2026 | 31 days | Extension Option Owned by Borrower | |

| Fourteenth | No Later than 05/10/2026 | 04/01/2026 | 04/30/2026 | 30 days | Extension Option Owned by Borrower | |

| Fifteenth | No Later than 06/10/2026 | 05/01/2026 | 05/31/2026 | 31 days | Extension Option Owned by Borrower | |

| Sixteenth | No Later than 07/10/2026 | 06/01/2026 | 06/30/2026 | 30 days | Extension Option Owned by Borrower | |

| Seventeenth | No Later than 08/10/2026 | 07/01/2026 | 07/31/2026 | 31 days | Extension Option Owned by Borrower | |

| Eighteenth | No Later than 09/10/2026 | 08/01/2026 | 08/31/2026 | 31 days | Extension Option Owned by Borrower | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the 6th dividend period, the borrower owns 2 six-month extension options, and investors will receive dividends accordingly.

- CrowdFunz Fund 623 will partner with Cross River Bank to invest in the project’s Special Purpose Vehicle (SPV), providing a total of $17.75 million in first-lien mortgage financing. Of this amount, the 623 Fund will contribute $4.75 million and Cross River Bank will provide $13 million.

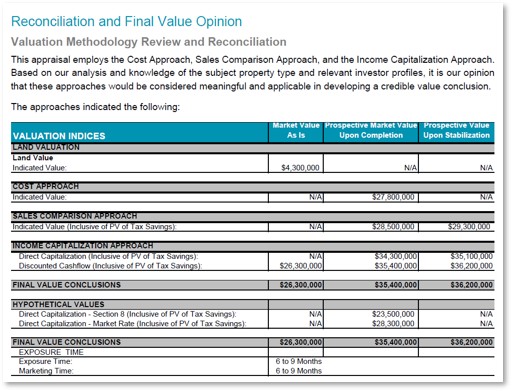

- According to the Appraisal Report provided by Cushman & Wakefield, the current market value of the property is approximately $26.3 million, and it is projected to be worth around $36.2 million once completed and rental stabilized.

- Located in Brooklyn’s Cypress Hills neighborhood near Highland Park, this property enjoys a pleasant environment and a traditional local community with supermarkets, convenience stores, and other neighborhood shops within walking distance. It is only ten blocks away from the East New York transportation hub.

- Sited on the north side of Atlantic Avenue, it’s a five-minute walking to the J train at Cleveland Street and a 15-minute walking to the Broadway Junction. The site also has convenient access to key roadways, including Jackie Robinson Pkwy and NY-27.

- The borrower plans to use the major borrowing proceeds provided by CrowdFunz Fund 623 to repay its current loan and the rest to cover the construction and soft costs.

- After the project obtains a Temporary Certificate of Occupancy (TCO), the borrower expects to repay Fund 623 using either a new commercial bank loan or returns generated from its other projects.

- The borrower is a traditional Jewish family firm in New York City with decades of experience and strong capabilities in residential development. They have completed 78 real estate projects across the city’s five boroughs, primarily focusing on multifamily housing, long-term rental apartments, and small to mid-sized hotels.

- Their portfolio is valued at over $1.45 billion and includes around 1,890 completed units. Current properties generate more than $3.68 million in monthly revenue from rentals and hotels, reflecting the borrower’s strong financial health and reliable debt repayment capacity.

Capital Structure of CrowdFunz Fund 623

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| CrowdFunz Fund 623 First Lien Mortgage | $4,750,000 | 18.06% | |

| Cross River Bank First Lien Mortgage | $13,000,000 | 49.43% | |

| Borrower Equity Contribution | $8,550,000 | 32.51% | |

| Total Capital | $26,300,000 | 100.00% | |

- According to the appraisal report provided by Cushman & Wakefield, the property’s current value is about $26.3 million and is expected to reach $36.2 million once construction is completed and rental is stabilized.

- The capital structure includes $4.75 million from CrowdFunz Fund 623 (18.06%), $13 million from Cross River Bank (49.43%), and $8.55 million in borrower equity (32.51%). This results in a 67.49% loan-to-value ratio which is considered within standard industry levels.

- The borrower, with strong financial capabilities, will personally guarantee the loan, and the key individual involved has a net worth exceeding $366 million.

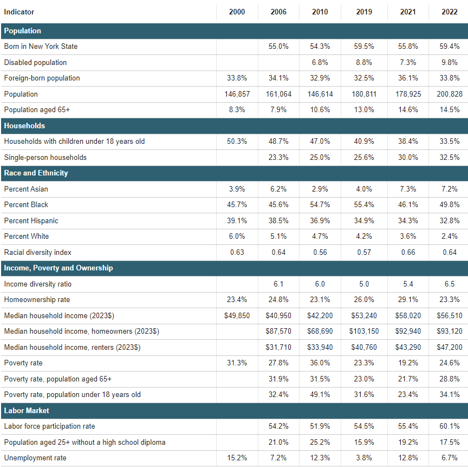

Demographics in Zip Code Area

| East New York/Starrett | |

|---|---|

| Population | 200,828 |

| Median Age | 35.40 |

| Born in | New York State (59.40%) / Out of the U.S. (33.80%) |

| Race | African American (49.80%) / Latino (32.80%) / Asian (7.20%) / Caucasian (2.40%) |

| Median Family Income | $56,510 |

| Child-bearing (Under 18) | 34.10% |

| Unemployment Rate | 6.70% |

Cypress Hills is part of the East New York/Starrett City administrative district in Brooklyn, with a highly diverse population including African American, Dominican, Puerto Rican, South Asian, Caribbean, and Caucasian residents. African Americans make up about 49.8% of the district’s population, followed by Latinx at 32.8%, while Asian and white residents are smaller groups at 7.2% and 2.4%, respectively.

Over the past decade, an influx of new immigrants has lowered the median age to around 35. Approximately 33.5% of households have children, and homeownership is only 23.3%, reflecting a predominantly rental market. The area has seen significant population growth in the last ten years, accompanied by steady increases in both property values and rental rates.

* Source: NYU Furman Center and U.S. Census Bureau, in February 2025.

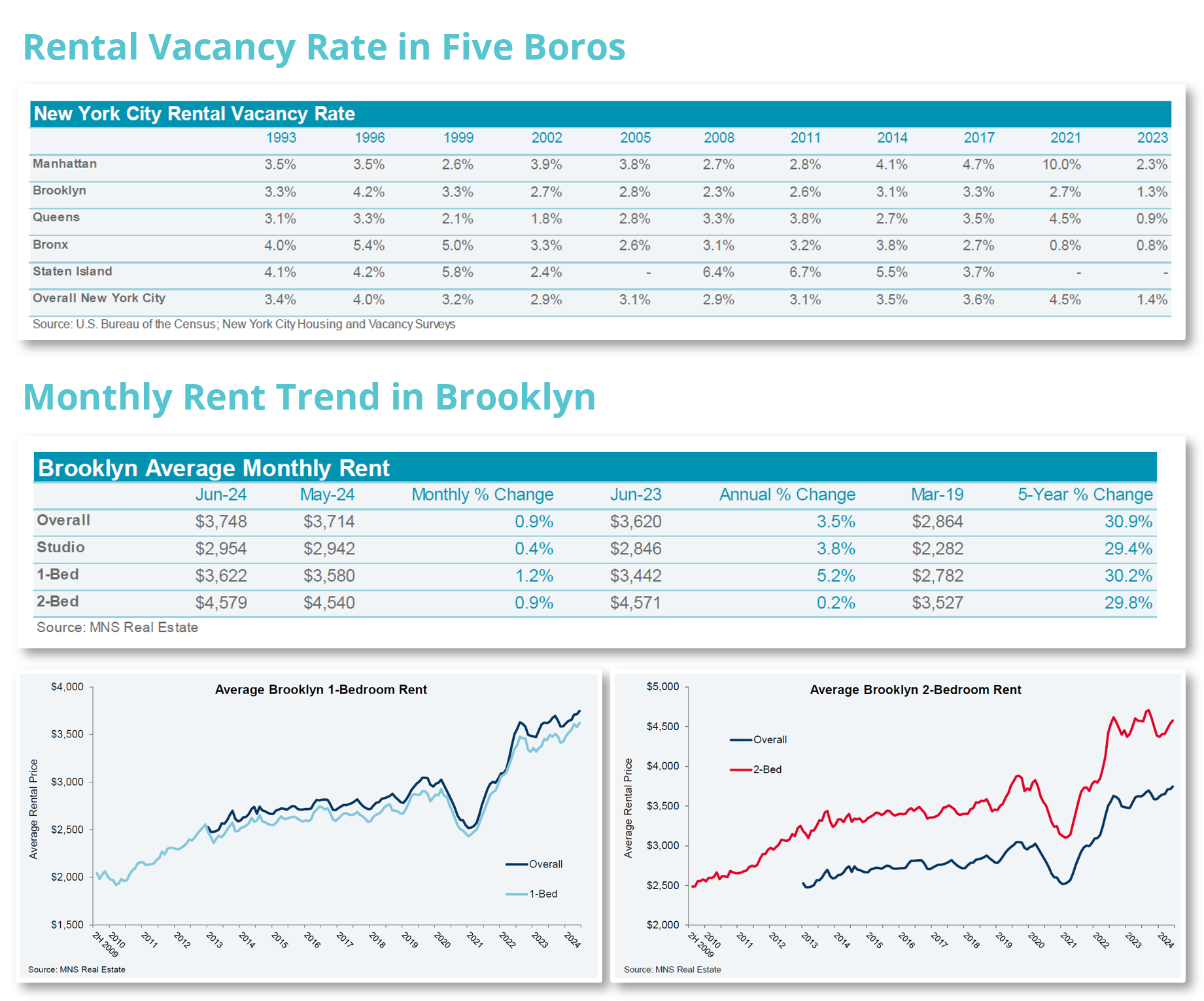

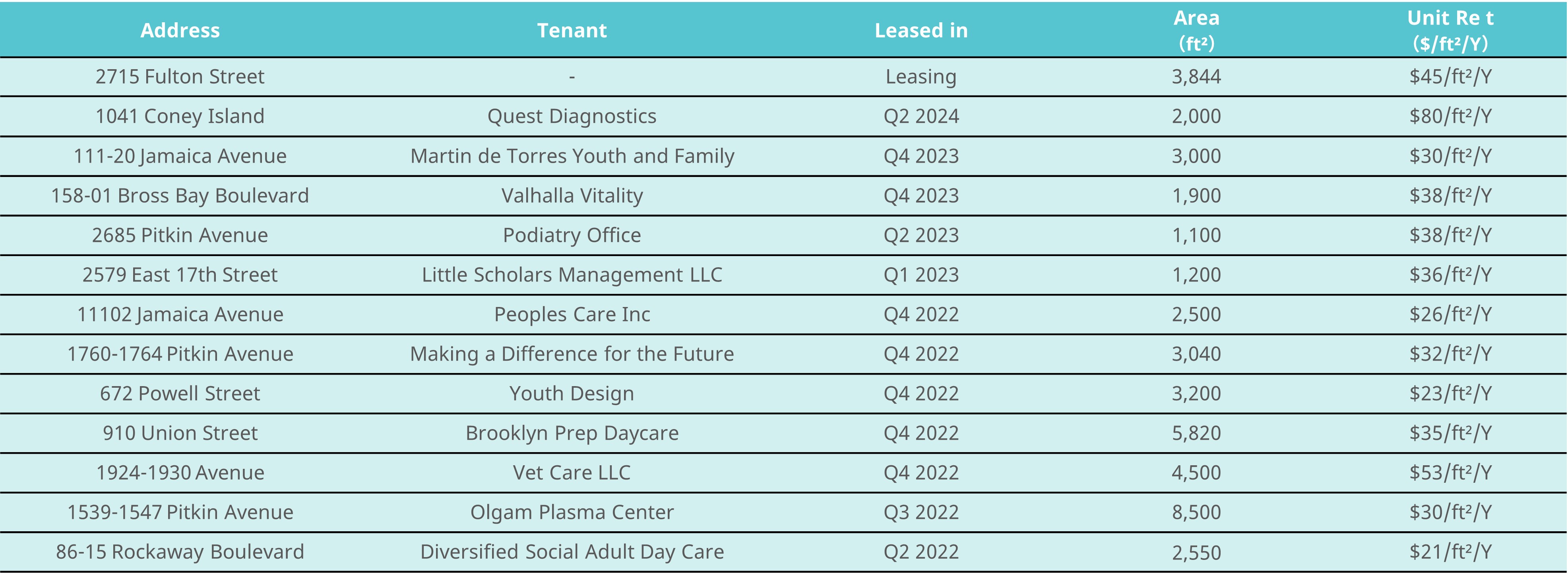

Residential Market in Cypress Hill, Brooklyn

Cypress Hills lies in the eastern part of Brooklyn’s East New York area, a densely populated region where over half the land is dedicated to various forms of residential housing. Older industrial clusters are found in the northwest and southern sections, while commercial and retail spaces are mainly located along major avenues. New developments also tend to concentrate along these principal roads.

According to the appraisal report provided by Cushman & Wakefield, Brooklyn’s apartment vacancy rate is about 1.3%, indicating a tight rental market. The proposed 12-story rental building in Cypress Hills is expected to be highly competitive, offering affordable units—an attractive option for new immigrants seeking cost-effective housing—alongside excellent transportation access. As a result, the project is well-positioned for stable, long-term rental income.

* Source: Appraisal Report provided by Cushman & Wakefield.

Valuation Analysis

The project involves a 12-story rental apartment building with 49 units, 1,502 square feet of retail space, and 25 bicycle spots. Purchased in March 2023, the property’s main structure has already topped out. The construction is expected to be completed in 2025, and the Temporary Certificate of Occupancy is expected to be obtained by late 2025 or early 2026.

According to the appraisal report provided by Cushman & Wakefield, the current unfinished property is valued at $26.3 million, and once rental stabilized post-completion, the property is expected to reach $36.2 million valuation. CrowdFunz agrees with Cushman & Wakefield’s valuation of $26.3 million under the income capitalization approach, given the project’s current valuation.

* Source: Appraisal Report provide by Cushman & Wakefield.

Location

The property is in Cypress Hills, Brooklyn, near the Highland Park green space. It’s a pleasant area with traditional local neighborhoods, and supermarkets, convenience stores, and other amenities within walking distance. East New York, a key district in Brooklyn, is just over ten blocks away.

Transportation

- Subway: Metro J/Z lines

- Train: LIRR East New York Station

- To JFK: 5.1 miles(about 15-minute driving)

- To LGA: 10.9 miles (about 30-minute driving)

School

Cypress Hills is part of New York City’s District 19, a traditional residential area offering abundant school resources, including 36 public and private elementary and middle schools. Known for its diverse student population, standout local options include P.S. 65, P.S. 108 Sal Abbracciamento, and the private Fresh Creek School.

Living Facilities

Cypress Hills, part of Brooklyn’s East New York area, is a traditional residential neighborhood that began developing in the mid-17th century. It has a well-established commercial district serving the local community. The area’s population is predominantly Latinx and African American, and it is known for its many Jamaican-style restaurants.

Entertainment

The Cypress Hills area offers libraries, community centers, and easy access to Highland Park. The nearby Gateway Center, opened in 2002, is a popular shopping destination. Following a 2016 rezoning, many mid- to high-end residential projects and new residents have arrived, along with gyms and leisure venues popular among younger demographics.

Developer Company: 3051 ATLANTIC BX LLC.

- CrowdFunz Fund 623 is providing a short-to-medium term mortgage loan to the borrower in partnership with Cross River Bank to moderate the risks. Upon project completion, the borrower plans to repay the loan originated by Fund 623 either through a new refinancing or cash flow from other existing properties.

- With the borrower’s strong personal net worth, exceeding $366 million, and a 67.49% loan-to-value ratio which is considered within standard industry levels, the risk of default is considered low.

- Sited in the prime location of Cypress Hills, Brooklyn, the property benefits from favorable geography, strong transportation links, and growing real estate investment in the area. Overall, CrowdFunz believes that the short-term debt investment of CrowdFunz Fund 623 carries relatively low, manageable risks and is suitable for investors seeking fixed-income opportunities.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)