Mortgage Debt Fund 625

Type: Debt

Target: $6,000,000

Annual Return: 8.15% - 8.40%

Min-invest Amount: $10,000

Duration: 6 – 18 Months

| Fund Type | Private Equity Fund |

| Offering Amount | $6,000,000 |

| Estimated Return | 8.15 – 8.40% Annualized Return*1 |

| Investment Type | First Lien Mortgage |

| Unit Price | $10,000 per Subscription Unit |

| Offering Date | Nov 2025 |

| Investment Timeline | 6 – 18 Months*2 |

| Dividend Schedule | Prepaid Every 6 Month*3 |

*1 8.15% Annualized Return for Investment of 1-19 Units; 8.40% Annualized Return for Investment above 20 Units;

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan;

*3 After the first dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

- The subject property is located at the intersection of Dyker Heights and Borough Park in Brooklyn, on the south side of 63rd Street near the I-287 corridor. Dyker Heights is a well-established residential neighborhood, with growing housing demand and convenient access to public transit. It is also close to Brooklyn’s major Chinese community along 8th Avenue.

- The 9-story community facility building includes charter school offices on part of the 1st to the 5th floors, office and medical condominium units on the 6th to the 8th floors, and a 4,699 sq. ft. underground garage. The developer acquired the site in September 2022 for $8.2 million, completed construction in 2025, and has obtained Temporary Certificate of Occupancies from the basement to the 5th floor. TCOs for the 6th to 8th floors are expected to be obtained by the end of 2025, after which unit sales will begin. A 32-year lease has been signed with a charter school for the lower floors. The unsold units on the 1st, 6th, 7th, and 8th floors, along with the garage, will be mortgaged as collateral for this borrowing to refinance a construction loan close to its maturity.

| Address | 1222 63rd Street, Brooklyn, New York 11219 |

| Area | Dyker Heights, Brooklyn, New York |

| Total Building Area | 22,970 Sqft |

| Net Usable Area | 8,000 Sqft |

| Intended Use | Medical Offices on the 1st, and 6th to 8th floors, and Underground Garage |

| Expected Dividend Calendar | ||||||

|---|---|---|---|---|---|---|

| Round of Dividend | Funding Amount | Dividend Date*1 | Counting Date | Ending Date | Dividend Period | Note |

| First | $6,000,000 | No Later Than 11/14/2025 |

11/3/2025 | 5/2/2026 | 181 Days | Prepaid Dividend*2 |

| Second | - | No Later Than 5/14/2026 |

5/3/2026 | 11/2/2026 | 184 Days | Extension Option*3 Owned by Borrower |

| Third | - | No Later Than 11/14/2026 |

11/3/2026 | 5/2/2027 | 181 Days | Extension Option Owned by Borrower |

*1 In case of holidays and non-working days, the dividend date will be automatically postponed to the next working day.

*2 Investors will receive a minimum of 6 months of dividend; dividends will be calculated in terms of days till Borrower repays the loan.

*3 After the first dividend period, Borrower owns 2 extension options, and investors will receive dividends accordingly at the same dividend rate.

- According to the appraisal provided by Colliers International, the unsold units on the 1st, 6th, 7th, and 8th floors, along with the underground garage, have a current market value of approximately $14,500,000. The loan issued by CrowdFunz Fund 625 will be secured by the mortgages on these condominium units and the garage, as well as a 100% equity pledge of the property-owning entity, which is currently valued at around $8,500,000. In addition, the key person of borrower, will provide the unlimited personal guarantee for timely repayment of principal and interest.

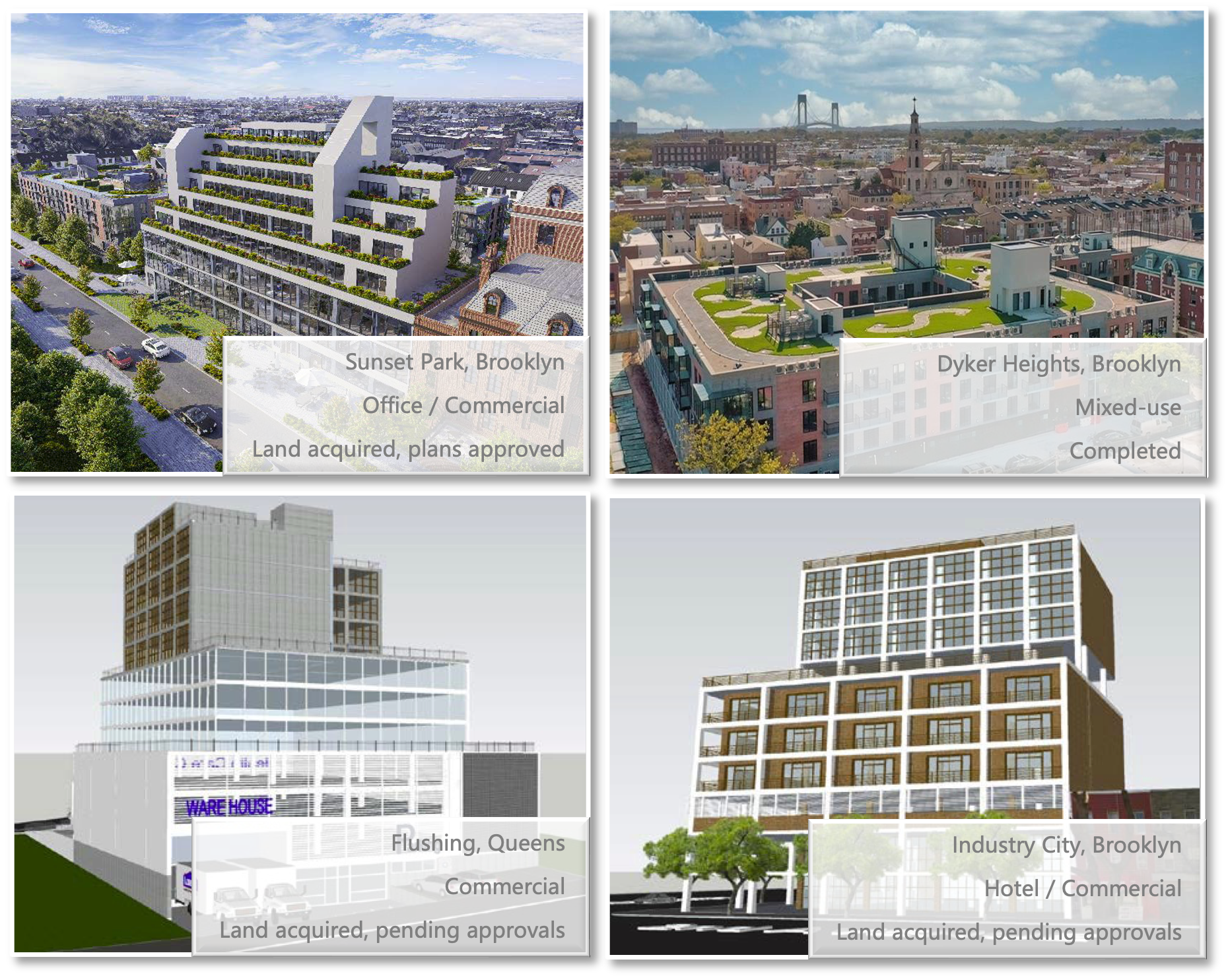

- The borrower has over 20 years of experience in real estate development, construction, and supply chain management, and has grown into a fully integrated real estate firm with in-house capabilities across acquisition, financing, design, engineering, construction management, and marketing. In recent years, the developer has focused on emerging neighborhoods in Brooklyn, New York City, and has completed multiple projects with a deep understanding of local market dynamics and residential and commercial demand.

- CrowdFunz Fund 625 marks the fourth cooperation between CrowdFunz and the borrower, following successful partnerships through Fund 842, Fund 624, and Fund 855. Through this project, both parties aim to continue delivering investment opportunities to CrowdFunz clients while supporting the developer to achieve project successes.

- The borrower plans to use the loan provided by CrowdFunz Fund 625 to repay the existing construction loan close to its maturity, while retaining working capital to support the next phase of property sales. As construction works of the property had been fully completed, there is no further construction risk.

- Once the certificate of occupancies are obtained for the unsold commercial condominiums, the borrower expects to repay the loan provided by Fund 625 by using the proceeds from unit sales or cash flows from other real estate projects it owns.

Capital Structure of CrowdFunz Fund 625

Capital Stack

| Capital Stack | Percentage | |

|---|---|---|

| CrowdFunz Fund 625 Mortgage | $6,000,000 | 41.38% |

| Equity Value | $8,500,000 | 53.81% |

| Property Valuation | $14,500,000 | 100.00% |

- According to the third-party valuation report provided by Colliers International, the unsold units on the 1st, 6th, 7th, and 8th floors of the project, along with the underground garage, have an estimated market value of approximately $14,500,000.

- CrowdFunz Fund 625 will provide a first-lien mortgage in total of $6,000,000, financing the project, representing 41.38% of the total capital structure. The developer's equity is approximately $8,500,000, or 53.81% of the total capital structure.

- Based on the current capital structure, the loan-to-value (LTV) ratio for this project is 41.38%, significantly lower than the average industry standard, indicating lower investment risk.

- Additionally, the developer’s key person will provide the unlimited personal guaranty, committing to timely repay the principal and interest. In the event of default, CrowdFunz Fund 625 will pursue legal action to recover investor funds through the guarantor’s personal assets.

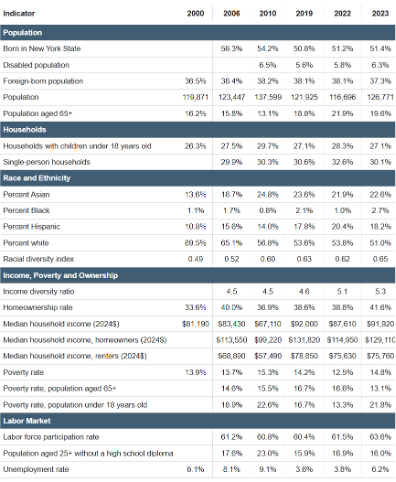

Demographics in Zip Code Area

Bay Ridge/Dyker Heights Population 126,771 Median Age 41.90 Born in New York (51.40%) / Out of the U.S. (37.30%) Race Caucasian (51.00%) / Asian (22.60%) / Latino (18.20%) / African American (2.70%) Median Family Income $91,920 Child-bearing (Under 18) 27.10% Unemployment Rate 6.20%

Dyker Heights in Brooklyn is a historically white neighborhood that has seen increasing housing demands in recent years, driven by its convenient public transit, strong infrastructure, and proximity to Brooklyn’s largest Chinese community along 8th Avenue. The area has become increasingly attractive to Chinese homebuyers.

The neighborhood is ethnically diverse, with a population that is 51% white, 23% Asian, 18% Hispanic, and 3% Black. Roughly 37% of residents are foreign-born, and the community is largely composed of middle-income, working-age families employed in New York City. The median household income is about $91,920, placing it in the upper-middle tier for Brooklyn.

Recent years have seen a significant influx of Asian residents, fueling a strong rental market. With limited housing inventory and rising demand, property values in the area have steadily increased.

* Source: NYU Furman Center and U.S. Census Bureau, October 2025.

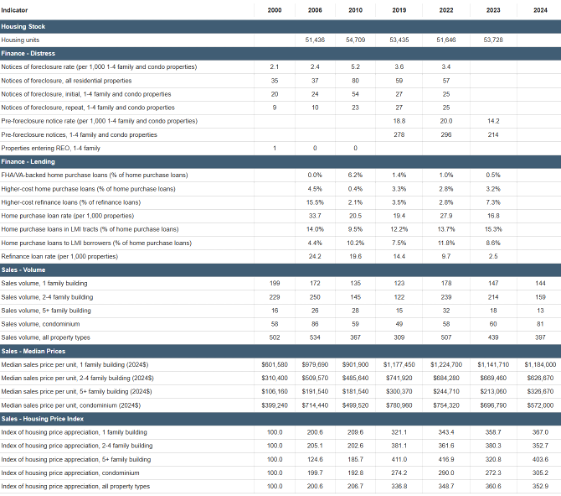

Real Estate Market in Dyker Heights

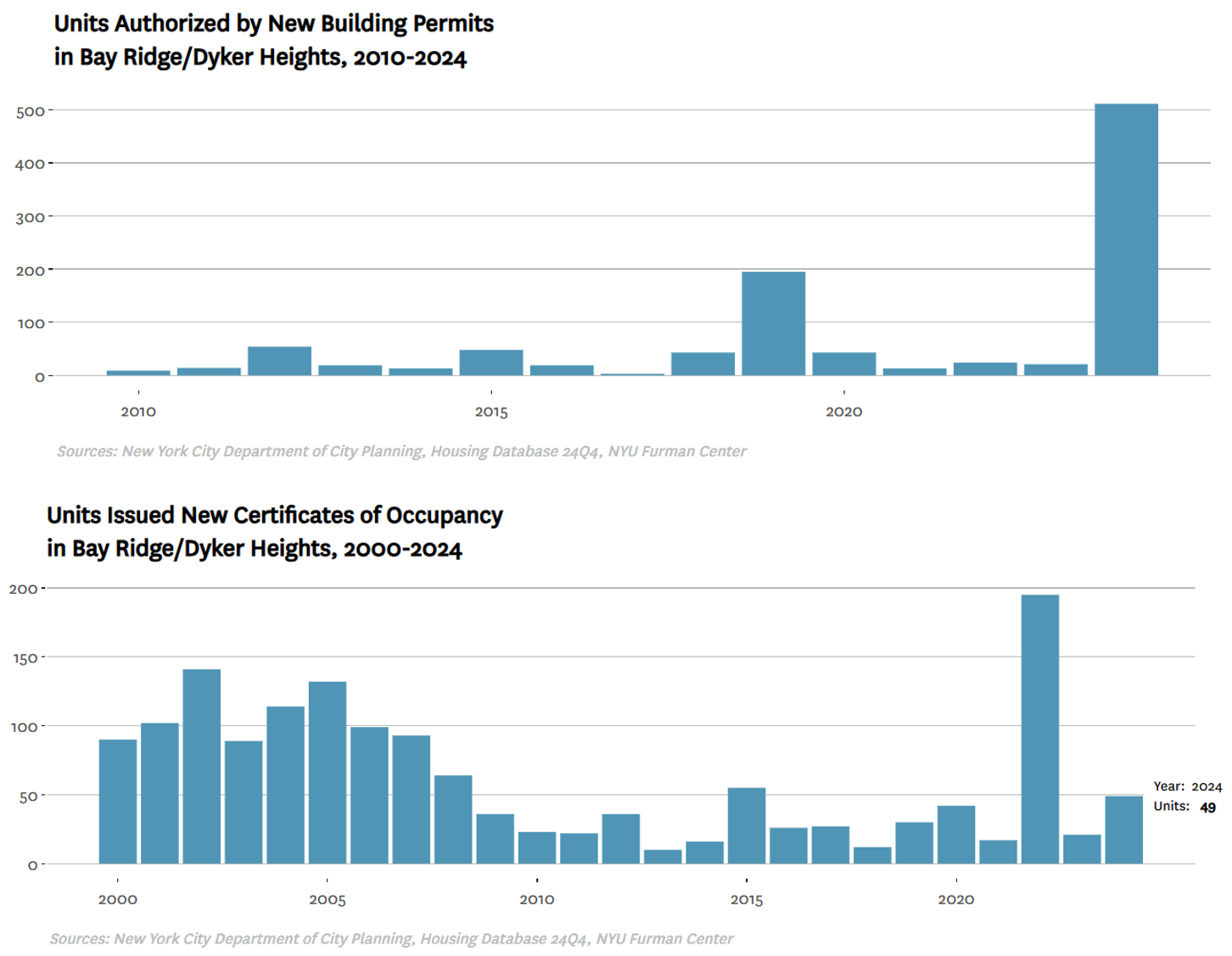

According to data from the NYU Furman Center based on U.S. Census Bureau, as of the end of 2024, home prices in Dyker Heights have increased by 353% since 2000 across all residential property types. The median sales price is currently $1,184,000 for single-family houses, $626,670 for 2–4 family homes, and $572,000 for condominiums. The area experienced a new wave of development in 2024, with 511 new building permits issued. The previous peak in residential Certificates of Occupancy was in 2022, with 195 units approved that year.

* Source: NYU Furman Center, October 2025.

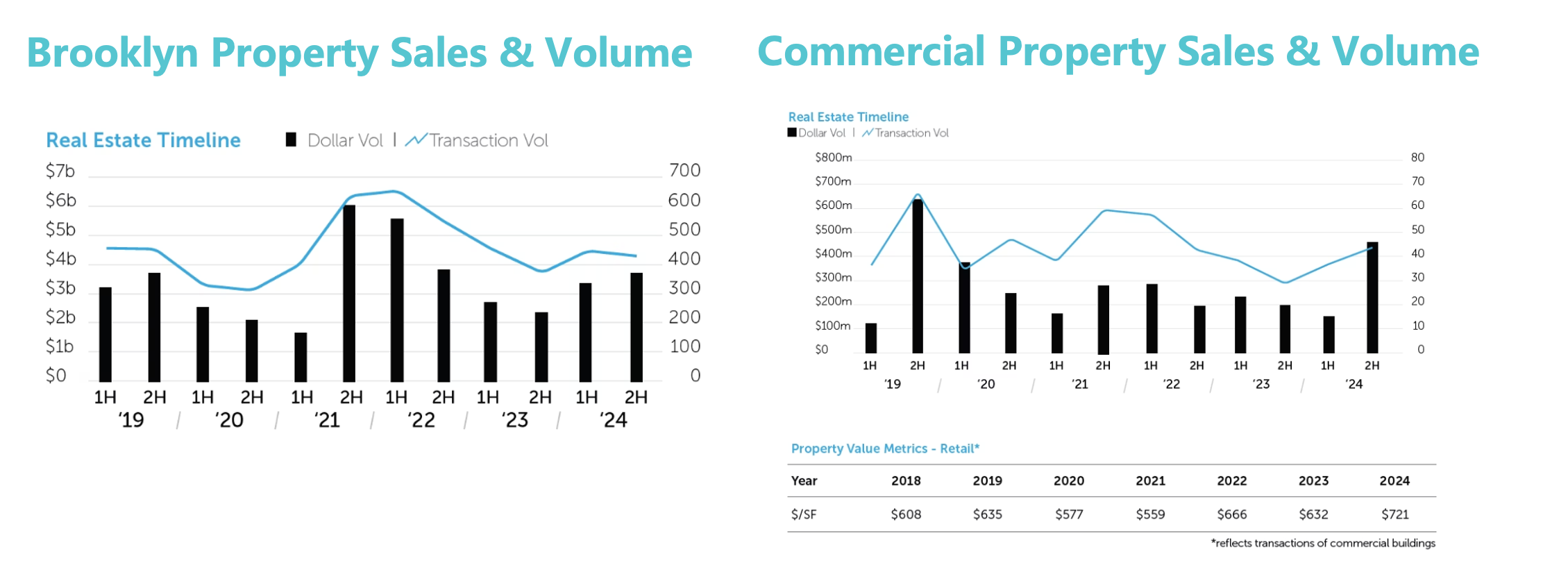

Real Estate Sales and Commercial Rental in Brooklyn

According to industry data provided by Ariel Property Advisors, Brooklyn's real estate market recorded 890 transactions in 2024, totaling approximately $7.15 billion. This reflects a 5% increase in transaction volume and a 37% increase in dollar volume compared to 2023. Excluding hotel and special-use properties, all other asset types saw year-over-year growth in both transaction count and value.

In the commercial and retail asset class, Brooklyn experienced a strong rebound in 2024, marking its third-highest annual transaction volume on record with 81 deals totaling $642 million—up 19% in volume and 48% in value year-over-year. The second half of 2024 was particularly active, with $480 million in transactions—75% of the annual total—and 11 deals exceeding $10 million, the strongest second half since 2019, signaling renewed investor confidence.

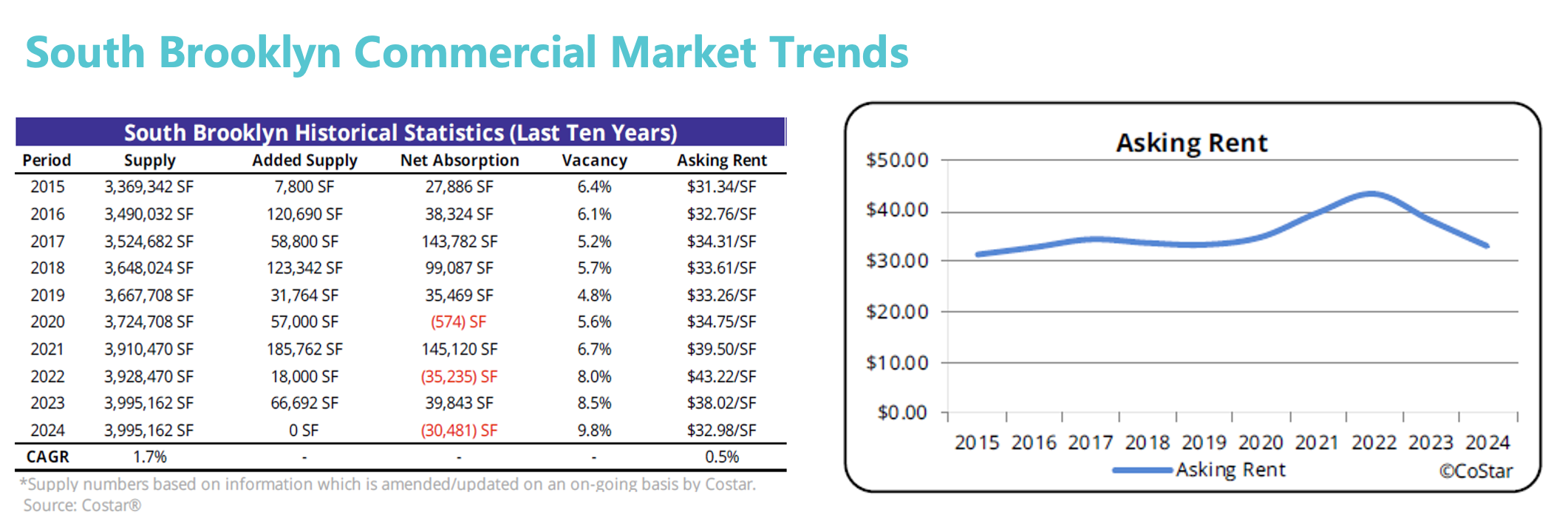

According to a third-party appraisal by Colliers International, the total commercial lease inventory in South Brooklyn submarket, where the property is located, grew steadily at 1.7% annually over the past decade, reaching 3,995,162 square feet by the end of 2024. As more space entered the market, the vacancy rate rose to 9.8%, and average asking rents declined from $43.22/sqft/year in 2022 to $32.98/sqft/year in 2024.

Comparable Commercial Properties Sold

Property Address

Sale Date

Built in

Area (ft²)

Sale Price

Unit Sale Price ($/ft²)

Source

Name 766 Union Street 7/31/2025 1920 874 $795,000 $910 Appraisal 4719–4723 8th Avenue 5/26/2025 2008 1,798 $1,300,000 $723 Appraisal 849 53rd Street 6/6/2025 2021 796 $775,160 $974 Appraisal 50 Shore Boulevard 7/13/2025 1957 408 $285,000 $698 Appraisal 818 60th Street 5/18/2023 1950 1,687 $1,830,830 $1,085 Appraisal 4016 7th Avenue 6/16/2025 2022 1,569 $1,287,812 $821 Appraisal

- According to the data provided by Colliers International, the average sale price of comparable commercial properties sold is $868.50/sqft.

* Source: Appraisal report provided by Colliers International.

Comparable Medical Office Lease

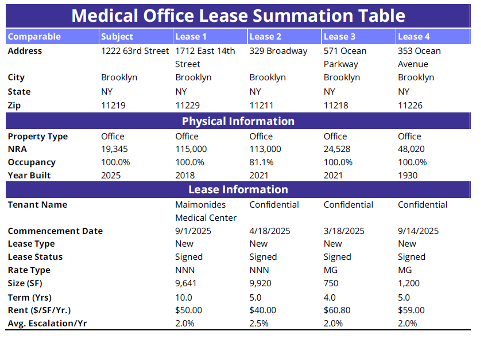

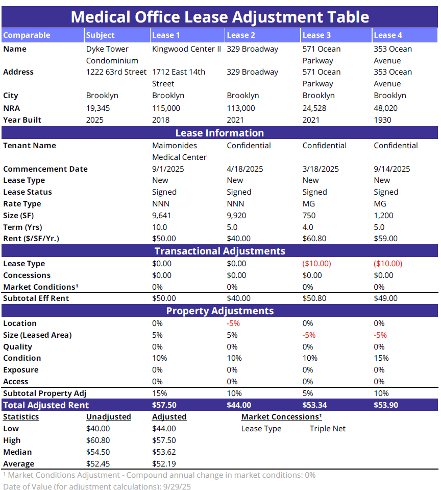

- According to the third-party appraisal by Colliers International, the average rent for comparable leased medical office units in the area is $52.19/sqft/year.

* Source: Appraisal report provided by Colliers International.

Property Valuation Summary

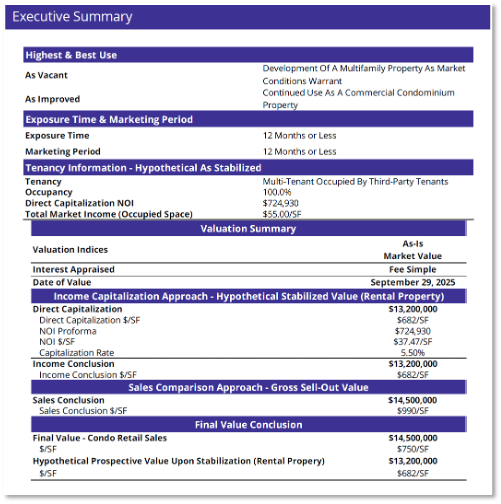

According to the third-party appraisal by Colliers International, the unsold commercial units on the 1st, 6th, 7th, and 8th floors of the subject property, along with the underground garage, have a combined estimated market value of approximately $14,500,000. The average sales price for the commercial units is around $990 per square foot.

Based on the local market conditions, the stabilized rental income of the subject property is expected to reach $55.00 per square foot annually, generating approximately $724,930 in annual rental revenue.

CrowdFunz considers that the valuation suggestion provided by Colliers International is reasonable and consistent with the underwriting standards of CrowdFunz debt investment.

| Bay Ridge/Dyker Heights | |

|---|---|

| Population | 126,771 |

| Median Age | 41.90 |

| Born in | New York (51.40%) / Out of the U.S. (37.30%) |

| Race | Caucasian (51.00%) / Asian (22.60%) / Latino (18.20%) / African American (2.70%) |

| Median Family Income | $91,920 |

| Child-bearing (Under 18) | 27.10% |

| Unemployment Rate | 6.20% |

Dyker Heights in Brooklyn is a historically white neighborhood that has seen increasing housing demands in recent years, driven by its convenient public transit, strong infrastructure, and proximity to Brooklyn’s largest Chinese community along 8th Avenue. The area has become increasingly attractive to Chinese homebuyers.

The neighborhood is ethnically diverse, with a population that is 51% white, 23% Asian, 18% Hispanic, and 3% Black. Roughly 37% of residents are foreign-born, and the community is largely composed of middle-income, working-age families employed in New York City. The median household income is about $91,920, placing it in the upper-middle tier for Brooklyn.

Recent years have seen a significant influx of Asian residents, fueling a strong rental market. With limited housing inventory and rising demand, property values in the area have steadily increased.

* Source: NYU Furman Center and U.S. Census Bureau, October 2025.

According to data from the NYU Furman Center based on U.S. Census Bureau, as of the end of 2024, home prices in Dyker Heights have increased by 353% since 2000 across all residential property types. The median sales price is currently $1,184,000 for single-family houses, $626,670 for 2–4 family homes, and $572,000 for condominiums. The area experienced a new wave of development in 2024, with 511 new building permits issued. The previous peak in residential Certificates of Occupancy was in 2022, with 195 units approved that year.

* Source: NYU Furman Center, October 2025.

According to industry data provided by Ariel Property Advisors, Brooklyn's real estate market recorded 890 transactions in 2024, totaling approximately $7.15 billion. This reflects a 5% increase in transaction volume and a 37% increase in dollar volume compared to 2023. Excluding hotel and special-use properties, all other asset types saw year-over-year growth in both transaction count and value.

In the commercial and retail asset class, Brooklyn experienced a strong rebound in 2024, marking its third-highest annual transaction volume on record with 81 deals totaling $642 million—up 19% in volume and 48% in value year-over-year. The second half of 2024 was particularly active, with $480 million in transactions—75% of the annual total—and 11 deals exceeding $10 million, the strongest second half since 2019, signaling renewed investor confidence.

According to a third-party appraisal by Colliers International, the total commercial lease inventory in South Brooklyn submarket, where the property is located, grew steadily at 1.7% annually over the past decade, reaching 3,995,162 square feet by the end of 2024. As more space entered the market, the vacancy rate rose to 9.8%, and average asking rents declined from $43.22/sqft/year in 2022 to $32.98/sqft/year in 2024.

| Property Address | Sale Date | Built in | Area (ft²) | Sale Price | Unit Sale Price ($/ft²) | Source |

|---|---|---|---|---|---|---|

| Name 766 Union Street | 7/31/2025 | 1920 | 874 | $795,000 | $910 | Appraisal |

| 4719–4723 8th Avenue | 5/26/2025 | 2008 | 1,798 | $1,300,000 | $723 | Appraisal |

| 849 53rd Street | 6/6/2025 | 2021 | 796 | $775,160 | $974 | Appraisal |

| 50 Shore Boulevard | 7/13/2025 | 1957 | 408 | $285,000 | $698 | Appraisal |

| 818 60th Street | 5/18/2023 | 1950 | 1,687 | $1,830,830 | $1,085 | Appraisal |

| 4016 7th Avenue | 6/16/2025 | 2022 | 1,569 | $1,287,812 | $821 | Appraisal |

- According to the data provided by Colliers International, the average sale price of comparable commercial properties sold is $868.50/sqft.

* Source: Appraisal report provided by Colliers International.

- According to the third-party appraisal by Colliers International, the average rent for comparable leased medical office units in the area is $52.19/sqft/year.

* Source: Appraisal report provided by Colliers International.

According to the third-party appraisal by Colliers International, the unsold commercial units on the 1st, 6th, 7th, and 8th floors of the subject property, along with the underground garage, have a combined estimated market value of approximately $14,500,000. The average sales price for the commercial units is around $990 per square foot.

Based on the local market conditions, the stabilized rental income of the subject property is expected to reach $55.00 per square foot annually, generating approximately $724,930 in annual rental revenue.

CrowdFunz considers that the valuation suggestion provided by Colliers International is reasonable and consistent with the underwriting standards of CrowdFunz debt investment.

Location

The property has excellent transportation access. It is within a 5-minute walking distance to the subway line N, Q, W, and D, taking a 20-minute commute to Downtown Manhattan. By driving car, it takes approximately 30 minutes to reach LaGuardia Airport and 35 minutes to JFK International Airport.

Transportation

- Subway: N, Q, W, D (5-minute walk)

- To Lower East Side: 20-minute subway

- To JFK: 35-minute drive

- To LGA: 30-minute drive

Schools

The project is in the heart of Dyker Heights, a well-established neighborhood with access to a full range of educational institutions, including several elementary, middle, and high schools. The area also features a variety of language schools and early childhood education centers, supporting well-rounded development for children.

Living Facility

The community is conveniently located near a well-established Chinese commercial district, offering excellent access to daily necessities. The area features a variety of Chinese and Korean supermarkets, diverse dining options including traditional and fast food, as well as large shopping centers that meet residents’ everyday needs.

Entertainment

The area offers abundant cultural and recreational amenities. Nearby attractions include the Brooklyn Museum, one of New York’s premier cultural landmarks, and the city’s second-largest museum after the Met, as well as Sunset Park, Dyker Beach Park, the New York Aquarium, and the Barclays Center, home of the Brooklyn Nets.

Developer: Leeboy Group

Website: https://www.leeboygroup.com/

Past Cooperation: Fund 842 / 624 / 855

Previous Completed Projects

- CrowdFunz Fund 625 provides a short-to-mid-term first-lien mortgage to the borrower. The proceeds will be used entirely to repay the existing construction loan close to its maturity, while retaining working capital to support the next phase of property sales. The borrower expects to repay the loan provided by Fund 625 by using the proceeds from unit sales or cash flows from other real estate projects it owns.

- The underlying project of Fund 625 has completed its construction works and is going to enter the final sales phase with no further construction risk. As of October 2025, office space from part of the 1st floor to the 5th floor has been leased under a 32-year agreement to a charter school.

- The underlying project of Fund 625 has a relatively low financial leverage. The loan-to-value ratio (LTV) of the project is only 41.38%, well below the industry average, and the borrowing is backed by significant equity value.

- The underlying project is located in a prime location of Dyker Heights, a traditional high-quality neighborhood in Brooklyn near the region’s largest Chinese community along 8th Avenue, providing superior location advantages.

- CrowdFunz believes that investing in Fund 625 represents a low-risk, short-term debt opportunity suitable for investors seeking fixed-income products with stable returns.

Subscription Agreement (Only available to accredited investors)

Appraisal (Only available to accredited investors)