Equity Pledge Debt Fund 853

Type: Debt

Target: $1,350,000

Annual Return: 8.25% - 8.50%

Min-invest Amount: $10,000

Duration: 6 – 24 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $1,350,000 |

| Estimated Return | 8.25 – 8.50% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | April 2025 |

| Investment Timeline | 6 – 24 Months*2 |

| Dividend Schedule | Prepaid Every 6 Month*3 |

*1 8.25% Annualized Return for Investment of 1-19 Units; 8.50% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 3 extension options, and investors will receive dividends accordingly at the same dividend rate.

- This project is in the heart of Flushing, Queens, New York City, adjacent to Main Street, a major thoroughfare. Flushing has become one of the fastest-growing areas in NYC over the past 20 years, with convenient public transportation, proximity to LaGuardia Airport (LGA) and Citi Field, and a large Chinese population that has driven demand for Chinese-speaking medical services.

- The property is an 8-story community facility building with 12 commercial condo units designed for medical offices. The developer acquired the site at a low cost in 2017, demolished the original two-story structure, and completed construction in late 2021. The condominium offering plan of the property was approved, and the Certificate of Occupancy has been issued. Currently, two units have already been sold under contract.

| Address | 133-20 41st Road, Flushing, NY 11135 |

| Area | Flushing, Queens, New York |

| Lot Area | 5,000 Sqft |

| Max FAR | 29,563 Sqft |

| Intended Use | 12 Medical Office Units |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Dividend Date *1 | Counting Date | Ending Date | Dividend Period | Notes | |

| First | No Later than 5/15/2025 | 4/30/2025 | 10/30/2025 | 184 days | Prepaid Dividend *2 | |

| Second | No Later than 11/15/2025 | 10/31/2025 | 4/29/2026 | 181 days | Extension Option Owned by Developer | |

| Third | No Later than 5/15/2026 | 4/30/2026 | 10/30/2026 | 184 days | Extension Option Owned by Developer*3 | |

| Forth | No Later than 11/15/2026 | 10/31/2026 | 4/29/2027 | 181 days | Extension Option Owned by Developer*3 | |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the second dividend period, the borrower owns 3 extension options, and investors will receive dividends accordingly at the same dividend rate.

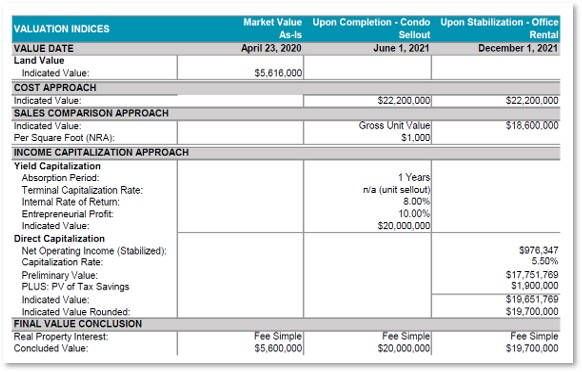

- According to the third-party valuation report provided by Cushman & Wakefield, the property's current market value is approximately $20,000,000.

- The short-term loan originated by CrowdFunz Fund 853 is secured by 100% equity interest in the project entity, currently valued at around $11,050,000. In addition, the key persons of the project provide unlimited personal guarantees for the borrowing.

- The property is in the heart of Flushing, directly above the Q58 bus stop, a 10-minute driving from LaGuardia Airport (LGA), and just a 5-minute walking to the Main Street subway station. Its prime location makes it ideal for medical offices serving the Chinese community.

- As the largest Chinese community in the U.S. East Coast, Flushing has seen rapidly growing demands for healthcare services—not only locally, but also from Chinese-speaking populations across New York City and surrounding areas. Most existing medical offices in Flushing are operating at full capacity, indicating strong market potential for new peer units.

- The borrower plans to use the loan from CrowdFunz Fund 853 to repay existing debt and cover carrying costs during the final sales phase of the project. CrowdFunz has chosen a fully constructed and completed building as collateral to help mitigate investment risks.

- The loan repayment is expected to come from the proceeds of future medical office unit sales or cash flows from the borrower’s other real estate holdings.

- As a family-run business deeply rooted in the local market, the borrower began with small-scale residential projects and now owns or has developed over 200,000 square feet of commercial and residential space. It holds a strong reputation within New York’s Chinese real estate industry community and has seasoned knowledge of the Queens market.

- The borrower has successfully collaborated with numerous CrowdFunz funds—804, 807, 809, 812, 818, 822, 823, 617, 827, 841, 843, 619, and 850—all of which have met their repayments and interest obligations on time, demonstrating solid creditworthiness.

Capital Structure of CrowdFunz Fund 853

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| Commercial Bank Mortgage | $7,600,000 | 38.00% | |

| CrowdFunz Fund 853 Equity Pledge Loan | $1,350,000 | 6.75% | |

| Equity value | $11,050,000 | 55.25% | |

| Total Capital | $20,000,000 | 100.00% | |

- The collateral for the CrowdFunz Fund 853 loan is a completed medical office building in Flushing developed and owned by the borrower. The project has obtained both the Condominium Offering Plan approval and a Certificate of Occupancy from the Department of Building in New York City.

- According to the third-party appraisal, the property is valued at approximately $20,000,000. Existing mortgage issued by Commercial Bank totals in $7,600,000, and the loan issued by CrowdFunz Fund 853 is $1,350,000. After deducting both loans, the borrower’s equity value in the project stands at around $11,050,000, resulting in a Loan-to-value (LTV) ratio of 44.75%.

- Additionally, the borrower's key persons provide unlimited personal guarantees, committing to full repayment of principal and interest. In case of default, CrowdFunz Fund 853 reserves the right to pursue legal claims against the guarantor’s personal assets.

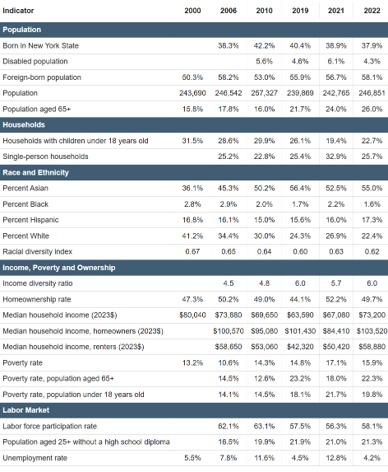

Demographics in Zip Code Area

| Flushing/Whitestone | |

|---|---|

| Population | 246,851 |

| Median Age | 47 |

| Born in | New York (37.90%) / Out of the U.S. (58.10%) |

| Race | Asian (55.00%) / Caucasian (22.40%) / Latino (17.30%) / African American (1.60%) |

| Median Family Income | $73,200 |

| Child-bearing (Under 18) | 22.70% |

| Unemployment Rate | 4.20% |

Flushing has been one of the fastest-growing neighborhoods in New York City over the past 20 years, thanks to its convenient transportation and proximity to LaGuardia Airport, attracting many Asian immigrants.

The area is highly diverse, with Asian residents making up 55% of the population, followed by White (22%) and Hispanic (17%) residents. Most residents are middle-aged, working families with stable incomes, and the average age is around 47. The local unemployment rate is low, at just 4%.

In the past decade, Flushing has seen rapid growth, with a surge of new Asian immigrants fueling strong demand in the rental market. Low housing inventory combined with high buyer interest has driven steady increases in local real estate prices.

* Source: NYU Furman Center, and U.S. Census Bureau,in April 2025.

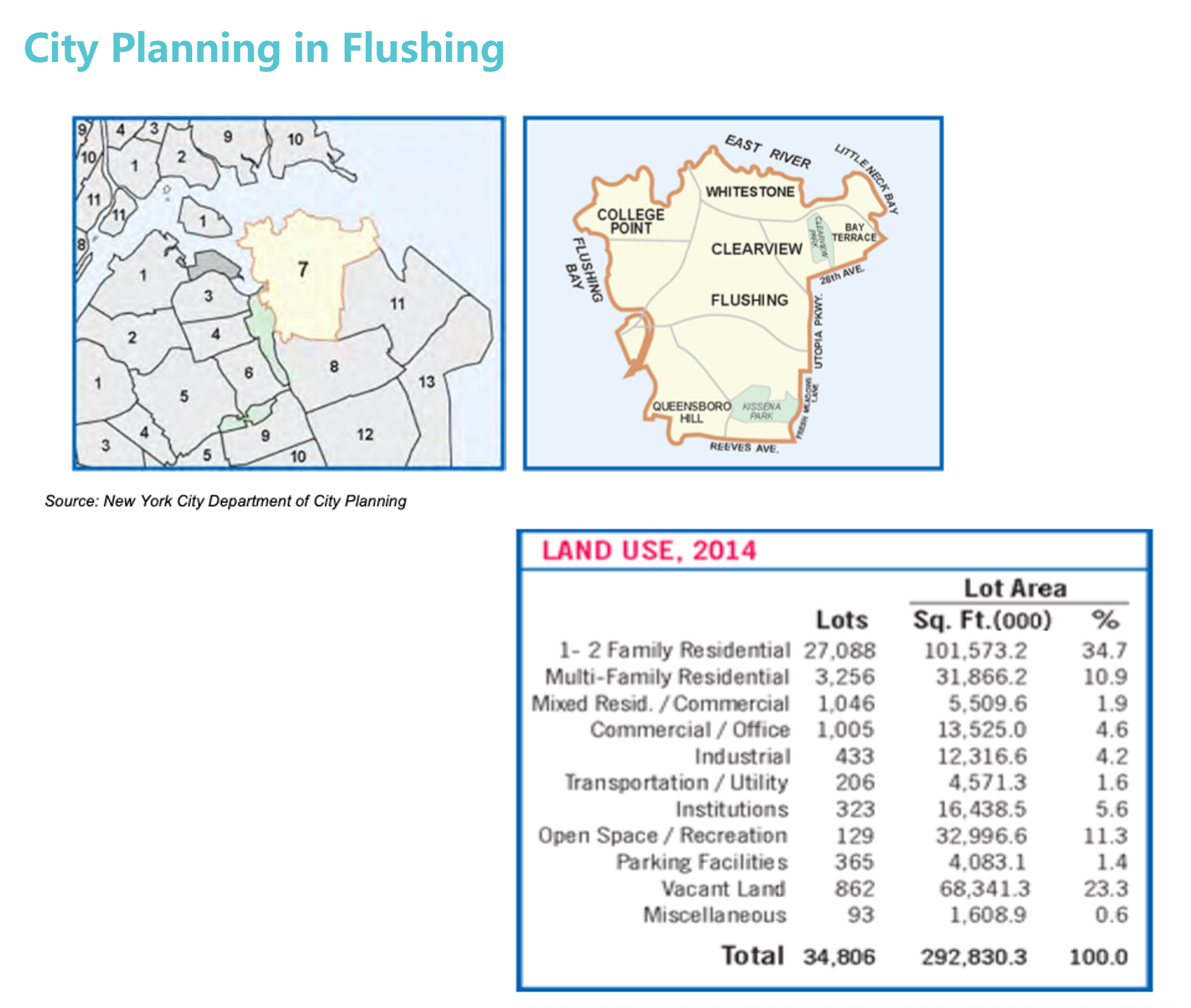

Residential Market Trend in Flushing

According to the third-party valuation report provided by Cushman & Wakefield, Flushing is currently the fourth-largest commercial hub in New York City—after Midtown Manhattan, Downtown Manhattan, and Downtown Brooklyn. The intersection of Main Street and Roosevelt Avenue, near the Flushing–Main Street 7 subway station, is one of the busiest pedestrian crossings in the city. The report estimates that around 50,000 commuters pass through the Flushing transit hub daily, including subway, bus, and train traffic.

Despite growing demand, commercial properties such as medical offices make up only 4.6% of zoning based on land use in Flushing, while 1–2 family homes account for 34.7% and multifamily buildings account for 10.9%. The rising Chinese-speaking population continues to drive up demand and prices for commercial space, especially for services tailored to the Asian community.

This population growth, combined with the area's self-sustaining, Chinese-speaking business ecosystem, has made Flushing a unique and resilient commercial district. Its real estate market is largely driven by strong local demand and remains relatively insulated from broader citywide fluctuations, with property prices rising steadily.

* Source: Appraisal Report provided by Cushman & Wakefield.

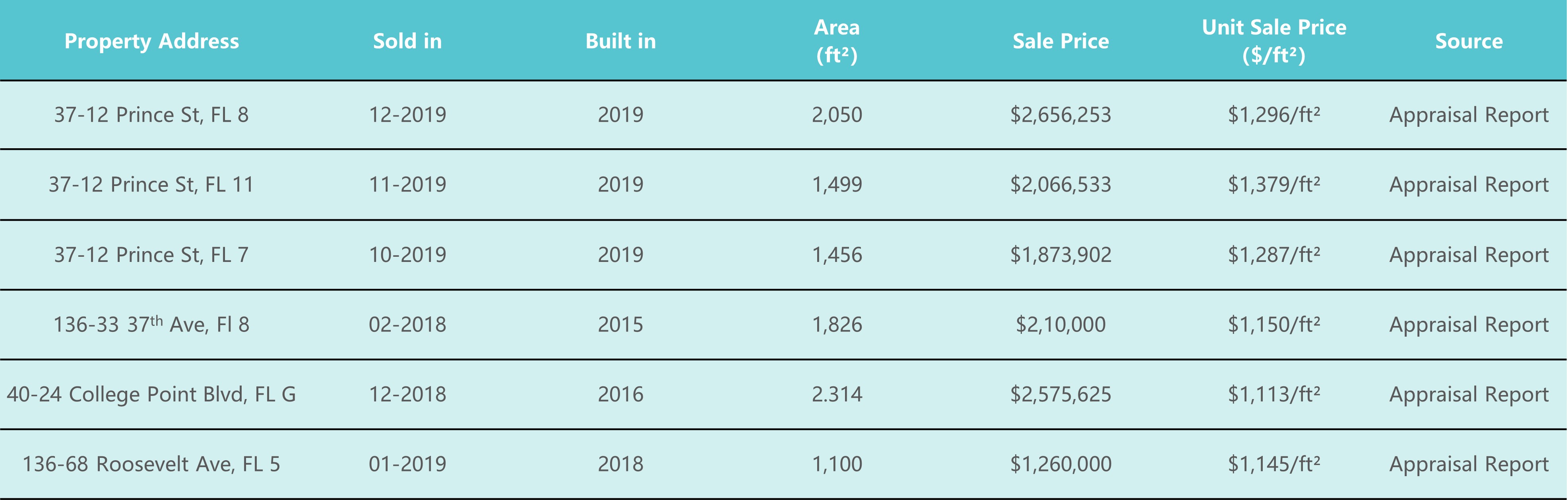

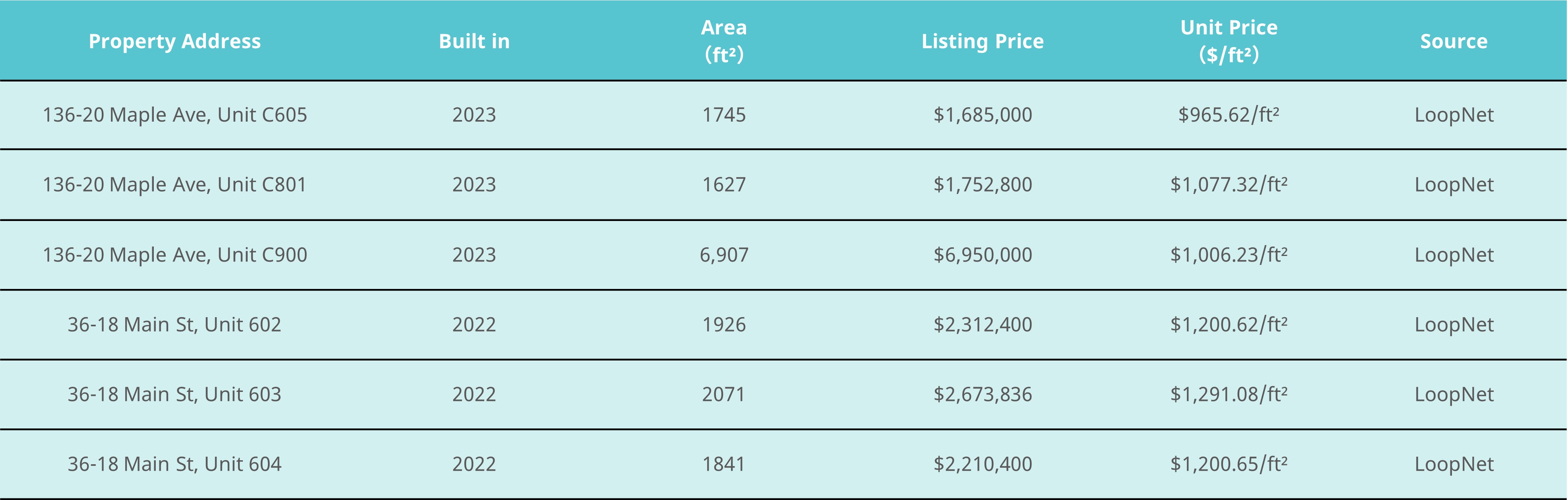

Valuation Analysis of the Property

According to the third-party valuation report provided by Cushman & Wakefield, the underlying property is estimated to have a market value of approximately $20,000,000 upon successful sales, as shown in the accompanying chart.

The building’s construction has been fully completed. It has received formal approval for its Condominium Offering Plan and has obtained the Certificate of Occupancy from the NYC Department of Building.

CrowdFunz believes that the $20,000,000 valuation aligns with current market conditions and meets the fund’s loan underwriting criteria.

* Source: Appraisal Report provided by Cushman & Wakefield.

Location

The property is in a highly accessible location with convenient transportation links. It is a 5-minute walking to the 7 train, a 3-minute walking to the LIRR station (20 minutes to Midtown Manhattan by train), and just an 8-minute driving to LaGuardia Airport. Several major bus routes are also accessible within a 1-minute walk.

Transportation

- Subway: 7 Train (5-min walk away)

- To Midtown: 20-min train

- To JFK: 20-min driving

- To LGA: 8-min driving

School

The project is in central Flushing, surrounded by a wide range of educational resources, including elementary, middle, and high schools, as well as language and early childhood education centers—supporting well-rounded development for children.

Living Facilities

The neighborhood is adjacent to a well-established Chinese commercial district, offering exceptional convenience. Residents have access to a variety of Chinese and Korean supermarkets, diverse dining options, and major shopping centers that meet everyday living needs.

Entertainment

Cultural and recreational amenities are abundant nearby. Notable attractions include Corona Park, the New York Hall of Science, the Queens Museum, the USTA National Tennis Center, Queens Zoo, New York Badminton Center, and Citi Field.

Developer Company: JLS Group Construction.

Developer Website: https://www.jlsgrp.com/

Prior Cooperation: CrowdFunz Fund 804 / 807 / 809 / 812 / 818 / 822 / 823 / 617 / 827 / 841 / 841 / 841 / 843 / 619 / 850

- The CrowdFunz Fund 853 provides a short- to mid-term mezzanine loan to the borrower, which will be used to repay existing debt and cover carrying costs during the final sales phase of the project. Loan repayment is expected to come from future sales of medical office units or cash flows from the borrower’s other real estate assets.

- The underlying property has completed construction and is already on the market, eliminating construction risk. The loan is secured by the completed building to reduce investment risk. As of April 2025, two medical units have been under contract.

- The project has a conservative capital structure, with a Loan-to-value (LTV) ratio of 44.75%, below average industry levels, indicating low default risk and strong equity support from the borrower.

- Located in the heart of Flushing, the property enjoys a prime location and is well-positioned to meet strong demands for Mandarin-speaking medical services. Given its stable structure and clear exit plan, CrowdFunz considers this investment suitable for investors seeking low-risk, fixed-income products.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)