Equity Pledge Debt Fund 855

Type: Debt

Target: $6,000,000

Annual Return: 8.15% - 8.40%

Min-invest Amount: $10,000

Duration: 6 – 24 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $6,000,000 |

| Estimated Return | 8.15 – 8.40% Annualized Return*1 |

| Investment Type | Equity Pledge Loan |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | June 2025 |

| Investment Timeline | 6 – 24 Months*2 |

| Dividend Schedule | Prepaid Every 6 Month*3 |

*1 8.15% Annualized Return for Investment of 1-19 Units; 8.40% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 5 extension options, and investors will receive dividends accordingly at the same dividend rate.

- The property is at the intersection of Sunset Park and Borough Park in Brooklyn, on the north side of 65th Street and the west side of the 8th Avenue, and is located at Brooklyn Chinatown commercial area. It has a 5-minute walking north to the 8th Avenue station of the Metro N line (Broadway Express), and a 5-minute walking south to Leif Ericson Park, the area’s largest community park. Since 1980s, the area has become a major hub for Mandarin-speaking immigrants, giving rise to a vibrant Chinatown in Brooklyn, centered around 8th Avenue, with grocery stores, supermarkets, and various retail shops.

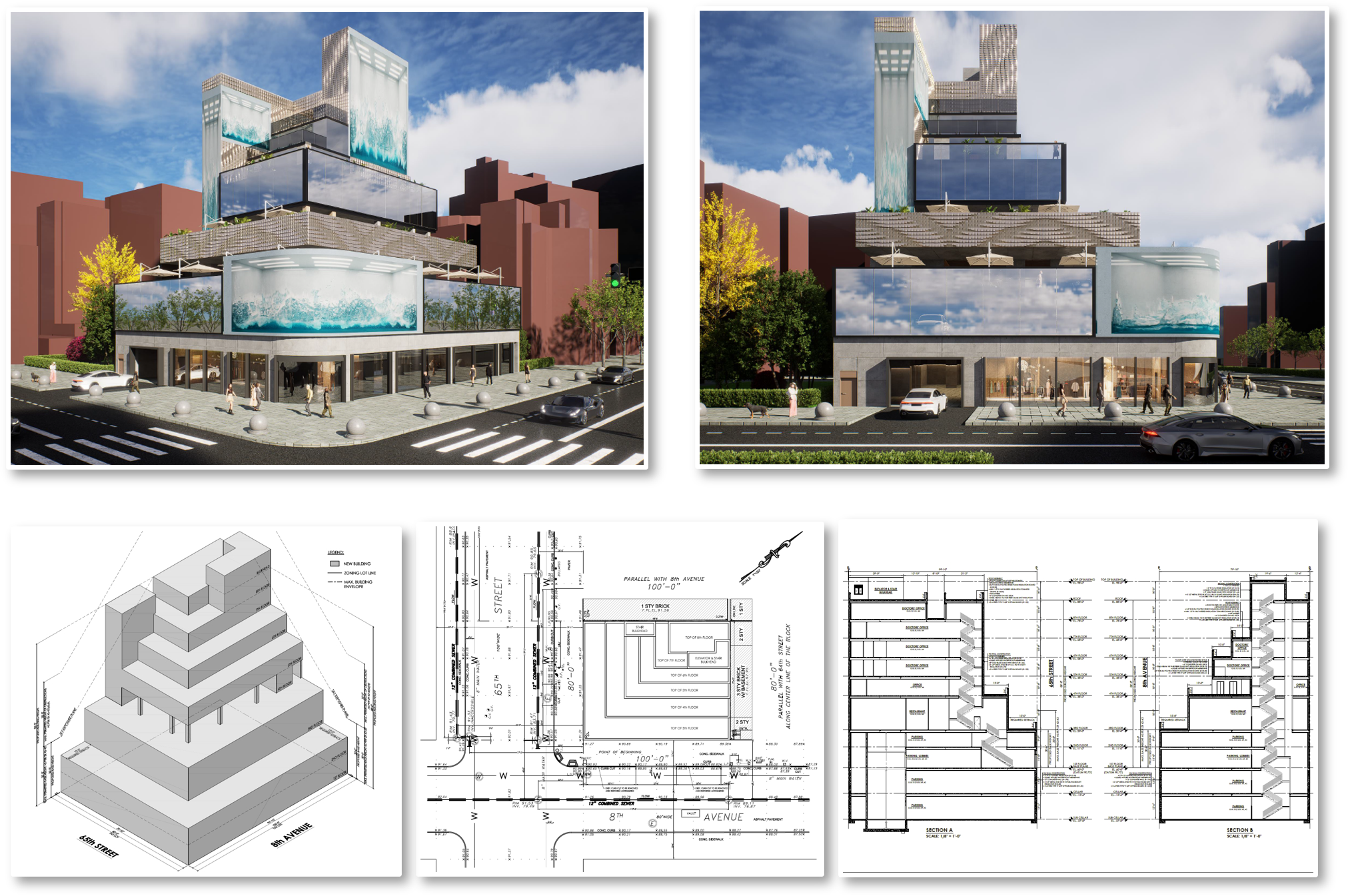

- The land was acquired by the borrower in August 2023 for $4.3 million. The proposed development is an 8-story commercial complex with 4 floors of medical offices, 1 floor of professional office space, 1 floor of restaurant, 1 floor of retail, 2nd floor parking and two basement levels of parking. All commercial units will be for lease upon completion. The construction progress is about 50% completion, currently completed the structural work of topping out, and the construction is expected to be completed in Q1 2026. After completion, the total building area will be approximately 49,844 square feet, with about 21,454 square feet rentable commercial area.

| Address | 6418 8th Avenue, Brooklyn, NY 11220 |

| Area | Sunset Park, Brooklyn, New York |

| Lot Area | 8,000 Sqft |

| Building Area | 49,282 Sqft |

| Intended Use | 4 Medical Offices, 1 Professional Offic, 1 Floor of Restaurant, 1 Floor of Retail Space, 2nd Floor parking and 2 floors basemen Parking. |

| Expected Dividend Calendar | |||||||

|---|---|---|---|---|---|---|---|

| Round of Dividend | Phase *1 | Amount | Dividend Date *2 | Counting Date | Ending Date | Dividend Period | Notes |

| First | First | $3,000,000 | No Later Than 7/18/2025 | 7/7/2025 | 1/6/2026 | 184 Days | Prepaid Dividend*3 |

| Second | $3,000,000 | No Later Than 8/18/2025 | 8/7/2025 | 1/6/2026 | 153 Days | Prepaid Dividend | |

| Second | - | - | No Later Than 1/18/2026 | 1/7/2026 | 7/6/2026 | 181 Days | Extension Option Owned by Developer *4 |

| Third | - | - | No Later Than 7/18/2026 | 7/7/2026 | 1/6/2027 | 184 Days | Extension Option Owned by Developer |

| Fourth | - | - | No Later Than 1/18/2027 | 1/7/2027 | 7/6/2027 | 181 Days | Extension Option Owned by Developer |

*1 Funding amount of different investment phases could be varied based on construction progress.

*2 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*3 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*4 After the first dividend period, Borrower owns 3 extension options, and investors will receive dividends accordingly at the same dividend rate.

- CrowdFunz will invest in the project through Fund 624 and Fund 855, using a layered capital structure. Fund 624 will provide a $6,000,000 U.S. dollars senior mortgage, while Fund 855 will issue a $6,000,000 U.S. dollars junior loan secured by equity pledge. This structure ensures that CrowdFunz maintains a senior creditor position while supplying the borrower with the capital needed to complete the project. Additionally, the key person of the borrower will provide an unlimited personal guarantee.

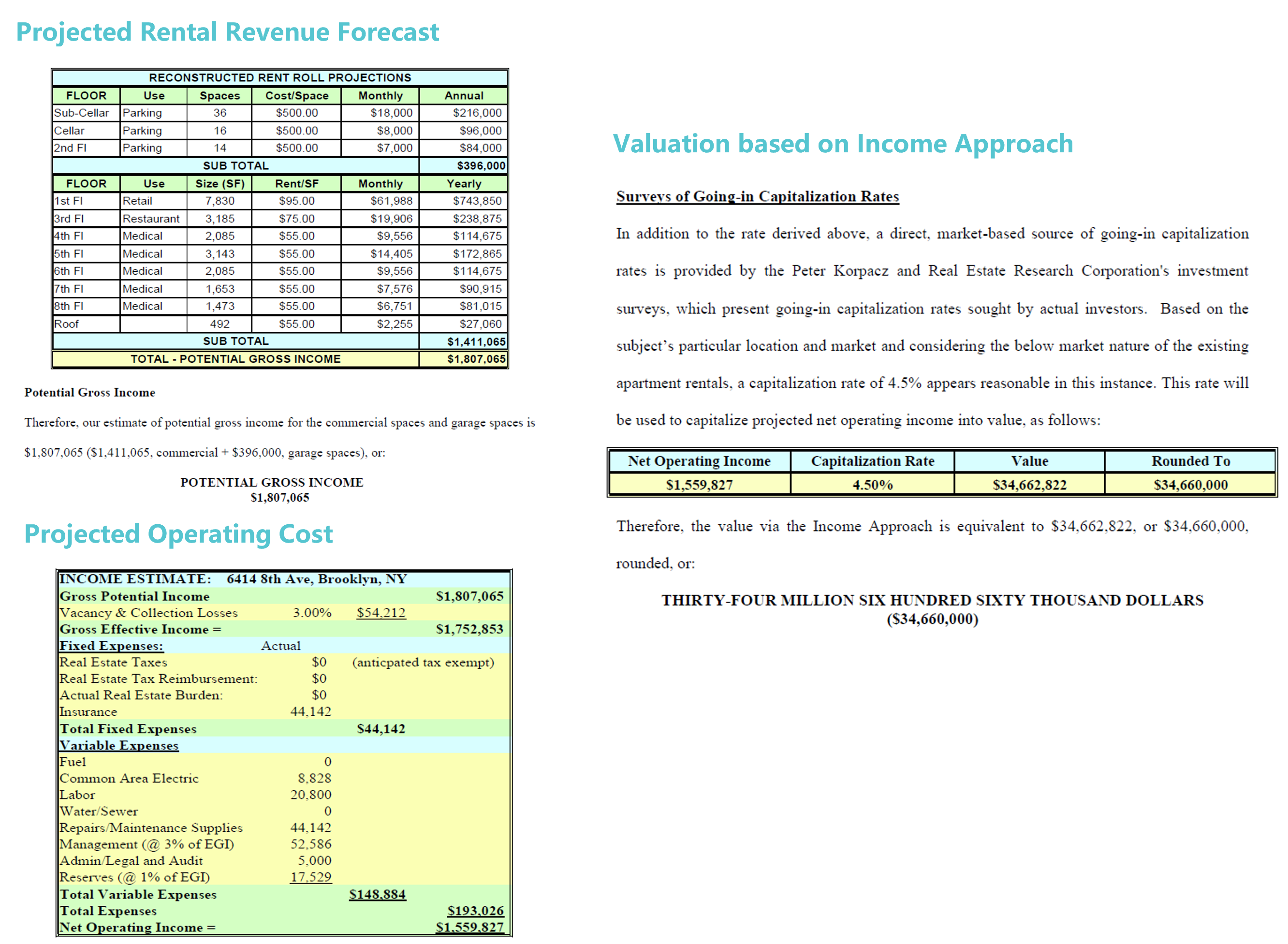

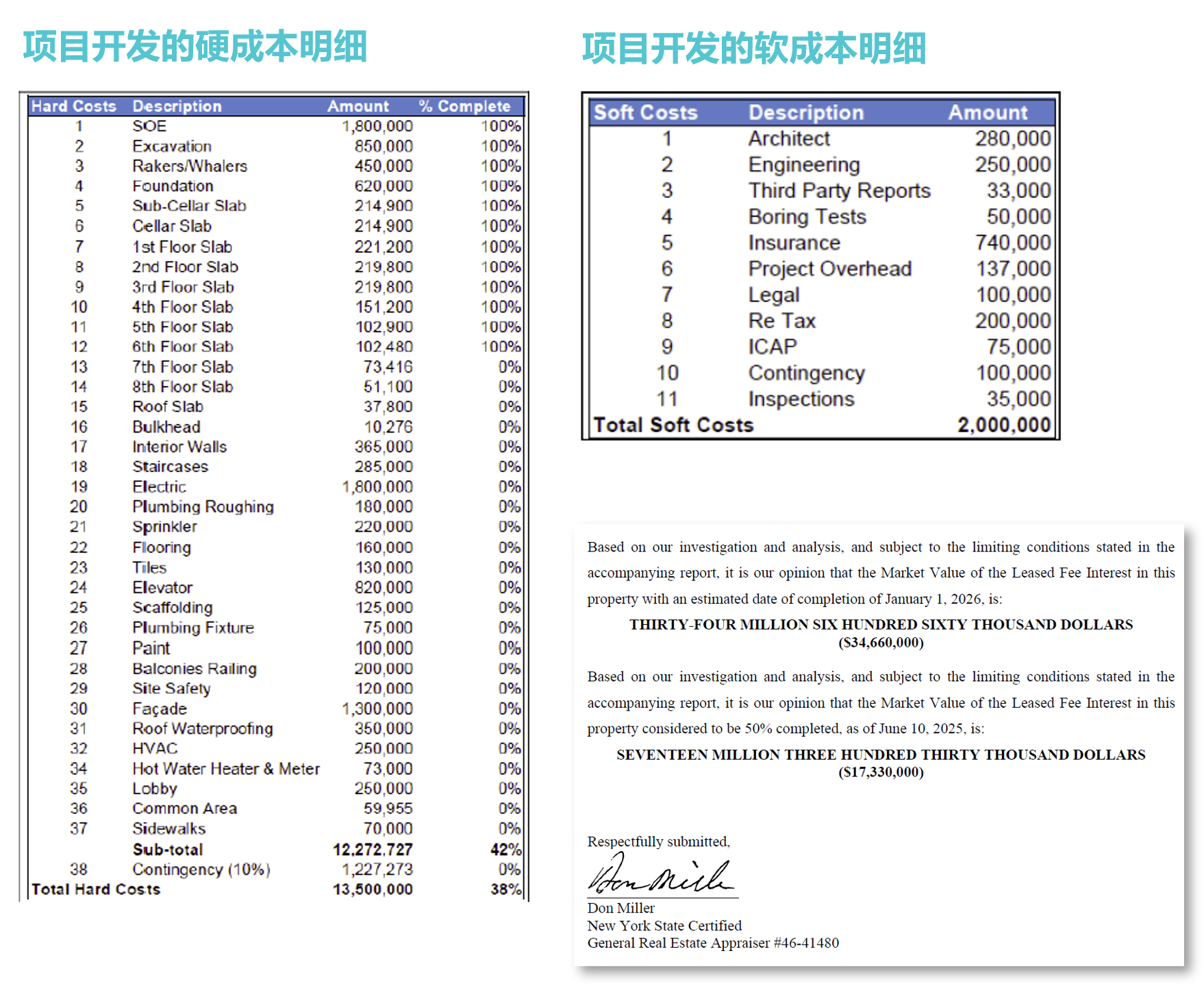

- According to the third-party appraisal provided by East Coast Appraisal, the land was purchased for $4,300,000. The project's value at 50% completion is estimated at $17,330,000 U.S. dollars, with a projected market value of $34,660,000 upon completion. Based on the borrower's submitted detailed cost projection, the estimated total development cost is approximately $21,500,000 U.S. dollars.

- The subject property is in Brooklyn Sunset Park neighborhood, on the north side of 65th Street and the west side of 8th Avenue, one of the busiest Asian commercial corridors in Brooklyn. It is a 5-minute walking north to the 8th Avenue station of Metro N line (Broadway Express), and a 5-minute walking south to Leif Ericson Park, the area’s largest community park. From the site, it takes about 30 minutes by taking subways to reach Manhattan and 45 minutes to arrive most of the areas of Queens. By driving a car, it takes approximately 35 minutes to LaGuardia Airport and 40 minutes to JFK.

- The borrower plans to use the loans provided by CrowdFunz Funds 624 and 855 entirely for the construction costs and other costs incurred during the project’s development, helping the project be completed on schedule and begin the commercial leasing promptly after completion.

- After the project is completed and the commercial units are successfully leased, the borrower expects to repay the loan provided by Fund 624 and 855 by using the proceeds from refinancing a permanent loan with a lower interest rate from a commercial bank, or using the cash obtained from other real estate projects it holds.

- The borrower has over 20 years of experience in development, construction, and supply chain management, and has grown into a fully integrated real estate company. With vertical capabilities spanning acquisition, finance, design, engineering, construction management, and marketing, the borrower has established strong track records. In recent years, they have focused on emerging neighborhoods in Brooklyn, gaining deep insights into the local residential and commercial demands.

Capital Structure of CrowdFunz Fund 855

Capital Stack

| Capital Stack | Percentage | ||

|---|---|---|---|

| CrowdFunz Fund 624 First Lien Mortgage | $6,000,000 | 27.90% | |

| CrowdFunz Fund 855 Equity Pledge Loan | $6,000,000 | 27.90% | |

| Equity Contribution | $9,500,000 | 44.20% | |

| Valuation – Cost Basis | $21,500,000 | 100.00% | |

- According to the third-party valuation report provided by East Coast Appraisal, the land for this project was acquired at a cost of approximately $4,300,000. At 50% completion, the estimated value of the underlying asset is about $17,330,000. After completion, the projected market value of the underlying asset is around $34,660,000. Based on the borrower’s submitted detailed cost projection, the total development cost is estimated at $21,500,000.

- CrowdFunz will invest in the project through CrowdFunz Fund 624 and 855. Fund 624 will provide a $6,000,000 senior mortgage (27.90% of the total capital stack), while Fund 855 will originate a $6,000,000 equity pledge loan (also 27.90% of the capital stack). The borrower will contribute $9,500,000 in equity, accounting for 44.20% of the total capital stack.

- The project’s loan-to-cost (LTC) ratio stands at 55.81%, indicating a conservative use of leverage, slightly below average industry levels.

- Additionally, the key person of the borrower will provide an unlimited personal guarantee, committing to fully repay the principal and interests. In case of default, Fund 855 retains the right to pursue recovery from the guarantor’s personal assets through legal actions.

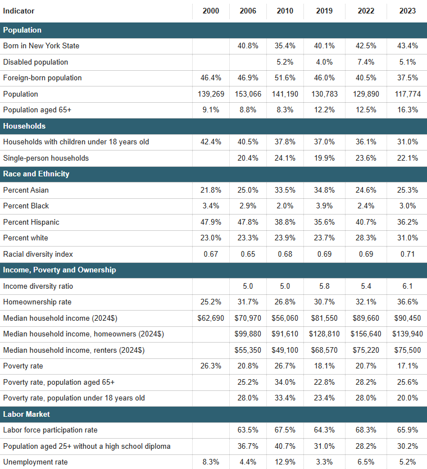

Demographics in Zip Code Area

| Sunset Park | |

|---|---|

| Population | 117,774 |

| Median Age | 37.40 |

| Born in | New York (43.40%)/ Out of the U.S (37.50%) |

| Race | Latino(36.20%) / Caucasian (31.00%) / Asian(25.30%) / African American(3.00%) |

| Median Family Income | $90,450 |

| Child-bearing (Under 18) | 31.00% |

| Unemployment Rate | 5.20% |

Sunset Park is a traditional residential neighborhood in Brooklyn, New York, bordered by Park Slope to the north and Borough Park, the city’s largest Orthodox Jewish community, to the east. Over the past 30 years, the area has attracted many Asian immigrants, giving rise to Brooklyn’s Chinatown and surrounding Asian commercial corridors.

The population is predominantly Hispanic (36%), followed by Caucasian (31%), Asian (25%), and African American (3%). Approximately 38% of residents were born outside the U.S., and many have established roots as local middle-class families. Compared to other parts of Brooklyn, the neighborhood is relatively young, with a median age of 37 and a median household income of $90,450. The area has a 5% unemployment rate.

* Source: NYU Furman Center, and U.S. Census Bureau, in June 2025.

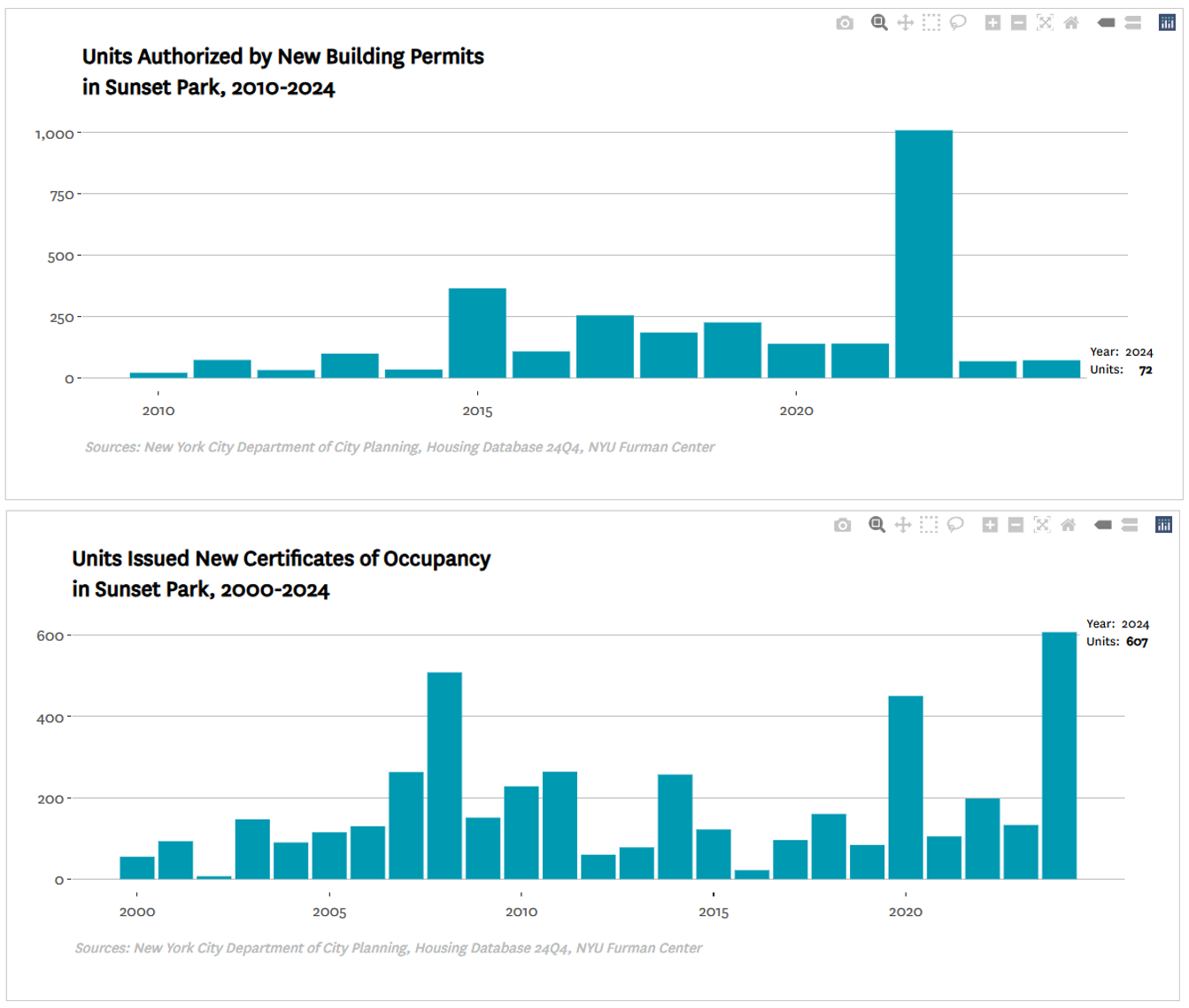

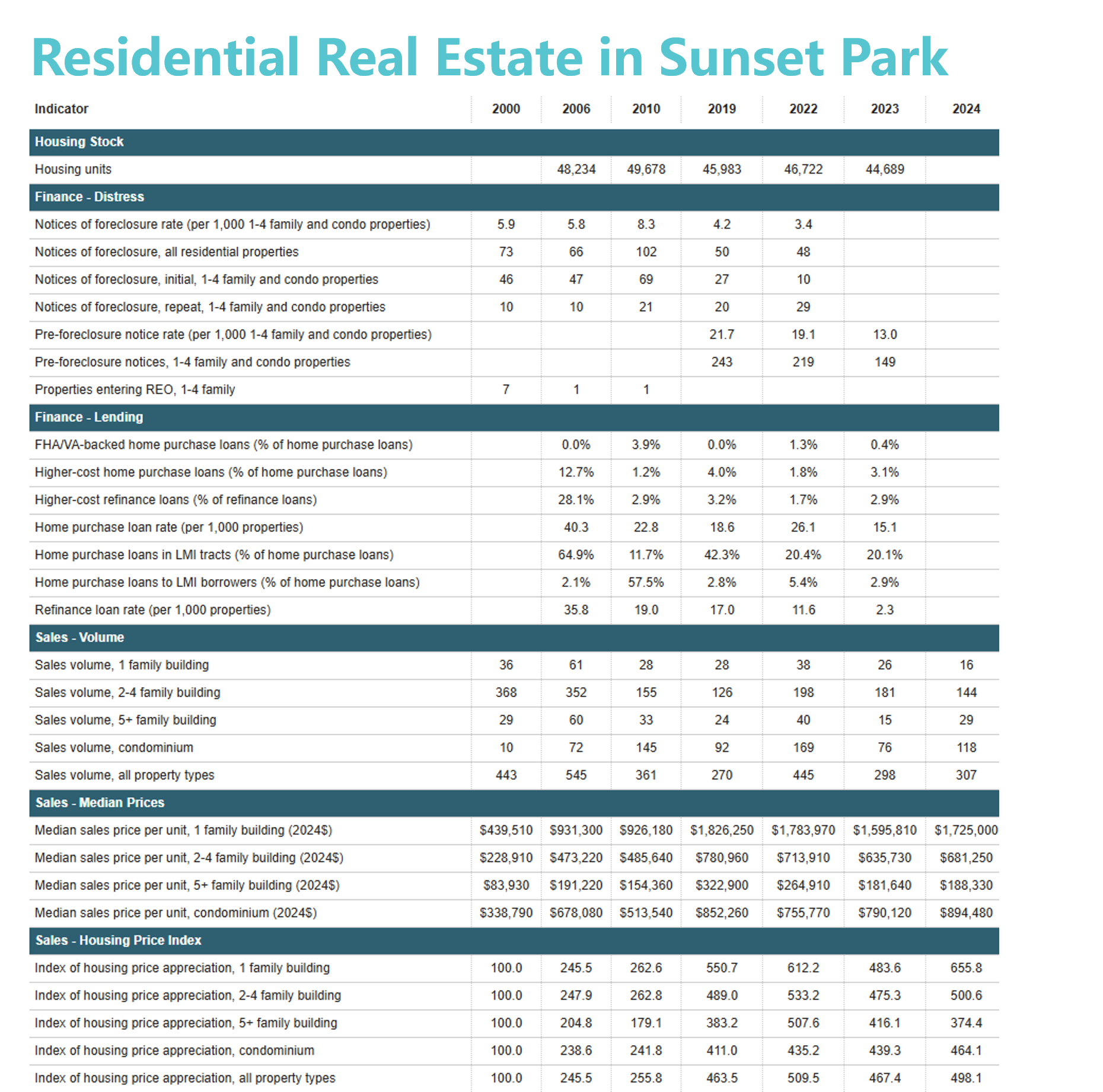

Real Estate Market in Sunset Park

According to data compiled by the NYU Furman Center, as of the end of 2024, residential property prices in Sunset Park have risen 498% compared to it in 2000. The median unit price for single-family houses reached $1,725,000, while 2–4 family units averaged $681,250. Condominiums had a median price of $894,480.

Sunset Park experienced a development boom in 2022, with 1,009 new building permits issued that year. By 2024, the neighborhood saw approval for 607 new residential certificates of occupancy.

* Source: NYU Furman Center, in June 2025.

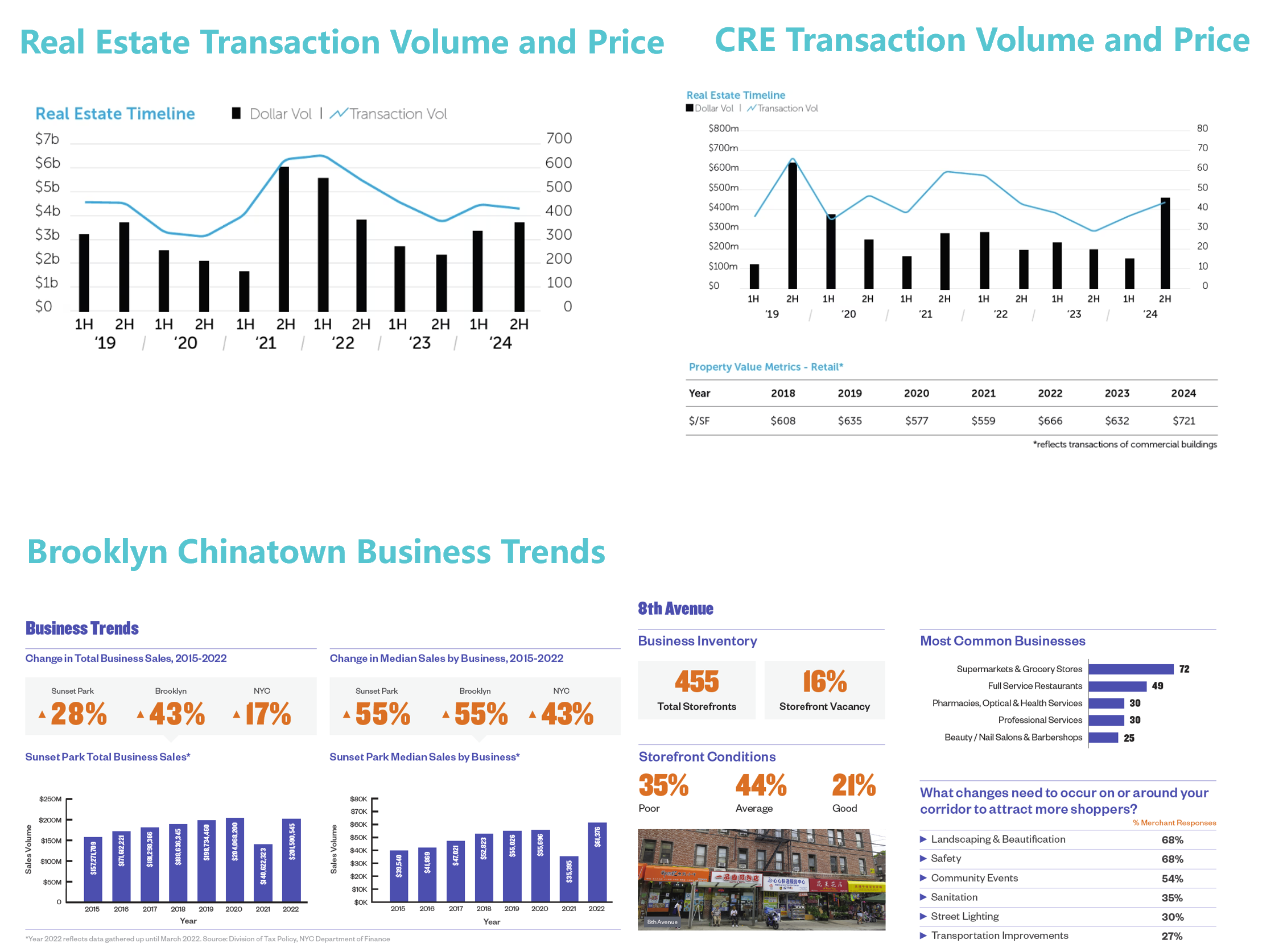

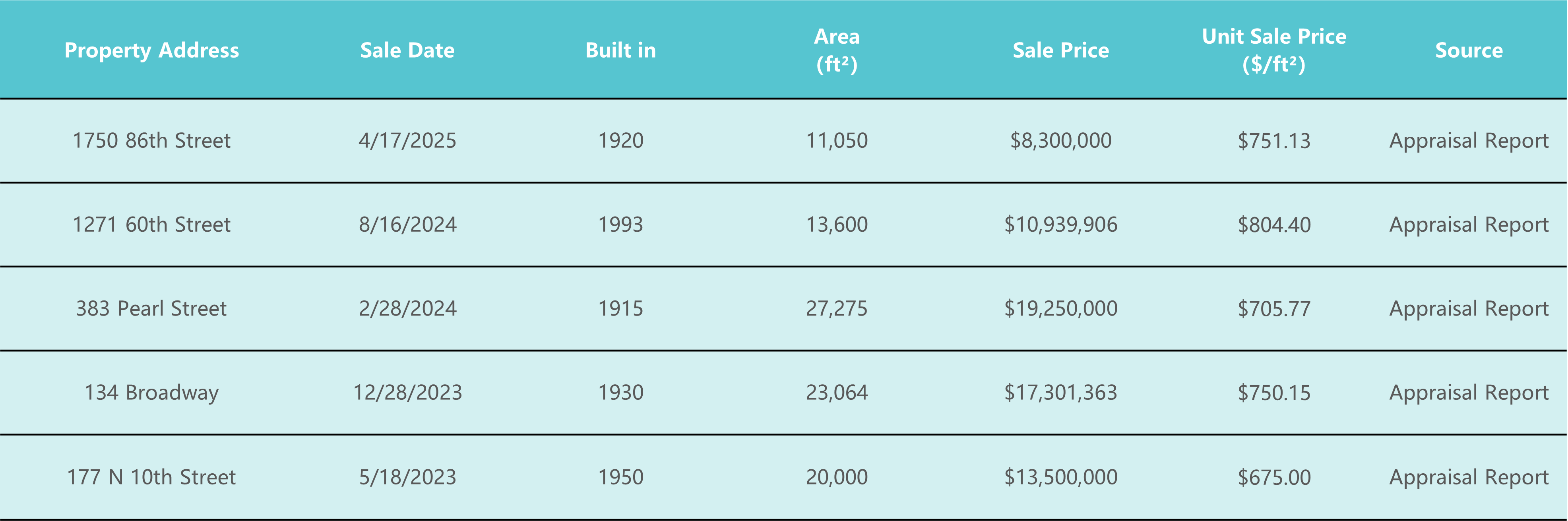

Real Estate Market in Brooklyn

According to Ariel Property Advisors' 2024 industry summary, Brooklyn real estate market recorded 890 transactions totaling approximately $7.15 billion, up 5% in volume and 37% in value from 2023. Excluding hotels and special-purpose assets, all other property categories saw increases in both deal volume and dollar value.

Brooklyn’s commercial and retail property sector rebounded strongly in 2024, reaching its third-highest annual total on record with 81 transactions worth $642 million, a 19% year-over-year increase in volume and a 48% increase in value. Notably, $480 million of that total occurred in the second half of the year (75% of the annual value), the strongest second half since 2019. Eleven deals exceeded $10 million, signaling renewed market confidence.

The average price for Brooklyn retail properties hit a record high of $721 per square foot in 2024, up from $632 in 2023. In Sunset Park specifically, New York City’s Small Business Services reported retail sales grew 28% from 2015 to 2022, with the median retail transaction value increasing by 55%—both outperforming citywide averages.

* Source: NYC Small Business Services, Sunset Park Brooklyn Commercial District Report.

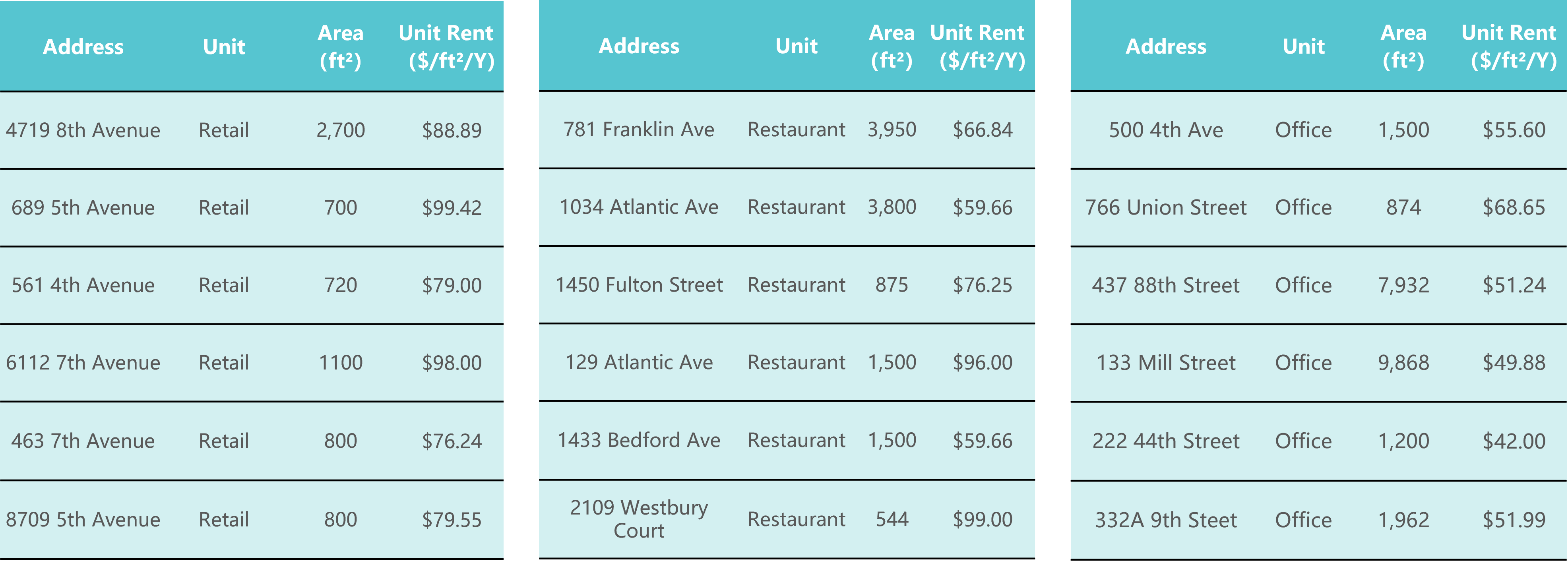

Valuation – Income Approach

Based on the third-party appraisal provided by East Coast Appraisal, the project is estimated to have a market value of approximately $34,660,000 upon completion.

This valuation is derived from projected annual rental income of $1,807,065 and estimated operating expenses of $193,026, resulting in a net operating income of $1,559,827.

Using a 4.5% capitalization rate, the market value is calculated at $34,660,000.

* Source: East Coast Appraisal.

Valuation – Cost Approach

According to the valuation report provided by East Coast Appraisal, the property currently holds an estimated value of approximately $17,330,000 at 50% completion. Based on the developer’s submitted budgets, the land is valued at $4,300,000, and the remaining construction costs are estimated at $17,200,000, resulting in a total projected cost of $21,500,000.

CrowdFunz believes that the valuation based on cost approach aligns with the actual value of the project and meets CrowdFunz underwriting standards and risk managements.

* Source: East Coast Appraisal.

Location

The property is well-connected with public transits. It is a 5-minute walking north to the 8th Avenue station of Metro N line (Broadway Express) and a 10-minute walking west to the Bay Ridge Avenue station of the R line. Two blocks south from the site is Leif Ericson Park, the largest community park in the area. From the property, it takes approximately 30 minutes by taking subways to reach Manhattan and 45 minutes to arrive most of the parts of Queens. By driving a car, it takes about 35 minutes to LaGuardia Airport and 40 minutes to JFK International Airport.

Transportation

- Subway: N Train (5-min walking) / R Train (10-min walking)

- To Midtown: 30-minute subway

- To JFK: 40-minute driving

- To LGA: 35-minute driving

School

The property is in Brooklyn Sunset Park neighborhood, within New York City’s District #15, an established residential area known for its strong public school system. The district includes 19 preschools, 27 elementary schools, 11 middle schools, and 14 high schools.

In addition, several private schools in the area, such as Brooklyn Preschool of Science, Hannah Senesh Community Day School, and Luria Academy of Brooklyn, offer bilingual education, serving the needs of local Chinese-American families.

Living Facilities

The surrounding Chinatown commercial district in Brooklyn is well-established and thriving. Nearby grocery stores, supermarkets, and various retail shops meet the everyday needs of local Chinese residents. Numerous authentic Cantonese restaurants also cater to the tastes of longtime Chinese immigrants, offering familiar flavors and a sense of nostalgia.

Entertainment

Just two blocks south of the project site is Leif Ericson Park, the largest park in the neighborhood, offering residents a variety of recreational amenities. The area includes soccer fields, tennis courts, baseball fields, and playgrounds for children.

Eight blocks further south is McKinley Park, which features basketball courts and additional outdoor sports facilities. Five blocks from the site is the area’s largest public library, providing accessible educational and cultural resources to the community.

Developer: Leeboy Group.

Website: https://www.leeboygroup.com

Past Cooperation: CrowdFunz Fund 842

- CrowdFunz Fund 624 and 855 will jointly invest in the underlying project. Fund 624 will provide a $6,000,000 senior mortgage, and Fund 855 will provide a $6,000,000 junior loan secured by equity pledge. The loan combination secures CrowdFunz senior financial claim and offer necessary financing for the project.

- The project loan-to-cost (LTC) ratio is 55.81%, below average industry leverage usage. The borrower’s equity contribution is $9.5 million, or 44.20% of total capital. The key person of the borrower will also provide an unlimited personal guarantee.

- The project is in Brooklyn Sunset Park neighborhood, a prime area of Brooklyn Chinatown. This traditional Asian-American community, along with Park Slope and Downtown Brooklyn, is experiencing strong growth with new residential and commercial developments in the recent years.

- CrowdFunz believes that investing in Fund 855 has a relatively low default risk, and it offers the investors considerable fixed-income investment opportunities.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)